Summary:

- We maintain a HOLD rating for Exxon Mobil shares, reflecting updated forecasts for oil prices, production, and market conditions.

- The Pioneer Natural Resources acquisition is expected to significantly boost Exxon Mobil’s oil and gas production, enhancing operational efficiency and synergies.

- Revised forecasts predict a shift from oil market deficit to surplus in 2025, with adjusted Brent oil price expectations for 2H 2024 and 2025.

- Despite increased Upstream revenue forecasts, overall revenue and EBITDA projections for 2024 are lowered, leading to a reduced target share price of $122.

CHUNYIP WONG

Investment thesis

We have covered the stock before, and there have been a number of changes since last quarter, which are the subject of this report. On the macro side:

- We maintain our forecast that the oil market will move from deficit to surplus in 2025 against a backdrop of rising OPEC+ oil production.

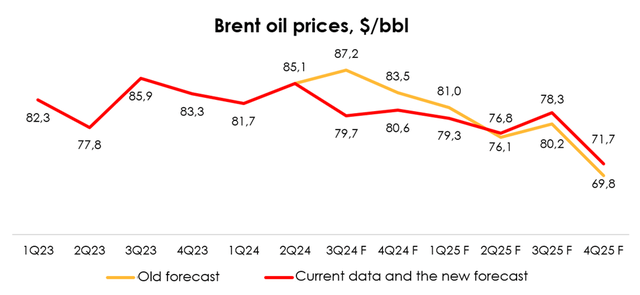

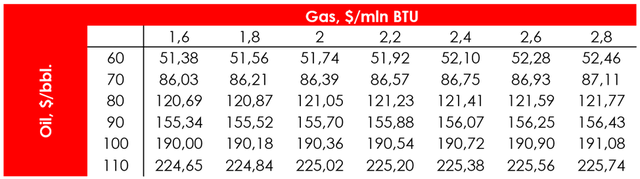

- We have lowered our oil price forecast for 2H 2024 from an average of $85.3/bbl to $80.2/bbl and raised it for 2025 from $76.3/bbl to $77.0/bbl.

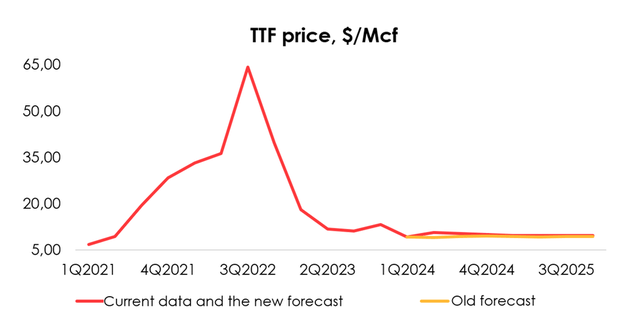

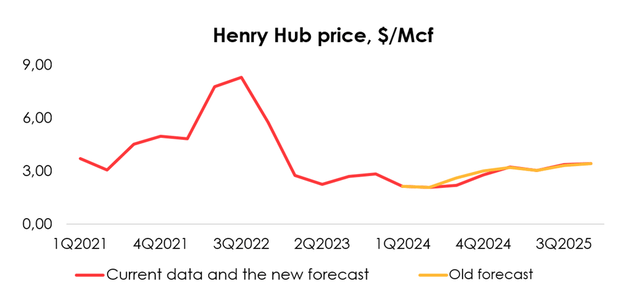

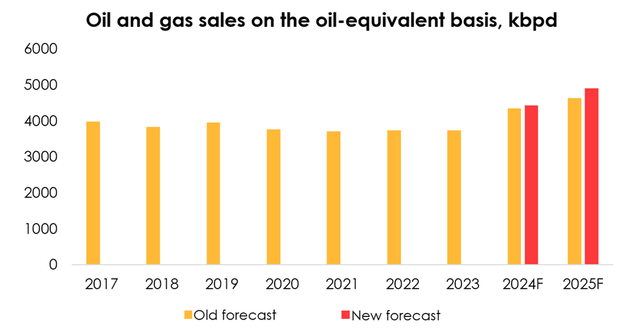

- The TTF forecast has been raised for 2024, Henry Hub, otherwise, was lowered.

- Regarding the Pioneer Natural Resources deal, which closed on May 3, 2024, Exxon Mobil’s (NYSE:XOM) management believes that synergies between Exxon Mobil and Pioneer will have a greater impact than previously expected. As a result, we have raised our oil-equivalent oil and gas production forecast for 2H 2024 from 4598 kbpd to 4785 kbpd and from 4637 kbpd to 4905 kbpd.

Based on the new assumptions, we maintain the HOLD rating for the shares.

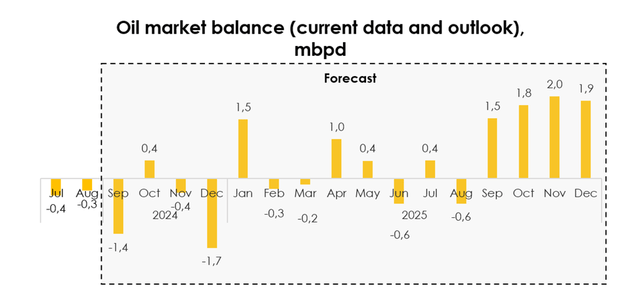

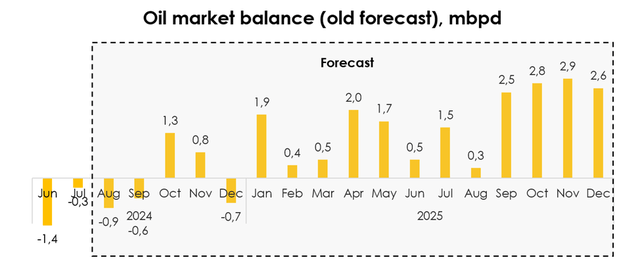

Oil market balance

Following the increase in the US Department of Energy’s forecast, we have raised the forecast for world oil demand in our model for September-December 2024 to 103.7 mbs and for 2025 to 104.6 mbs. Due to the decrease in the forecast for oil production in OPEC+, including Russia, (due to the postponement of the production increase), we have lowered the forecast for global oil supply for September-December 2024 to 102.9 mbs, and for 2025 to 105.3 mbs.

We maintain our forecast that the oil market will move from a deficit to a surplus in 2025 on the back of an increase in OPEC+ oil production. At the same time, due to an increase in the forecast for oil demand and a decrease in the forecast for world oil production, we have raised the forecast for the average deficit in September-December 2024 to an average of 0.8 mbs and slightly lowered the forecast for the average surplus in 2025 to 0.7 mbs.

Invest Heroes

Invest Heroes

Outlook for Brent oil prices

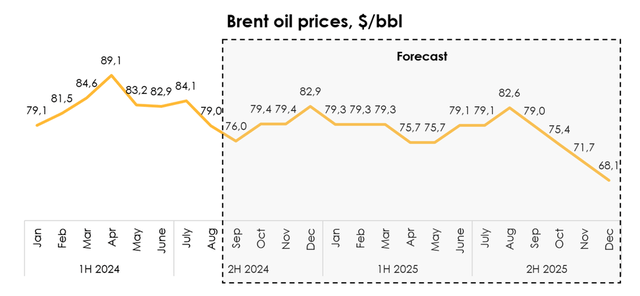

As a result of the weaker oil price environment in August and the first two weeks of September, we have lowered our September 2024 Brent crude oil price forecast to $76/bbl. As a result, we lowered our oil price forecast for the 2H 2024 from an average of $85.3/bbl to $80.2/bbl. Due to the reduction in the forecast for the average surplus, we have raised the forecast for the Brent oil price in 2025 from $76.3/bbl to $77.0/bbl.

We expect oil prices to average $76-82.9/bbl in September-December 2024 and to decline in 2025 from $79.3/bbl in January 2025 to $68.1/bbl in December 2025.

Invest Heroes

Invest Heroes

Macro outlook for the gas market

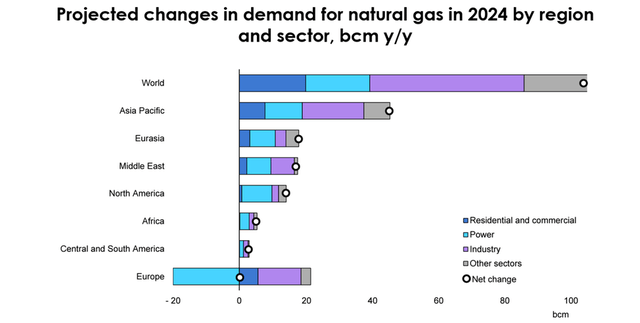

Compared with last quarter, the International Energy Agency has slightly raised its forecast for growth in gas demand in 2024 from 2.3% y/y (+1.8 pp y/y) to 2.5% y/y (+2 pp y/y). Fast-growing Asian markets will continue to drive up demand.

The forecast for growth in the Asia-Pacific region (which includes Exxon Mobil’s two major gas markets: Asia and Australia and Oceania, together making up more than 60% of demand for the company’s gas) was raised from 4% y/y to ~5% y/y in 2024. Growth in demand for natural gas in Asia is mostly driven by the manufacturing industry and the energy sector. China and India continue to be the region’s largest importers. Developing countries (Bangladesh, Malaysia, Thailand and Pakistan) continue to steadily ramp up their gas demand.

The forecast for US demand growth was slightly raised to 1% y/y. Despite declining gas demand in the residential and commercial sectors in 1H 2024 amid mild weather conditions from February-May, gas consumption in the power sector climbed by 6% y/y due to higher demand for electricity, which, as can be expected, will continue to be a key driver of gas demand growth for the rest of the year.

The estimate for European natural gas demand in 2024 was cut from rising by <2% y/y to remaining at the 2023 level, as increased gas consumption in buildings and the manufacturing industry will be almost entirely offset by lower gas-fired power generation. Gas consumption in the power sector is expected to decline by >10% y/y in 2024 on the back of rapid development of renewable energy generation and increasing availability of nuclear power in key European markets.

IEA

Gas price outlook

In 2Q 2024, natural gas prices were quite volatile and generally increased in all key markets. The reasons for this were as follows:

- declining supply (the stoppage of an LNG plant in Norway for most of June; falling US natgas production);

- geopolitical turbulence (the new US sanctions on Russian LNG, the news that Ukraine will cease transit of Russian natgas in 2025, uncertainty about supplies of Russian pipeline natgas to Europe);

- steadily rising demand, especially from Asia.

In connection with this, we are raising the forecast for TTF prices from $9.30/Mcf to $10.06/Mcf for 2024, and from $9.37/Mcf to $9.67/Mcf for 2025.

Invest Heroes

Subsequently, following the sharp increase in US gas prices in May and June 2024, as well as an extremely hot July across much of the US, the actually observed US price environment was weaker than the EIA had anticipated, prompting a reduction in the forecast for HH prices in 2024 from $2.46/MMBTU to $2.3/MMBTU. Lower prices could push US gas production further down, which with all other things being equal, is causing a slight increase in the forecast for HH prices in 2025, from $3.24/MMBTU to $3.27/MMBTU.

EIA

Impact from buying Pioneer Natural Resources

In 2Q 2024, financial statements of Exxon Mobil and Pioneer Natural Resources were consolidated following the closure of the acquisition deal on May 3, 2024. The management said that across various industries, it took an average of more than 11 months to complete similar (likely in scale) transactions in the past several years. However, the Exxon Mobil team did it within six months, allowing a quicker start of joint operations, and reporting their results for two months of 2Q 2024.

Pioneer’s resources had a significant impact on Exxon Mobil’s Upstream segment (exploration and production). They made it possible to achieve record production of 4358 kbbd of oil equivalent (+574 kbbd q/q, or +15% q/q) in 2Q 2024. And that’s just after two months of joint operations, meaning that production will rise even further in the future.

Moreover, Exxon Mobil’s management sees synergies with Pioneer exceeding initial expectations.

Therefore, we are raising our forecast for oil and gas production on the oil-equivalent basis from 4633 kbpd to 4785 kbpd for 2H 2024 and from 4637 kbpd to 4905 kbpd for 2025 due to:

- expectations of a greater impact from the synergy between Exxon Mobil and Pioneer, which will raise the efficiency of oil and gas production by Exxon Mobil;

- the increased forecast for Exxon Mobil’s share of the global oil production market following the purchase of Pioneer;

- the increased forecast for global natgas demand.

Invest Heroes

Exxon Mobil’s updated revenue structure

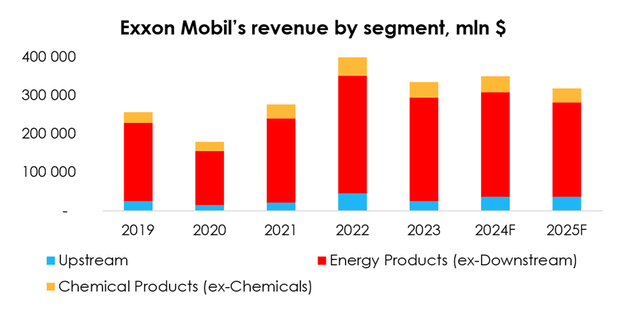

Following the deal to acquire Pioneer, we expect the proportion of the Upstream segment in the company’s revenue structure to rise to 10.5% (+2.8 pp y/y) in 2024, and 11.5% (+1 pp y/y) in 2025.

We expect Energy Products (ex-Downstream) to remain the company’s most significant segment in terms of revenue and will bring the energy giant 77%-78% of its total revenue in 2024 and 2025.

The Chemical Products (ex-Chemicals) segment is expected to contribute 11.5%-12% of the total revenue.

Company data, Invest Heroes calculation

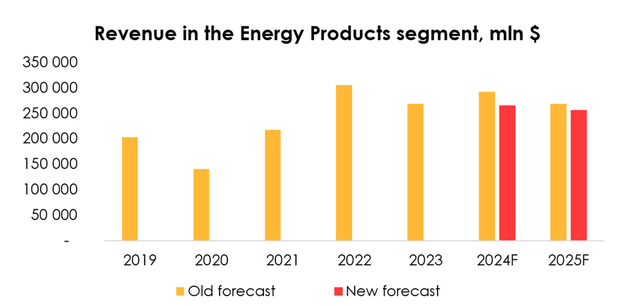

We have lowered the forecast for revenue in the Downstream segment from $292.5 bln (+9% y/y) to $265.9 bln (-1% y/y) for 2024, and from $269.1 bln (-8% y/y) to $256.9 bln (-3% y/y) for 2025 due to:

- the reduction of the forecast for Brent oil prices from $84.5/bbl to $81.8/bbl for 2024, and the slight increase from $76.3/bbl to $77.0/bbl for 2025;

- a lower estimate for selling prices of oil products in 2024, which will follow oil prices;

- a lower estimate for oil-product sales in 2Q 2024 and further cuts to estimated sales over the forecast period.

Company data, Invest Heroes calculation

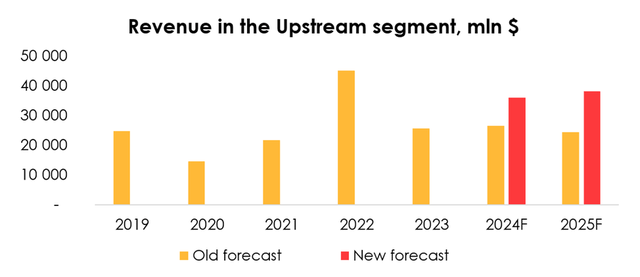

We are raising the forecast for revenue in the Upstream segment from $26.5 bln (+4% y/y) to $35.9 bln (+40% y/y) for 2024, and from $24.4 bln (-8% y/y) to $38.2 bln (+6% y/y) for 2025 due to:

- the increased forecast for oil and gas production in 2024 and 2025 and, consequently, sales (positive effect);

- the reduction of the forecast for Brent oil prices from $84.5/bbl to $81.8/bbl for 2024 (negative effect), and the slight increase from $76.3/bbl to $77.0/bbl for 2025 (positive effect);

- the lower forecast for natgas prices for sales on the domestic market in 2024 (negative effect);

- the higher forecast for natgas prices for sales overseas in 2024 and 2025, and for domestica sales in 2025 (positive effect).

Company data, Invest Heroes calculation

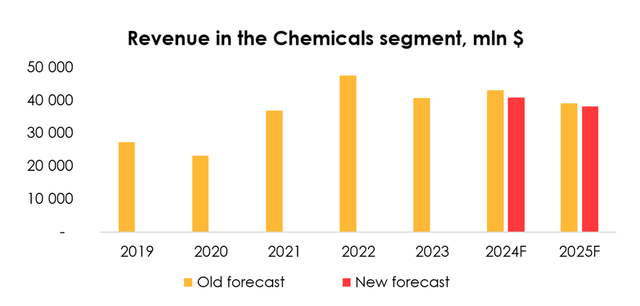

The forecast for revenue in the Chemical Products segment has been lowered from $43.1 bln (+6% y/y) to $40.9 bln (+0% y/y) for 2024, and from $39.1 bln (-9% y/y) to $38.2 bln (-7% y/y) for 2025, which was driven by the projection that selling prices of oil products will fall in 2024, as they follow oil prices, while the outlook for sales remained almost unchanged.

Company data, Invest Heroes calculations

Exxon Mobil’s financial results

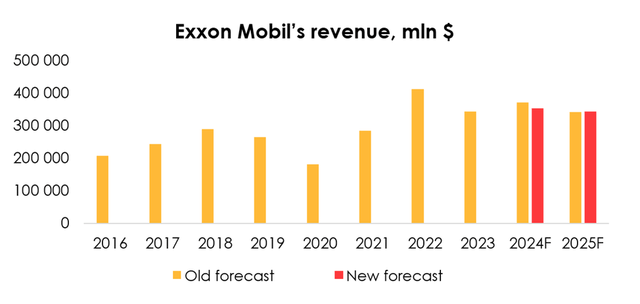

We are lowering the forecast for Exxon Mobil’s revenue from $372.8 bln (+8% y/y) to $353.8 bln (+3% y/y) for 2024, and slightly raising it from $342.5 bln (-8% y/y) to $343.9 bln (-3% y/y) for 2025 due to:

- the reduced forecasts for revenue in the Energy Products and Chemical Products segments in 2024 and 2025, although that was partially offset in 2024 and fully offset in 2025 by the higher forecast for the Upstream segment’s revenue.

Company data, Invest Heroes calculations

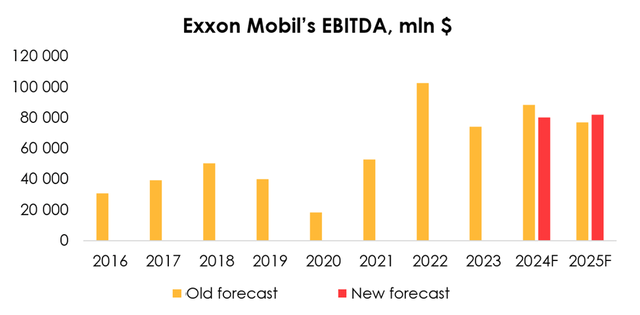

We are lowering the forecast for Exxon Mobil’s EBITDA from $88.2 bln (+19% y/y) to $80.3 bln (+8% y/y) for 2024, and raising it from $77.1 bln (-13% y/y) to $82 bln (-7% y/y) for 2025 due to:

- the reduced forecast for Exxon Mobil’s revenue in 2024 and the increased forecast in 2025;

- the reduction of the forecast for the company’s operating margin from 25.5% to 24.1% for 2024.

In 2Q 2024, the spread between the purchasing price of crude oil and oil products and the Brent price continued to widen, which was not in line with our expectations. However, we continue to expect its incremental normalization in subsequent quarters.

Company data, Invest Heroes calculations

Valuation

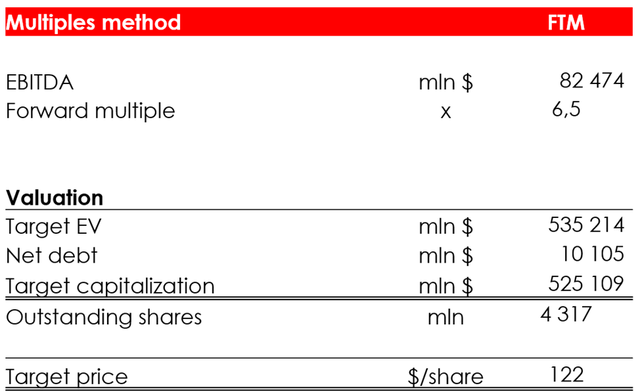

We are lowering the target price of the shares from $134 to $122 due to:

- the reduction of the EBITDA forecast for the period from 3Q 2024 – 2Q 2025 (negative effect);

- the increase of Exxon Mobil’s net debt from the projected $3.5 bln to the actual $10.1 bln (negative effect);

- the reduction of the number of outstanding shares from the estimated 4.5 bln to 4.3 bln (positive effect);

- the shift of the FTM valuation period (positive effect).

Based on the new assumptions, we are maintaining the rating for the shares at HOLD.

Invest Heroes

Invest Heroes

Conclusion

In line with the company’s portfolio diversification strategy, Exxon Mobil is actively pursuing M&A deals. On May 3, 2024, Exxon Mobil closed the deal to merge with Pioneer Natural Resources and it will not only increase Exxon Mobil’s capacity to produce oil and gas, but also will reduce oil and gas production costs, compared with the industry-average level, through technology and knowledge sharing with Pioneer Natural Resources.

Based on the new assumptions for the oil balance market and the gas market, we assign a HOLD rating to the stock. To manage your positions, we recommend following the earnings releases of Exxon Mobil as well as the news related to the oil and gas market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.