Summary:

- Schlumberger is poised for strong growth and margin expansion in 2H24, driven by high-quality backlog turning to revenue.

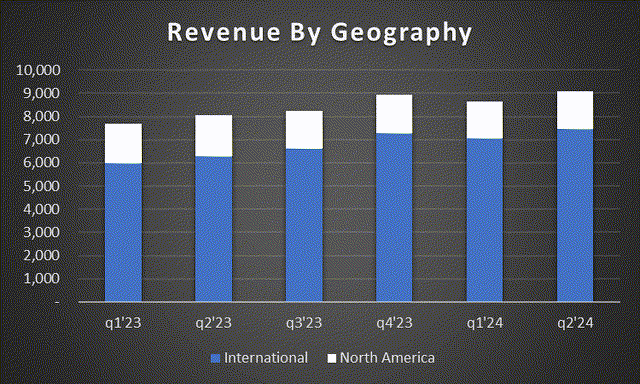

- SLB’s growth is expected internationally, with deepwater developments in Latin America and Africa, and a focus on gas production in the Middle East and Asia.

- Management’s focus on operational efficiency, strategic resource allocation, and the ChampionX acquisition supports margin improvement and an expansion of offerings.

- Despite SLB shares’ high correlation to WTI prices, SLB’s $3b share repurchase commitment for eFY24 and $4b for eFY25 provides shareholders value as they navigate choppy waters.

Monty Rakusen/DigitalVision via Getty Images

Schlumberger (NYSE:SLB) is well positioned for strong growth and margin expansion in e2h24 as high-quality backlog turns to revenue. Despite the softer oil market, SLB is realizing strength in Digital & Integration, gas, and LNG internationally. With domestic land rig count in decline from a year ago, SLB is finding opportunities in EOR of more mature assets and new exploration in frontier regions. I reiterate my BUY rating for SLB shares with a price target of $68.84 at 8.96x eFY25 EV/aEBITDA.

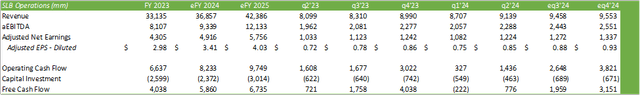

SLB Operations

Management reiterated their 2024 goals for expanding margins through high-quality revenue growth, a higher focus on operational efficiency, and an optimized support structure for strategic resource allocation across certain markets to better align the business with the expected levels of activity going forward into the next cycle. In addition to this, shareholders voted in approval of the ChampionX acquisition, allowing for SLB to resume share repurchases as part of their $3b commitment for 2024. The deal is slated to be finalized during eq4’24 or in early q1’25.

From a macroeconomic perspective, gas production and trade is the primary focus for new developments as LNG capacity continues to expand. Reuters has reported that Saudi Aramco gas production is expected to rise by 60% by 2030. QatarEnergy is also bolstering their gas production as the country seeks to become a major provider of LNG capacity. Qatar is expecting to increase production of LNG by 85% by 2030 to 142mm tons per year.

Management denoted that the majority of oil capacity expansions will be deepwater developments, primarily in Latin America and Africa. Stateside, production in the Gulf of Mexico is expected to grow as more firms turn their focus to long-cycled production. Management anticipates offshore FID for 2024 will reach $100b with a similar rate in 2025 as a result of the growing interest in the high-producing, low-carbon emitting assets.

Management remains ambitious in achieving margin improvement across the organization as the firm realizes scale for their digital platform. The firm is currently undergoing a mild restructuring to achieve cost improvements through organizational optimization to improve efficiencies. This includes centralizing their digital delivery services to improve efficiency. In turn, management anticipates the improved cost structure paired with scale will achieve an adjusted EBITDA of 25%+ for eFY24, a growing improvement above FY22-23 margins of 23% and 24.5%, respectively.

Much of the firm’s growth is expected to occur internationally as frontier basins are further explored paired with an increased focus on gas production in the Middle East and Asia.

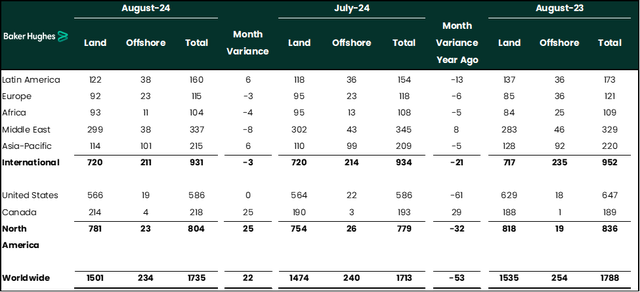

This shouldn’t come to that much of a surprise for investors as domestic rigs deployed have modestly declined as a result of softer commodity prices. Schlumberger, Baker Hughes (BKR), as well as a number of IOCs have suggested that offshore and deepwater production will be the primary focus for long-cycle production while fracking will act as an ancillary production node.

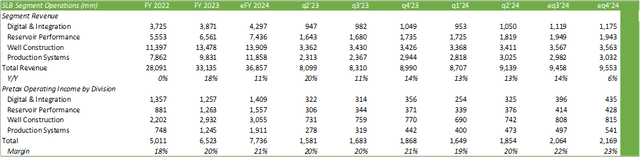

Looking at each individual operating segment, I anticipate SLB to realize strong growth going into eq3’24 across the portfolio with most segments realizing sequential growth.

I anticipate Digital & Integration to realize strong adoption in the coming quarter as more operators seek to better understand well performance and automate more operations with AI & machine learning. I anticipate this segment will scale and provide stronger margin performance as more operators seek to optimize performance and have a better understanding of the in-basin geology. Management noted that APS is expected to remain relatively flat in e2h24 with digital driving the margin expansion in the back-half of the year.

I anticipate a similar upswing in reservoir performance and production systems as operators are seeking to enhance well performance and squeeze every barrel of oil out of the ground. As more upstream operators seek to enhance well performance with the use of CO2 and other chemicals, I believe SLB will realize strength in this segment, especially as fewer rigs are deployed to maintain similar production volumes. These two segments will likely continue to benefit from more frontier basins being explored and tested as new discoveries emerge offshore.

I anticipate that well construction will grow at its current rate as operators enhance production at more mature wells. Though I do anticipate growth for the segment as new basins are explored and drilled, I do not anticipate a major upswing, especially given the current prices for oil and natural gas.

SLB Financials

Looking to financial performance, SLB reported a strong 13% top-line growth rate in q2’24 with a 25% aEBITDA margin. Operating margins were primarily driven by Digital & Integration’s 31% margin with well construction bringing in significant volume. I anticipate eq3’24 to provide significant strength across all segments with a top-line growth rate of 14% paired with a tailwind to the total operating margin to 22%. I anticipate EOR-related segments will benefit despite fewer domestic land wells being drilled & completed.

I believe that domestic will manage their frac fleets relatively flat for e2h24 given the challenged commodity prices with an upswing in offshore production. Similar to Baker Hughes, SLB will likely realize strength in reservoir and production chemicals once ChampionX is integrated into SLB, despite the modest decline in q2’24.

I have updated my forecast for eFY24 given the strong performance in q2’24 and the improved forecast for e2h24. I’m forecasting SLB to generate $36.8b in revenue with an adjusted EPS of $3.41/share. This should drive free cash flow to reaching $5.86b for eFY24.

Risks Associated With SLB

Bull Case

Management remains focused on managing operating costs by optimizing performance, centralizing digital assets, and regionalizing reservoir-related assets. This structural shift along with higher quality revenue generation should bolster margins in the coming quarter despite the softer price per barrel. Operations will likely be driven by offshore and deepwater investments, which aren’t as tied to the price of oil as onshore fracking given the longer time horizon.

Bear Case

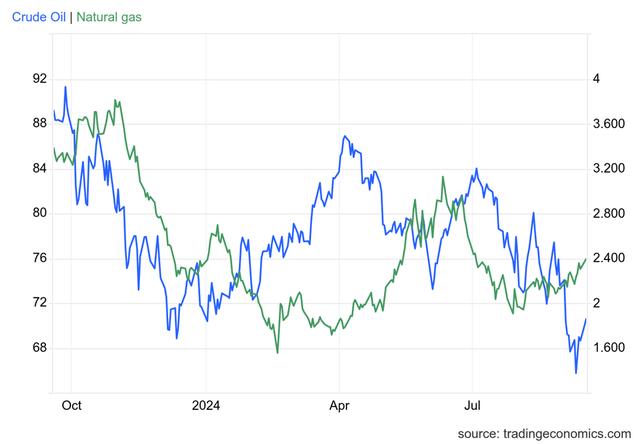

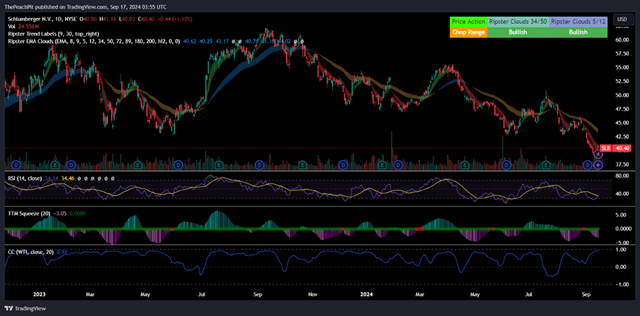

SLB shares are highly correlated with WTI prices and may continue their decline if oil continues to slide on softer demand coming out of China. This factor may drive volatility in the stock price and result in share price performance that isn’t reflective of the company’s operational performance.

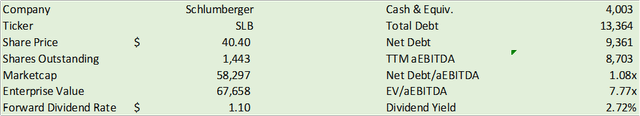

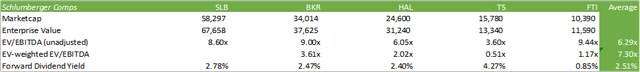

SLB Valuation & Shareholder Value

SLB shares currently trade at 7.77x EV/aEBITDA, a significant discount to its peer domestic OFS competitor Baker Hughes (BKR) at 9.07x EV/aEBITDA. This dispersion may provide some mean reversion upside potential to SLB, especially as the firm brings in ChampionX’s chemicals business to bolster SLB’s offerings. On an unadjusted basis, SLB trades at the higher-end of its peer cohort of OFS despite the discount to BKR.

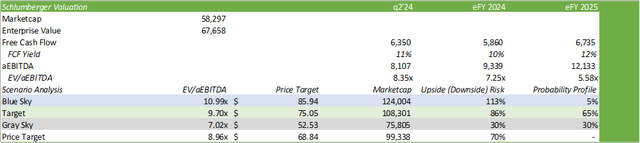

Using an internal model based on my forecast for adjusted EBITDA going into eFY25 paired with SLB’s historical trading premiums, I believe SLB shares hold a significant upside potential as the firm navigates through the next frontier of hydrocarbon production. I believe SLB shares are significantly discounted to potential outlay as the firm realizes strength in gas & LNG and offshore & deepwater investments. I reiterate my BUY rating for SLB shares with a price target of $68.84/share at 8.96x eFY25 EV/aEBITDA. If SLB shares reach this target, this will bring investors a 70% return from the current price levels.

One defining factor to bear in mind is SLB shares’ high correlation to WTI prices, as depicted in the chart below. This can provide certain volatility in SLB share price as the stock is directionally weighted to WTI as opposed to the firm’s ability to generate cash.

On the upside, management has committed $3b in share repurchases for eFY24 and $4b in eFY25. This should provide for some upside potential as the firm focuses on returning cash to shareholders while optimizing operations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BKR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.