Summary:

- Airbnb stock is a Strong Buy due to its high free cash flow, growth potential, and undervalued market price.

- The company plans to expand internationally, enhance its Experiences segment, and introduce a co-hosting marketplace.

- Regulatory risks exist, but Airbnb’s growth and profitability prospects outweigh these concerns.

- The market underestimates Airbnb’s growth, pricing in only 6.05% annual FCF growth, making it an attractive investment.

The Good Brigade

Airbnb (NASDAQ:ABNB) stock has essentially gone nowhere since its IPO in 2020. Meanwhile, the business has improved significantly, generating high amounts of free cash flow since 2021. Moreover, Airbnb has a good amount of growth potential ahead, as it plans to penetrate international markets and introduce new products and services that will improve the customer/host experience and generate more revenue. This leaves investors with a stock that, I believe, is currently a bargain based on the low growth rate its valuation is implying.

While there are risks to consider, such as laws regulating short-term rentals and new listing requirements in California, I believe the pros far outweigh the cons, especially at the current valuation. As a result, I rate Airbnb stock as a Strong Buy.

ABNB Stock Chart (TradingView)

The “Next Chapter Of Airbnb”

After reading Airbnb’s Q2-2024 earnings call, I became even more bullish on the stock than I already was. The company’s CEO, Brian Chesky, highlighted his plans to prepare Airbnb for its “next chapter.” Basically, Airbnb will be expanding out of its core business of short-term rentals (next year, according to the CEO), relaunching its Experiences business, and introducing other products and services.

Airbnb Will Introduce A Co-Hosting Marketplace

One notable service that it will launch in October for hosts is a co-hosting marketplace.

Brian Chesky described it in the following way:

“So, there are people that have homes but they don’t have time. There are other people in the world that have time but they don???t have a home. And so, there’s a Venn diagram of people today who have both that get host. But what if we can match those two people together? That would unlock a lot more inventory. That’s what we’re going to be launching later in October.”

This is in line with Airbnb’s strategy of creating more supply (high-quality supply at that), which will make the app even better and amplify its network effect.

Experiences Have High-Growth Potential

Now, let’s talk about Experiences. For those who don’t know, Airbnb doesn’t only offer short-term rentals, but it also offers “Experiences.” These are things like unique, locally guided activities and tours. For instance, an Experience listing that I’ve seen is “Fun Camp Animal Therapy,” where you get to go to a farm and hang out with friendly animals. But it’s not just rural Experiences. They can vary widely, including things like cooking classes, bike tours, and more.

I believe this has the potential to be huge, especially as Airbnb plans to market it more effectively. One current issue is that not too many people even know that Airbnb offers Experiences, especially because they’re not straightforward to find on the app. However, the company has recognized its flaws, meaning that there’s considerable upside potential in this segment.

When talking about Experiences in the conference call, Mr. Chesky stated:

They need to be more affordable. They need to be more unique to Airbnb when you think so you can only find on Airbnb. They should be merchandised, videos not photos. They should be discoverable in the app and we should market them.

He also stated this:

I mean a lot of people they come to our homepage they don’t ever see experiences. You wouldn’t know these sell experiences. So we’re going to completely reimagine our search and discovery engines to cross-sell experiences after you book a home and to really target the right homes.

This plan makes sense. Make it easy to find Experiences, show videos of the listings instead of pictures, make them more unique and affordable, and market them more.

The only reason Airbnb hasn’t done this already is because it stated that it was focused on prioritizing its core business. But now, the firm can unlock this potential, especially through cross-selling. Imagine you just rented an Airbnb, and then you saw on the app that there’s a nearby Experience listing. You may be swayed to book that as well.

International Expansion Plans

In the earnings call, Airbnb highlighted its international expansion plans, noting several countries that it wants to penetrate further, including countries in Asia, Latin America, and Europe. Management stated that there are tens of billions of dollars of gross booking value to be had if Airbnb can just penetrate these countries to the same level that it has in Canada or Australia. For context, its gross booking value in Q2 was $21.2 billion. Therefore, it’s easy to see how international expansion plans can notably drive growth.

Generative AI Ambitions

Ah, good ol’ AI. Management mentioned AI in the conference call, but these are longer-term, multi-year ambitions. Airbnb plans on using AI to transform its platform into a more personalized travel concierge that you can talk to or get recommendations from based on your preferences. This should improve the customer experience, which can, of course, lead to more revenues.

Airbnb Is A Free Cash Flow Powerhouse

All of the things I said above would be much less important if Airbnb was a cash burner, but it’s not. It’s a free cash flow powerhouse. The firm generated $1.043 billion in FCF in Q2 and $4.308 billion in the trailing 12 months. That’s because its business model requires minimal capital expenditures. For example, in the past quarter, its “purchases of property and equipment” were only $8 million compared to cash from operations of $1.051 billion.

For the trailing 12 months, its levered FCF margin came in at over 41.5%, per Finbox. For Fiscal 2024, analysts expect the company to generate $4.445 billion in FCF on $11.02 billion in revenue, implying a margin of 40.3%.

Its FCF margin may decline by a few percentage points in the short term as the firm invests in long-term initiatives, but I see no reason why it won’t be able to maintain high profitability in the future, especially after its “next chapter” investments eventually end.

When asked about long-term margins in the Q2 earnings call, Airbnb’s CFO said, “We will use some of the probability to invest, but we don’t anticipate any kind of sea change in the foreseeable future around overall profitability levels.” Given Airbnb’s track record, I will take management’s word for it.

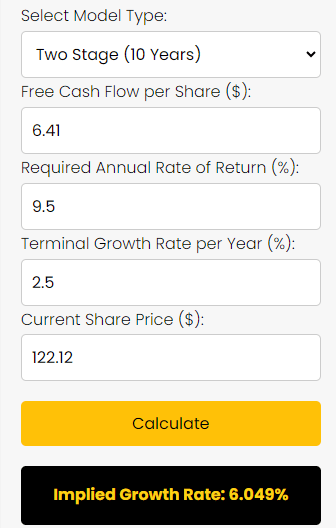

The Valuation Hardly Prices In Any Growth

I’ll be valuing Airbnb using a reverse DCF calculator that I’ve created, which you may be familiar with by now if you follow my work. Essentially, it calculates an implied growth rate that the market is expecting, and then you can decide if the stock can exceed that implied growth rate (which would make it undervalued) or not (which would make it overvalued). A more comprehensive guide can be found here.

Here are the valuation inputs:

- TTM FCF per share: $6.41 (manually calculated using a share count of 672 million)

- Cost of equity (manually calculated using the CAPM model): 9.5%

- Terminal growth rate: 2.5%

- Share price: $122.12

Here’s why I used 2.5% as the terminal growth rate (my terminal growth rates generally range between 2-3%). First, global GDP growth is estimated at around 3% for the next few years, which seems like a reasonable growth rate in perpetuity, but I wanted to be more conservative and choose 2.5%, especially as the travel industry is relatively mature.

Second, if we assume the Fed’s 2% inflation rate goal is achieved, Airbnb’s pricing power (which can easily be proven by its very high and expanding ~82.6% gross profit margin) could allow it to potentially raise prices that slightly outpace inflation.

The Valuation Calculation

Looking at the screenshot below, we can see that the market is currently pricing in that Airbnb will see its FCF per share increase by 6.049% per year for the next 10 years and then grow 2.5% per year after that in perpetuity.

This seems modest, given the growth potential. According to the consensus estimate from 3 analysts, Airbnb is expected to have FCF of $5.2206 billion by Fiscal 2027. From the current figure of $4.308 billion, that implies an 8% CAGR. This doesn’t include the fact that Airbnb regularly repurchases its shares, lowering its share count. As a result, its per-share growth should be even higher.

ABNB Stock Reverse DCF Valuation (Author)

Some Risks To Consider

Airbnb has faced some regulatory issues lately. First, it is facing trouble from New York City’s Local Law 18. The law requires rentals that are shorter than 30 days to be registered with the city so that the city can see if any rules are being broken. One rule requires that hosts be permanent occupants of the rental units. In short, this has caused Airbnb to see an 83% decrease in short-term rentals, according to data analytics firm AirDNA.

Meanwhile, Airbnb is fighting back, arguing that while the law was intended to ease the housing crisis, it has been unsuccessful. Rents have continued to rise by as much as 3.4% in New York City in the 11 months since the law was introduced. The firm also pointed out that the law has reduced accommodation options for tourists. Other cities in the US and around the world have also placed restrictions on short-term rentals. If this trend continues and Airbnb doesn’t effectively fight back, it will impact its growth.

Airbnb also faces challenges in California, where a new regulation came into effect on July 1, 2024. It requires companies like Airbnb to show the full price of a booking upfront, including taxes and fees.

Of course, this will result in a higher listed price, and Airbnb’s management stated in the conference call that this has caused headwinds. However, the company is monitoring “how quickly consumer behavior normalizes after these regulations have been put into place.” Perhaps consumers can get used to (and even come to appreciate) being shown the full price. Nonetheless, California makes up 10% of Airbnb’s gross booking value, so this is something worth watching.

The Takeaway

While Airbnb faces regulatory hurdles, which can definitely hinder growth, I believe the pros outweigh the cons. Plus, there are plenty of cities around the world, and I doubt that most of them will impose strict laws against short-term rentals. If they do, then sure, it can become a problem. But for now, Airbnb is still growing and is expected to grow further despite these headwinds.

The company generates plenty of free cash flow, and its FCF should continue growing as it scales its business. Additionally, the company has impressive plans to bring its business into the “next chapter,” including a bigger focus on Experiences, generative AI integration, a co-hosting marketplace, and a continued international expansion.

When looking at ABNB stock’s valuation, I found that the market is implying just 6.049% free cash flow per share growth over the next 10 years and then 2.5% per year after that. Those are the growth rates you’d expect from a mature company, but Airbnb is not that. It’s a disruptor with plenty of room to grow. Consequently, I rate ABNB stock as a Strong Buy.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.