Summary:

- Chevron is set to report its Q4 earnings on January 27th which will likely follow an announcement of its latest dividend increase.

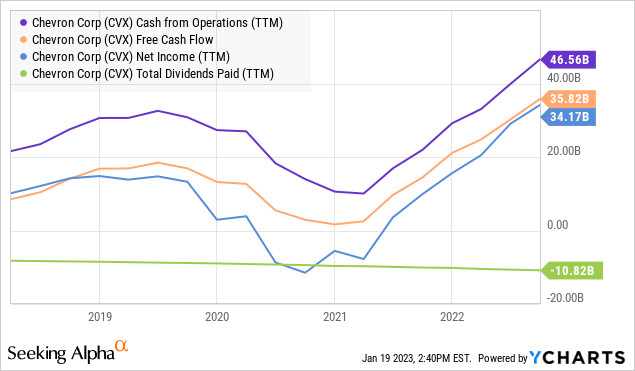

- A record year for earnings and cash flow provides room for a higher payout.

- We highlight the themes to watch in 2023 and our dividend increase forecast.

Mario Tama

Chevron (NYSE:CVX) had a banner year in 2022 with shares climbing more than 55%, benefiting from the elevated pricing environment in oil and gas. The company is set to report its final Q4 earnings which will likely cap off a record year for profitability supporting a positive outlook.

Investors can also expect an announcement of a dividend hike to the company’s quarterly rate which has historically been declared one day before the year-end results. Chevron is a “Dividend Aristocrat” with a 35-year history of increasing the annual payout with all signs suggesting room for that pattern to continue. Considering the strong trend in cash flows alongside a strengthened balance sheet position, we see the company well-positioned to reward shareholders.

Overall, there’s a lot to like about Chevron as a high-quality leader in an attractive market sector with several tailwinds in 2023. We’re bullish on the stock and expect more upside going forward.

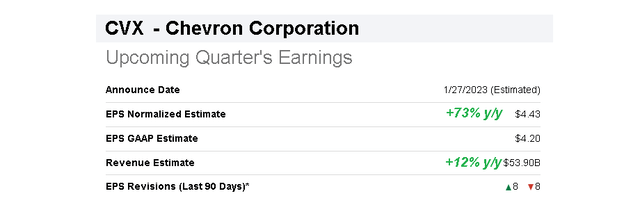

CVX Earnings Preview

CVX is set to report its Q4 results on January 27th, before the market opens. The current consensus for EPS at $4.43, if confirmed, will represent an increase of nearly 73% compared to Q4 2021. The momentum here considers a forecast for $53.9 billion in revenue, 23% higher year-over-year, as the sales prices for crude oil and natural gas liquids are on average higher compared to the period last year.

At the same time, those same energy prices have been volatile in recent months, and sharply lower from highs in the first half of 2022 which describes a more normalizing trend in financials compared to the windfall second quarter. The Q4 revenue estimate is also tracking for a -12% decline from the last reported Q3.

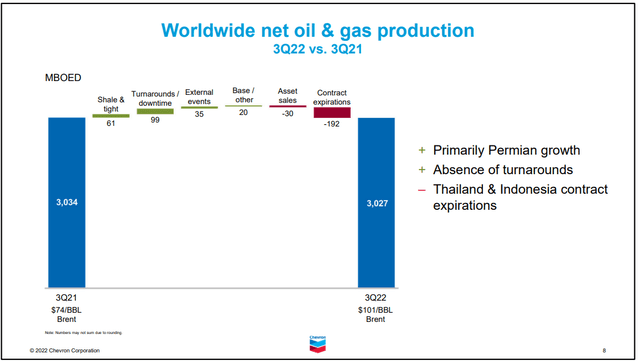

All this is in the context of the company’s net-oil equivalent production at 3 million barrels per day in Q3, roughly flat in the first nine months of the year compared to levels in 2021. Even as U.S. output from the Permian basin and other regions has increased to a record, the total worldwide figure is balanced by some contract expirations and certain asset sales. On the other hand. downstream operations have been a strong point and profit driver based on high margins for refined products.

Overall, the expectation is for similar operating trends in Q4 based on previously announced guidance, outside some modest planned turnarounds and downtime. The top-line result for the Q4 results will largely depend on final realized prices with the upside being Chevron’s ability to come in at the upper end of its production range. There is also a case to be made that the company benefited from easing supply chain disruptions and lower inflationary cost pressures as a positive for margins.

What’s Next For CVX?

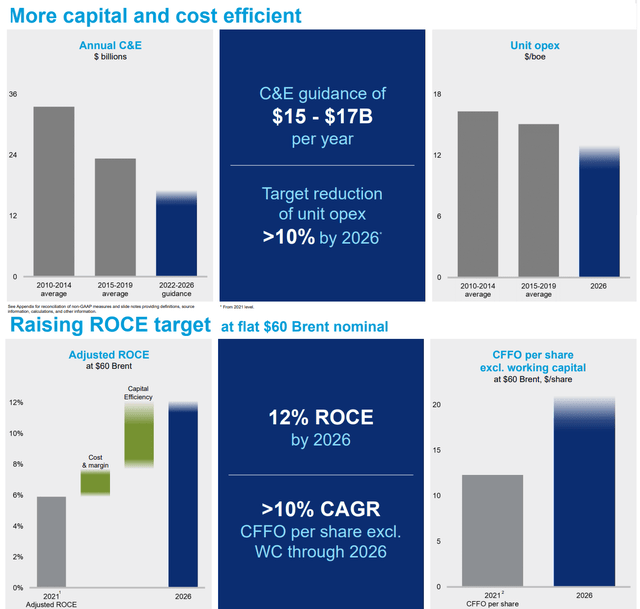

The bigger story is the trend in underlying cash flows and improved financial efficiency. One of the takeaways from Chevron’s last Investor Day conference back in November was that the group was raising its adjusted return on capital employed (ROCE) target to reach 12% by 2026, which compares to 6% in 2021 using the $60 Brent level as a benchmark.

The idea here is to capture a consistent reduction in unit operating expenses over the period to generate higher margins. Chevron is targeting total capital and exploratory expenditures (C&E) to average between $15 and $17 billion annually over the next four years, compared to levels above $20 billion in the past decade.

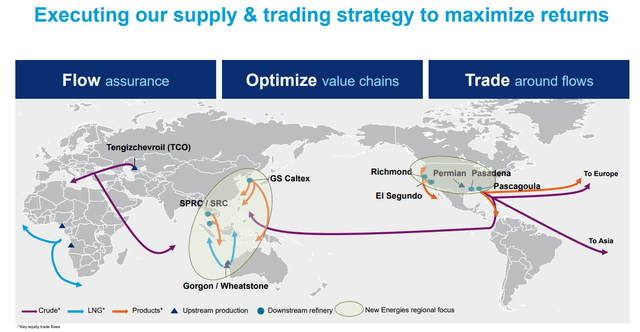

Part of the dynamic is an expectation for output growth to accelerate over the next few years driven by efforts in the Permian basin as a core part of the long-term global strategy. Chevron sees the potential for total net production to climb above 4mbpd through 2031. This is important as it supports not only an outlook for higher free cash flow but also translates into improved flexibility in terms of shareholder payouts including for the regular dividend.

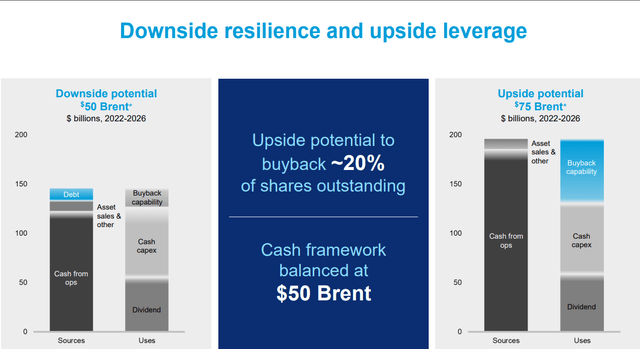

Overall, when we look at CVX, the sense is that this is a company hitting its stride compared to what may have been some hiccups in the last decade. Management has projected confidence citing its financial resiliency in various pricing environments. The company is expected to operate in a cash-balanced neutral framework even down to $50 Brent crude, which would be a near 40% downside from the current level. At $75 Brent and above, the operating leverage opens the door for significantly more share repurchasing incremental to the regular dividend.

CVX Dividend Forecast

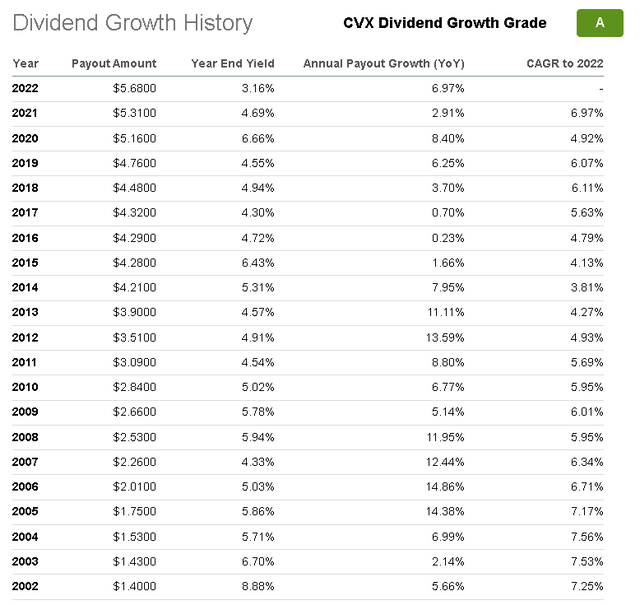

All that leads into our discussion of where Chevron may set its 2023 dividend rate. Going through the growth history, the annual increase has averaged 6% since 2018, or 5% over the past decade. This considers there was a period around 2015 with sharply depressed energy prices during the oil price crash that year which translated to only a meager $0.01 increase in the quarterly rate. The company also took a conservative approach at the start of 2021 amid the pandemic uncertainties with a 3% hike.

In recent years, Chevron has favored buybacks to represent the bulk shareholders’ return considering the $3.8 billion in repurchases compared to the $2.7 billion in dividends just in the last third quarter. We expect that trend to continue.

At the same time, it’s clear there is room to go with a more generous increase to the per share rate as various payout ratios in terms of cash flow and earnings have trended lower given the improved profitability. A big increase now authorized by the Board of Directors would help affirm confidence in the company’s outlook and management’s strategy.

- We forecast Chevron to hike its dividend to a new quarterly rate of $1.56, a 10% increase from the current level of $1.42.

The annualized rate at $6.24, or a total distribution of $12.1 billion for the year, would represent an approximate payout ratio of 32% on the full-year 2022 consensus EPS of $19.15. Considering the current market outlook is for earnings to normalize to $16.31 for 2023, considering the pullback in energy prices more recently, the implied forward earnings payout ratio at 38% would still be consistent with the average range over the past decade.

On a cash flow basis, a potential payout of $12.1 billion would comprise around 25% of the $46.6 billion generated over the past year through Q3, or slightly 35% in terms of the reported free cash flow. Even recognizing 2023 may be a less robust year for earnings compared to 2022, our take is that the effectively higher plateau of profitability and cash flow warrants a higher dividend increase compared to recent years. The management guidance for a higher ROCE and production growth over the next several years means a higher payout can be sustainable.

Again, this is simply our estimate and the reality is that the CVX dividend particularly increase is particularly difficult to gauge on a per share amount relative to other companies in different sectors. By this measure, we wouldn’t be surprised by an even larger increase toward $1.60 per share targeting a round number. On the other hand, anything below the 7% increase from last year to $1.52 would be surprising in our opinion.

The only constraint here is the company’s preference for buybacks that have been guided in a range between $5 billion to $15 billion per year against the trend in free cash flow. We $12 billion annually for the regular dividend going forward incremental to the top end of share repurchasing would still be under 100% of annual free cash flow going forward, providing room for continued debt repayments as necessary.

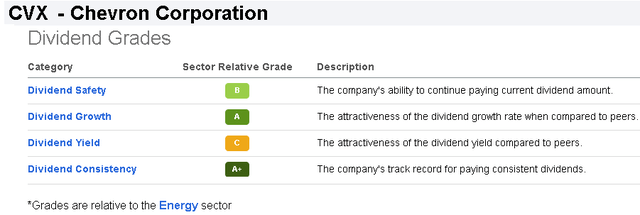

What we can say is that the company scores well within Seeking Alpha’s quantitative “Dividend Grade” earnings a (B) on the side of safety, (A) for growth, and (A+) with consistency given the long-term payout record.

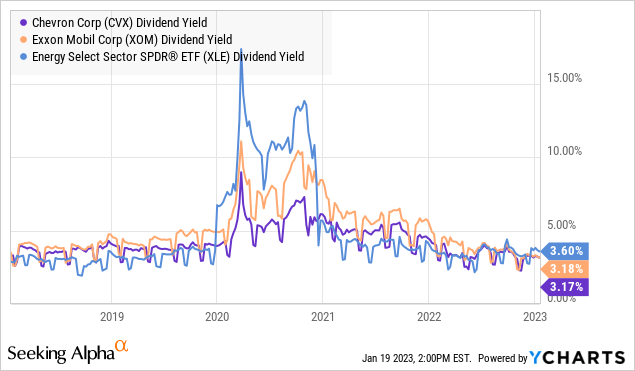

A hefty dividend hike this quarter would also help to bump up CVX’s dividend yield which has trended lower given the stock price performance. A new annualized dividend rate of $6.24 would suggest a forward yield of 3.5% placing CVX closer to the sector average of 3.6% based on the Energy Select Sector SPDR ETF (XLE). It also provides an opportunity for CVX to gain an advantage over its comparable Exxon Mobil Corp. (XOM) which last increased its dividend by a relatively meager 3% in late October.

CVX Stock Price Forecast

Entering 2023, the backdrop for the energy sector has been mixed. The current price of crude around $85 is up from levels in 2021, but also well below the 2022 peak when the benchmark price briefly approached $140 per barrel at the height of the Russia-Ukraine war supply disruption uncertainty. Still, as we noted from Chevron’s financial framework, the pricing environment is still relatively positive in terms of operating cash flows and earnings potential.

We’re energy bulls and see an upside to oil and natural gas based on stronger demand dynamics as a continuation of the underlying theme in the global post-pandemic recovery for segments like air travel. Even China, a major consumer, is just beginning to fully reopen which should represent a bid for all commodities.

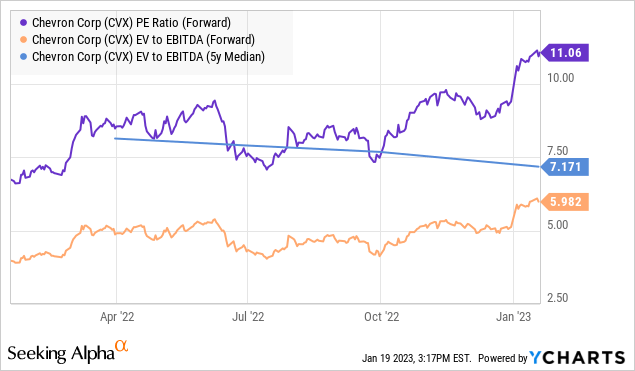

By this measure, we see room for CVX to outperform on the top line which generates value as its total production climbs and realizes those financial synergies. It’s hard to say shares are “cheap” trading at an 11x forward P/E or 6x on an EV to forward EBITDA ratio, but we believe shares can continue to climb higher and ultimately outperform the energy sector as a reference of quality.

As it relates to risk, a break lower in the price of crude oil under the recent low of $75 would mark a more concerning deterioration of the global macro outlook. Weaker-than-expected results on the production side or financials over the next few quarters would force a repricing of shares lower. Monitoring points for Q4 include updated 2023 guidance and cash flow trends.

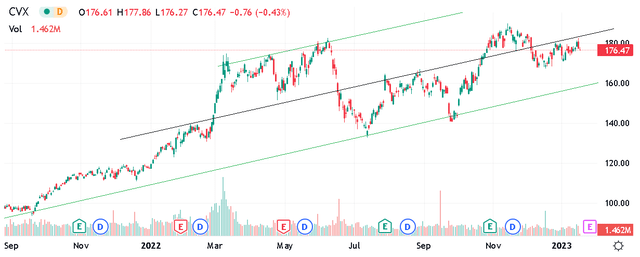

Looking at the stock price chart, it will be important for CVX to remain in the rising channel that has been in place since 2021 with the $160 level as an important area of support. To the upside, a breakout above $185 would open the door for renewed bullish momentum.

Disclosure: I/we have a beneficial long position in the shares of CVX, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.