Summary:

- Ford nears key support at $10.60; its RSI at 42.02 suggests it is oversold, while weak volume limits its short-term upside potential.

- The UAW strike has caused significant production delays, further raising concerns about Ford’s near-term profitability.

- Ford adjusted its EV strategy, increasing investments but lowering production targets due to demand and supply challenges.

- Ford Pro remains a high-margin division, projected to generate $70 billion in revenue by the end of 2024.

TennesseePhotographer/iStock Editorial via Getty Images

Investment Thesis

In July, we held a hold rating on Ford (NYSE:F) due to rising ownership costs, decreased affordability, and supply chain disruptions. Since then, F has dropped 23% lower, as recent developments, including the UAW strike, have triggered several plant shutdowns, production delays, and increasing concerns about profitability.

Ford has also adjusted its EV strategy, ramping up investments in electrification, but lowering production targets due to demand fluctuations and supply challenges. This cautious revision reflects ongoing uncertainties in Ford’s ability to scale its EV operations profitably, further reaffirming the hold rating.

Ford Stock Near Key Support: Will $10.60 Hold or Break for a Bullish Run?

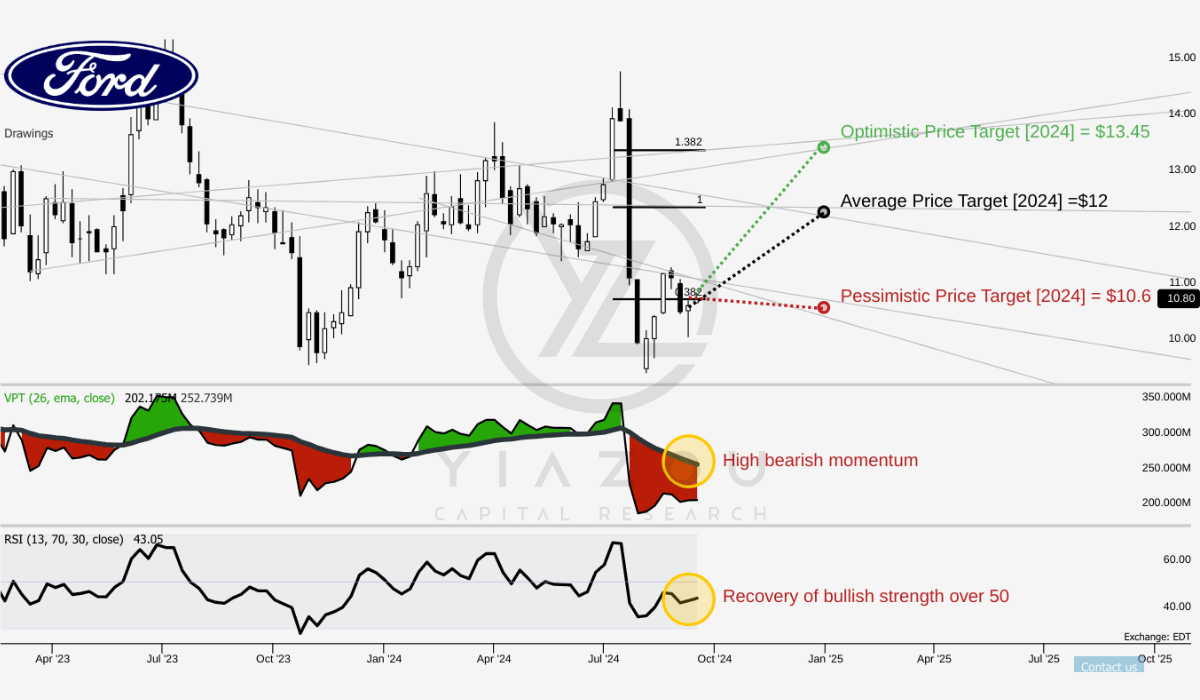

F’s current price of $10.90 aligns closely with its pessimistic price target of $10.60, which indicates the stock is trading near a key support level based on Fibonacci retracement levels. This suggests the market is cautious, as the pessimistic target corresponds to a retracement of 0.382. The average price target of $12, coinciding with the 1 Fibonacci level, reflects a potential stabilization and moderate upward trend. Meanwhile, the optimistic target of $13.45 aligns with the 1.382 Fibonacci extension level, implying stronger bullish momentum should the stock break resistance.

Further, the RSI stands at 42.02 below the neutral mark of 50, showing that Ford is inching closer to very oversold territory. No current bullish or bearish divergence is found, but the upward trend of the RSI line might indicate a potential recovery in momentum; it needs confirmation above 50, though. Hence, no current divergence means no immediate reversal signals, leaving the direction uncertain.

Finally, the Volume Price Trend (VPT) line is 202.17 million, flat below its moving average of 256.81 million. This type of sideways action indicates volume does not support price movements, thereby restricting the possibility of a sharp upside price move in the short term.

Yiazou (trendspider.com)

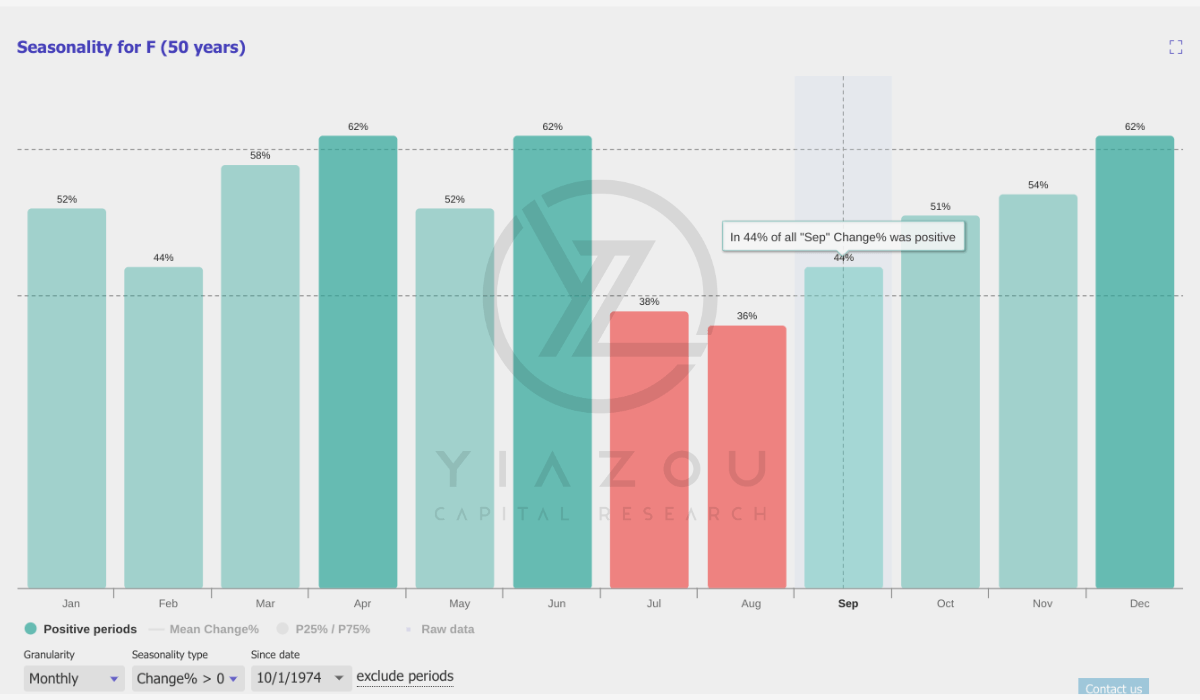

Based on 50 years of data, Ford’s stock has mixed seasonal results from September to November. September has a 44% probability of positive returns, reflecting slightly unfavorable seasonality — just 4% average returns during profitable periods. October improves somewhat, as the month provides an above-average 51% probability of positive returns, which indicates neutral seasonality. Finally, November exhibits more robust performance, with a 54% probability of gains. Therefore, this indicates that the more favorable trend usually occurs during the last few months of the year.

Yiazou (trendspider.com)

Fueling Growth with Cutting-Edge Software and Tech

Ford’s investment in software and digital experiences further strengthens its top-line growth. The company’s software business has grown considerably, with paid software subscriptions increasing by 40% to over 765K subscriptions. This growth has been broad-based as it spans all three customer segments (commercial, retail, and government), contributing significantly to Ford’s gross margins and exceeding 50% in this area.

Ford’s integrated service revenue is on track for double-digit growth in 2024, as the company is targeting $1 billion in revenue from software services next year. Hence, this represents a significant opportunity for margin expansion, as software businesses tend to generate higher margins than traditional vehicle sales.

Moreover, Ford’s edge in software is its lead in over-the-air (OTA) updates. According to the 2024 OEM OTA capability rankings, Ford leads the industry in terms of the quality of its updates that boost the performance capabilities of its vehicles. For instance, Ford has used OTA updates to improve its Mach-E electric vehicle’s range, battery efficiency, and acceleration. This product-based advantage may maintain competitiveness in the fast-growing EV market.

Finally, Ford’s BlueCruise hands-free driving tech is another point of its software lead. With 415K enabled vehicles and 213 million miles of hands-free driving, BlueCruise has become a significant competitive advantage in the US market. This growing installed base provides Ford a platform for further monetization through subscription services, boosting the company’s profitability and operating leverage over time.

Ford Pro’s High-Margin Mastery and Strategic Capital Efficiency

Ford Pro is a high-margin professional services division that could fuel $70 billion in revenue in 2024, capturing a significant portion of Ford’s consolidated revenue and growth potential within the commercial vehicle and fleet management sectors. Further, Ford Pro’s high profitability comes from its more diversified top line, extending beyond vehicle sales into parts, services, and software.

Ford Pro (professional services division) is a high-margin business that may derive $70 billion in revenue by the end of 2024. This indicates a significant portion of Ford’s consolidated revenue and growth potential within the commercial vehicle and fleet management sectors. Ford Pro’s profitability is boosted by a diversified top line that extends beyond vehicle sales to parts, services, and software.

Moreover, the decision to add 100K units of production capacity for the Super Duty line in Canada marks Ford’s capital-efficient growth strategy. Thus, expanding production in this area may derive high returns while minimizing upfront investment. For instance, considering flat to modest US industry growth (16 million to 16.5 million vehicles) and lower industry pricing, Ford Pro’s EBIT may improve 32% to $9.5 billion in 2024 against $7.2 billion in 2023.

Additionally, Ford has reversed its previous trend of international losses and may continue to turn its global operations (including China— profitable). This shift is the core of Ford’s global growth strategy, which enables the company to channel more capital into higher-margin segments.

Furthermore, the company is optimizing its product portfolio by focusing on iconic, high-margin models like the F-Series trucks, Transit vans, and popular sub-brands such as Raptor and Tremor. This strategic shift may also continue to support its competitive standing in the US automotive market. For instance, the company has maintained its position as the number one brand in internal combustion engine (ICE) vehicles, the number two in EVs for over 2.5 years, and the number three in hybrid vehicles.

Similarly, Ford’s electrification strategy pushes the company towards becoming more disciplined in its EV operations. Ford’s larger EVs are appealing in the ICE market, but they put excessive pressure on margins due to the high cost of large batteries. This factor has prompted Ford to focus on smaller EVs that are more affordable and more cost-efficient to produce. For instance, the company is focused on bringing EVs priced under $40K, and even $30K, to market and targeting the high-volume.

Lastly, the global hybrid portfolio is expected to grow by 40% this year across nine nameplates. Here, hybrid trucks like the F-150 and Maverick lead the charge. In H1 2024, hybrid pickups grew more than 3X faster than the overall hybrid segment, signaling strong demand. This rapid growth in hybrid trucks and the potential for Ford’s broader electrification strategy may generate revenue in the coming quarters.

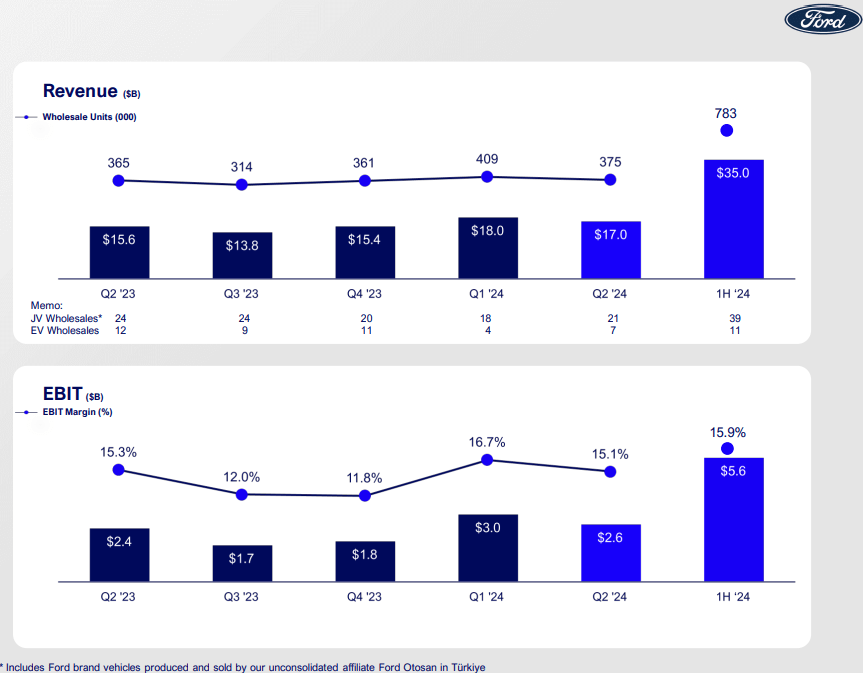

Q2 2024 Ford Earnings Presentation

Downsides: EVs Are Still A Loss-Making Game

Ford’s EV strategy has a fundamental weakness in becoming a lead in electrification. It remains significantly behind in production efficiency and profitability compared to Tesla (TSLA) and emerging Chinese EV makers.

Ford is unable to scale its EV operations without incurring massive losses. Ford’s Model-T business (responsible for EV production) is expected to post an EBIT loss between $5 billion-$5.5 billion, getting deeper from a $4.7 billion loss in 2023. Tesla, in contrast, has attained solid profitability across its entire EV portfolio. Ford has made strides in EVs but has not yet developed a sustainable model.

Another concern is that Ford’s large vehicle EVs have lower margins than their ICE counterparts. Larger vehicles require larger batteries, and Ford faces significant margin pressure as the market is not paying the premium required for these vehicles (due to inflation and interest rate issues).

Fundamentally, the automaker’s traditional business model symbolizing larger vehicles is incompatible with the economics of EVs. Technically, smaller vehicles are more profitable due to their smaller battery size and more efficient use of space. Yet, Ford’s iconic vehicle lineup, primarily based on larger trucks and SUVs, directly challenges its electrification shift. Also, the increasing market saturation, particularly from Chinese manufacturers, further intensifies this problem.

In short, Ford’s excess capacity in the industry may lead to downward pricing pressure, combined with the current high costs of EV production, which may limit Ford’s consolidated profitability. This bottom-line underperformance led to stock value erosion over the long term.

Takeaway

Ford has adjusted its EV strategy by increasing investments but cutting production targets due to demand and supply issues. Despite growth in high-margin businesses like Ford Pro and software services, challenges in scaling EV profitability and market volatility remain significant. These developments reinforce the hold rating as Ford navigates ongoing operational uncertainties and profitability pressures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.