Summary:

- Tesla faces significant challenges, including declining market share in China and stagnating EV adoption in Europe and the United States, leading to a bearish outlook.

- The stock appears overpriced based on both DCF and historical valuation metrics, suggesting a potential downside of nearly 33%.

- Potential delays in regulatory approval for Tesla’s Robotaxis and economic uncertainties further dampen short-term growth prospects, reinforcing my Sell rating.

- GARP investors should look to buy around the $150 level, as was seen in April 2024.

Editor’s note: Seeking Alpha is proud to welcome Shubhm Mitessh Thakkar as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Richard Drury

Executive Summary

Tesla Inc. (NASDAQ:TSLA) (NEOE:TSLA:CA) is part of the Magnificent 7 or Mag7 stocks that massively outperformed the market in 2023. However, this year, the stock has gotten a beating. The stock is down nearly 8% Year-to-Date. The company faces challenges in the Chinese market and lack of EV Adoption in Europe and USA. Additionally, it appears the stock is overpricing the impact of the Robotaxis. As a consequence, growth has stagnated and financial measures aren’t improving but rather worsening this year, and Tesla seems overpriced even by its own valuation metrics over the last ten quarters.

Triggers

The China problem

Tesla’s second-largest market and Asia’s largest economy is China, where the company has a manufacturing plant called the Gigafactory Shanghai. But, the company has faced several problems in China such as production lags in 2022, and a recall of 1.6 million cars due to a steering software issue in January 2024.

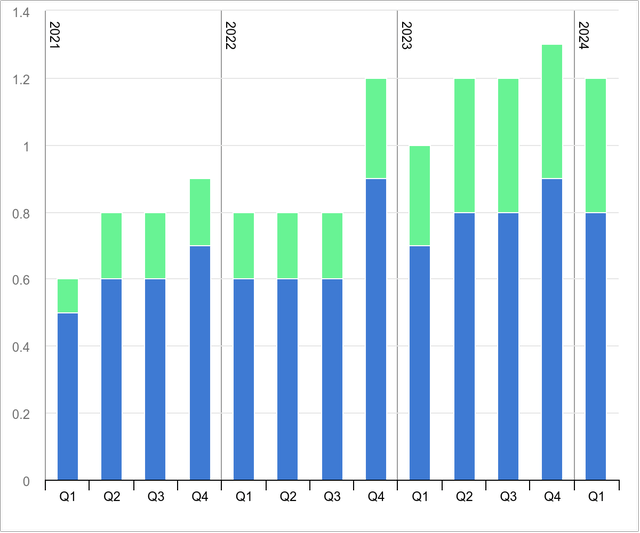

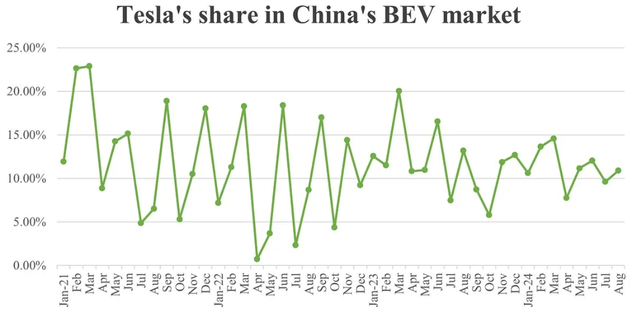

However, the biggest problem Tesla faces is not related to production, but to market performance. Tesla’s sales in China have plateaued based on data for January-August 2024 compared to the same period last year (down 0.57%). As a result, Tesla’s share of the Chinese market has steadily been in decline. Most of this loss has been snapped up by Chinese local EV giant – BYD (OTCPK:BYDDF) (OTCPK:BYDDY).

China Passenger Car Association

Source: CPCA via CNEV Post

China Passenger Car Association

Source: CPCA via CNEV Post

The main reason for this could be the cost differential between Tesla and BYD, since the latter sells cars at a fraction (at a quarter or a third) of the price at which Tesla sells its cars. China accounts for 22% of Tesla’s sales as per the company’s 2023 Annual Report, so a loss of market share could be a huge blow to Tesla’s growth.

Additionally, Tesla now also faces competition from Xiaomi launching an electric vehicle in the same price range as Tesla ($30,000-$40,000). Xiaomi CEO Lei Jun also claims it beat its category rival the Tesla Model 3 on 90% of its specifications. In the first 36 hours of its launch, Xiaomi got 120,000 orders for its car – a number that equals nearly twice the monthly domestic sales of Tesla in China.

I expect this trend to continue and Tesla’s market share to drop further until Tesla is left catering only to the Chinese upper-middle class and upper class who have the ability to pay for a Tesla and see the price differential (compared to BYD) as money’s worth for the higher features Tesla has over the base BYD BEV.

Lack of EV Adoption in Europe and USA

When electric vehicles were launched, the main concerns that people highlighted were the high upfront investment of buying an Electric Vehicle and concerns around range anxiety arising from insufficient charging infrastructure.

After the COVID pandemic, when electric vehicles grew immensely in popularity as a climate friendly solution, many governments introduced incentives schemes both on the supply and demand sides. However, these policies are now starting to get rolled back, as a consequence of which, the switch to EVs seems to have plateaued across the globe as shown below, especially in Europe (Blue) and the United States (green).

Source: International Energy Agency

Research from Ernst and Young Global Ltd. highlights electric vehicle trends in Europe and USA, and the reasons to explain the trends. For the United States, EY suggests that higher interest rates, a lack of charging infrastructure coupled with a constant fear of uncertain economic conditions over the last two years have stifled EV sales growth by creating affordability concerns and anxiety around not just the range of the vehicle but also economic conditions. For Europe, EY cites similar reasons – high prices, inadequate charging infrastructure, and economic uncertainty as headwinds.

In the short term, consumers who want Electric Vehicles are switching to Hybrid vehicles and not the Battery Electric Vehicle kind that Tesla manufactures.

The United States was Tesla’s largest market in 2023, accounting for nearly 47% of the company’s sales. The sales data for the six months of 2024 (H1 2024) reveals that the company’s revenues in the USA have grown a mere 2%. This may suggest that in the short term, the company’s sales have plateaued.

In the European Union, monthly car sales hit their lowest in three years during the month of August. This is largely attributable to the double-digit declines in Europe’s largest economies – Germany, France, and Italy. Sales of Fully Electric Vehicles dropped 43.9%, dropping for the fourth consecutive month. The EU’s largest economies, Germany and France, saw a 68.8% and 33.1% decline, respectively. Tesla saw a 43.2% decline in monthly sales during the month of August.

It is unclear as to exactly what percentage of Tesla’s sales come from Europe since any European country or the European Union was not mentioned separately in the Financial Statements, which means it must be less than 10%. However, the stagnation across geographies has reflected in its automotive sales segment revenues (34.99 billion in H1 2024 Vs 39.3 billion in H1 2023) and the Total Revenues which have also stagnated around $95-96 billion on a Trailing Twelve-Month Basis.

Robotaxis: Already priced into earnings despite challenges?

Elon Musk is no stranger to making bold promises when it comes to the quality of new product launches and especially their deadlines. In the Q1 2024 earnings call, he attempted to put focus on the launch of Tesla’s robotaxis.

I see this as a negative catalyst, especially in the time horizon for my report (12–15 months) for two reasons. First, is very specific to Tesla’s Fully-Self Driving or the Advance Driver Assistance System – it seems that the market is pricing regulatory approval of FSD technology much more easily than it actually has been playing out. Elon Musk has been promising autonomous vehicles since 2016 and has repeatedly failed to deliver on that promise. In April 2019, Elon Musk promised there would a million robotaxis on the road by the end of 2020. Obviously, he could not have predicted the pandemic, but it has been nearly 3 years since the world recovered and the robotaxi has still not been developed.

This was a promise he was meant to deliver on in 2020. Even though Musk and Tesla like to call it the “Full-Self Driving” feature, it is not even close to Level 4/5 of SAE Standards that truly represent such capabilities.

A robotaxi is an autonomous vehicle that needs to have achieved Level 4 or 5 autonomy – operating without any human intervention. Currently, Tesla has only developed Level 2 autonomy and even Tesla’s Autopilot is not SAE Level 3. So technological development and regulatory approval of Level 4 autonomy could still be a year or two away. It does come as a surprise, but Mercedes-Benz has beaten Tesla to developing Level 3 autonomy cars. Hyundai with its IONIQ 5 robotaxi claims to have achieved Level 4 autonomy.

Tesla still does not have regulatory approval to operate autonomous vehicles in California. There are other questions about the product design such as the inclusion of a steering wheel, and pedals that Elon Musk did not answer during the Q2 2024 earnings call. If the product prototype due to launch on 10th October 2024 does not have the aforementioned traditional control features, Andrew Hawkins (transportation editor with 10+ years of experience) is of the opinion that regulatory approval across geographies could take months if not years.

The experience of driverless taxi services like Waymo and Cruise in Phoenix, San Francisco and a few other cities has raised questions about when robotaxi services will become profitable and how much money they will make. This should force Tesla investors to re-think the magnitude and timeline of their growth expectations for Tesla’s revenues and profits.

Macroeconomic Headwinds

Multiple highly credible recession indicators such as the Inverted Yield Curve, the Sahm Indicator and the Conference Board indicator are predicting that the United States economy could be headed for a recession in the next 12 months.

However, I’d like to discuss factors more prevalent to the automobile sector that either already are or could have a deterring impact on automobile demand.

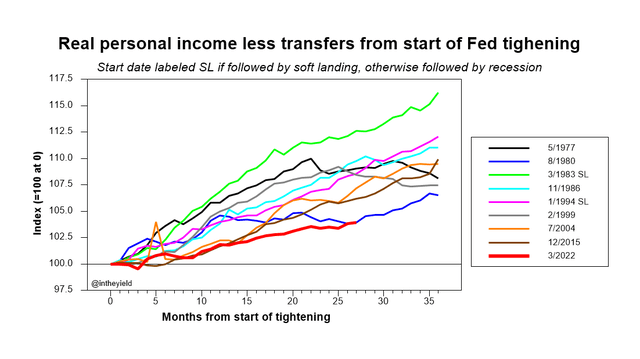

First off, the financing rate for new 48-month automobile loans is at the highest since May 2001, at 8.65% for May 2024 (most recent available). Even if it were to move lower to 7% in the next year, it may make loans more affordable, but the financing rate would still be the highest since 2008. I do not think it would be enough to spur a lot of demand. Growth in real personal income less transfers, a key data point used by the NBER Business Cycle Dating Committee, has shown the lowest growth in all interest rate hiking periods observed since 1977.

This suggests the consumer may not have a lot of strength and that a lower financing rate may not be enough to spur demand for automobiles.

Source: Arturo Estrella, former SVP at NY Fed via Twitter

Additionally, the continued rise in auto loan delinquency rates to 8%, the highest since the 2008 Financial Crisis, a third of which are seriously delinquent is likely to make banks and other lending institutions less willing to advance loans for automobiles.

Valuation – Discounted Cash Flow and Pricing (EV/EBIT and Fwd P/E)

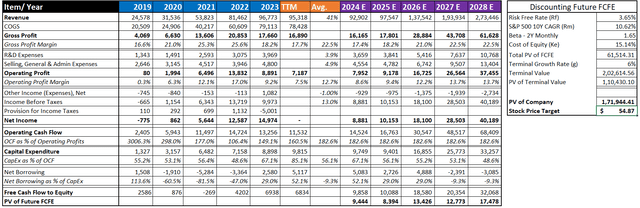

The DCF Valuation assumes a 4% revenue decline in 2024 due to a decrease in car deliveries YoY, a 5% revenue growth in 2025 keeping in mind economic headwinds and then 41% revenue growth (as per 5Y Avg.) in 2026 and beyond. While the company is bigger than it was before, the introduction of a more affordable in the future alongside an increase in the average selling price could propel revenue growth, especially if governments take EV policy measures more seriously.

I assumed Gross Profit Margins are near their lows and will revert to their 3-year average. The same logic was applied for operating expenses’ estimates, which were used to calculate the Operating Profit. Then, an average of the Operating Profit to Operating Cash Flow conversion ratio was taken to estimate the Operating Cash Flow. Capital Expenditures were assumed to be slowly declining (as % of OCF – reinvestment rate) assuming the company matures further and requires lesser investment in Property, Plant and Equipment.

Net Borrowing was taken as % of Capital Expenditure with the intuitive underlying logic of how much of the investment in fixed assets was funded by debt. If the number was negative, the company had enough cash and chose to net repay debts. The 2024 number was estimated based on TTM figures while 2025 and 2026 were assumed to be similar to 2023. Thereon, it was assumed that this metric would revert to its 5-Year Average and the company would slowly repay its debts as it matures.

The Free Cash Flow to Equity estimates were then discounted at the Cost of Equity which was estimated using the CAPM method (calculation attached with DCF). The above calculations showed us that Tesla’s estimated fair market value was ~$172 billion resulting in a stock price equivalent Price Target of $54.87, which was obtained after dividing 172 billion by Tesla’s outstanding number of shares (3.19 billion shares).

The problem with the intrinsic value via discounted cash flows approach might be Tesla’s high beta which led to future cash flows being heavily discounted giving them a lower value today. Also, it requires a high number of assumptions about the future, which is why I look at pricing the Tesla stock compared to its own historical multiples.

Tesla’s Historical Multiples Approach

Apart from finding the intrinsic value of the stock for Long Term, for a shorter-term price target, I will be using the various valuation metrics and comparing it to the last two years, which is reflective of the high rates environment we are in and the EV adoption cycle.

Over the last ten quarters, Tesla has traded at an average NTM EV/EBIT of 53x, whereas currently the stock trades at 67.27x NTM EV/EBIT. A reversion to the mean, based on my estimation of FY25 EBIT, would give a price target of $132.07. On an LTM EV/EBIT basis, the average across the last ten quarters has been 65.77x, whereas currently it trades at 91.25x. A reversion to the mean, based on the TTM EBIT, would give a price target of $148.14.

Based its average NTM P/E Ratio across the last ten quarters has been 58.97x compared to the current 71.86x that the stock currently trades at. A reversion to the mean based on my estimate of the 2025 earnings gives us a price target of $164.12. While this is the highest price estimate of the three historical valuation measures, even a $164 price target suggests that the stock is highly overvalued.

In this case, we only looked at the historical multiples Tesla has traded at – that the market has considered a fair valuation for the stock at the time. This yet again yields the view that the Tesla stock has a downside of nearly 33% with an average price target of $148 (the average of $132, $148 and $164).

Risks

Increased EV Adoption

One of the core factors of my thesis is the lack of EV adoption in Europe and the USA. The risk to this thesis comes from government initiatives that promote Electrical Vehicles through both the demand and supply side of the equation. However, this has already been factored into my valuations. That is one of the reasons I expect that Tesla can continue to grow revenues at its 5-year average of 41% despite being a larger company.

Technological breakthroughs that massively decrease the cost of producing electric vehicles or increase the range of battery electric vehicles can also increase EV adoption and this has not been factored into my valuation models. If that were to happen in the case of Tesla, I would be forced to revisit my valuation models pertaining to revenue growth and margins which affect future Cash Flow estimations.

FSD Launch in Europe and China

Apart from the hype surrounding Robotaxi, another major step to be taken by Tesla is the launch of the Self Driving/ ADAS product for the European and Chinese car markets. Being optimistic (worst case for my Sell thesis), nearly $50 billion of Tesla’s revenue comes from China and Europe combined as per their 2023 10-K Filing. Since Elon Musk has clarified that the take-rate for FSD is much higher than the reported 2%, I will assume it to be 10%, equal to the FSD take rate in North America and accounting for the downward trend. Tesla earned $18.53 billion from the delivery of 443,956 cars giving an ASP of nearly $42,000. FSD now costs $8,000 in the US so an incremental revenue of nearly 19% per car sale. 10% (adoption) x 50B (EU+China Revenue) x 19% (incremental revenue) = $0.95B revenue

Assuming people who’ve bought Tesla in the last 4 years buy FSD, adjusting for growth, let it be 3x that amount.

Assuming, FSD gets approved immediately in both China and Europe, it nets Tesla an additional $2.85 billion in 2025 and consequently an extra $1 billion consequentially. That is approximately an extra 1% in revenue CAGR, which would still not be enough to justify Tesla trading at current valuations when considering the difference in its current market cap and the fair value estimates, for both GARP investors and value investors.

Conclusion

I would like to conclude my bearish thesis on Tesla based on the loss of market share in a growing EV market in China and the lack of EV adoption in Europe and North America, and over-factoring of the Robotaxi potential with a Sell Rating on Tesla stock with a price target of $148. This may be a good point to enter a wider bull market and a growing economy, and for investors who seek Growth At a Reasonable Price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am a trader, so I may take long/short positions across stocks or indices based on trading signals. I want to disclose that I do not have any position in Tesla (stock, option or other derivatives), nor do intend to do so in the next 72 hours. However, I may take trading positions in Indices that Tesla is a part of – S&P 500 and NASDAQ 100.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.