Summary:

- V has been almost entirely spared from the current stock market turbulence and is benefiting from the people’s renewed desire to travel and go out after COVID.

- From a valuation point of view, the stock seems highly undervalued considering its fundamentals, growth and margins.

- From a technical standpoint, the stock could breakout from a multi-year sideways channel and represent a super-performance stock.

- Investors should be well-advised to use the current weakness of the market to accumulate the stock.

hatchapong

1. Introduction

The current turbulences on the stock market have affected many stocks. However, the financial services company Visa Inc. (NYSE:V) has been almost entirely spared from the current stock market turbulence.

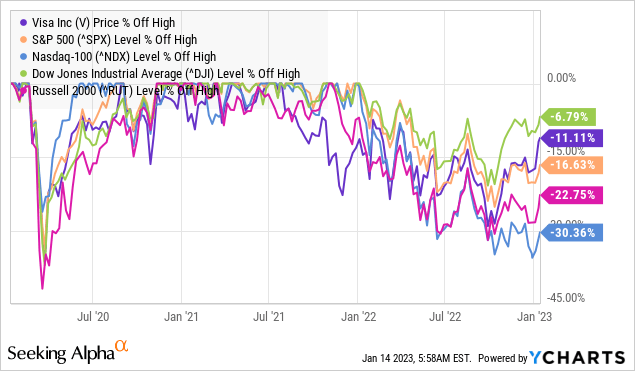

While the Nasdaq lost 23% and the S&P 500 17% from their all-time highs, V is currently down by merely 11%. Only the Dow Jones is currently doing better, with a loss of 7% (see chart).

Price % off high – V vs indices (YCharts)

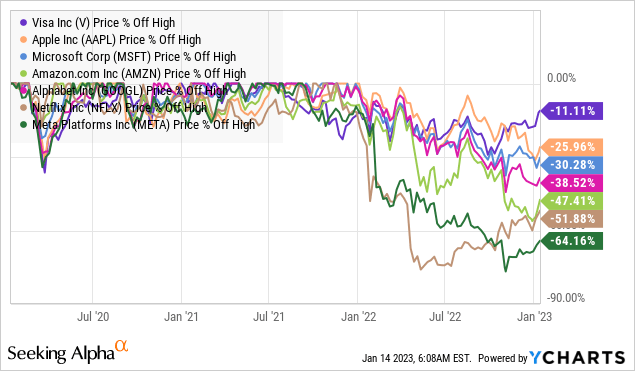

Even compared to investor darlings from the tech sector – the so-called FAANG stocks – V is performing significantly better (see chart).

Price % off high – V vs so-called FAANG stocks (YCharts)

Well, which reasons besides the relative strength compared to the overall market and investor darlings speak for an investment in V?

2. Valuation

In terms of valuation, I have chosen three valuation models to substantiate my investment thesis:

- The first valuation method is based on a DCF calculation.

- The second valuation method is based on an earnings-per-share calculation.

- The third valuation method is based on the rule of 40 by using the revenue growth rate and EBITDA margin, which is mainly used for evaluating growth stocks.

In any case, I have chosen a conservative approach by using a discount rate of 12% due to the monetary tightening phase of central banks on a global scale and the related rapidly rising interest rate environment. Other factors favoring a conservative approach include the uncertain macroeconomic and political environment and rising recession risks, which have probably not yet been fully priced in.

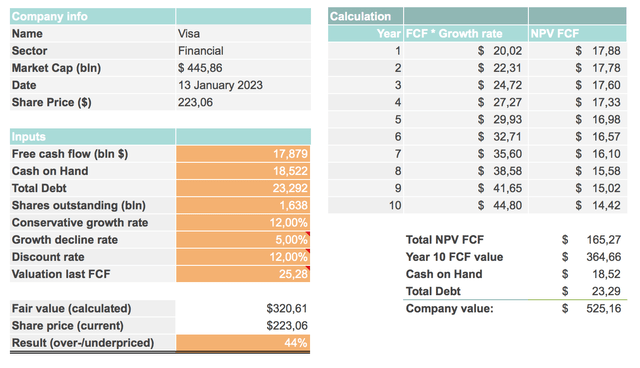

2.1 The valuation method based on a DCF calculation

With regard to the valuation method based on a DCF calculation, I have chosen a growth rate of 12% per year and a growth decline rate of 5% in terms of the free cash flow (FCF). V managed to grow its FCF by 23% in FY 2022 and by 45% in 2021, according to Morningstar. Analyst’s consensus predict a FCF growth of 11% in FY 2024 and 13% in FY 2025, according to MarketScreener.

In terms of Price/Cash flow multiple, I have chosen a multiple of 25.28 for the last FCF, which represents the current multiple of V. This Price/Cash flow multiple is well below V’s 5-year-average of 31.96 but higher than the S&P 500 multiple of 14.60, according to Morningstar.

In the first valuation method based on a DCF calculation, the fair value is $320.61, which corresponds to a current undervaluation of 44% (see figure below).

V fair value calculation based on DCF (Author’s calculation)

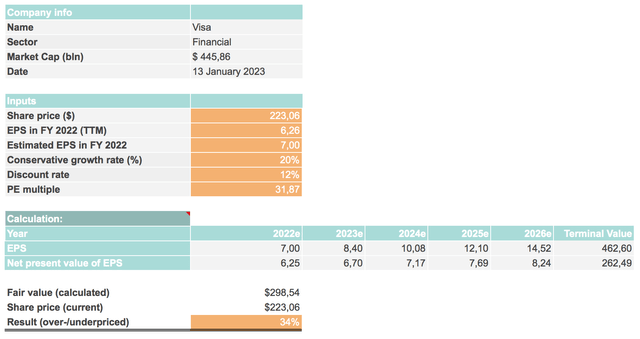

2.2 The valuation method based on an earnings-per-share calculation

With regard to the valuation method based on an EPS calculation, I have chosen a growth rate of 20% per year in terms of EPS growth. The 5-year average EPS growth rate was 20.11%, while the EPS grew 24.33 year-over-year, according to the latest indications on Morningstar.

In the second valuation method the fair value is $298.54, which corresponds to an undervaluation of 34% (see figure below).

V fair value calculation based on EPS (Author’s calculation)

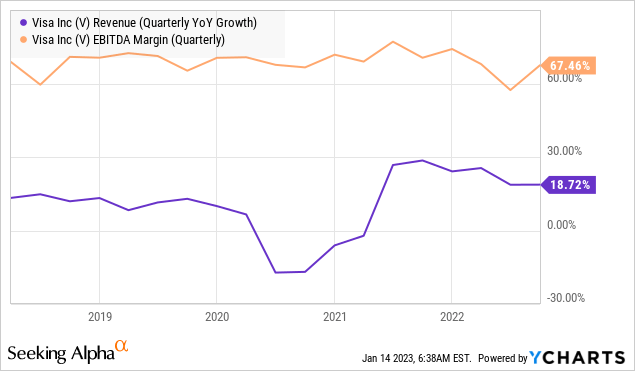

2.3 The valuation method based on the rule of 40

With regard to the rule of 40 and a revenue growth rate of around 19% in the most recent quarter, it can be stated that the ratio of 86.21 (67.46 plus 18.72) is just amazing, which suggests operational excellence and a highly profitable business model.

According to the rule of 40, a promising investment should have a ratio of 40 or more. The more this ratio exceeds 40, the better.

Rule of 40 – V quarterly revenue growth rates and EBIDTA margin (YCharts)

3. Technical Analysis

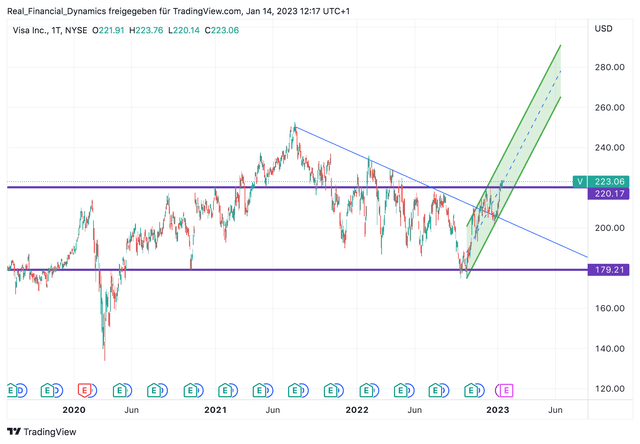

From a technical point of view, there are some exciting developments concerning V.

First, the stock managed to break out of his downtrend started in June 2022 and even managed to close above the resistance line at $220 (see chart).

Second, the stock started an uptrend in October 2022 (see green trend channel in the chart).

Third, the stock is just about to break out from its sideways trading channel in which it had been trapped since July 2019 (see purple lines in the chart).

So, if V succeeds to surpass its sideways channel, it could become a super-performance stock in the months to come.

On the other hand, since the general market is still trapped in a downtrend, the stock could fall back on top of the blue trend line for a re-test or – even worse – drop to the support line of $179 or even lower.

In general, the better the general market’s recovery, the better should V perform. Nevertheless, V seems to outperform the market in any case.

V technical analysis – setting up for a super-performance (TradingView)

4. Conclusion

Visa is benefiting greatly from the re-opening of the economy after COVID and people’s renewed desire to travel and go out and the increasing digitalization of payment processes.

My fair value calculation based on a DCF method shows an undervaluation of the stock of 44% and my fair value calculation based on an EPS method indicates an overvaluation of around 34%.

Moreover, considering the rule of 40, the company has a ratio of 86.21, which demonstrates high quality growth despite being a blue chip, operational excellence and a tremendous business model.

Furthermore, the technical analysis suggests a potential breakout from a multi-year sideways channel and a potential super-performance as soon as the market recovers.

The flip side of the coin: in the event of an economic downturn, the stock will logically be affected as people cut back on spending or may have trouble paying their credit card debt.

However, due to its solid financials and margins, the company should remain profitable and be able to weather an economic storm with only short-term consequences.

Another factor that could weigh on the stock is the fact that credit card providers are often criticized for their high fees. If there is further regulatory pressure for this, margins could be affected.

To conclude, given the valuation, the technical analysis and operational success of V, investors should be well-advised to use the current weakness of the market to accumulate the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.