Summary:

- Warren Buffett’s firm has stopped buying Occidental Petroleum shares after consistently purchasing at $60, signaling potential caution.

- Berkshire Hathaway holds ~30% of OXY and aims for 50%, but hasn’t bought shares since June despite ample cash reserves.

- The stock could easily head much lower with EPS dipping below $3 with WTI below $70.

Alex Wong

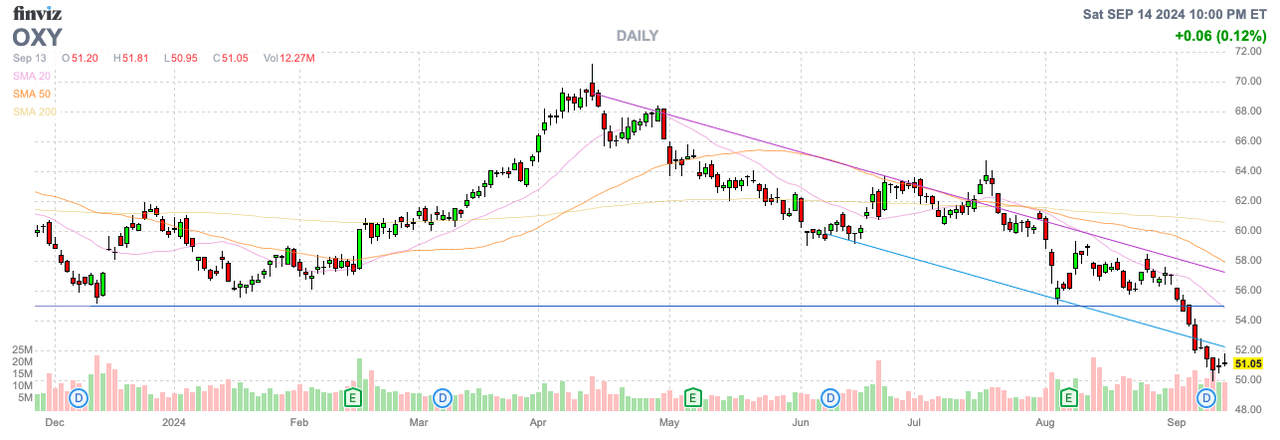

A long thesis of investing in Occidental Petroleum Corporation (NYSE:OXY) has been that Warren Buffett was keeping the stock propped up. The fear has always been that lower energy price normal of cycles would ultimately lead to lower stock prices. My investment thesis remains Bearish on the stock following the dip to $50 as Buffett has suddenly quit buying shares.

Warren Buffett Quit Buying

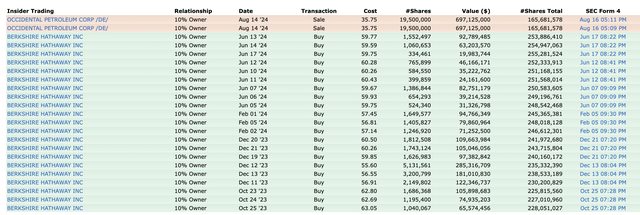

For a while now, Warren Buffett’s investment firm has regularly bought shares in OXY when the stock traded at $60. Berkshire Hathaway (BRK.A) (BRK.B) bought 7.3 million shares during June for $435 million at an average price just below $60.

The stock only started falling below $60 to start August, yet Berkshire Hathaway hasn’t bought any shares in the last quarter having last bought shares on June 17. Buffett’s firm hasn’t bought shares below $55 in the last year.

The investment firm ended last quarter with a $271 billion cash balance after selling a lot of Apple (AAPL) shares. Warren Buffett doesn’t lack the cash to load up on OXY, or any investment.

Berkshire Hathaway owns ~30% of OXY and appears to have plans to own 50% leading to analyst calling the regular purchases at $60 “the Berkshire put”. The whole concept of Buffett buying shares regularly at high prices just never added up. He famously wanted to buy shares when blood was in the street, yet his buys at $60 kept shareholders happy and preventing the stock from falling.

CrownRock Holdings, LP filed to sell 29.56 million shares in August for roughly $1.7 billion, yet Buffett didn’t step up to acquire those shares, or any since. OXY bought CrownRock holdings for ~$12 billion last December to build up Permian Basin assets while adding on debt.

Far Too Early

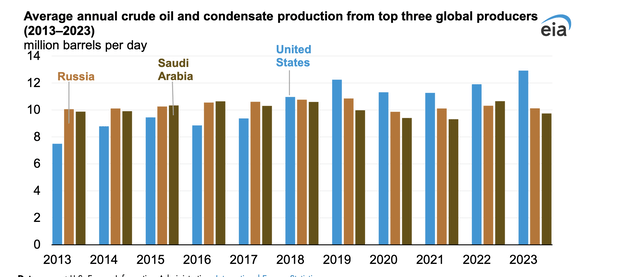

Oil prices have plunged in the last couple of months to the lowest level this year with WTI dipping below $70/bbl. While oil prices have mostly held above $70 since the start of 2022, WTI prices were regularly below this price level for the prior 7 years.

One of the odd parts of Warren Buffett buying OXY at $60 was the risk that cyclical energy prices would eventually dip providing a lower entry point for the stock. Not to mention, Buffett buying shares likely contributed to the stock price holding higher than reality.

In fact, Buffett originally started investing in OXY when the stock collapsed and the company offered Berkshire Hathaway $10 billion in 8% preferred stock. Oil prices have since gone from $20/bbl to over $100/bbl in a relatively short period and Buffett was famous for buying weakness, not paying up.

OXY reported a solid Q2 due to higher energy prices. The CrownRock deal will increase production by ~5% to 1.29M-1.34M boe/dd in 2024, but analysts apparently expected a higher boost to production.

As with any deals, the problem facing OXY is that debt levels jumped back up to $28 billion, including the $8 billion in preferred stock still outstanding. Acquisitions are never free, though corporations regularly want to only focus on the non-organic growth of a deal.

OXY saw the following realized energy prices during Q2 to help the strong results:

- Oil price rose 5% Q/Q to $79.89/bbl

- Natural gas price fell 39% Q/Q to $0.92/Mcf

- Natural gas liquids prices fell 4% Q/Q to $21.23/bbl

The energy company reported a Q2 EPS of $1.03 per share, but oil prices are already down over $10/bbl. OXY only produced an EPS of $0.63 in Q1 when oil prices were just $76/bbl with higher natural gas prices.

Oil production had dipped significantly during Q1, so the better comparison was the $0.74 earned in Q4’23. OXY only produced about $500 million in free cash flows when excluding the working capital adjustments.

With a slower economy requiring the U.S. Fed to likely cut interest rates at the upcoming meeting and U.S. energy production up to record levels, oil prices could be headed lower. The U.S. is now the leader in the energy markets with Russia and Saudi Arabia’s lower production over the last decade.

U.S. oil production took the global lead back in 2018 and averaged 12.9 million b/d in 2023. Energy production sits at 13.2 million b/d in mid-2024 while other countries like Russia and OPEC have actually seen a reduction in production for various reasons suggesting the market could easily be flooded with oil in the future. Both Russia and Saudi Arabia only produce ~10 million b/d now.

The consensus analyst estimates have OXY producing upwards of $4 in EPS annually. The company could be lucky to generate a $3 EPS with lower oil prices supporting an even lower profit view.

The fear here is that OXY could fall even further with the Berkshire put disappearing. All of the investors buying shares at $60 now realize downside risk is a real possibility.

Naturally, the stock would rally on higher oil prices. Global interest rate cuts could lead to a rebound in growth or an expanding conflict could lead to higher oil prices.

A scenario where Buffett returns to buying shares and energy prices head higher could quickly lead the stock back to the $60 with the Berkshire put in place. Russia and Saudi Arabia could definitely cut oil production further in a push to raise prices, but a major move seems unlikely knowing market share could just be loose to U.S. producers.

Takeaway

The key investor takeaway is OXY likely has more downside risk with oil prices falling. Investors should allow the price to clear out after Berkshire buying shares helped prop the stock up at $60.

Buffett could very well have gotten out of the way letting OXY fall due to fears of a U.S. recession leading to lower oil prices. Investors should stay on the sideline until Berkshire returns to buying shares.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks??mispriced by the market to start September, consider joining Out Fox The Street.??

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in??the next few years.??