Summary:

- Occidental Petroleum stock has weakened considerably as it lost the $55 support zone.

- The lack of recent purchases from Warren Buffett didn’t help matters, as OXY’s bullish thesis was threatened.

- Occidental’s integration of CrownRock’s assets will be scrutinized. Potential delays could impact near-term sentiments.

- However, OXY’s ability to improve production levels while boosting low-breakeven inventory should help mitigate oil price volatility.

- I explain why the market seems to have missed OXY’s robust execution amid recent energy market fears. Read on to find out more.

jetcityimage

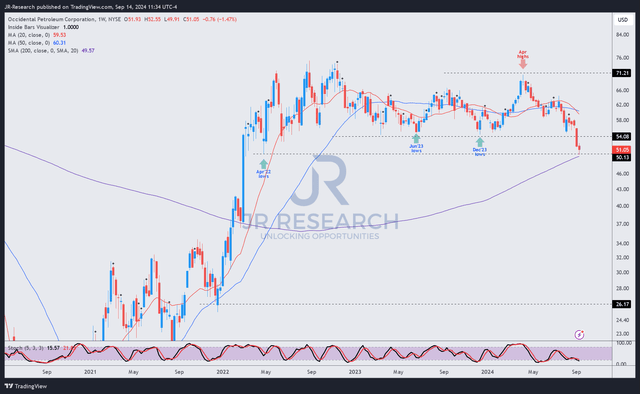

Occidental Petroleum Corporation (NYSE:OXY) investors have endured a torrid Q3 as the stock fell to lows last seen in early 2022. As a result, OXY has dropped below the critical $55 consolidation zone held since mid-2022. I assess that its buying momentum has weakened considerably, aligning with the weakness in crude oil futures (CL1:COM). The energy sector (XLE) has also pulled back toward its early 2024 lows, although OXY’s relative underperformance could have stunned its bulls.

In my previous bullish OXY article in January 2024, my thesis proved timely before the stock posted a solid recovery through its April 2024 highs. However, it has dropped markedly since then, hampered by underlying market volatility and continuing oil price weakness.

Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett seems to have paused additional OXY purchases even as the stock fell recently. Therefore, the stability offered by the Buffett Put has gone missing at a pivotal moment as investors reassessed its bullish proposition. Occidental Petroleum’s underperformance suggests the market is likely concerned about potential oil price cyclicality impacting its production and operating performance.

Notwithstanding the potentially accretive CrownRock acquisition, investors are likely worried whether the significant increase in capital spending is astute. Given the mixed and increasingly bearish outlook affecting oil demand dynamics, OXY investors must determine whether the anticipated increase in production can offset the potential weakness in demand.

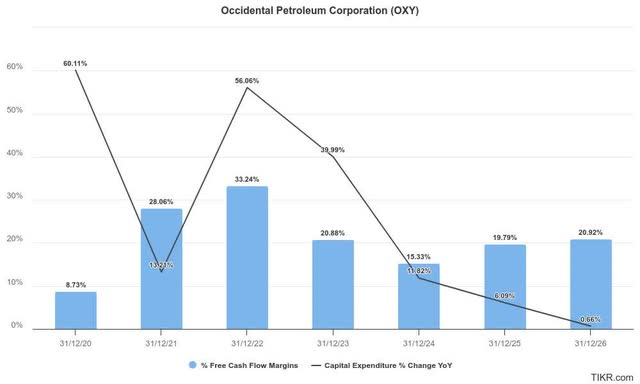

Accordingly, Occidental is expected to generate relatively robust free cash flow margins through the FY2026 forecast period, even as it ramps up its capital spending. The company boasts low breakeven inventory, bolstered by its market-leading position in the Permian Basin. Therefore, execution risks emanating from increased capital spending should not be expected to impact its FCF margins significantly. In addition, the integration of CrownRock’s portfolio is anticipated to improve its operating efficiencies. Consequently, it should enhance Occidental’s prospects of maintaining a low breakeven inventory, sustaining its competitive advantage. OXY’s “A” profitability grade underscores my conviction, justifying the market’s confidence in its profitability through the cycle.

Moreover, Occidental isn’t resting on its laurels, as it continues its “strategic divesture” and delivers its commitment to lower debt. Accordingly, management articulated the potential to reduce about $3B in debt by Q3, moving significantly closer to its $4.5B debt reduction efforts. In addition, it has also achieved about $1B in divestitures since the start of 2024, pivotal in its efforts to optimize its portfolio. As a result, I assess that the company has made substantial progress in delivering tangible outcomes that should improve shareholder value. It has also added credibility to the company’s target of attaining a “principal debt target of $15 billion or less” by the end of 2026 or early 2027.

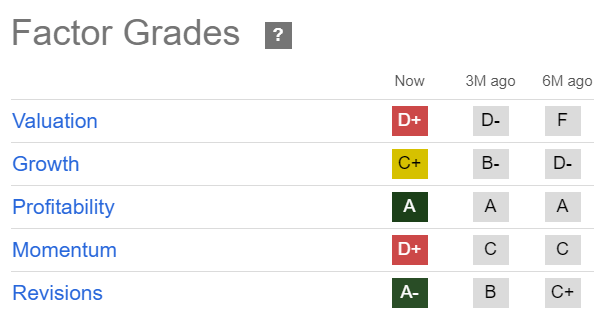

OXY Quant Grades (Seeking Alpha)

OXY’s “D+” valuation grade suggests it has improved from its “F” rating six months ago. Hence, the relative underperformance has improved its appeal, although it’s still valued at a premium. The stock’s buying momentum has also worsened considerably (from “C” to “D+”) over the past six months, suggesting investors are likely concerned with the weaker underlying market.

Notwithstanding the market’s near-term caution, investors must question whether the market could be unduly concerned about the execution risks moving ahead. Notably, the CrownRock acquisition is expected to add about 170K boe per day to Occidental’s portfolio. However, investors are urged to consider potential delays in attaining the anticipated production increase, worsening execution risks at a crucial moment. In addition, management’s ambitious asset divestitures and debt reduction program could also be impacted if oil price volatility continues. Hence, I assess that the market is justified to reflect increased concerns over Occidental’s execution capabilities if the underlying market conditions don’t improve over the next six months.

OXY price chart (weekly, medium-term, adjusted for dividends) (TradingView)

OXY’s price action suggests its bullish bias has weakened significantly. As a result, OXY lost the critical support zone above the $55 level, suggesting dip-buyers lost interest in defending that level. In addition, the missing Buffett Put has likely lowered the market’s confidence in OXY’s bullish thesis as the market reassessed its risk/reward. The caution is justified given OXY’s relative premium to its energy sector peers.

Despite that, OXY’s re-test against its early 2022 lows above the $50 level seems to have attracted dip-buyers. However, we still need several more weeks to ascertain the robustness of the consolidation zone.

While I assess OXY’s buying momentum has weakened, I’m still confident about its fundamentally strong business model and the potential benefits from its recent acquisition. In addition, its low-breakeven inventory and anticipated production increase should mitigate underlying oil price volatility, helping stabilize its operating performance. While delays over its production increase could hamper recent integration efforts, further clarity could also lift investor sentiments, providing a timely boost to OXY’s buying momentum.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.??

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!