Summary:

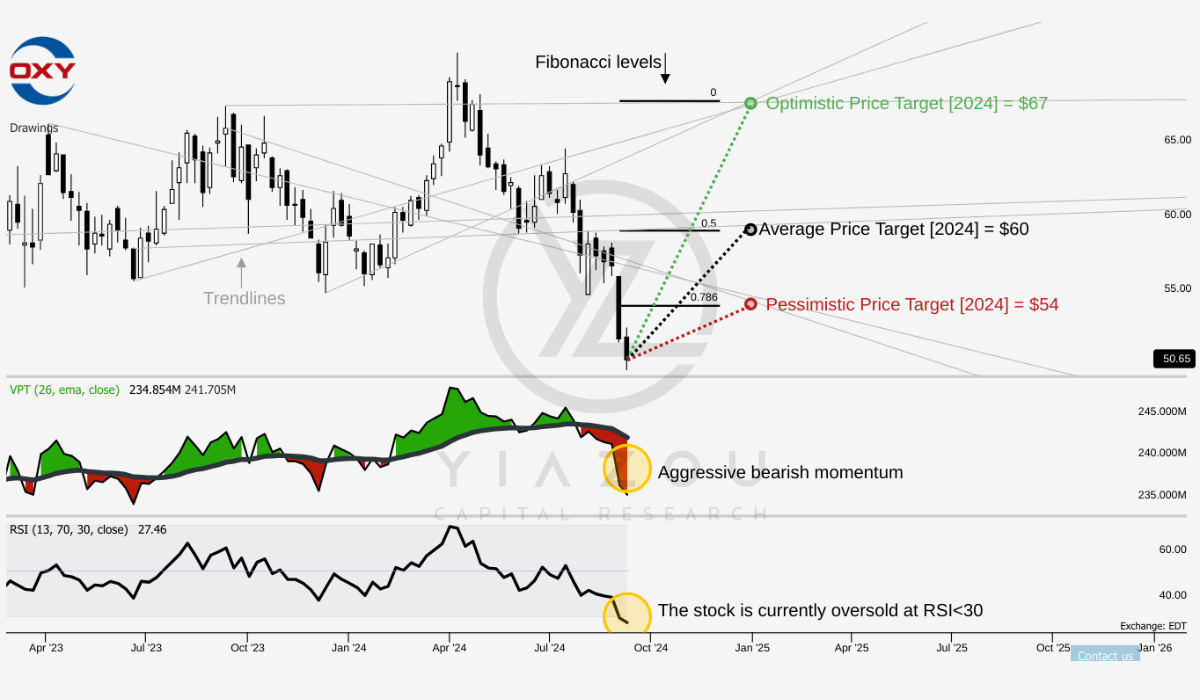

- OXY trades at ~$51, with a target of $60, reflecting an 18% upside, anchored by Fibonacci resistance levels.

- An RSI of 27.46 signals oversold conditions, potentially undervaluing OXY; no immediate reversal is expected due to bearish sentiment.

- Occidental achieved record production in Q2 2024, with $1.3 billion in free cash flow before working capital adjustments.

- The recent strategic acquisition of CrownRock assets enhances OXY’s portfolio, boosting high-margin production and operational efficiency.

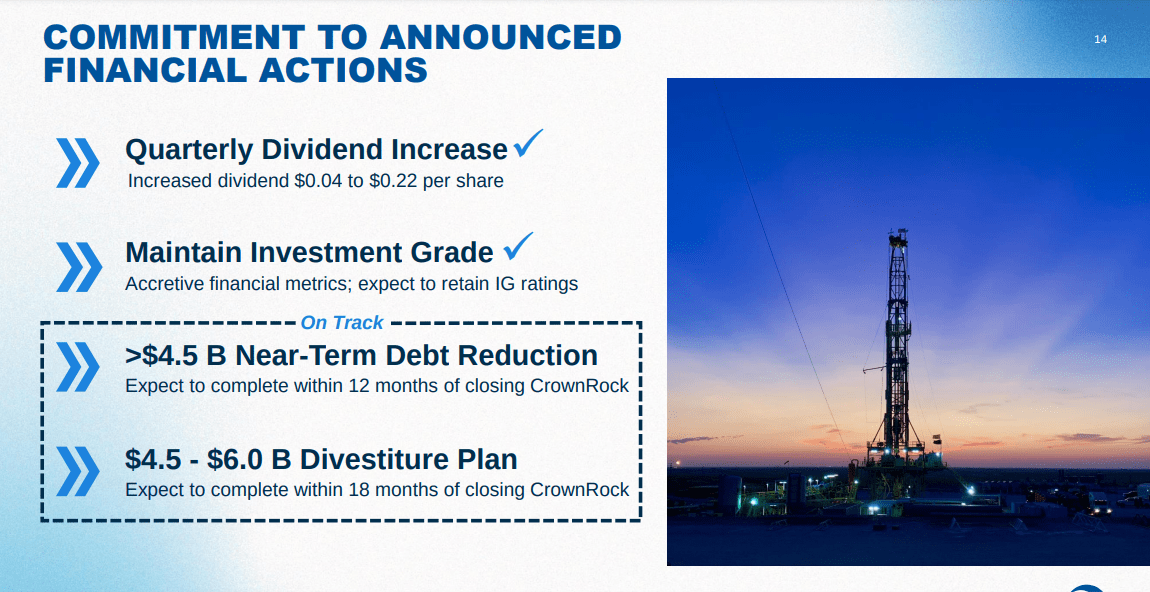

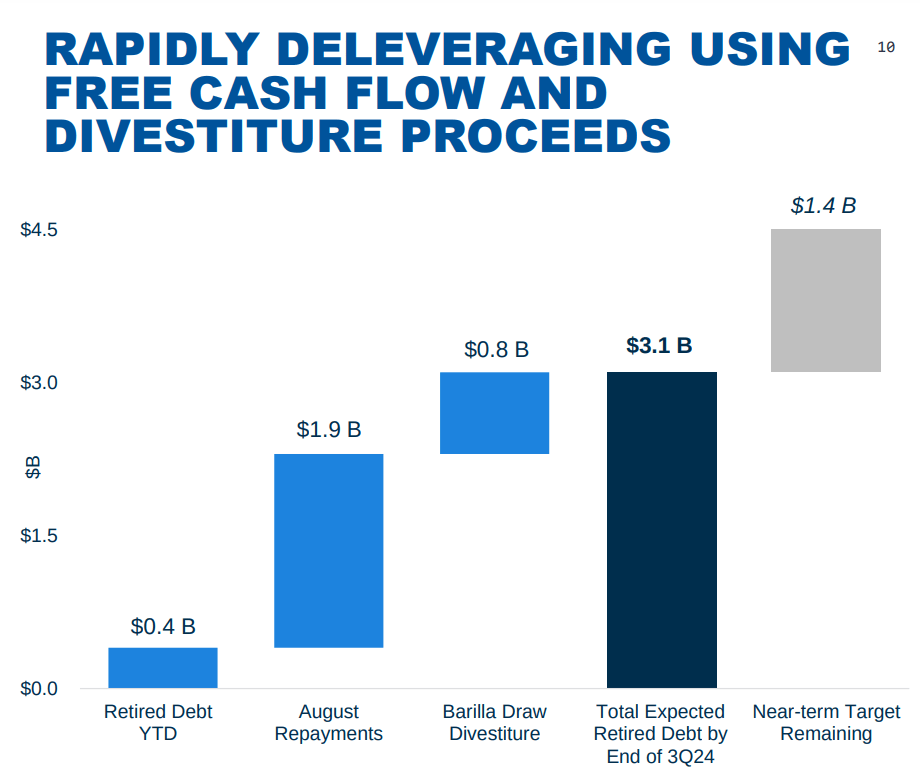

- OXY aims to reduce $3.8 billion in debt by Q3 2024, reinforcing financial stability and future growth potential.

Jeremy Poland

Investment Thesis

Despite a 20% price drop since our last coverage, Occidental Petroleum’s (NYSE:OXY) technical indicators suggest short-term weakness. The RSI signals the stock is oversold, and the declining Volume Price Trend (VPT) indicates lower trading volume as the price falls.

Although there is near-term downside risk, OXY’s strong fundamentals make for a pretty compelling long-term value argument; for investors focused on the long haul, current weakness can be seen as a possible buying opportunity.

Oversold Signals with Upside Potential Amid Fibonacci Resistance Levels

OXY currently trades at ~$51, with an average price target of $60, which aligns with the 0.5 Fibonacci retracement level. This indicates a median-level resistance point based on past price movements. The optimistic target of $67 corresponds to the 0 Fibonacci level, suggesting a significant potential upside if the stock returns to previous highs. Conversely, the pessimistic target of $54 is anchored at the 0.786 Fibonacci level, which reflects a more conservative outlook assuming a modest recovery from recent declines.

Furthermore, the RSI stands at 27.46, well below the oversold threshold of 30. This position suggests that OXY may be undervalued. However, the lack of bullish divergence does not signal an imminent reversal. The RSI line’s downward trend further reinforces a continuation of the current bearish sentiment.

Moreover, the VPT line is also trending downwards, with a current value of 234.85 million and a moving average of 241.71 million. This decline in the VPT indicates that the trading volume decreases as the price drops, potentially signaling further price weakness in the short term.

Yiazou (trendspider.com)

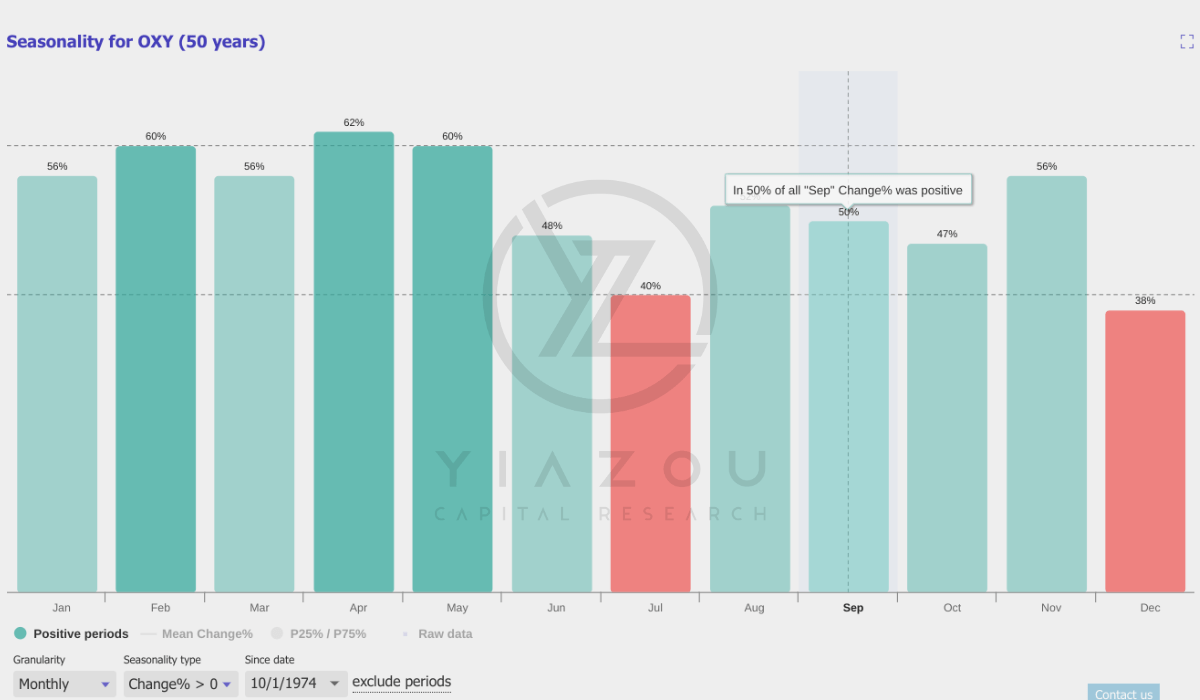

The seasonality analysis for OXY over the past 50 years indicates a 50% probability of positive returns during September. Historical trends show a mixed pattern, with January, March, April, and May having higher positive periods ranging from 56% to 62%. Meanwhile, months like July and December have lower positive return rates, reflecting weaker seasonal performance during those months. Investors may consider these seasonal tendencies when timing their trades, as September offers a moderate probability of gains.

Yiazou (trendspider.com)

Occidental Petroleum Surges with Record Production and Strategic Cost Reductions in Q2 2024

In Q2 2024, Occidental attained its highest quarterly production in four years for the company and US onshore operations. This performance exceeded the midpoint of the company’s production guidance and resulted in $1.3 billion in free cash flow before working capital adjustments.

The record production is based on strong operational performance in the Permian Basin and Gulf of Mexico. Occidental surpassing its production guidance suggests that it has a robust operational framework and the capability to manage and exploit its assets sharply. The high production level indicates a strong foundation for top-line growth.

With the production growth, the company has attained ~10% improvement in unconventional well costs against H1 2023. This reduction is based on lower non-productive time, increased frac utilization, and operational efficiency gains. These cost savings provide a vital push for improving profitability and capital efficiency. The improvement in well costs signifies that Occidental is increasing production more cost-effectively.

In Q2, Occidental reduced its per-barrel lease operating expenses by over $0.60, a 6% improvement compared to the average of the previous three quarters. This reduction is a result of various optimization initiatives. These Initiatives include more efficient CO2 utilization in enhanced oil recovery (EOR) processes and reduced artificial lift failure rates. The ability to lower lease operating expenses indicates the company’s solid operational and cost-control strategies that may continue to deliver immediate cost savings and improve overall margins.

Moreover, Occidental’s acquisition of CrownRock’s assets in the Midland Basin is a significant strategic move. Integrating these high-margin production assets and low-breakeven undeveloped inventory may boost Occidental’s asset portfolio. This acquisition increases the company’s scale in the Midland Basin and provides more scope for operational efficiencies and infrastructure sharing. The additional high-margin barrels and the potential for resource optimization show how this acquisition supports Occidental’s rapid growth. The integration plans (including leveraging scale and applying technical expertise) may continue to realize the full potential of the newly acquired assets.

Finally, Occidental has made substantial progress in its debt reduction and divestiture programs. By the end of Q3 2024, the company may hit ~$3.8 billion in principal debt reduction, representing ~85% of its near-term $4.5 billion debt reduction target. This move is supported by proceeds from various divestitures like the $818 million Barilla Draw divestment and $700 million from the sale of common units in Western Midstream Partners. The progress in debt reduction boosts the company’s financial standing by reducing interest expenses and increasing its capacity for growth investments.

Q2 2024 Presentation

Maximizing Output: Rapid Growth Through Operational Activity

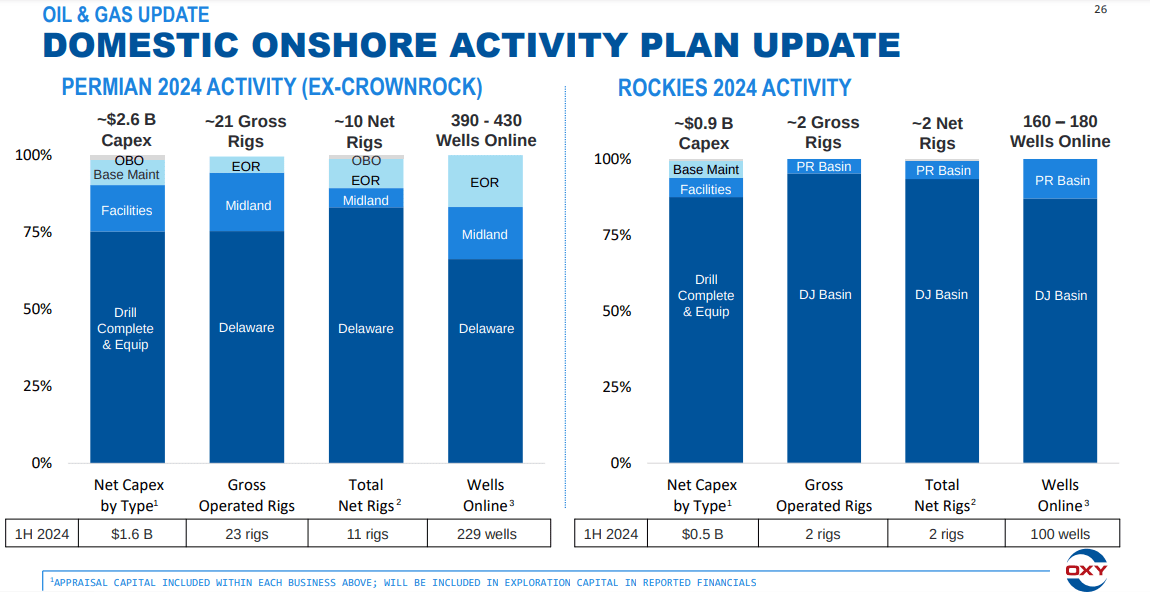

In the first half of 2023, Occidental operated 25 rigs in the Permian Basin, bringing 157 wells online. By the first half of 2024, the rigs slightly decreased to 23, but the number of wells brought online surged to 229, representing a 45.8% increase in well completions. This indicates an improved operational edge as the company achieves more production with fewer rigs. Such a trend also points to the strength of Occidental’s well-completion process and operational optimization.

Similarly, Occidental operated three rigs in the Rockies and brought 35 wells online in H1 2023. By the same period in 2024, the number of rigs decreased to 2, but the company managed to bring 100 wells online, a solid 185.7% increase. This efficiency gain reflects the company’s ability to boost well productivity and maximize returns from reduced capital investment, as fewer rigs are required to achieve greater output.

Looking forward, Occidental plans to further boost the number of rigs in the Permian Basin to 21 while still bringing ~410 wells online throughout the year. This marks a substantial 79% increase in wells completed compared to H1 2024. Whereas, in the Rockies, the company expects to bring ~170 wells online (+70% from mid-2024) with just 2 rigs, while from CrownRock, Occidental plans to add ~150 wells and 5 rigs in 2024. Therefore, these outlooks suggest continued production gains and a focused maximizing output strategy.

Q2 2024 Presentation

Debt Dilemma: Balancing Reduction Efforts with Growth Limitations

Although the company has thoughtfully managed to pay off its debts and has accomplished a lot in this regard, the high level of debt is still a major cause for concern. An aggregate debt load of $18.4 billion still overhangs Occidental and constrains financial flexibility; it impacts the firm’s ability to invest aggressively in growth, since its main priority is paying down debt.

The company’s plan to use proceeds from asset divestitures and operational cash flow to reduce debt illustrates a reliance on external measures to manage debt levels. While these divestitures are channeled toward debt management, these moves directly reduce the company’s asset base. This may impact revenue generation, and with high leverage, the company’s vulnerability to market and economic downturns increases.

For instance, the planned divestiture of 15K thousand barrels of oil equivalent per day (Mboed) in the fourth quarter further indicates a reduction in production capacity. Fundamentally, the company’s reliance on asset sales to fund debt reduction and operational improvements suggests a limited ability to generate organic growth solely through its existing asset base. Moreover, the focus on high-margin, low-breakeven inventory in the Permian Basin points to the potential risks associated with asset concentration and dependency on specific regions for growth.

Q2 2024 Presentation

Takeaway

Occidental Petroleum remains a compelling long-term investment due to its strong operational performance, which includes record production, strategic acquisitions like CrownRock, and significant cost reductions. The company has also made substantial progress in reducing debt, improving its financial standing, and ability to invest in future growth. With a diversified portfolio and efficient asset management, OXY is well-positioned for continued value creation.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.