Summary:

- Occidental Petroleum sells 20 million Western Midstream common units that it owns to reduce debt.

- CrownRock acquisition takes center stage, with management stating it was instantly accretive.

- CrownRock may or may not sell the shares that the registration statement covers. The statement enables the sale but does not guarantee it will happen.

- Occidental still owns a sizable amount of Western Midstream common units.

- The operational improvements made while CrownRock was closing could add to the benefits of the CrownRock acquisition.

Jeremy Poland

Occidental Petroleum (NYSE:OXY) had already announced a sale of some acreage to Permian Resources (PR). But they still had more debt that they wanted to pay. The solution for much of that debt balance was an announcement today by Western Midstream (WES) that Occidental was going to offer to sell through a secondary offering roughly 20 million shares. This is coming complete with an overallotment possibility; therefore these shares are going to be sold, and Occidental will receive any proceeds and pay any expenses.

The last article noted how Occidental was spending money on “green projects”. That is still ongoing. But right now, the CrownRock situation is going to take “center stage”.

CrownRock Acquisition

The second quarter report noted that the acquisition has closed. Of course, management has stated that the acquisition was instantly accretive. But there were also some established debt goals along with the acquisition.

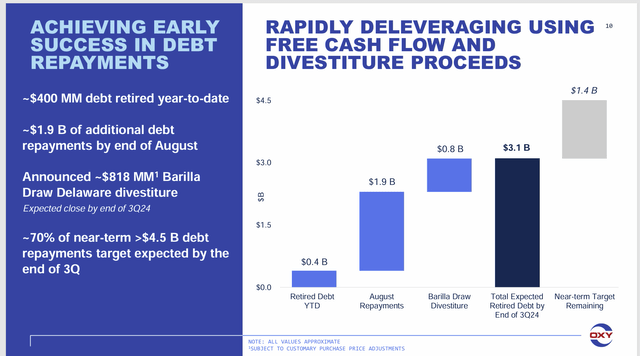

Occidental Petroleum Deleveraging After CrownRock Acquisition (Occidental Petroleum Second Quarter 2024, Earnings Conference Call Slides)

As was noted before, the proceeds from the sale to Permian Resources combined with debt progress already made has reduced the goal to $1.4 billion more. Now, it would appear that the company will raise at least $1 billion from the sale of some Western Midstream (WES) shares of stock. That would leave a very nominal amount (if anything) left before the company reaches its goal.

As noted in the Western Midstream annual report, Occidental owns 185 million common units, which represents about 47% of the shares outstanding. The sale of 20 million (give or take) is still going to leave Occidental with a formidable block of common units. Occidental still has a significant way to participate in the continuing turnaround of Western Midstream.

Transaction Details

This is the description of the original amount of debt taken on with the deal:

“The transaction???s total consideration is approximately $12.0 billion. Occidental intends to finance the purchase with the incurrence of $9.1 billion of new debt, the issuance of approximately $1.7 billion of common equity and the assumption of CrownRock???s $1.2 billion of existing debt.”

If the company pays down $4.5 billion of debt (as now looks very likely), then the remaining debt would be the assumption of $1.2 billion of CrownRock debt shown above combined with $4.6 billion of remaining additional Occidental debt.

CrownRock Cash Flow

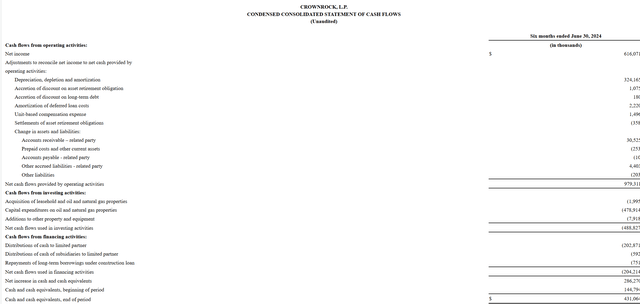

The six-month cash flow statement that was filed shows the following:

CrownRock Cash Flow Statement For The Six Month Period Ending June 30, 2024 (Occidental Petroleum 8-K Statement Filed July 19, 2024)

For an additional roughly $5.8 billion of debt, the company picked up roughly $2 billion of cash flow with this acquisition. Note that the capital expenditures are about half of the cash flow. That makes a roughly (very roughly) annual free cash flow of about $1 billion a reasonable first goal. In theory, at a high level, that would mean that the debt from this acquisition could be retired over six years and then the cash flow would be free of any debt maintenance requirements.

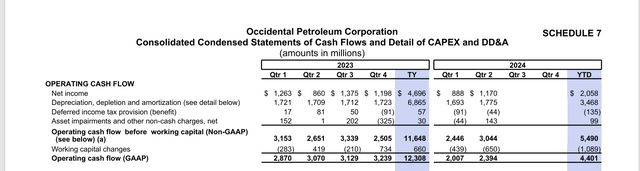

Occidental Petroleum Second Quarter Cash Flow Trends (Occidental Petroleum First Quarter 2024, Earnings Press Release)

The proposal to add about 2 billion dollars to the operating cash flow is no small amount. That amount is nearly what the company reports as cash flow in a quarter. That would appear to make the production very profitable compared to what the company already has.

The same quarterly statements show about $18.4 billion in debt. With the additional debt from the acquisition, the total debt would be about $24.2 billion. The debt ratio would still be less than two, although I suspect the market would like to see it lower.

Now for common stockholders, the preferred stock has a superior call on the company assets and therefore should be considered as part of the company debt. When that calculation is made, the debt ratio does go over 2 (which is not the greatest thing to happen). What likely justifies this is the extra profitability of these wells would appear to add to free cash flow disproportionately. If that remains the case, then future repayments of debt and retirements of preferred should be a bit easier.

As a show of optimism about the future of the stock price and company prospects, the dividend was increased $.04 per quarter to $.22 per share. Plus, the company still has an investment grade debt rating.

CrownRock

CrownRock itself received almost 30 million shares of stock as part of this deal. Occidental posted that those shares were registered for sale today. Unlike the Western Midstream sale which will definitely happen complete with an overallotment, this was simply an announcement that these shares may be sold by the selling shareholder (CrownRock) at its discretion at any time in the future. The sales could be any size from absolutely none to all of the shares.

CrownRock may also choose to dissolve (depending upon how it is organized) and give this stock to the interests in itself for the various interests to either keep or sell. I do not know enough about CrownRock to know what it will decide to do, but the registration makes me think that they will likely sell the shares and then decide what to do with the cash received.

Summary

Occidental reported over $1 per share earnings for one of its better quarters lately. The cash flow statement shown above also demonstrates that this was a relatively good quarter.

Occidental management has hopes of this acquisition significantly adding to earnings “from day one”. But that is hard for shareholders to tell because the prices received for the products produced fluctuate with the commodity prices.

Still, this management has an impressive track record as the last acquisition, Anadarko contributed to record earnings in fiscal year 2022.

Occidental remains a strong buy, although with the debt and the preferred stock the risk elevates a bit for common shareholders. Management appears to be joining the industry trend of improving its position by acquiring very profitable deals and then using a combination of common stock and debt to make sure the deal is accretive while keeping the debt to acceptable levels (for management).

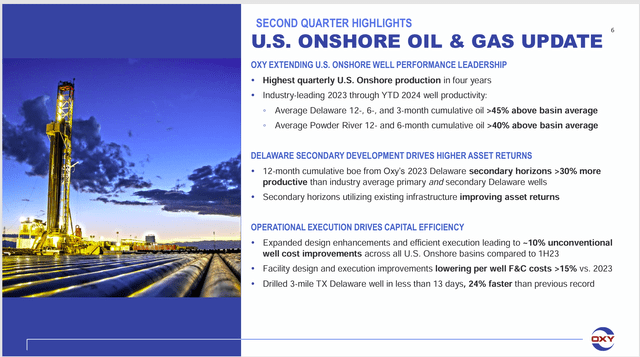

Occidental Petroleum Summary Of Operational Progress (Occidental Petroleum Second Quarter 2024, Earnings Conference Call Slides)

One of the things that may help is that this acquisition took a long time to close. In the meantime, as is noted in the slide above, there has been a 10% improvement in unconventional well costs. That could add to the projected expectations of this particular acquisition. Combined with the acquisition expectations, it may make improvements visible enough for shareholders to see even with the volatility of commodity prices.

Risks

Any acquisition can fail to meet management expectations. More than one time an acquisition turned out to have issues that management never saw coming. This management has a very good record with both acquisitions and sales of non-core properties. Even though larger acquisitions are riskier than smaller acquisitions, management experience should minimize that issue.

Any upstream company is subject to the volatility and low visibility of future commodity prices. A severe and sustained downturn can materially change the outlook of the company.

This company struggled with the Anadarko acquisition back when 2020 challenges happened. But the company also made it to 2022 when the benefits of the acquisition became apparent to many of us. Still, that 2020 challenge serves as a warning to be very careful about having a deleveraging strategy that manages under anything the future can “throw at you”.

A loss of key personnel could prove critical to the company’s future prospects.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of OXY OXY.WT PR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Occidental Petroleum and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.