Summary:

- Occidental Petroleum has a differentiated business model with integrated operations in the Permian Basin, focusing on oil and gas extraction, midstream, and chemical commercialization.

- Despite its unique strategy, Occidental’s financial performance is heavily impacted by oil prices, with high fixed costs affecting profitability.

- The fair valuation of Occidental Petroleum suggests a potential 11% premium over its current stock price, but the high risks associated with the industry warrant a prudent approach.

grandriver

Overview

I will analyze Occidental Petroleum (NYSE:OXY), a company with the credentials of its primary investor, Warren Buffett, and its differentiated business strategy. I will show you how this business strategy isn???t reflected in the numbers, and with a fair valuation, its risks recommend holding the position.

A Differentiated Business Model In The Industry

Occidental Petroleum is not the biggest oil company. In the midstream business, Occidental operates 35,000 miles of pipelines, but Enterprise Products Partners (EPD) has 50,000 or Kinder Morgan (KMI) 70,000 miles. Occidental???s pipeline capacity is 5 million barrels of oil equivalent per day, and Plains All American Pipeline (PAA) and Enterprise Product Partners manage 6 million. However, the most significant competitive advantage is its integrated model.

This integrated model starts by concentrating on the Permian Basin region, one of the world’s most prosperous oil regions. The extensive land in the Permian allows the drilling of horizontal wells, which are more efficient than multiple shorter wells, with technological developments in the last few years. According to the Dallas Fed Energy Survey, the average break-even price for oil production in the Permian Basin is $54 per barrel. Occidental states it is below $40 per barrel, lower than its competitors.

Integrating oil and gas extraction, midstream storage and transportation, and chemical commercialization allow it to capture a bigger value share. By owning and operating its midstream infrastructure, Occidental can transport and process its oil and gas more efficiently and at a lower cost than if it relied on third-party services. This vertical integration also eliminates potential bottlenecks and delays, ensuring a smooth flow of products from production to market.

Diversifying revenue streams across upstream, midstream and chemical segments reduces OXY’s dependence on any single market or commodity, mitigating the impact of price fluctuations and demand shifts.

Integration leads to innovation, which in turn opens up new markets. Occidental’s existing oil and gas operations provide it with infrastructure and expertise that can be leveraged for carbon capture and storage. For example, the company has access to geological formations suitable for CO2 storage and pipelines for transportation. Occidental Petroleum invests over $1 billion in a Texas direct-air capture (DAC) plant. This technology aims to extract carbon dioxide (CO2) from the atmosphere and store it underground, enabling the company to offset its emissions and potentially profit from selling carbon credits.

The plant is projected to capture 500,000 metric tons of CO2 annually, and Occidental plans to construct up to 135 such plants by 2035. The company believes that DAC technology will help it achieve net-zero emissions by 2050 while allowing it to continue investing in fossil fuels. However, there are concerns about the technology’s scalability, cost, and potential environmental impact.

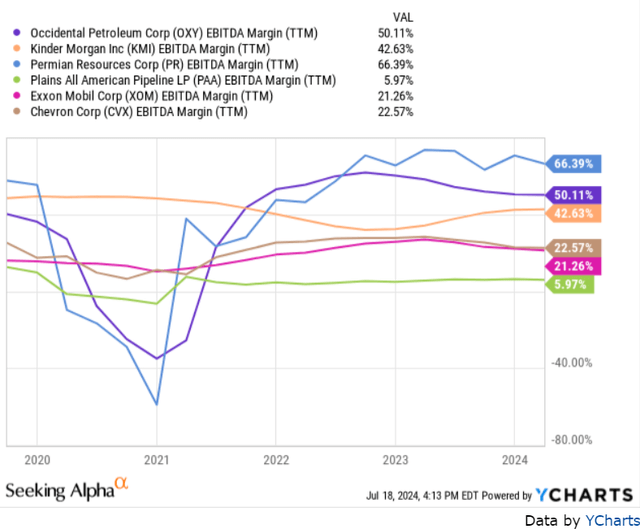

To reflect this advantage over competitors, Figure 1 shows that Occidental has the highest EBITDA margin, except for Permian Resources (PR).

Figure 1: Seeking Alpha

When I see the numbers, the model is not that neat

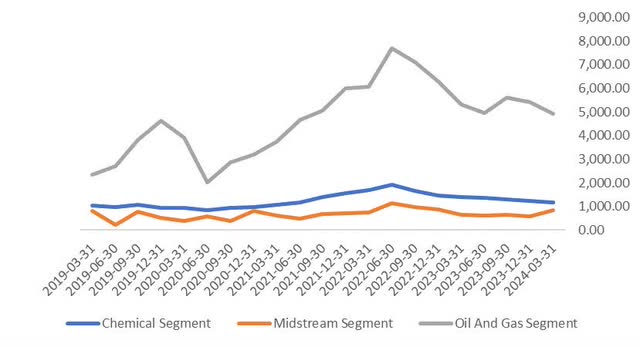

In Q1 2024, Occidental reported $6.0 billion in revenue, a 17% decrease from last year???s revenue. This decrease is due to lower realized commodity prices. I expect to improve this revenue growth rate in the coming years due to ongoing production growth and the CrownRock acquisition, but it is not a sure thing. Oil and Gas was $4.9 billion per segment, 71% of total revenue. Midstream was $856 million and had 12% overall revenue. Finally, Chemicals??? revenue was $1.2 billion, 17% of total revenue. As we have outlined, this integrated model should have the advantage of diversifying the revenue stream and being protected from commodity prices (Figure 2).

Figure 2: Author

You can observe the volatility of the oil and gas segment, which depends on oil prices. And in Figure 3 it is shown the significant correlation between oil prices and Occidental quarterly revenue.

Figure 3: Seeking Alpha

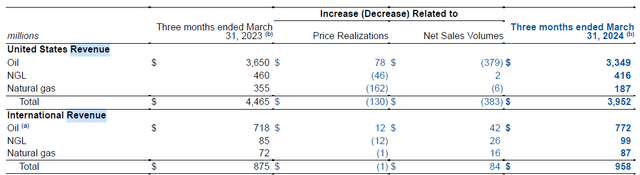

But the story is not entirely explained by prices. In Figure 4, you can see that Occidental is struggling with oil volumes, especially in the US, with a negative contribution of $379 million.

Figure 4: 10-Q Occidental Petroleum

Lower caustic soda prices have negatively impacted the Chemical segment’s earnings, partially offset by improved demand and lower ethylene and energy costs. The segment earned $218 million less from this quarter than the equivalent last year.

The Midstream business lost $33 million due to lower winter weather activity and higher costs in the low-carbon ventures business.

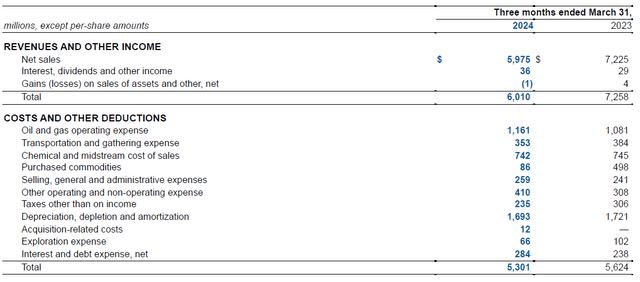

And when revenue decreases, the whole value chain decreases, where EBITDA decreases due to mainly fixed costs, as you can see in Figure 5:

Figure 5: 10-Q Occidental Petroleum

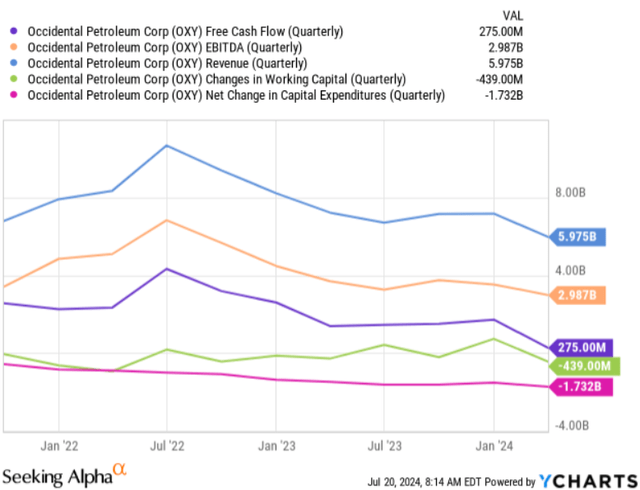

Free cash flow has declined by 80% compared to last year’s quarter to get a value of $275 million. You can observe in Figure 6 that it is a tough quarter because margins have gone down, and net working capital and CAPEX investment have been more intense.

Figure 6: Seeking Alpha

After analyzing the quarterly financial results, I find it difficult to see the model in the real numbers. I see a business dependent on oil prices, with high fixed costs that drive an operating leverage that intensifies the effects of oil prices. I would expect volumes to keep growing and mitigate some oil price effects, but those volumes depend on external factors, and the company can???t use them as a lever. The company continues to invest aggressively, and new ventures, like low-carbon ones, are still too small to make a difference.

We have lights and shadows in capital allocation

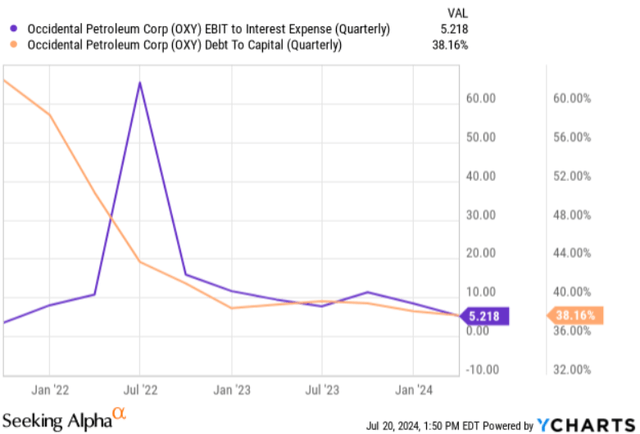

In Figure 7, you can see the company is achieving what is promising about debt reduction, and the current situation allows it to pay down debt nicely. The company???s debt was about 60% of total capital three years ago. Now it is just 38% and with the promise to reduce it further. On this front, the company is achieving something very important in a business that is dependent on external factors. Financial risk is reduced handsomely, which is why the company???s value has increased in the last few years.

Figure 7: Seeking Alpha

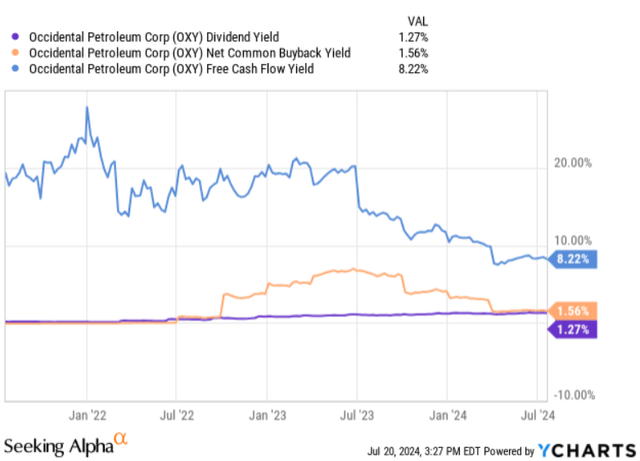

The company distributes to shareholders a fraction of what it earns. Its total yield is 8.22%, and it distributes 2.8% in dividends and share buybacks. The company plans to increase share buybacks, but I don???t expect dividends to grow. Free cash flow yield has decreased over the years, reflecting the increase in the company’s value.

Figure 8: Seeking Alpha

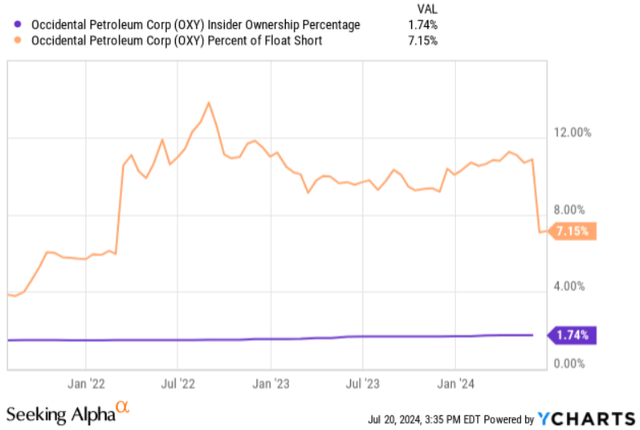

Finally, we are all happy that Warren Buffett holds 29% of the company???s shares, but I see a high short interest at 10%. Even though it has decreased to 7% lately, it is still significant for me. I also remark that insiders hold just 1.74% of the outstanding shares. I would like to see a bigger number on this front.

Figure 9: Seeking Alpha

Fair Valuation with High Risks

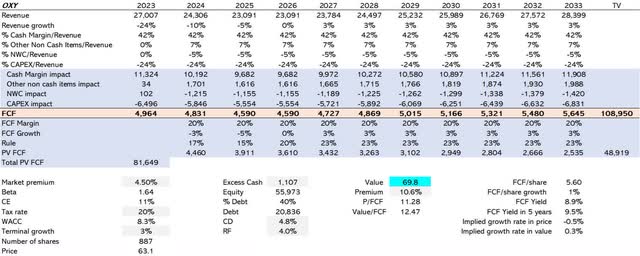

I estimate value discounting free cash flow estimates at an appropriate WACC (Weighted Average Cost of Capital). I use the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Revenue estimation is difficult, especially in this situation, which depends on oil prices. As a base case, I think revenue growth will remain negative, capturing the evolution of current prices over three years. Later, I consider a 3% growth rate in line with economic growth. It is hard to model the evolution of oil prices and demand, the evolution of the different segments, and the evolution of low-carbon ventures. I consider revenue to be high-risk and complex to estimate. This risk is also hard to model. What is certain is that fluctuations will be significant. In my model, I assume the years up will average years down, and in the long term, the company could grow its supply at 3%.

In this scenario, I assume the company will maintain its cash margin, which aligns with smooth revenue growth. However, this wouldn???t be the reality; I have shown you how a decrease in revenue implies a decline in margins due to high fixed costs.

For net working capital investment, I assume 5% of revenue, which is in line with the last four years. In my model, CAPEX is still a high 24% of revenues, as the company will keep investing in both the low-carbon and traditional businesses.

Cash flows will be discounted at 8.3% WACC because the beta is 1.64 and risk-free at 4.0%. The company’s leverage is 40%, and the terminal growth rate is 3%.

Figure 10: Author

As shown in Figure 10, my value estimate is $70 per share, an 11% premium over its current stock price. It is not a big difference in the current price. I would like to see a more considerable premium and a bigger margin of safety to consider it a buy.

To model risk, I consider that revenue growth can change from -10pp to +10pp in a normal distribution, and margins will be impacted by 70% of this variation, which is a conservative setting. I also model CAPEX needs, so using a minimum extreme distribution, I model that those needs can be as 5pp additional to the 24% of revenue until -16pp. The overall result is that the probability of having a price higher than current stock prices is 47%, which is too low to consider a potential investment.

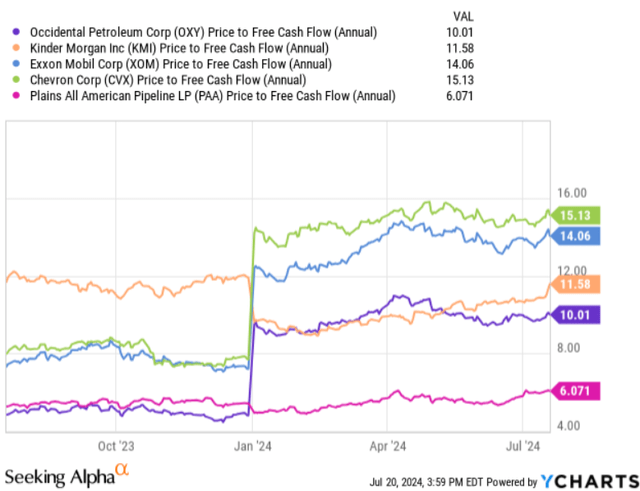

To see Occidental’s valuation in the market, you can see in Figure 11 that it is in a midpoint measuring Price to Free Cash Flow among oil companies with a higher multiple and midstream businesses in the low range.

Figure 11: Seeking Alpha

Conclusion

I outlined Occidental Petroleum’s business model and concluded that its strategy differs significantly from its peers. I noticed its integrated model concentrated in the Permian Basin, which allows it to permeate to big swings in oil prices and external factors (like COVID). It is important in this strategy to put efforts into low-carbon ventures, especially with direct-air capture.

When I examined the company’s financial performance, I saw a business that was too affected by oil price movements, with high fixed costs that damaged its profitability. Its capacity to generate more volume due to its exposure to high-quality wells is not reflected in the numbers, as are the new ventures.

The valuation is fair to the current stock price, but the risk inherent in the business will keep me in a prudent position. I will hold for the moment until I see more consolidation of the business strategy into the financial numbers.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.