Summary:

- Intel targets over $10 billion in savings by 2025, reducing OpEx to $17.5 billion — a 20% cut.

- Plans to decrease workforce by over 15% by 2025, aiming to streamline operations and boost profitability.

- Intel’s Panther Lake and Lunar Lake CPUs target the AI PC market, which is expected to exceed 50% by 2026.

- Despite revenue growth, Intel reported $2.8 billion in operating losses in Q2 due to higher manufacturing costs.

- Intel aims to regain process leadership with Intel 18A by 2025, but execution risks lead to a hold rating.

tupungato/iStock Editorial via Getty Images

Investment Thesis

Last month, we evaluated whether Intel Corporation (NASDAQ:INTC) has bottomed out following the strong pullback of the stock. Despite entering the oversold territory which implies an upside, due to Intel’s ongoing execution challenges and the higher risks associated, we remain cautious.

Following the drop below $19 I have averaged down but capped my INTC position to 2% of my portfolio, treating it as a speculative buy rather than a strong conviction. While Intel’s strategic moves in AI and next-generation technologies show promise, the uncertainties warrant limiting exposure until clearer signs of successful execution emerge.

On the positive side, Intel has aggressively pursued its turnaround strategy to reclaim its competitive edge. The company’s focus on AI and next-generation technologies, such as developing AI-optimized CPUs like Panther Lake and Lunar Lake, positions it to capitalize on the projected growth of AI-powered PCs and data centers. Additionally, Intel has an aggressive roadmap that involves embedding AI capabilities directly into its CPUs, among other things, while extending foundry services through Intel Foundry Services (IFS). Further, the company plans to improve operational efficiency partly by cutting over $10 billion in costs by 2025.

The company has an ambitious technology roadmap demanding a flawless execution to overcome its history of recent manufacturing delays and formidable technical challenges. Competition remains fierce, with competitors such as AMD (AMD) and Nvidia (NVDA) actively developing innovative products and gaining market share. Intel also needs to create a solid software ecosystem to go with its hardware offering in AI, a necessary ingredient for broad market acceptance and one that’s tough to build.

Given the foregoing factors, we have also downgraded our rating on Intel to hold. Until there is more proof of successful execution and market traction, we believe it is prudent not to maintain an overweight position in Intel.

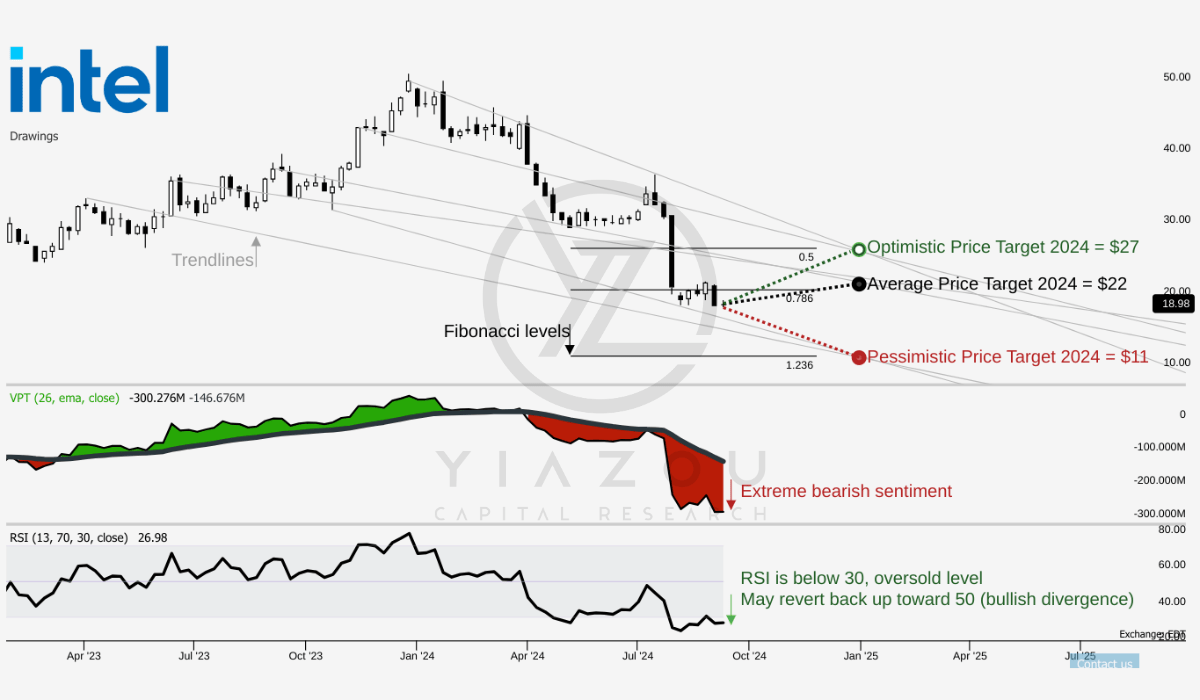

Oversold Conditions Signal Possible Reversal, Fibonacci Levels Define Key Price Targets

INTC hovers around $21, and it may attain the average 2024 price target of $22. This target aligns with the 0.786 Fibonacci retracement level and suggests moderate upward potential. Meanwhile, the optimistic target is $27, matching the 0.5 Fibonacci level and indicating a more aggressive recovery. The pessimistic target of $11 is associated with the 1.236 Fibonacci extension on the downside and suggests a possible significant decline due to market sentiment based on the company’s fundamental issues.

Moreover, the RSI is 26.98, below the 30 threshold, which still indicates that the stock is oversold. A low RSI combined with a bullish divergence suggests a potential upward reversal in the short term. The RSI line trend is sideways but shows signs of moving upwards, which could mark the start of an accumulation phase.

The Volume Price Trend (VPT) line is declining, currently at -300.28 million. The moving average stands at -146.68 million. This downtrend shows extreme bearish trading volume relative to price movements over the midterm. A reversal toward the moving average may point to a lack of conviction in the current bearish trend, based on reduced selling pressure in the short term.

Yiazou (trendspider.com)

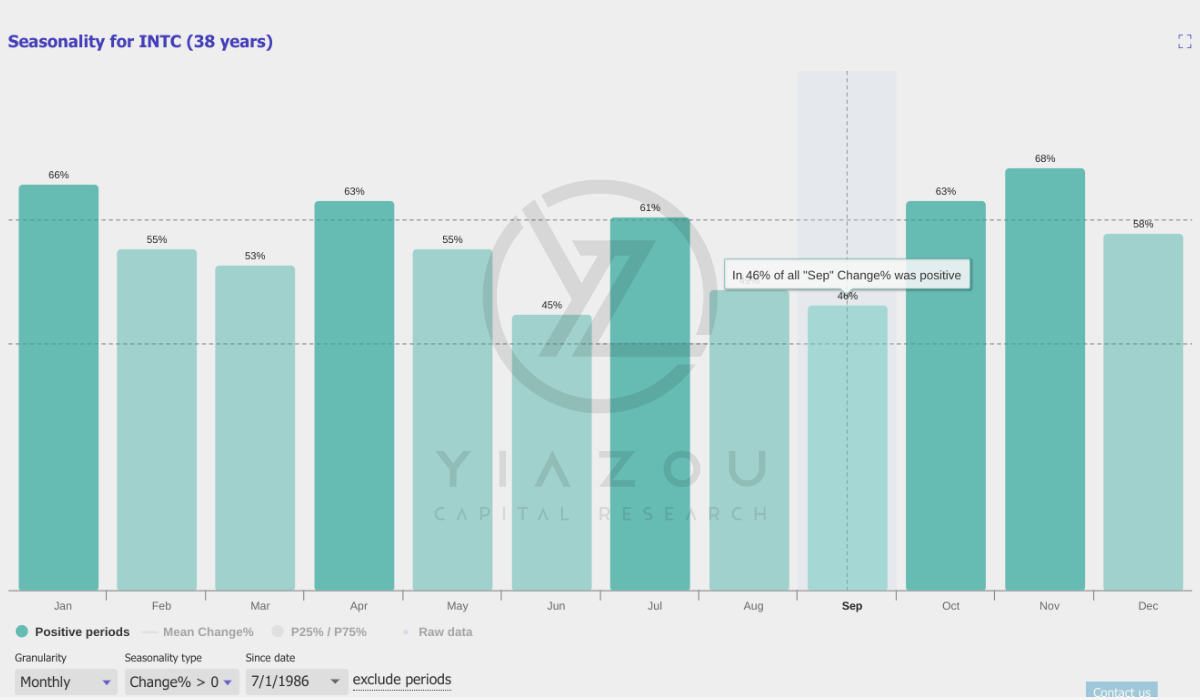

Historical data over 38 years shows a 46% chance of positive returns in September. This seasonality factor suggests a slightly less than even chance of positive returns this month and indicates that the favorable seasonal influence is not overwhelmingly strong.

Yiazou (trendspider.com)

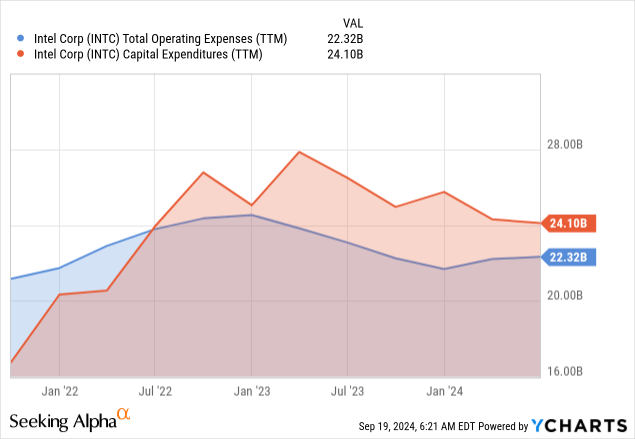

Intel Slashes Costs and Bets Big on AI PCs

Intel is trying to boost profitability and capital efficiency (by +$10 billion by 2025). The company plans to cut OpEx to ~$20 billion in 2024. In this line, the target is $17.5 billion for 2025 and the company aims to reduce OpEx by over 20% in two years, representing $2.5 billion saved from 2024 and another $2.5 billion from 2025. Similarly, Intel will lower gross CapEx to $25-$27 billion in 2024, which is a reduction of over 20% from initial estimates.

The target for 2025 is $20-$23 billion and the net capital spending may hit between $11 billion and $13 billion for 2024 and near $12-$14 billion for 2025. These cost measures align with Intel’s restructuring plan, which includes reducing headcount by over 15% by 2025. In short, most reductions may be placed by the end of 2024, making Intel leaner and possibly more profitable.

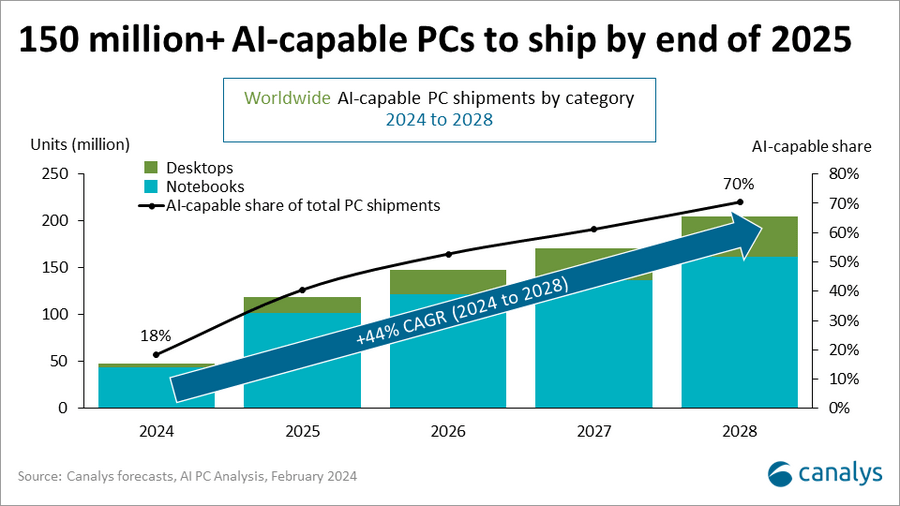

Moreover, Intel’s focus on the AI PC market is a major growth catalyst. AI PCs currently account for less than 10% of the market. However, by 2026, this category may exceed 50% and this shift represents a significant opportunity for Intel, as per the management. Targeting AI PC market share, Intel’s Panther Lake CPU may be launched in H2 2025. The company is also boosting its AI PC chip portfolio with the Lunar Lake CPU, which provides 50% higher graphics performance and 40% more power efficiency (over its predecessor). Since December 2023, over 15 million AI PCs have been shipped, and by 2025’s end, cumulative AI PC shipments may be over 100 million.

canalys

In this direction, Intel is ramping up production to have a grip on the growing demand. New products like Arrow Lake and Lunar Lake are in the pipeline, strengthening Intel’s position in the market. Partnerships with Microsoft (MSFT) further support Intel’s strategy. For instance, Lunar Lake is qualified to power over 80 new Copilot+ PCs. An external source, Gartner, projects a 33% YoY increase in AI chips revenue in 2024, and by 2026’s end, all enterprise PC purchases may be AI PCs. Hence, this development may be a bullish catalyst for Intel’s Client Computing Group.

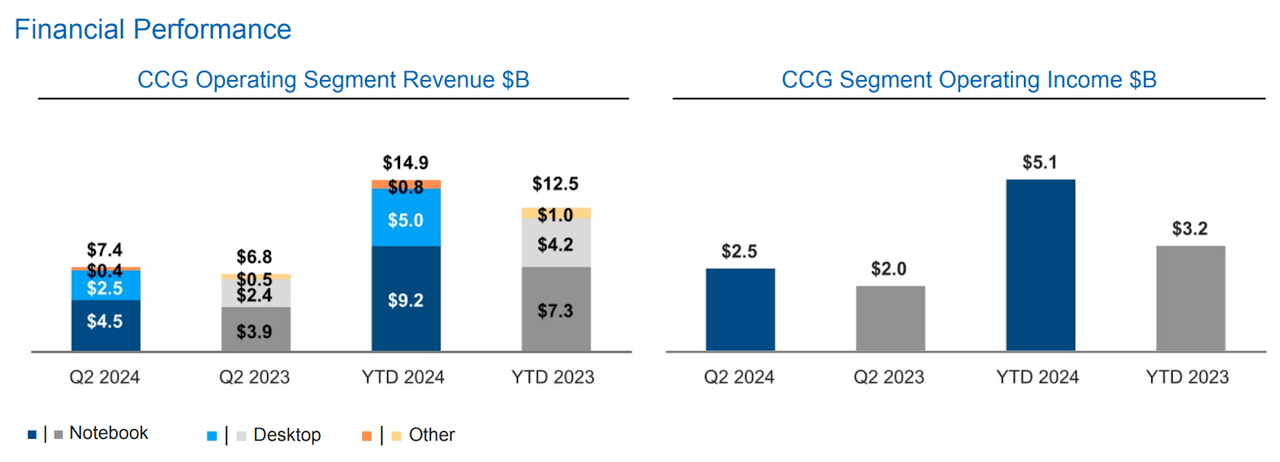

Lastly, year-to-date, 2024 operating income has increased by 62% compared to 2023. In Q2, the segment operating income was $2,497 million, including $422 million income derived from higher notebook and desktop revenue. Similarly, YTD 2024 operating income includes $1,428 million derived from higher notebook and desktop revenue, reflecting the bottom-line impact of Intel’s AI PC revenue. On a YTD basis, notebook and desktop volume increased by 24% and 19% YoY. However, this expansion reflects market share expansion, considering notebook ASPs increased by 2% and desktop ASPs were flat YoY.

10-Q – Intel Corporation

Intel’s Aggressive Node Roadmap & AI Push Signal Turnaround

Intel’s Foundry business follows a five-nodes-in-four-years plan. Intel 4, Intel 3, and Intel 20A are in production or nearly so. Intel 18A is the next major advancement expected in 2025 and will complete the five-node roadmap. This will restore Intel’s process lead. Moreover, the company is also advancing packaging technologies like RibbonFet, PowerVia, and Foveros Direct, which will boost chip performance and flexibility at lower costs. With that, Intel may stay ahead in high-demand markets (data centers and AI). For instance, Intel Foundry’s embedded multi-die interconnect bridge (EMIB) technology enables cheaper chip designs.

Despite $2.8 billion in operating losses for Q2, 2024 may see a turnaround in upcoming quarters. For instance, investments in the Ireland facility and EUV node shifts will reduce costs, and the Foundry business’s gross margins may improve over time. Similarly, the Xeon 6 processors, built on Intel 3, feature P-core and E-core designs, showing Intel’s competitive edge. Early adopters report a 25% performance per watt improvement. Combining performance, scalability, and reduced ownership costs fundamentally creates Intel’s competitive advantage. Thus, Intel’s open models and developer frameworks appeal to enterprises seeking customizable AI solutions.

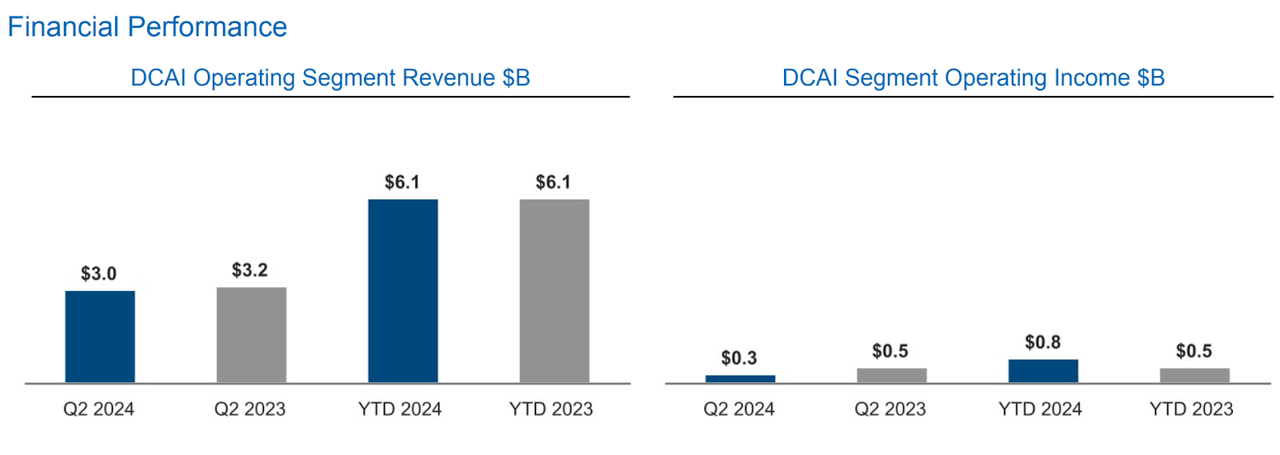

Further, the Gaudi 3 launch in Q3 2024 marks another AI strategy milestone, as it costs two-thirds of competitors’ offerings. Gaudi 3 may deliver twice the performance per dollar versus Nvidia’s H100, and ecosystem support from Dell (DELL), Hewlett-Packard (HPQ), Lenovo (OTCPK:LNVGY), and other hardware giants boosts Intel’s market lead. As early signs, the DCAI segment’s operating revenue remained stable YoY as of YTD 2024.

Meanwhile, YTD’s operating income has improved by 54% from YTD in 2023. Unlike the Client Computing segment, $431 million in product profit on higher ASPs on lower volumes led to this stability. The issue with Intel is dropping market share in data center servers.

10-Q – Intel Corporation

Downsides: Intel’s Profit Miss Spurs Cuts, Casting Doubt on Growth Plans

Despite revenue growth, profits fell short of expectations, which posed a red flag in Q2. One issue was the accelerated rollout of Intel’s Core Ultra AI CPUs, which hurt margins in the short term. Higher initial manufacturing costs of these CPUs, with production shifted from Oregon to Ireland, are increasing expenses. The production shift may eventually save $1 billion in capital costs, but it will currently negatively impact margins.

Moreover, Intel’s operating model changes may bring in more challenges. For instance, the company has a cost-reduction plan that targets $10 billion in savings by 2025 to cut OpEx. That might boost profitability, but halt rapid expansion, as Intel plans to reduce its workforce by over 15% by the end of 2025. This measure points to structural inefficiencies, and the significant headcount reduction (amid expansion requirements) reflects deeper cost management issues that may hinder Intel’s ability to invest in growth projects.

Moreover, Intel has cut its gross CapEx forecast for 2024 by over 20%, reflecting softer demand and tighter capital scrutiny. The cut in CapEx may improve capital efficiency but limits Intel’s ability to expand capacity. Slower CapEx growth could restrict Intel’s ability to scale production, critical for capturing market share in fast-growing sectors like AI. Finally, Intel’s decision to suspend its dividend in Q4 2024 reflects a critical state of liquidity constraints. The suspension to prioritize liquidity for investments in AI and advanced manufacturing indicates the company is struggling with cash flow in funding growth projects.

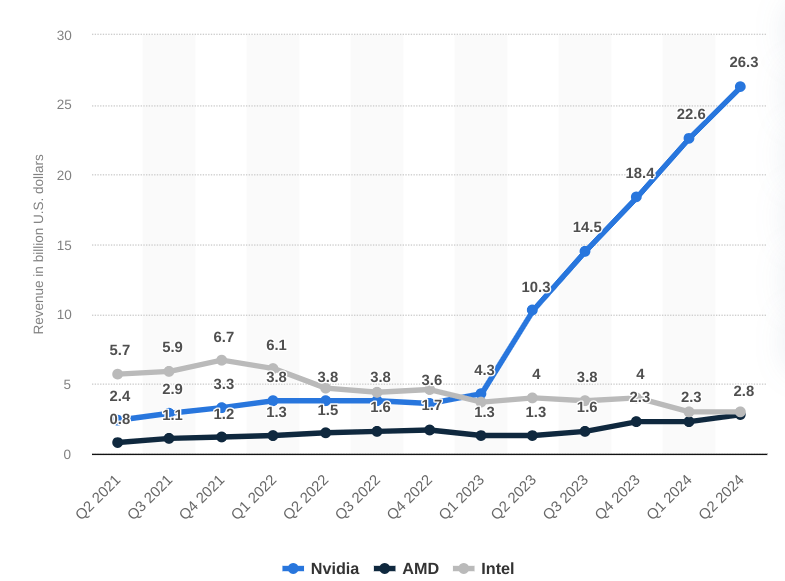

Overall, these pressures could limit Intel’s ability to invest in growth areas, including AI and foundry services. Consequently, competitors like Nvidia might continue to capture a larger data center market share. Currently, comparative data segment revenues reveal significant growth for Nvidia. This extraordinary growth further emphasizes Intel’s loss of profitability and strategic potential.

Statista – The Statistics Portal (Data center segment revenue)

Takeaway

Despite Intel’s aggressive push into AI and next-generation technologies, ongoing execution challenges and fierce competition lead us to maintain a cautious stance. Given these factors, we’ve downgraded our rating on Intel to hold until there are clearer signs of successful execution and market traction.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.