Summary:

- Abercrombie & Fitch Co. recently reported Q2 earnings that missed on both the top and bottom line.

- The company, yet again, cut guidance estimates, and now see revenue declining year over year and profits of ~$0.

- I re-iterate that this stock isn’t worth buying – I forecast $17/share over an 18-month view.

jetcityimage/iStock Editorial via Getty Images

Introduction & Purpose

Abercrombie & Fitch Co. (NYSE:ANF) reported Q2 earnings that were underwhelming, and sent the stock down 23% the week after. The company’s revenue declined materially from the prior year, and ANF cut its guidance again for the remainder of 2022. My recent article on ANF showcased a bear view, and these results reinforced my opinion. With a macro environment likely to remain challenged as rates rise, and ongoing turmoil as profits evaporate, ANF isn’t well-positioned to outperform. I reiterate my “Hold” rating with a $17 USD price target over an 18-month timeline.

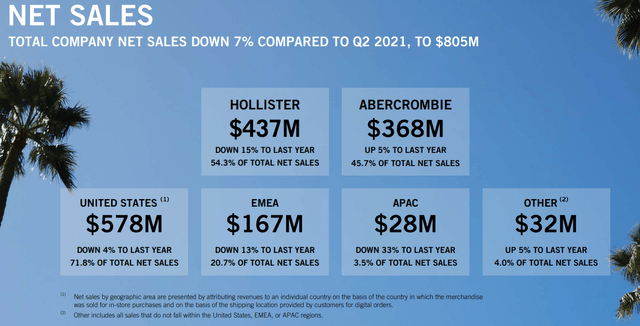

ANF Q2 Review

ANF announced Q2 earnings on August 25, 2022 that underwhelmed, sending the stock downwards in the following week. Total revenue fell sharply to $805MM, down 7% year over year. The company also reported a 7.3% margin deterioration from the previous year. ANF saw jumps in SG&A and marketing expenses, and ended the quarter with a net loss of ($16.8MM). Additionally, ANF wrote off ~$2.2MM in asset impairments. Given the track record of the company, I believe more impairments will come in the near future as the sales season transitions and the economy slows due to rising rates. Hollister, the largest brand by revenue in the portfolio, saw sales slide 15% year over year. There was some promise from the Abercrombie brand, which saw a 5% revenue jump, given its strength in the return to school demographic. However, the Hollister weakness lagged significantly on the company as a whole. Global sales fell significantly, highlighted by a 33% plummet in the Asia-Pacific region, while domestic sales in the U.S. also fell 4%. The company maintained 734 store fronts, and saw operating expenses jump ~6% to 58% of revenue. Management has not been able to adapt quickly enough, unlike their peers, and this quarter proved that ANF remains a laggard.

ANF ended the quarter with just $370MM in cash, well below the previous year in which the company had close to $1B on hand. The company also burned $260MM from operations. Inventory of $708MM, up 70% year over year, is concerning given the amount of discounting the company has engaged in. Fran Horowitz, CEO, noted on the conference call that Hollister inventory still remains higher than they would like. CAPEX is expected to hit $150MM by the end of the year, as the company hones in on growth in the Abercrombie brand. ANF also cut guidance for the remainder of the year, citing a difficult environment, and now forecasting a mid-single-digit decline. Overall, this quarter was very disappointing. No matter what metric you looked at, both from the company perspective or a macro lens, negativity engulfed the quarter. It’s difficult to see a path to turnaround in the near future based on these results.

Model Shows Limited Upside

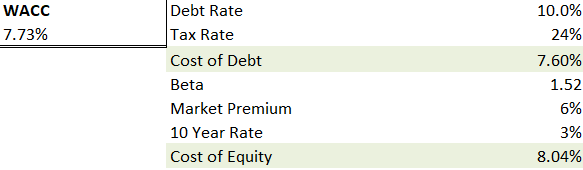

With guidance pulled and rising costs, the company will struggle. A senior note at 8.75% stings in hindsight given the net loss, and the company’s net cash position has dropped dramatically once again. Given their weak Q2 performance, I anticipate the cost of debt rising to 10% should they attempt to adjust their leverage in this environment.

Author WACC

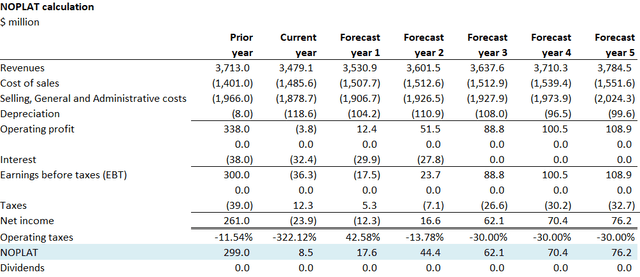

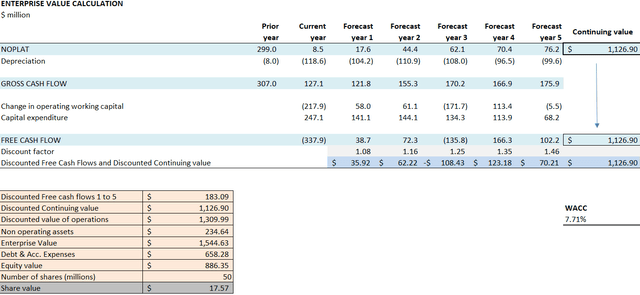

I forecast the continuing value of about $1.2B, given a -6% revenue decrease this year and blended revenue gains of 1.25% for five years, as supply chain woes and inflation continue. I see SG&A expenses slowly returning to 53-54% over time as a percentage of revenue within a 5-year period – synergies from the digital sales won’t offset raw materials & distribution costs jumping. I hold other cost ratios equal as a percentage of revenue from historical figures. I forecast that the company will hold the debt to maturity without refinancing, which explains the low cash flow in 2025. As the margin dips slightly, just a $17 share price (see below) can be supported with fundamentals of a 14x 2023 EV-EBITDA.

Author Revenue Forecast Author EV Calculation

Conclusion

As ANF flounders with revenue declines and operational challenges, the company will remain an underperformer. ANF has weak brands and a significant cost base with too much square footage. The company reported sluggish earnings and yet again cut full year guidance. I project an $17 price target with a “Hold” rating over an 18-month timeline.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.