Summary:

- Nike has strong fundamentals, but faces volatile profit margins and returns, leading to investor disappointment despite its historical strengths.

- The stock has been a good short-term trade, but lacks the characteristics of a long-term compounder, with a concerning forward P/E of 26.

- Leadership changes and macroeconomic challenges, including stiff domestic competition and cautious consumer spending, pose significant risks to Nike’s future performance.

- In this article, I explain why, though I like the company, I am exiting my position.

Thank you for your assistant

Nike’s Puzzle For Investors

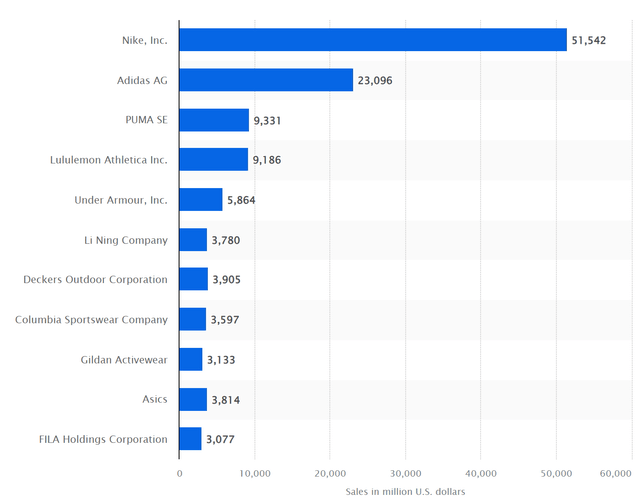

In recent years, we have learned from many investors that one secret to long-term success is to buy and hold truly great companies for a long time. Companies with an endurable moat, strong pricing power, strong brand recognition, high return on capital employed, low capex requirements, and so on. Nike (NYSE:NKE) appeared to fit in almost every category of this description. Some questioned whether Nike faced competition and the pros and cons were highly debated, but, surely, it appeared as the established leader in footwear and sports apparel, almost doubling the sales of its largest competitor Adidas.

statista

Nike’s gross margins constantly stay above 40% and often surpass 45%. It earns a return on capital employed in the mid-teens, and it spends less than $1B in capex, ($812M in FY2024, around 1.6% of its revenues). For the last nine years, Nike has consecutively been the world’s most valuable apparel brand, with a valuation of $31.3B, beating Louis Vuitton by $5B, and lapping Adidas’s valuation of $15.7B. However, Nike’s brand value in 2023 was down 6% due to slower revenue growth, while Adidas added a healthy 7%.

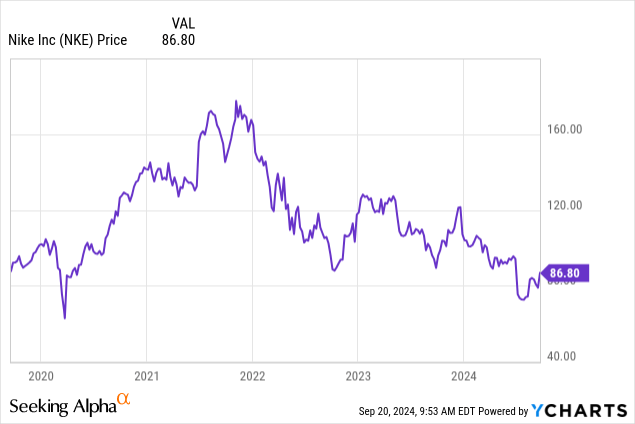

Well, none of this helped Nike’s stock, and those who invested in it before the pandemic now find themselves rather disappointed.

Looking at Nike’s stock in the past five years, we see it was a rather good short-term pandemic winner, but since late 2021 has been nothing but a good stock to short or to trade based on momentum. Surely, it doesn’t look like a compounder.

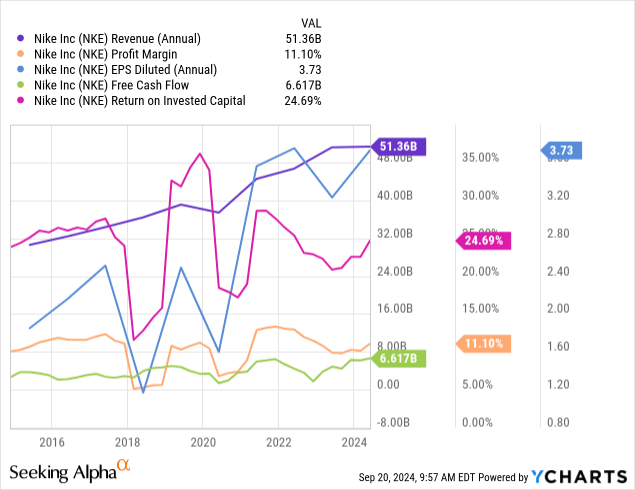

Let’s look at its fundamentals and see what happened. Here, I am zooming out to the 10-year chart to better see the picture. Well, while revenues steadily increased, we see some shakiness in EPS. But most importantly, the profit margins are volatile, as well as the returns on invested capital.

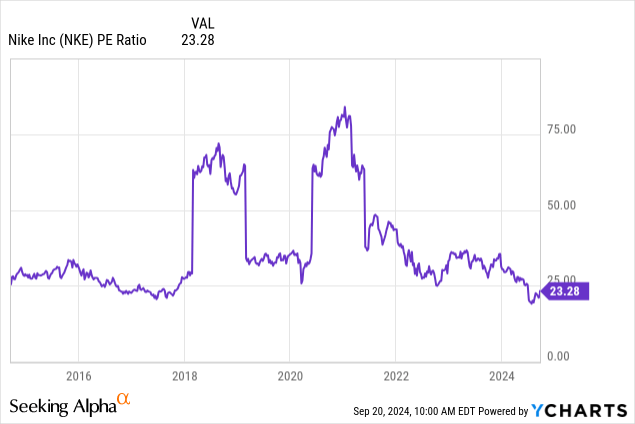

Now, this is not a bad graph. It shows a company that, overall, does well. But when it comes to Nike, investors expect no less than perfection and punish the stock severely if the company doesn’t meet the high standards. After all, we are talking about a company that rarely dips at an earnings multiple below 25. Recent struggles in China and rising competition from more nimble rivals led to this situation, with the stock hammered sharply in June after disappointing guidance.

Right now, the stock trades at a TTM P/E of 20, but a rather concerning fwd P/E of 26. The translation is: investors are expecting Nike’s earnings to be down sharply.

However, some excitement has spurred the market and the stock is now up 7% on the news that, after the current CEO John Donahoe decided to retire effective October 13, Elliott Hill is returning as CEO after retiring in 2020. Mr. Hill began working at Nike as an intern in 1988 and has been promoted through 19 different roles until his retirement. Many say he “knows the company inside and out”. He is seen as carrying a “bootstraps mentality”, meaning he is highly determined to succeed despite challenges.

What should we make of this? Will Nike’s turnaround materialize for investors? Here is how I solved the puzzle I have faced with Nike for some time.

Why am I selling Nike

I bought Nike at the end of 2022, making it a small position with a 0.5% weight on my portfolio. I planned on increasing it, but as things developed, I became more cautious and questioned my initial take. My reasoning was that in late 2022, Nike had already been discounted quite a bit, but showed all the characteristics I mentioned above. However, after a year of further scrutiny and research, I came to a more neutral stance on the stock, considering it a true battleground for bulls and bears. More recently, as I read once again some words on valuation from Peter Lynch where he argues that a P/E ratio of any company that’s fairly priced equals its growth rate, I concluded Nike could actually not be undervalued at all. After all, it has reported flat growth for some years now and its guidance has also been reduced stating that 2025 will be a transition year. With this in mind, we should be aware that Nike won’t probably be a 2025 winner and that holding on to the stock may have an opportunity cost, that not everyone is willing to pay.

Now, in a tightening economic environment, we have already seen a few important CEO changes. When Starbucks announced its leadership change, the stock soared over 20%. Not the same is happening with Nike. Investors are excited, but not as much. After all, we all see how Nike’s strategy to strengthen its direct sales, doing without the help of retailers has freed up shelf space that was quickly filled by the Lululemons, Salomons, Pumas, Adidas and other rivals. This caused Nike’s market share to shrink and to higher inventories, which Nike had to clear through promotions and discounts.

While I think Mr. Hill can be a good CEO for Nike, he won’t stay at the helm for long since he already retired once. As a result, he may be inclined to lead the company with a short-term focus to maximize the results during his tenure. But even if he resists this human temptation, it won’t be good for the company to know that in a few years, there will be another leadership change. Stability matters.

Secondly, I don’t think a CEO can do much to solve macroeconomic issues, such as more cautious consumer spending. After all, Nike’s weaker markets are currently its domestic one and EMEA, while China, although posing some concerns, ended FY2024 with sales up 4% to $7.25B. It is in the U.S. that Nike faces stiffer competition, and this either means that Nike will engage in a price war or that it will bet big on more advertising and strategic (and costly) partnerships with athletes. In both cases, costs will be higher and margins will be lower.

Don’t get me wrong. I am no Nike bear, and I wish everyone well with the stock. But the opportunity cost of seeing yet another flattish year seems to be too high, especially when other opportunities in the market (especially among industrials and infrastructure plays) offer me greater visibility and predictability than Nike.

While many argue Nike’s headwinds won’t last forever and that paying now 20x earnings is a deal when the stock will once again soar. It may indeed be true, but 2025 earnings are currently forecasted to be down 21%, to then rebound by 15% in 2026. This means we need two full years before seeing some momentum. And yet, no one expects Nike to grow at a pace faster than 5% per year. This is a bit slow for the kind of portfolio I am building, where I seek revenue and earnings growth above 9% and well into the teens.

As a result, I decided to take advantage of today’s pop and exit at a minor loss to raise the cash I need for other bets I currently see as more attractive.

This is no suggestion to short the stock, and I think bulls can be happy for the leadership change. But those who have a more bearish view as I have developed, could actually profit as well right now before a likely guidance cut after the upcoming earnings report scheduled on October 1.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.