Summary:

- Target (TGT) is a dependable blue-chip stock with a strong U.S. presence, manageable debt, and a high price/book ratio.

- Risks include competition, changing consumer preferences, macroeconomic conditions, and maintaining vendor relationships, but Target remains resilient.

- Target’s P/E ratios are below the sector median, indicating potential value despite flat revenue growth. They have solid earnings projections.

- Target generates strong cash flow, pays a 2.92% dividend yield, and has the potential to grow dividends, making it a solid long-term investment.

JHVEPhoto

Stocks can be an exciting thing to engage in, and for decades I’ve loved watching the comings and goings of small companies that are trying to become big. A lot of money can be made or lost in engaging in those companies. But sometimes, you want a blue-chip stock that you can just sit on for years on end, collect dividends and trust that the company value will steadily grow.

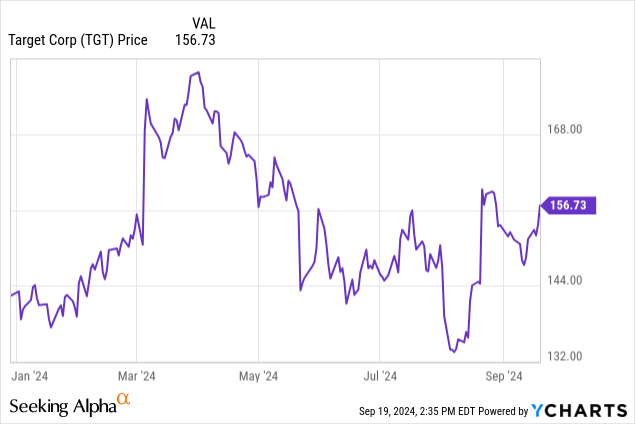

Today, I want to look at Target (NYSE:TGT), a department store company that certainly fits the definition of a blue-chip stock. The big danger with these companies is that they sometimes command more of a premium than is justified, so the focus will be on how much they can be expected to deliver in the long run, and their value with respect to other companies in their sector. There is, after all, always another retailer out there.

Consolidated Balance Sheet

|

Cash and Equivalents |

$3.5 billion |

|

Inventory |

$12.6 billion |

|

Total Current Assets |

$17.9 billion |

|

Total Assets |

$56 billion |

|

Total Current Liabilities |

$20 billion |

|

Long-Term Debt |

$13.6 billion |

|

Total Liabilities |

$41.6 billion |

|

Total Shareholders Equity |

$14.4 billion |

(source: most recent 10-Q from SEC)

Target is a big company with a strong presence across the United States. They currently have a fairly responsible level of debt, which for a profitable company like them should be more than manageable. A slight concern is that the current ratio is below 1.0, though the operating cash flow, which we’ll look at more later, should be sufficient to maintain their position.

At current prices, Target is trading at a price/book ratio of 4.91. That’s a bit of a high premium, though not necessarily unjustifiable for such a valuable company. Still, it is higher than the 2.63 sector median, so if we’re to find value in Target, it’s not going to be in its balance sheet.

The Risks

Debt is just part of the risks of being a big department store chain in this day and age. As I said before, there’s always another retailer for consumers to patronize.

Target has the task of differentiating itself from the other big retailers. They’ve historically been quite successful in doing that, but it is important that customers don’t start seeing them as just another big box chain.

Like every retailer, Target also has to anticipate changing consumer preferences. People don’t shop the same as they did ten or twenty years ago, and that means the store can’t be the same as it was back then.

Earnings for such an important chain are also highly dependent on macroeconomic conditions in the United States. Target isn’t a bad flight to safety pick in the event of a recession, but in a bad economic state like the pandemic, you have to understand that the estimates may prove overly optimistic.

Finally, Target has to maintain its important relationships with its various vendors. They do a lot of business and can move a lot of products, so it should be a fairly easy task to convince those vendors to keep them a priority.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Total Revenue |

$106 billion |

$109 billion |

$107 billion |

$50 billion |

|

Operating Income |

$8.9 billion |

$3.8 billion |

$5.7 billion |

$2.9 billion |

|

Net Income |

$6.9 billion |

$2.8 billion |

$4.1 billion |

$2.1 billion |

|

Diluted EPS |

$14.10 |

$5.98 |

$8.94 |

$4.60 |

(source: most recent 10-K and 10-Q from SEC)

Target is a mature company, not a growth target. That doesn’t mean they won’t improve same store sales going forward, but they can be expected to generate roughly flat revenue, and hopefully keep up with decent earnings through their solid margins.

Estimates are that this is going to continue, more or less. This year, they’re expected to have a revenue of $106.9 billion and earn $9.50 per share. That’s a P/E of 16.16, which is below the sector median by a fair bit. That’s a promising sign, and next year we can expect $110.2 billion in revenue and earnings up to $10.45, which makes for a forward P/E of 14.69.

I feel like this is a good situation, even if Target isn’t the deep discount value play I generally look for, they’re a dependable company and trading at P/Es that are ways below the sector median, which is always a positive sign.

Cash Flow and Dividends

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Operating FCF |

$8.6 billion |

$4.0 billion |

$8.6 billion |

$3.3 billion |

|

Investing FCF |

($3.1 billion) |

($5.5 billion) |

($4.7 billion) |

($1.3 billion) |

|

Financing FCF |

($8.1 billion) |

($2.2 billion) |

($2.3 billion) |

($2.3 billion) |

(source: most recent 10-K and 10-Q from SEC)

Target does one thing very well, and that’s generating cash. That’s important, because as we’ve seen, the company is trading at a fairly high premium to its book value. The cash will give them flexibility to continue to grow their business, and also offers an opportunity to return value to shareholders.

In that regard, Target pays $4.48 per year in dividends. That’s a 2.92% yield, which is slightly above the sector median. I would like to see Target grow that dividend in the years to come, and it seems like the company should have the capability of doing so. That’s important, especially for long-term investors.

Conclusion

Target seems like an excellent candidate for long-term investments. They’re solid as a rock and have shown a capability to expand and adapt as the market allows. They’re not going to be expanding like crazy, but if there’s a bet that the company will be this strong or stronger 5-10 years down the road, I’m definitely taking that bet. I’m rating Target a buy.

Investors should keep an eye on the company’s general reputation. They’re doing fine and a lot of people love shopping there. That can always change, and there are countless other retailers liable to try to compete for their business in the future.

I would also keep an eye on the possibility of growing dividends, as that’s one thing that the company seems to easily have the flexibility to do, and will differentiate the company well as a solid income play.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.