Summary:

- Textron’s Aviation and Bell segments achieved decent revenue growth, up by 10% and 13% YoY, respectively, despite ongoing supply chain delays.

- Nonetheless, revenue in the industrial segment fell by 11%, with profit dropping nearly 47% YoY in this segment. Weak demand in automotive and consumer goods is likely to persist.

- Key risks include reliance on US government contracts and ongoing development costs in the eAviation segment.

- Despite headwinds and lack of insider buying, Textron’s strong growth, with several milestones achieved during the second quarter and good fundamentals, led to my buy rating.

Robert Buchel/iStock Editorial via Getty Images

Textron Inc. (NYSE:TXT) has shown decent performance results during the second quarter of the year. Since then, the share price has slightly declined by 5%, which could be an interesting entry point for a long position in the company.

In this article, I considered reviewing their recent financial performance, including some of the headwinds that the company is experiencing, like delays in the supply chain, the decline in the industrial segment, or the ongoing development costs within the eAviation business.

In the outlook section, I will provide the rationale behind my Buy rating, including a closer look at their fundamentals and insider trading activity.

For now, I will begin with a brief company overview section for those readers new to this stock.

Company Overview

Textron Inc. is an American industrial conglomerate based in Providence, Rhode Island.

The company operates through 6 business segments:

- Textron Aviation: This segment is focused on designing, manufacturing, and selling business jets, turboprop aircraft, and piston-engine airplanes for both civilian and military uses.

- Bell: This segment produces military helicopters and tiltrotors, focusing on defense contracts, mainly with the US government.

- Textron Systems: This segment provides defense products, including unmanned systems and weapons.

- Industrial: This segment is focused on selling specialized vehicles and machinery across several industries.

- Textron eAviation: Develops electric and sustainable aircraft solutions.

- Finance: This segment offers financing solutions primarily for Textron products.

I considered including below a breakdown of the total revenue per segment, from their latest 10-Q.

| Segment | H1 2024 ($ million) | H1 2023 ($ million) |

|---|---|---|

| Textron Aviation | 2,663 | 2,511 |

| Bell | 1,521 | 1,322 |

| Textron Systems | 629 | 612 |

| Industrial | 1,806 | 1,958 |

| Textron eAviation | 16 | 15 |

| Finance | 27 | 30 |

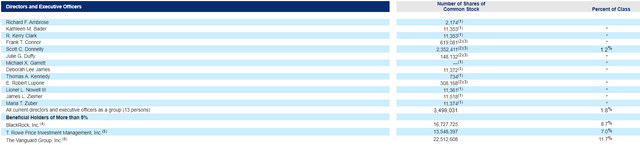

Ownership-wise, the latest 14A shows a common stock ownership of 1.8% across all 13 directors and executive officers. In my view, not a significant amount of skin in the game.

The CEO, Scott C. Donnelly, owns about 1.2% of the common stock.

In regard to the 5% owners, aside from BlackRock and Vanguard, T. Rowe Price Investment Management has an ownership of 7% in the company.

Headwinds, Challenges, And Risks

I like to start dinner with dessert, so I will cover first the headwinds that could tear apart my bull thesis.

Inefficiencies, mostly related to delays in their supply chain, contributed to an unfavorable $33 million impact on performance in the aviation segment during the second quarter.

The CEO, Scott Donnelly, acknowledged during the Q2 2024 earnings call that supplier delays continue to disrupt production. In other words, key parts arriving late cause production inefficiencies, leading to work out of sequence, and costly rework operations, which has a direct impact on operating margins.

To be transparent, I am not overly concerned about these supply chain delays considering that revenue increased in the aviation segment by $113 million (10% YoY), and by $93 million (13% YoY) in the Bell segment, despite missed deliveries due to delays in receiving components for its helicopters. Additionally, both segments experienced an increase in segment profits, despite the supply chain delays.

Another headwind comes from an 11% decline in revenue in the industrial segment. What is even more concerning is that profit declined by 46.8% YoY. So, what has been going on in this segment to drive such a decline?

In just a few words: lower demand in the automotive and consumer goods sectors. Management mentioned during the earnings call that they are not expecting a miraculous turnaround in demand for these markets in the near future. Instead, they are focusing on cost-cutting measures.

Among the reasons for the decline in demand, the main contributing factors were high interest rates over the past year and increased costs for raw materials and labor due to inflation.

Another pressure comes from the eAviation segment, reporting in Q2 2024 about $9 million in revenue, while suffering $18 million in losses, an increase from the $12 million loss in the same quarter of 2023.

Their two key platforms within this segment, Nuuva and Surveyor, are still in development, and it may take years before they start contributing meaningfully to Textron’s bottom line. In the meantime, the cost of developing these programs has a direct impact on overall profitability.

Another risk that I see is their high dependency on US government contracts, especially in the Bell segment, where Textron has secured several contracts, including the DARPA X-Plane program and the U.S. Navy’s METS program.

Considering their large timeline, the long-term success of these programs depends on continued government funding, which can be unpredictable. Any change in US defense priorities, or budget cuts, could put these projects at risk, impacting future revenue growth.

Another risk tied to the Bell segment could be delays in the execution of the Future Long Range Assault Aircraft (FLRAA) program, which contributed significantly to the $104 million increase in military volume for the Bell segment.

Good Performance And Progress

Aside from these headwinds, the recent performance of the company was outstanding.

Total revenue increased by $3.5 billion in Q2 2024, up from $3.4 billion in Q2 2023. The main drivers for this revenue increase were the aviation (+8.3% YoY) and the Bell (13.3% YoY) segments.

The better-than-expected performance in these 2 segments led to an increase in adjusted EPS, totaling $1.54, up from $1.46 in Q2 2023.

Among the progress with Textron Aviation, I considered mentioning the following milestones:

- Successful certification of the third variant of the Cessna SkyCourier, which allows operators to transport passengers and cargo simultaneously.

- First flight of Cessna Citation Ascend, logging over 400 hours of flight testing.

- First units (of a total of 64) of King Air 260s were delivered under the multi-engine training systems (METS) contract for the US Navy.

For the Bell segment, I already mentioned in the previous section the importance of the FLRAA program to the segment’s revenue. Additionally, Bell was selected as one of two companies for the next phase of DARPA’s X-Plane program. Finally, the backlog of this segment increased by 10% YoY, with new contracts from Nigeria for 12 H-1 helicopters.

The eAviation segment achieved two milestones. The first one was the completion of vehicle one assembly of the Nuuva prototype. Ground testing has started in preparation for hover flight later in 2024. The second one was the acquisition of Amazilia Aerospace, bringing in expertise in digital flight controls and vehicle management systems.

Outlook

A quick look at the weekly chart below shows the share price above the $75-$80 resistance level, which was broken at the start of this year.

Despite the increase in the share price, the RSI shows no signs of overbuying activity.

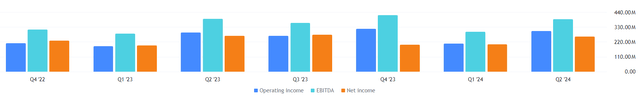

In regard to their income statement, despite an increase in net income over the past quarters, operating income and EBITDA didn’t follow the same trend.

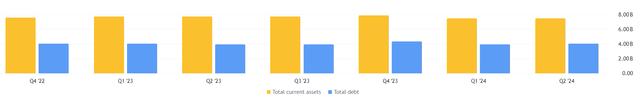

A quick look at their balance sheet shows that both debt and total current assets have been relatively flat over the past year, with a slight decrease in total debt.

As seen above, total current assets are close to 2x total debt (1.87x in Q2 2024). Therefore, I am not sweating a drop about their debt levels.

In regard to their cash flow statement, free cash flows seem to be quite choppy, but positive in most of the quarters.

In regard to the insider trading activity, aside from a sale operation by one of the directors, Bader Kathleen, of about $1 million, there was no other relevant insider activity.

A similar situation happens when we look at the latest 13D/Gs. Aside from T. Rowe Price Investment Management, Inc. selling 22.5% of its ownership in February, nothing relevant happened.

Nonetheless, despite the lack of insider buying activity, the strong growth and fundamentals of this company led to my buy rating.

Conclusion

To conclude, despite headwinds, including supply chain delays, a decline in the industrial segment, and the ongoing development costs in the eAviation segment, I find Textron’s overall performance quite impressive.

The Aviation and Bell segments have experienced decent revenue growth during the last quarter, and despite some delays, especially in the Bell segment, they continue to deliver on key milestones.

I remain impressed with management’s ability to secure government contracts, particularly in the US, however, the reliance on these contracts presents some risk.

Nevertheless, and despite the lack of insider buying activity, I expect Textron to continue delivering solid results. Therefore, I maintain a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.