Summary:

- Despite near all-time low valuations, Unity remains a leader in 2D/3D content development, particularly in mobile and indie games and the XR market.

- Unity’s diversified revenue streams, particularly in non-gaming sectors, and strategic positioning in high-growth markets like XR, bolster its long-term growth potential.

- Significant restructuring progress with the new management addressing past missteps evident by the rollback of the controversial runtime fee.

- With analysts predicting no real growth until 2028 Unity holds a significant upside if it executes its strategy successfully.

- The synergy between Unity’s Create and Grow solutions could prove to be a key competitive advantage, though the increasing competition in the advertising and gaming markets remains a notable challenge.

JulPo/E+ via Getty Images

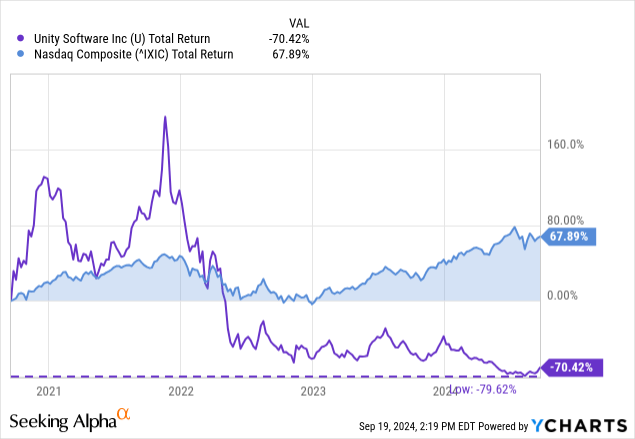

After a brief market outperformance in the 2020-2021 period, boosted by the inclusion in the retail-favorite Cathie Wood’s disruptive innovation fund, ARK Innovation ETF (ARKK), Unity Software Inc. (NYSE:U) stock has suffered significantly during the 2022 downturn and failed to recover thereafter. The company is navigating significant challenges, evident by the near all-time-low valuations, as it refocuses on its strategic portfolio and attempts to realign with market demands under new management.

YCharts

Investment Thesis

Pessimistic analyst predictions indicate no real growth for Unity Software’s topline until after 2028, leaving ample room for positive surprises in the coming years. Despite historically depressed valuations, Unity’s core strengths remain intact including its concrete position in the 2D/3D game engine and its suite of complementary monetization and growth solutions.

The company is strategically positioned in the rapidly growing XR (Extended Reality) market while experiencing meaningful growth in its non-gaming revenues. Its financial position is solid with positive free cash flow and minimal near-term capital-raising needs. Moreover, management has acknowledged past mistakes and taken meaningful steps to resolve the issues. With new leadership in place and the introduction of the highly anticipated Unity 6 engine in the second half of 2024, Unity is likely at a pivotal point.

A Discounted Cash Flow valuation demonstrates that Unity stock holds considerable upside if it manages to achieve industry-average revenue growth and operating margins over the coming years. However, investors should remain aware of mounting competitive pressures in the monetization/growth and 2D/3D content creation markets.

A Top-Down View Of Unity And Its Market

How Unity Software Makes Money

Unity Software generates revenue through two segments: Create Solutions (33.57% of Revenue, 2Q24) and Grow Solutions (66.43% of Revenue, 2Q24).

The biggest and most well-known segment of Unity, Create Solutions, provides a platform and suite of tools for building and deploying real-time 2D and 3D content. Commonly referred to as a ‘game engine’, the platform is currently used most in gaming but is increasingly being adopted in other industries like construction, retail, aerospace, architecture, and AI model training. Unity offers its developers the ability to create interactive experiences that can be deployed across multiple platforms. Create Solutions generates through the following channels:

-

Subscriptions: Access to platforms and tools that allow the editing, running, and iteration of real-time 3D and 2D content.

-

Enterprise Support: Sold separately to enterprise customers.

-

Professional Services: Consulting, platform integration, training, and custom application and workflow development.

-

Cloud And Hosting Services: Fixed fee or consumption-based fee.

Grow Solutions offers services to developers to publish and monetize their content, expand their user base, and manage devices:

-

Monetization Services: through Unity Ads, ironSource Ads, Unity LevelPay, Unity Programmatic Solutions, and Tapjoy.

-

User Acquisition Services: through Unity Ads, ironSource Ads, Tapjoy, and Aura from Unity.

-

Publishing Services: through Supersonic.

-

Device Management Services: through Aura from Unity.

Game Engines Are Essential And Are Here To Stay

Traditionally, each video game used its proprietary rendering engine which had to be programmed for that purpose. Over the years, commercial Game Engines (e.g., Unity, Unreal, Godot) have been developed to act as frameworks that simplify and streamline video game and digital content development. They provide core features like 2D or 3D game rendering, physics simulation, sound management, animation, and even interactive AI among other useful tools and features.

Without Game Engines, smaller studios and indie developers would have no chance of competing with bigger developers due to massive quality and feature differences stemming from the tremendous budgets and manpower required to implement features and tools that make modern games so entertaining and consequently profitable.

As reported by itch.io statistics, Unity is the number one game engine used for indie games. Indie games (short for ‘independent video games’) are games made by individuals or small studios and are not supported by an established game publisher, contrary to triple-A games. Such games are constrained in budget and usually focus on innovation and tend to take more risks than a game publisher would be willing to.

Leveraging 2D/3D Content Creation Through Multi-Platform Support

Broad platform support has been one of Unity’s great strengths from early on. Unity Engine supports over 20 different platforms including desktop, consoles, mobile, and extended reality platforms. It offers developers great flexibility and leverage by developing content for every major mainstream and growing gaming and extended reality platform on the market. Unity also launched a Chinese version of Unity Engine called “Tuanjie Engine” on August 2023 which supports popular Chinese platforms like Weixin Mini Game and AliOS.

Unity Engine Compatible Platforms (Unity Software)

A Booming Extended Reality Market Could Boost Unity Software Significantly

Game engines are poised to play a significant role in the XR (Extended Reality) space, an all-encompassing term for VR (Virtual Reality) and AR (Augmented Reality). As more tech giants like Meta Platforms, Inc. (META) with its Quest VR headset and Apple Inc. (AAPL) with its Vision Pro make record sales every year, it is apparent that the XR experience and game development will thrive with it.

The two biggest game engines, namely Unity Engine and Unreal Engine, serve as the backbone of XR content development. Similar to traditional game development, Unity’s strength in this area lies in its user-friendliness, multi-platform support, and solid performance while the Unreal Engine is preferred for its photorealistic capabilities and advanced features.

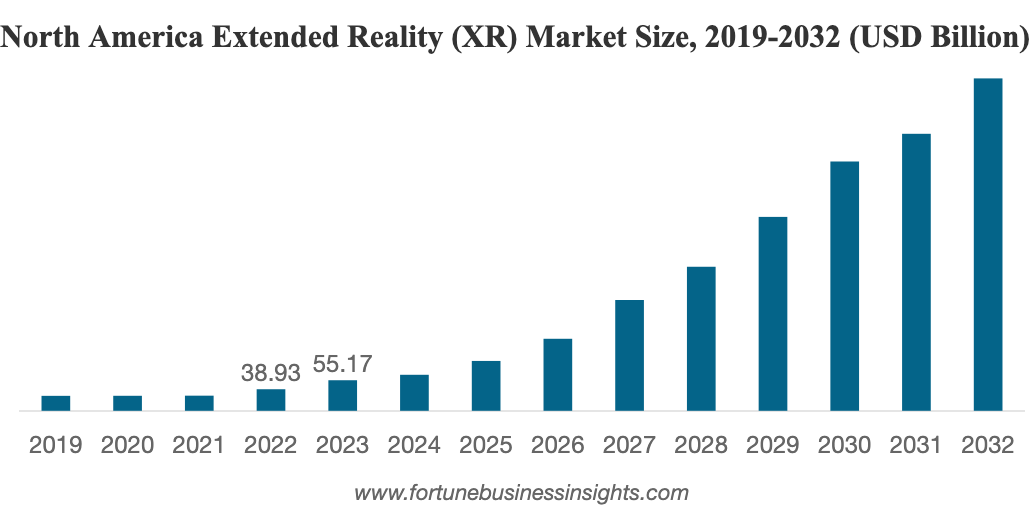

Fortune Business Insights estimates the worldwide XR market to be around $184 billion in 2024 and is projected to be worth around 1,707 billion in 2032, growing at a CAGR of 32%. The Extended Reality market is expected to outpace the Game Engine market (discussed below), and is, therefore, an important part of Unity’s future expected TAM (Total Addressable Market).

The figure below demonstrates the high-growth expectations for the North American XR Market.

fortunebusinessinsights.com

Wide Industry Applications Are Growing

In the latest 2Q24 earnings, Unity’s reach and potential to markets outside gaming was the biggest ever for the company. Unity is experiencing significant growth in its non-gaming revenues, with a 59% year-over-year increase in the ‘Industries’ segment, now representing a record 18% of total Create Solutions revenue.

Unity Engine’s use and value in various applications like AI training for driverless cars, architectural simulations, and virtual film production sets, among others, is more apparent than ever. An important factor to consider is the compatibility of innovations in the gaming-focused Unity Engine with industry applications. R&D spending, attributed traditionally to Unity’s game engine, could potentially have immense leverage given its applicability in adjacent markets. Furthermore, the robust growth in non-gaming revenue means Unity is becoming increasingly more diversified and less risky.

Game Engine Market Insights

Unity’s Strategic Portfolio Addresses Some Of Gaming’s Biggest Submarkets

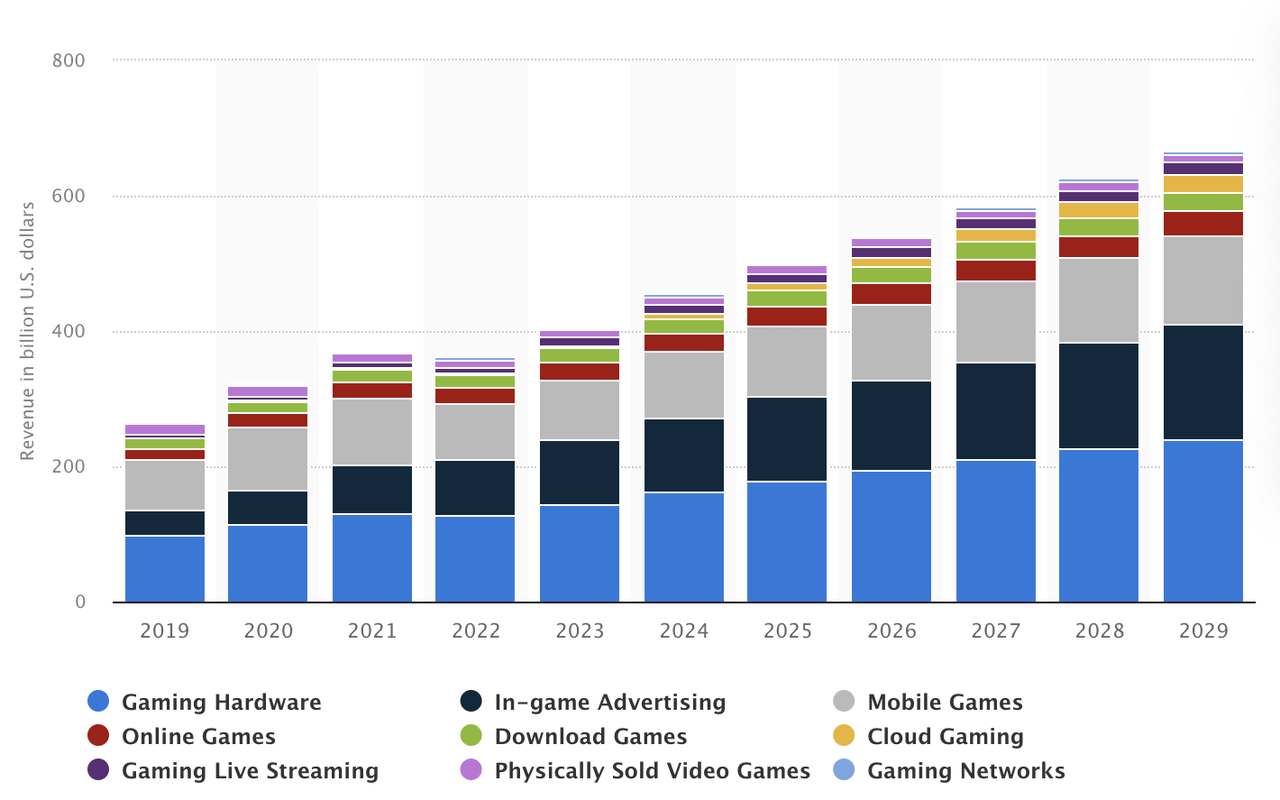

“In-game Advertising” and “Mobile Games” are two of the biggest gaming submarkets by revenue according to Statista, and are both projected to grow meaningfully over the coming years. Unity might be strategically positioned to benefit if these trends materialize, as discussed below.

Global video game market revenue by segment (Statista)

The company’s success and focus on Mobile Games are evidenced by Unity being used for the top 69% of the top 1,000 mobile games, according to the company’s latest 10-K report. Also, the company’s Grow Solutions include monetization products that allow customers to grow and engage their users and monetize their content, putting the company firmly in the growing In-game Advertising market.

From the developer perspective, Mobile is the most popular gaming medium, and 2.7 million out of a total of 11.1 million developers used it as their primary development platform, according to the “Game Developer Population Forecast” report published in June 2024 by Developer Ecosystem Insights.

Unity Is The Most Popular Game Engine Among Developers

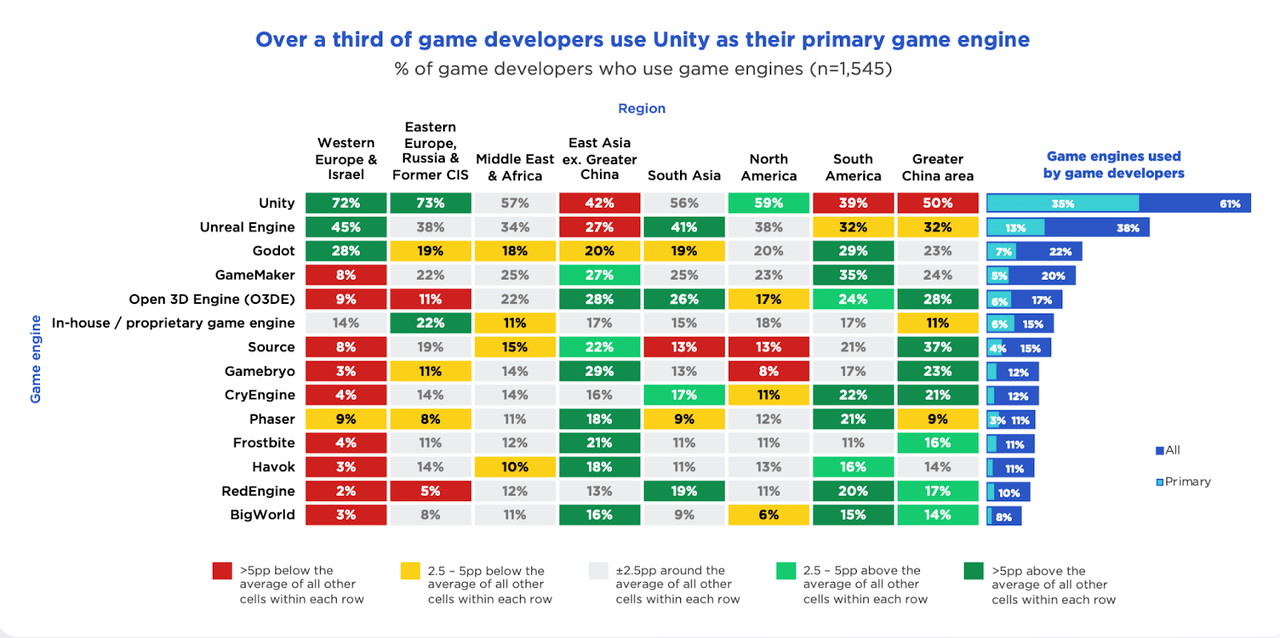

According to the “Landscape of game developers” report [Developer Ecosystem Insights | SlashData] by Developer Ecosystem Insights published in July 2023, Unity was cited as the most used primary game engine at 35% of the 1,545 developers questioned. When taking into consideration the developers’ use of secondary game engines, the percentage skyrockets to 96%, topping the next most popular Unreal Engine at 51%. Overall, it is estimated that around 60% of game developers use game engines to create their games.

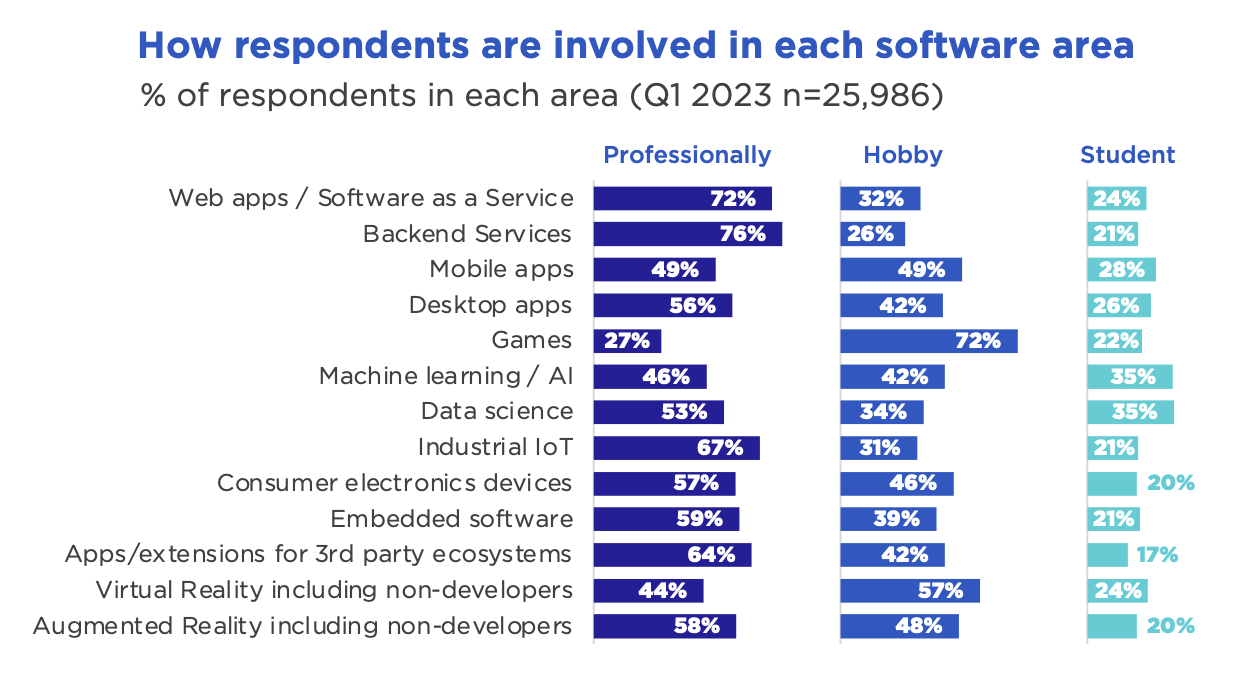

Game development has the lowest percentage of developers who work on games professionally at 27%, while it enjoys the highest percentage of hobbyist developers at 72% of the developer sample population. It is evident that there is a significant interest in the supply side of the gaming industry, particularly for independent and hobbyist developers which is part of Unity’s core user base.

slashdata.co/developer-insights

Game Engine Market Set To Experience Double-Digit Growth

Taking the average of four different estimates, the Game Engine market is expected to grow at an equal-weighted average CAGR of 14.1%. It is worth noting that a significant portion of the growth is attributable to the high expected growth of Extended Reality technology.

Table 1: Game engine market size estimations and future market size projections by various research companies

|

Research Company |

Latest Market Size Estimation |

Market Size Forecast |

Implied CAGR |

|

$3.3 billion (2024) |

$11.6 billion (2032) |

17.1% |

|

|

$2.4 billion (2022) |

$7.74 billion (2031) |

13.9% |

|

|

$2.4 billion (2023) |

$6.5 billion (2032) |

12.3% |

|

|

$3.3 billion (2024) |

$8.76 billion (2032) |

12.9% |

|

|

Average CAGR |

14.1% |

Monetization And Growth Solutions Complement Game Engines

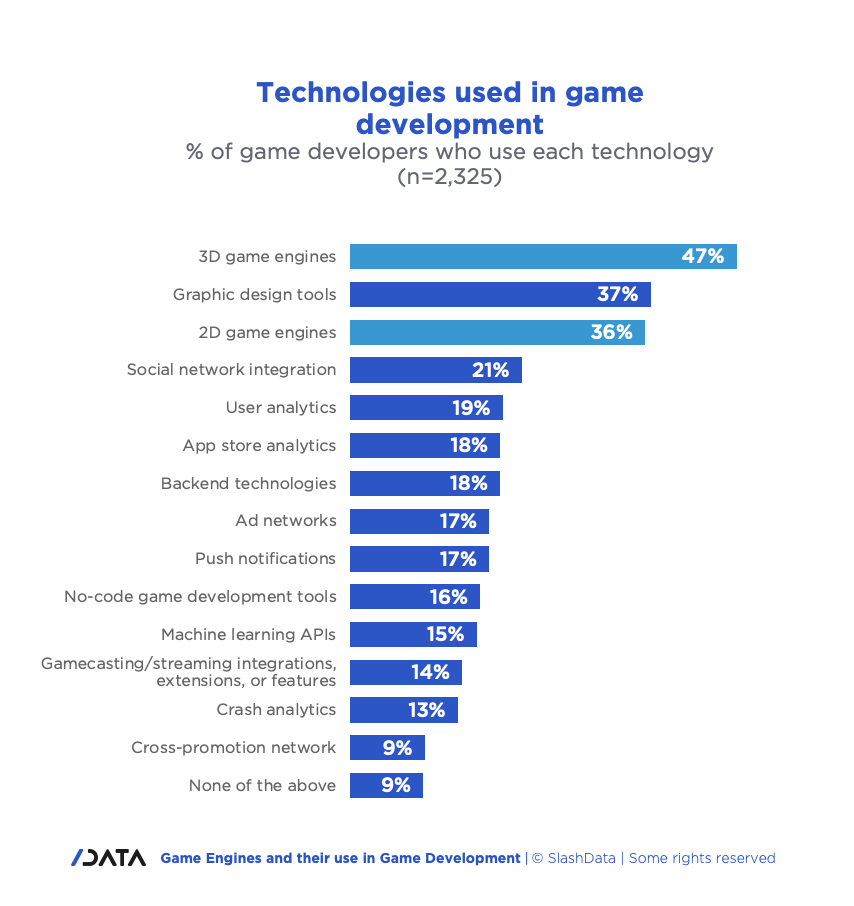

As illustrated by the “Game Engines and their use in Game Development” report, developers utilize a wide variety of tools to create, monetize, and grow their game.

slashdata.co/developer-insights

Traditionally, content creation solutions have been served by game engine companies like Unity Software and Epic Games, while monetization and growth solutions were offered by other companies like AppLovin Corporation (APP) and Google Alphabet Inc.’s (GOOG) (GOOGL) AdMob. With the acquisition of ironSource in 2022, Unity Software has solidified its position in the Grow Business through mobile app and game monetization, user acquisition, and ad networks among other services.

The synergy of Unity’s Create Solutions and Grow Solutions combined with the cross-compatibility with all major platforms make the company strategically positioned to offer a competitive end-to-end service for the full game/app lifecycle. Unity does not limit its Grow Solutions services to Create customers, however, developers who choose to produce their products with Unity’s Create tools and platform may benefit from additional features, support, and data that would otherwise be impossible to have.

Developers not only require a capable platform for content creation, but also various tools to publish, grow, and monetize their product.

What Really Matters For Long-Term Growth With Unity

Unity is currently experiencing the consequences of bad executive decision-making over the last years, notably the abrupt introduction of the runtime fee and the overallocation of resources into unproven industries and applications. This mismanagement was evident in the second half of 2023, marked by stalling Revenue and a declining Dollar-based Net Expansion Rate, along with a management team overhaul and a restructuring of the company’s focus and offerings to contain costs.

On the other hand, Unity no longer needs to prove product-market fit or the value of its solutions, this is already established. It must, however, reorganize and focus on promising applications with a long-term perspective and execute well. With new leadership and a renewed focus on its ‘strategic portfolio’, as indicated by the recent rollback of the controversial runtime fee, the company seems to be on the path of recovery and reigniting growth.

Despite the depressed share price and investor concerns, what really matters with Unity remains strong in my view:

-

A pioneer and leader in real-time 2D and 3D content development platforms and tools.

-

Leverages the work of its users through its multi-platform development support.

-

Provider of core technological infrastructure for building the metaverse through the XR/AR/VR technologies.

-

Biggest developer community in the world with high accessibility and ease of use for entry-level developers.

-

Poised to benefit from emerging ‘Industry’ applications like automotive, architecture, film-making, and AI model training among others.

-

Potential to challenge dominant technology companies in emerging technologies.

-

Solid financial position with 65.5% debt-to-equity, positive FCFF on a TTM basis, and significant progress in restructuring.

Risks

Unity Software Idiosyncratic Risks

-

Declining Dollar-Based Net Expansion Rate: The company has seen its Dollar-Based Net Expansion Rate drop over time, most recently to 96%, indicating challenges in retaining a portion of its customer base, particularly in the Grow Solutions segment (2Q24). Increased competition in the advertising market exacerbates the issue. A continued contraction of the Dollar-based Net Expansion Rate over time will be a significant red flag of Unity’s inability to retain and expand its customer base.

-

Competition and Market Share Loss: Well-funded competitors like Epic Games through Tencent ($TCEHY) and Amazon Web Services through Amazon ($AMZN) could take advantage of their liquidity and CAPEX-heavy technologies such as Cloud and AI to improve their market share at the expense of Unity.

-

Reputation and Brand Impact: Mismanagement, such as the controversial pricing model changes, could further harm Unity’s reputation and adoption among the developer community, leading to lower contract renewals and customer acquisitions.

-

Slow Innovation And Adoption Of AI Solutions: With the pace of innovation in AI, Unity could fall behind and fail to introduce AI-powered features and tools that could lead current and potential customers to prefer competitors.

-

Limited Success In Industries and Extended Reality: Failure to turn some Industry applications (e.g., automotive, AI training, film-making, construction, etc.) and/or XR (extended reality) platforms into substantial revenue growth drivers, the company may fail to achieve significant growth over the coming decade.

-

Shareholder Dilution: If the use of SBC (Stock-Based Compensation) or the need to raise capital through equity increases over the coming years, shareholders might continue to face substantial dilution effects.

Unity Software Systemic Risks

-

Platform Dependencies: Due to its reliance on operating systems and app stores like Apple Inc.’s (AAPL) iOS and Alphabet Inc.’s (GOOG), (GOOGL) Android, Unity could face changes to terms of use that could harm the company in many ways, for example, restrict the gathering and/or use of customer data effectively.

-

Regulatory Restrictions: As a global company, Unity could face regulations from various governments that could restrict its operations and therefore growth opportunities and TAM (Total Addressable Market), for example, the restrictions on gaming by minors in China.

-

Investment Risk Due To Technological Shift: New and growing markets like XR/AR/VR and AI require significant investment and allocation of resources to stay competitive, however, the success and growth of those markets may turn out to be underwhelming for the company.

-

Macroeconomic Uncertainty: high interest rates and potentially tight credit markets affect small companies like Unity the most. Refinancing debt or raising capital under these conditions means that the company will be faced with a significantly increased cost of capital.

Stock Valuation And Characteristics

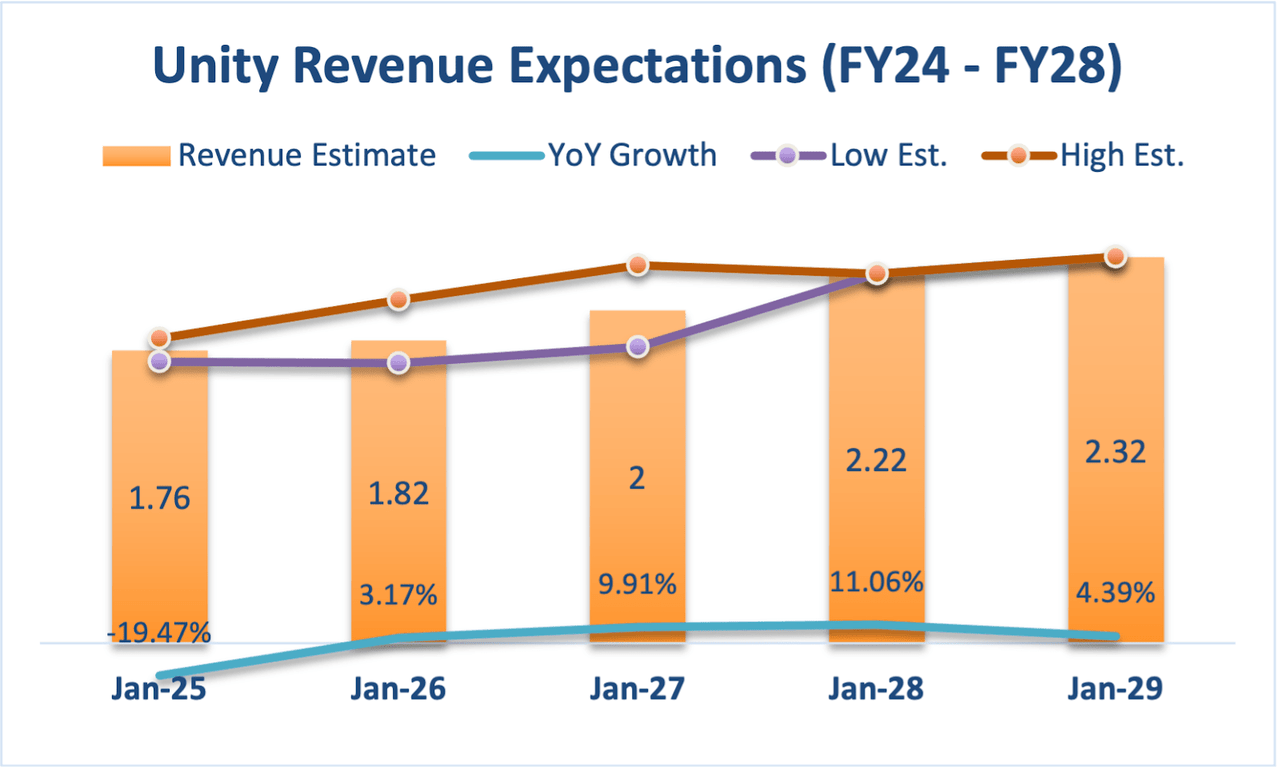

Analysts Project Stagnant Growth For Unity Through FY28

According to the Seeking Alpha ‘Earnings Estimates’ tool, Analysts expect an underwhelming 2.41% CAGR until 2028 to reach a Revenue of $2.32 billion. That means that Unity is expected to exceed the latest FY23 Revenue of $2.19 billion only in FY27, at which point the company is projected to reach $2.22 billion, effectively experiencing no real growth in the next four to five years when taking inflation into account.

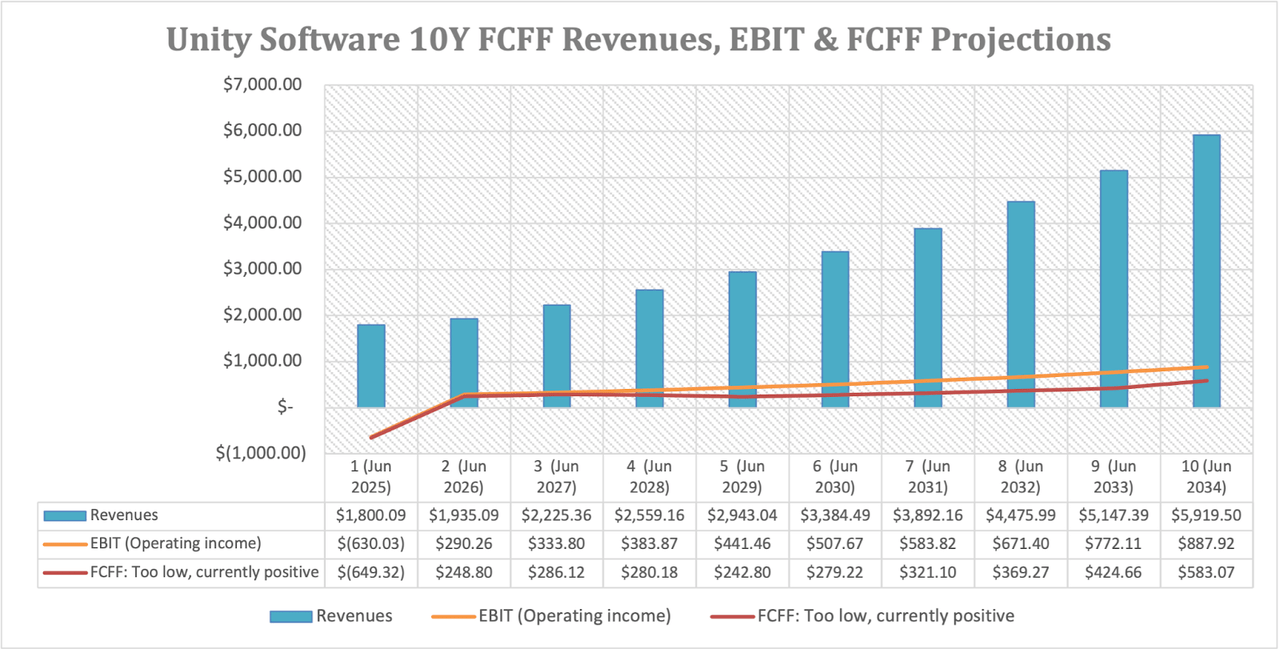

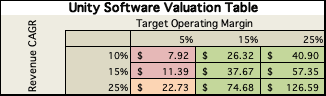

Assumptions And Methodology

The DCF (Discounted Cash Flow) valuation uses an FCFF (Free Cash Flow to the Firm) approach. It assumes a cost of capital at 12% for the 10 years and 8% thereafter. The Operating Margin is varied at 5%, 15%, and 25%, and assumes it will be achieved in 2026 while the 10-year Revenue CAGR is varied at 10%, 15%, and 25%, and assumes it will be achieved linearly by 2027. Also, the US Software Industry averages in Table 2 below, along with the projections for the Game Engine Market discussed previously were used to set realistic expectations of Unity’s growth over the coming decade.

Table 2: US Software Industry Averages

|

Revenue Growth |

15.9% |

|

Pre-tax Operating Margin |

25.3% |

|

Sales to Capital Ratio Return on Invested Capital |

0.92 |

|

Return on Invested Capital |

23.22% |

|

Cost of Capital |

9.49% |

DCF Valuation Results

The following figure visualizes the Revenues, Operating Income, and Free Cash Flow to the Firm over the next ten years, assuming a 15% Revenue CAGR and 15% Operating Margin.

With a current stock price of $20.00, the valuation table below demonstrates an undervalued (green), fairly valued (orange), and overvalued (red) given the assumptions provided.

Author’s Figure

The median case of 15% Revenue CAGR and 15% Target Operating Margin, which I see as the base case for the stock price, values Unity stock at $37.67, at an 88% upside above the current price levels.

Overall, the valuation portfolio demonstrates that if Unity manages to achieve a mere industry average (software) Operating Margin and a Revenue CAGR over the next decade, the stock holds significant upside, given the assumptions made.

Action Recommendation

Given a blend of factors Quant, Valuation, and Future factors, I initiate Unity Software Inc. (U) stock with a ‘BUY’ recommendation.

Table 3: Action recommendation table with Quant, Valuation, and Future factor ratings.

|

Factor |

Description |

Grade |

|

Quant |

Seeking Alpha Quant |

HOLD |

|

Valuation |

Fundamental, Top-down, Multiple, Financial Health |

BUY |

|

Future |

Market Projections, Market Positioning, Economic Sensitivity, Ownership & Management |

BUY |

|

Overall |

BUY |

Investing and portfolio management are nuanced, and action recommendations can vary depending on the investor’s profile and exposures. I encourage readers to consider which factors are most relevant to their situation and adjust accordingly. For example, a young investor with a long-term time horizon might ignore the Quant rating or even see the recent price weakness as a buying opportunity, contrary to an older, more cautious, and income-oriented investor.

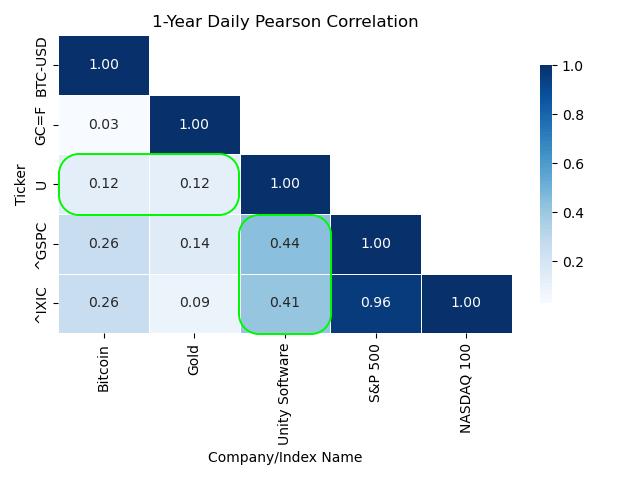

Geographical, market, and factor exposure are also important considerations. In the following section, I provide some correlation figures to aid investors in determining whether Unity stock aligns with their portfolio strategy.

Stock Correlation For Portfolio Diversification

The inclusion of uncorrelated (i.e., zero correlation), high expected return assets to a portfolio has been termed as the ‘holy grail of investing‘ by the successful investor and former hedge fund manager Ray Dalio. The sections below analyse Unity stock from the portfolio management perspective.

Unity Stock Correlation With Major Indices, Bitcoin And Gold

Over the last year, Unity stock appears to be moderately correlated with the major market indices S&P 500 (‘^GSPC’) and NASDAQ 100 (‘^IXIC’) at 0.44 and 0.41 respectively, while the stock exhibited a low correlation with Bitcoin (‘BTC-USD’) and Gold (‘GC=F’) over the last year at 0.12.

With the ideal stock being uncorrelated with major indices like the NASDAQ 100 (i.e., correlation = 0), Unity does not seem to be moving heavily with the market; however, it does not provide significant diversification to a market portfolio. On the other hand, a portfolio dominated by Bitcoin or Gold exposure would benefit more from the addition of Unity Software stock.

Daily Pearson Correlation from Sep 2023 to 2024 of Unity Software stock with the S&P 500, NASDAQ 100, Gold, and Bitcoin (Author’s Figure)

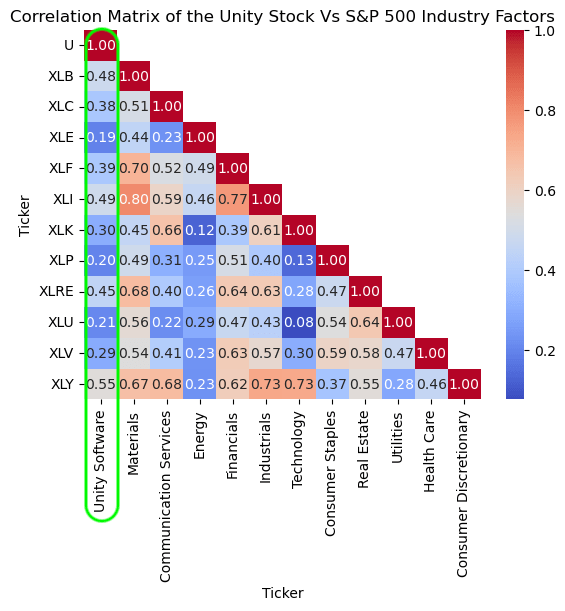

Unity Stock Correlation With S&P 500 Industry Factors

Over the last year, Unity’s stock was most correlated with Consumer Discretionary at 0.55, a factor dominated by companies like Amazon.com, Inc. (AMZN) and Tesla, Inc. (TSLA). The Technology factor, which the company would represent, was much less correlated over the last year at 0.30 which can be explained by the solid performance of tech giants like NVIDIA Corporation (NVDA) while Unity was having a rough year. As the company matures, I would expect a higher correlation with the S&P 500 Technology industry factor (XLK). The least correlated factor was Energy (XLE) at 0.19.

Author’s Figure

Overall, portfolios with a heavy allocation towards the Energy, Utilities, and Consumer Staples factors benefitted the most from the diversification effects of Unity stock, while the Consumer Discretionary, Industrial, Real Estate, and Material factors have benefitted the least.

Conclusion

Unity has experienced significant setbacks recently, evidenced by the near all-time-low valuations and a contracting Dollar-Based Net Expansion Rate. On the other hand, the company has indicated a potential turnaround and capability in addressing the problems, with a significant restructuring and more recently the rollback of controversial runtime fees. The introduction of Unity 6, and a new leadership team focused on execution and partner success, could prove pivotal for Unity stock.

From a top-down perspective, Unity boasts one of the most widely used game engines globally, particularly in the mobile gaming segment, positioning the company to benefit from the growing 2D/3D content creation demand and the anticipated high-growth XR (Extended Reality) industry over the coming decade.

From a valuation perspective, Unity stock appears to have considerable upside if it manages to achieve industry-average revenue growth and operating margins over the coming years. At the same time, high stock-based compensation and share dilution, along with mounting competitive pressures in the advertising and gaming markets, cannot be ignored.

Using a combination of Quant, Future, and Valuation factors, I initiate Unity Software stock with a ‘Buy’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.