Summary:

- Verizon’s stock has outperformed the S&P 500 over the past quarter, with a 38.4% return, driven by strategic moves and a solid financial performance.

- The acquisition of Frontier Communications for $20 billion is expected to enhance Verizon’s competitive position in the fiber broadband market.

- Verizon’s Q2 FY2024 results showed growth in wireless service revenue, EBITDA, and free cash flow, despite increased interest expenses and modest revenue growth.

- The Frontier acquisition is projected to bring cost synergies, revenue growth, and EPS accretion by FY2027, making Verizon an attractive buy.

- I think that by the end of the 2026 financial year, VZ stock should be trading at least 30% higher than it is today, and with a dividend yield of over 6% along the way – what’s not to like?

RiverNorthPhotography

Intro & Thesis

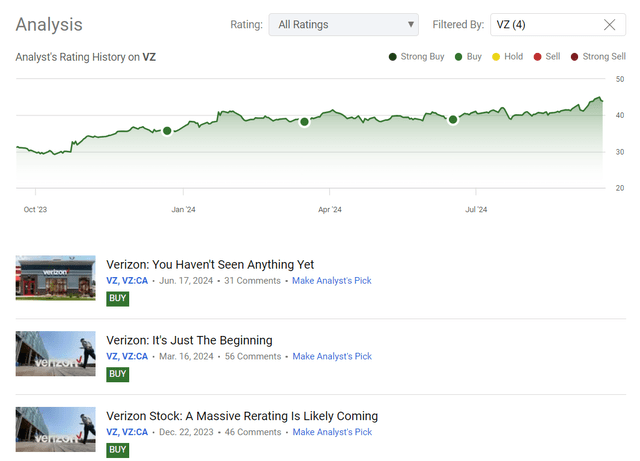

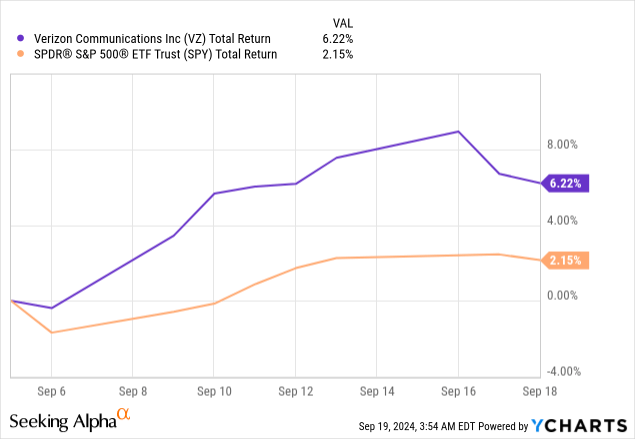

I initiated coverage of Verizon Communications Inc. (NYSE:VZ) stock back in mid-July 2023, more than a year ago. Since then, VZ’s total return has amounted to 38.4% compared to the S&P’s (SP500) (SPX) return of around 24.7%. Throughout the year, I have confirmed my bullish rating three times and so far, it’s been aging well:

Seeking Alpha, my coverage of VZ stock

It’s been 3 months since I last updated my VZ coverage in mid-June 2024, and a lot has changed in that time. For example, on September 5th, 2024, we found out that VZ had decided to acquire Frontier Communications in an all-cash transaction valued at $20 billion (with the assumption of debt). The company also released its Q2 FY2024 results in July and held several conferences with major banks where it outlined its future plans and prospects. From what I’ve seen so far, I’m only more convinced that the rally in VZ stock is likely to continue, driven by new growth initiatives, smart business decisions (in my opinion), and a still relatively reasonable valuation. Therefore, I have decided to reiterate my “Buy” rating today.

Why Do I Think So?

The main thing today is to figure out the consequences of the Frontier acquisition, but I can’t resist at least a brief analysis of the latest financial results.

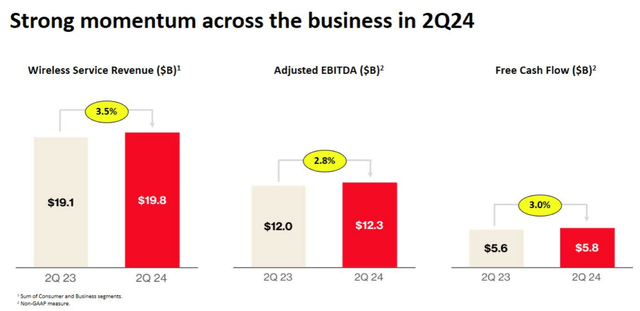

In Q2 FY2024, Verizon reported a 3.5% YoY increase in wireless service revenue, reaching $19.8 billion, and a 2.8% rise in adjusted EBITDA to $12.3 billion; free cash flow also grew by 3% compared to the previous year:

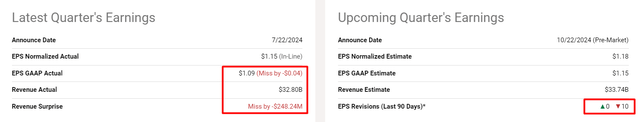

On the other hand, the consolidated revenue for the quarter was $32.8 billion, which is a modest 0.6% increase from the previous year. What I like about this is that consolidated OPEX has decreased by almost 1.6% YoY, which allowed EBIT to increase by 8.3% YoY. Unfortunately, VZ’s interest expenses increased by over 32% YoY in Q2, so we saw a 5% decline in adjusted EPS to $1.15. On an adjusted basis that was exactly what Wall Street expected, but anyway, Verizon missed on both unadjusted EPS and sales, which led to downward revisions for Q3:

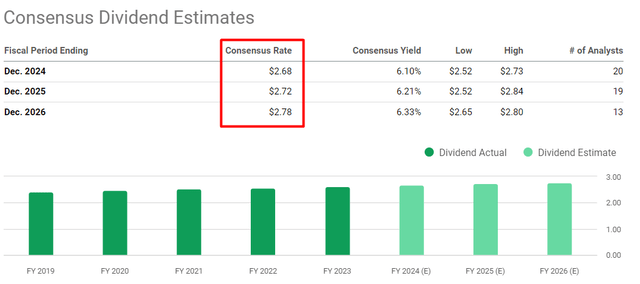

What kind of saves the day is the fact that the company maintained strong cash flow, with $8.5 billion in free cash flow for 1H FY2024, up nearly 7% from the prior year. So the dividend yield seems to be safe – moreover, the analysts see continued growth in payouts for the next few years at least:

Seeking Alpha, VZ, notes added

I generally liked the company’s unit economics for the quarter across the segments. Verizon’s consumer segment saw a 12% increase in postpaid phone gross additions, totaling ~1.8 million, while postpaid phone net losses improved significantly to just 8,000. The business segment added 156,000 postpaid phone net additions, the best performance in 5 quarters.

Speaking about Verizon’s broadband segment, I see that it continued to expand, with 391,000 net additions, driven by strong fixed wireless access growth, which saw 378,000 net adds. As a result, VZ ended the quarter with >11.5 million broadband subscribers, a 17% increase YoY, which looks quite solid.

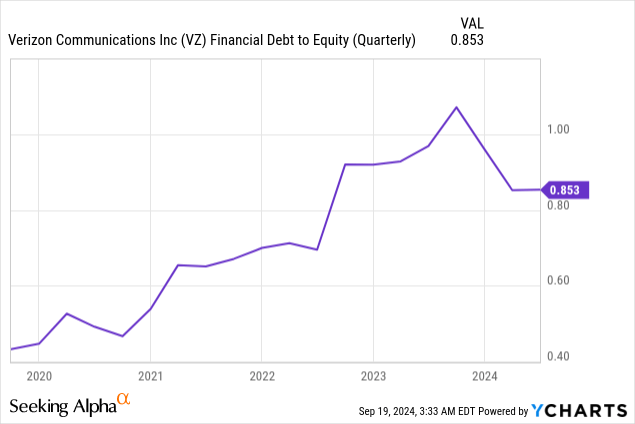

On the balance sheet front, we can see that Verizon reduced its net unsecured debt by $3.2 billion from the previous quarter, improving its debt-to-EBITDA ratio to 2.5x. Debt-to-equity, another leverage metric, stayed below 1, which is generally considered good:

Cash and cash equivalents on the balance sheet amounted to $2.4 billion, which is 17.8% higher than last year. However, it seems we will soon need to examine a completely different balance sheet for the company, as the acquisition of Frontier is “poised to be one of the largest in the industry in recent years” and will definitely demand significant financial resources from Verizon.

So now let’s figure out the potential impact on VZ post-acquisition, and why the market seems to be happy with that corporate move (judging by the stock’s price action since the announcement was made):

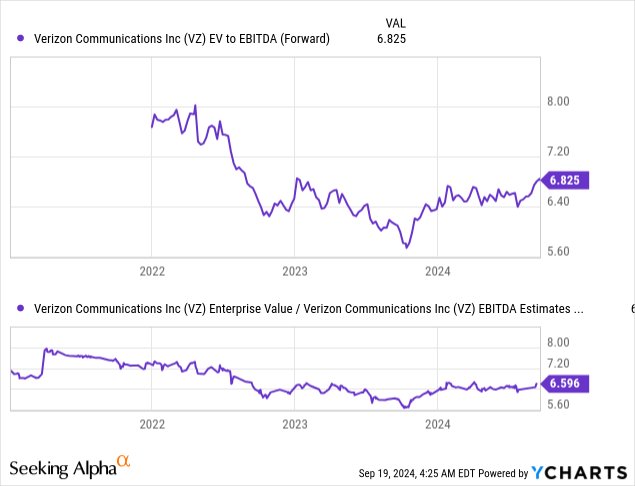

Goldman Sachs analysts (proprietary source) view Verizon’s proposed acquisition as “a strategically correct move, which may potentially enhance Verizon’s competitive position in the fiber broadband market.” The $20 billion all-cash deal represents a 43.6% premium over Frontier’s 90-day VWAP (GS calculation here) and values the company at ~9x its FY2024 EBITDA guidance. That multiple seems quite pricey for me, as Verizon itself trades at only 6.5x FWD EV/EBITDA, according to YCharts data. However, we should keep in mind the benefits: Verizon expects to achieve “$500 million in annualized cost synergies and sees potential for revenue and EBITDA growth” (they want to expand their wireless market share and reduce churn rates among its Home Internet and wireless customers). Also, Frontier will expand Verizon’s fiber broadband customer base to ~10 million, with ~25 million fiber passings across 31 states, aligning it more closely with AT&T’s (T) scale.

From what I see, Goldman Sachs’ pro forma analysis suggests modest EPS accretion by FY2027 (assuming the deal closes by January 2026). They project OPEX synergies of $300-700 million over the next 3 years and anticipate Verizon issuing $9.6 billion in debt, which should increase the leverage by just 0.2-0.3x. That doesn’t look critical for me, given the potential benefits I listed above. While the deal may be slightly dilutive to EPS in FY2026-2029, excluding buybacks, it could actually become accretive by FY2027-2029. If Verizon exceeds its synergy targets, EPS accretion could improve by approximately 2%.

Goldman Sachs [proprietary source, September 2024]![Goldman Sachs [proprietary source, September 2024]](https://static.seekingalpha.com/uploads/2024/9/19/49513514-17267323491136663.png)

Even though the deal will delay reaching management’s long-term debt target, I think Verizon should generate enough cash after dividend payments before closing to minimize the increase in debt leverage.

On September 12, 2024, the firm announced it would incur a non-cash severance charge of $1.7 billion to $1.9 billion in Q3 FY2024 due to “a voluntary separation programme” for up to 4,800 U.S.-based management employees announced in June 2024, followed by up to 8,000 additional non-management employees who will voluntarily leave the company by March 2025, Seeking Alpha reported. Although this will have a significant one-time impact on the financials, I believe that over the next year or two, these measures to reduce operating costs will be beneficial. The voluntary separation programme, as well as the real estate optimization effort, could make Verizon a more effective organization and bolster its performance and competitive position in the end markets as Verizon can use the reduced operating costs to gear up the core operations.

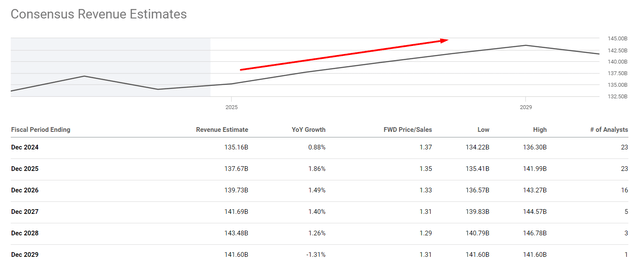

For many investors whose opinions I regularly found in the comments under my and other articles about VZ, the lack of revenue growth and generally stagnant business growth was one of the main reasons they viewed Verizon with caution. I agree with this risk: without growth incentives, it doesn’t seem to make sense to buy shares solely with the goal of getting a stable dividend that grows at about the rate of inflation. But given VZ’s expansion prospects to date, I think revenue growth should return. I’m not talking about 3-5% per year, but even at the level Wall Street is expecting right now (based on consensus data), I think VZ still looks attractive.

Seeking Alpha Premium’s data, VZ, notes added

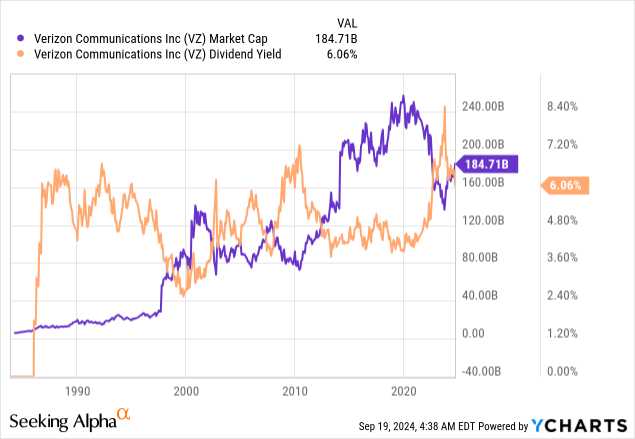

And of course, I can’t help but notice that Verizon’s stock appears undervalued when measured by its key multiples. Investment bankers have a method of valuing companies that they call precedent transactions. The idea is quite simple: we should look at recent mergers and acquisitions and assess the valuation of peer companies based on implied EV/EBITDA and P/E ratios, at which target companies (our analyzed sample) were sold. Verizon is willing to pay about 9x EV/EBITDA for Frontier, while VZ’s multiple, as I wrote above, is only 6.6x according to YCharts. This is although VZ is many times larger and logically should have a premium and not such a large discount.

Let’s assume that Goldman Sachs analysts were close to reality in their calculations where VZ’s pro forma EBITDA will arrive in FY2026 – they forecast over $54.6 billion. The company’s debt on the balance sheet will become higher, so the stock’s current valuation multiples should become slightly lower due to the resulting discount. Let’s say that VZ will trade at 7.2x EV/EBITDA in FY2026, which, I think, will be fair. Then we get an implied enterprise value of $393.5 billion. GS also calculated an approximate value for net debt, which should be $153.1 billion in FY2026:

Goldman Sachs [proprietary source, September 2024]![Goldman Sachs [proprietary source, September 2024]](https://static.seekingalpha.com/uploads/2024/9/19/49513514-17267349685557263.png)

After adjusting our EV for the net debt, we get an implied equity value of $240.4 billion – that’s more than 30% higher than today’s market cap. And it’s important to remember that VZ pays a nice dividend, whose yield should amount to 6.33% in the base case scenario for FY2026 (consensus data).

So I don’t think the Frontier takeover has had a negative impact on Verizon – VZ shares are still undervalued and should be considered a “Buy”, at least in the medium term.

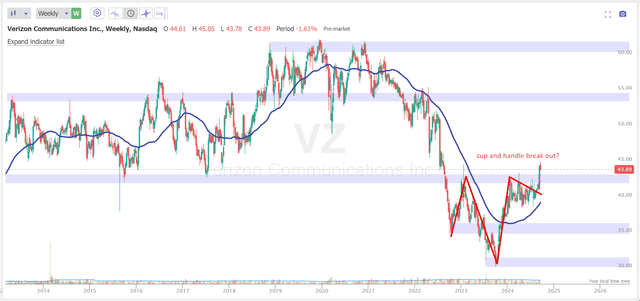

As I can see from the technical analysis on the weekly chart, the recently formed cap-on-handle formation of VZ has been breached to the upside, which could mean upside potential to the next resistance level in the $54-55/share range.

TrendSpider Software, VZ weekly, notes added

Where Can I Be Wrong?

Of course, today’s update to my bullish thesis harbors some risks. First, such a large acquisition looks like a very expensive purchase that delays management’s earlier plans to reduce debt, and that’s not good. The analysts at Argus Research (proprietary source, September 2024) also expressed their concerns regarding the company’s general corporate strategy.

We admit the Frontier acquisition is a bit of a head scratcher given Verizon’s often-stated strategy around its organic network buildout. Also, Verizon is essentially buying back some of the assets it sold to Frontier some years ago though that was a different era.

As I mentioned in my previous article, increased competition in the industry where VZ is trying to reignite growth, combined with changing customer behavior and longer handset retention periods due to rising prices, poses major risks for Verizon.

Also, I think every reader should take into account that my findings regarding the technical analysis and its applications to VZ are quite subjective. Depending on the time frame and indicators we may lay out on the chart, our conclusions may differ significantly.

The Bottom Line

Despite the risks surrounding the firm today, I still believe that Verizon, with a significant share of the U.S. postpaid phone market and a robust network infrastructure, is well-positioned to achieve its growth objectives and create value for shareholders.

I’m positive about the recent Frontier acquisition news and believe that Verizon will be able to accelerate revenue growth while realizing some OPEX synergies, which should theoretically allow management to return to its plan for deleveraging and increasing shareholder returns.

Apart from that, the stock doesn’t yet appear to be overvalued. I think that by the end of the 2026 financial year, VZ stock should be trading at least 30% higher than it is today, and with a dividend yield of over 6% along the way – what’s not to like?

So, given all that, I believe Verizon offers a compelling medium-term investment opportunity. I reiterate my “Buy” rating.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!