Summary:

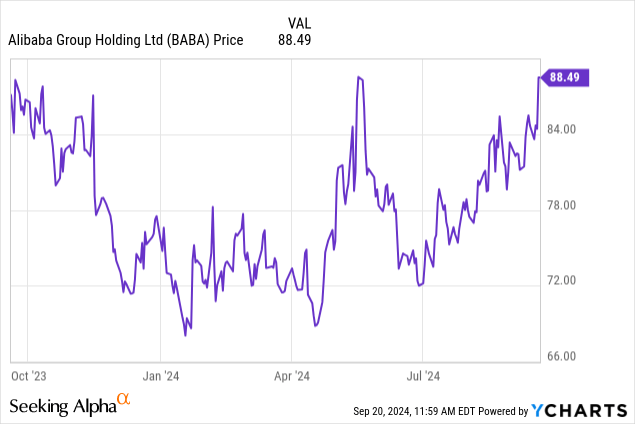

- Alibaba’s stock has gained momentum in recent weeks and currently trading at a 52-week-high.

- The company is launching several artificial intelligence applications through its updated Qwen2.5 large language model as a new growth driver.

- We like the stock for its compelling value within the tech-sector and improving earnings outlook.

Robert Way

Alibaba Group Holding Ltd. (NYSE:BABA) has quickly emerged as one of the market’s biggest turnaround stories, with shares currently trading at a 52-week-high. The e-commerce and cloud-computing giant appears to be turning the corner following a challenging period in recent years, pressured by an intense competitive landscape and soft macroeconomic data out of China.

We last covered BABA with a bullish article earlier this year, noting its otherwise solid fundamentals, including recurring profitability and a compelling valuation. The latest headlines have worked to reaffirm our positive outlook.

Notably, Alibaba is moving forward with an all-in strategy on artificial intelligence (AI) applications. With many U.S. companies effectively locked out of the Chinese market, Alibaba’s opportunity is to consolidate its regional leadership position. We believe the rally in the stock is just getting started.

Alibaba is an AI Leader

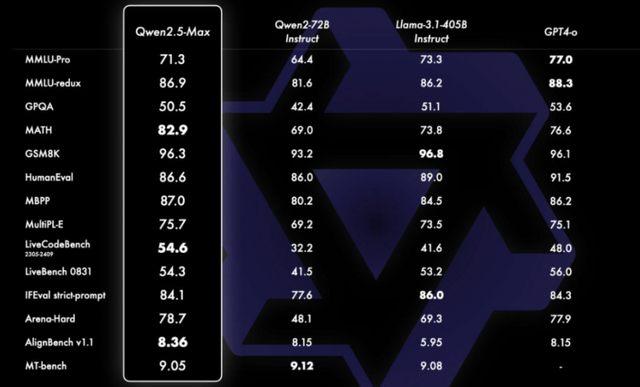

Alibaba recently hosted its annual flagship Apsara Conference announcing several updates to its AI ecosystem including the “Qwen2.5 Max” large language model (LLM), launching more than 100 new features including text-to-video capabilities.

Qwen is Alibaba’s answer to other LLMs like OpenAI’s GPT4 or the Llama3 from Meta Platforms Inc. (META). The company notes that its LLM ranks similar to or even outperforms global benchmarks in areas like language understanding and reasoning, mathematics, and programming based on standardized testing.

source: company IR

Where Alibaba and Gwen stand out is the hybrid development approach, including both proprietary capabilities alongside open-source access. This is in contrast to competitors including China’s Baidu Inc (BIDU) and OpenAI which (ironically) have closed-source API-based access representing restrictions on how developers can build within the ecosystem.

In this case, Alibaba is offering a more cost-effective, publicly accessible platform that could allow it to proliferate, allowing users the flexibility to fine-tune Gwen for specific tasks with innovative applications.

From a commercial standpoint, the company is incorporating AI within e-commerce through various areas to improve the buyer and seller experience, while optimizing its supply chain. Maybe the biggest impact on the business is in the cloud-computing where Alibaba is updating its infrastructure services to manage the next generation of advancements in data center architecture, data management, and model training and reasoning.

The company’s unique combination of native AI technology and a cloud-computing network is a differentiation that marks a competitive advantage for Alibaba as a tailwind for growth. That line of thinking was shared by Alibaba Group chairman Joe Tsai at an investor event earlier this year where he said:

Anybody that uses our AI will need to use cloud computing power… When they use open-sourced AI within our community, they also need computing power. That’s how we can grow our cloud computing revenue.. We’re the only company [in China] that both runs a leading cloud business and is competitive in AI. The combination of AI and cloud is important.

The Bullish Case for Alibaba

The main knock on Alibaba in recent years has been its string of disappointing sales and earnings momentum going back to its pandemic-era boom. The attraction of Alibaba today is that the company may have finally found a new catalyst through AI to support more positive market sentiment and a sustained rally in the stock.

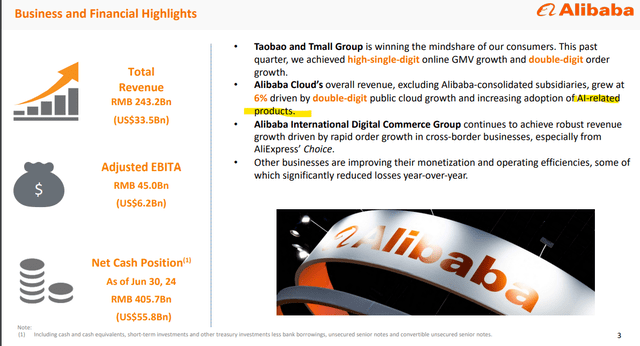

Trends from the last reported earnings covering fiscal 2025 Q1 (for the period ended June 30) highlight some positive signals. Alibaba revenue climbed by 4% year-over-year while the non-GAAP earnings per American Depositary Receipt (EPADR) of $2.26 beat expectations by $0.17.

Within the top-line result, growth from the cloud-intelligence group was stronger at 6% y/y. Management cited “double-digit public cloud growth” and increasing adoption of AI-related products as evidence its strategy was working.

The core e-commerce segment through the Taobao and Tmall Groups remains pressured by an ongoing shift away from direct sales toward a more third-party seller-based model. Still, gross merchandise value (GMV) climbed as the wholesale business delivered a 16% increase, helping maintain an overall sense of stability. Smaller Alibaba segments including international e-commerce and the digital media and entertainment group are seeing more positive results.

source: company IR

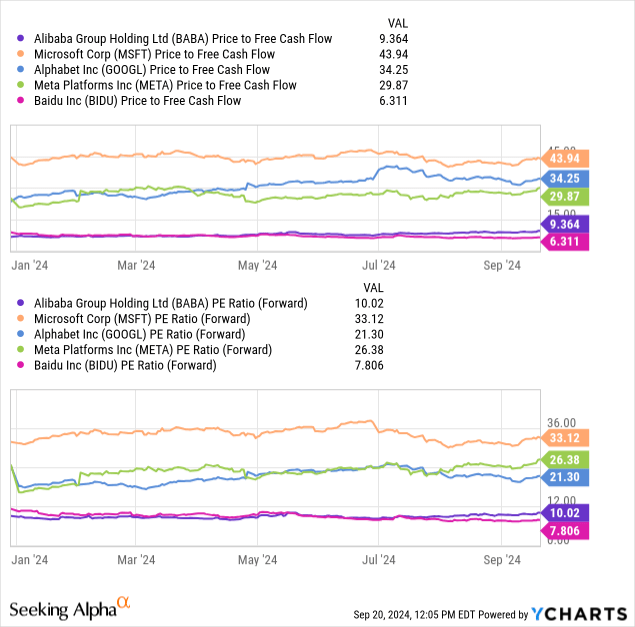

The potential that the AI initiatives represent a new growth driver leading to a ramp-up in profitability should allow shares to capture a higher valuation premium, from what remains a deeply depressed earnings multiple.

Shares of Alibaba are trading at just 9 times its free cash flow and 10 times its consensus full-year earnings per share as a forward P/E multiple. These levels are at a large discount compared to global tech leaders like Microsoft Corp (MSFT), Alphabet Inc. (GOOG) (GOOGL), and Meta Platforms Inc. (META) which trade with an average forward P/E closer to 30x.

In the case of Baidu, Alibaba does trade at a premium to its Chinese comparable, but we believe this spread is justified as Baidu may face a higher level of political risk with national security concerns given its focus on internet search.

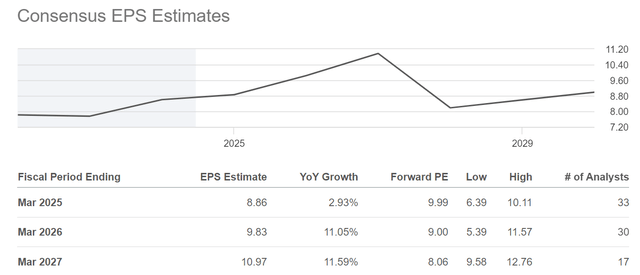

The bullish case for Alibaba is that stronger growth momentum going forward allows its valuation to converge towards that group average. According to consensus estimates, the market sees Alibaba’s EPS trending towards $8.86 this year and accelerating towards $9.83 by fiscal 2026 and $10.97 into fiscal 2027. The ability to outperform these forecasts should be rewarded by the market through a higher stock price.

Acknowledging the company’s poor record in recent years, investors can build some confidence around Alibaba’s rock-solid balance sheet and the improved outlook. Keep in mind that amid Alibaba’s current $206 billion market capitalization, the company maintains nearly $56 billion in net cash. Alibaba also pays a regular annual dividend with an ongoing $26.1 billion share repurchasing program.

Seeking Alpha

The big picture for investors

We rate BABA as a strong buy with a price target for the year ahead at $125, representing a 12.5x multiple on the current consensus fiscal 2025 EPS. This level begins to better value the company based on its long-term potential and the new opportunities within artificial intelligence.

In terms of risks, Chinese stocks are recognized as posing unique uncertainties as investments. Readers should consider the regulatory environment in both the U.S. and China related to artificial intelligence and how it could impact Alibaba’s growth potential. Weaker than expected sales or earnings boost over the next several quarters could also introduce a new layer of volatility into the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BABA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.