Summary:

- Cisco Systems is undervalued, trading at less than 15 times next year’s earnings, and poised to benefit from the AI buildout and economic setup in 2025.

- Despite flat performance over the past 5 years, CSCO’s strong revenue growth, high-margin business, and substantial capital returns to shareholders make it a compelling investment.

- The current economic environment, with lower rates, inflation, and commodity prices, is favorable for CSCO’s IT infrastructure and security products, driving future growth.

- CSCO’s growing subscription business and consistent dividend increases position it as an attractive value stock, especially as the Fed cuts rates and investors seek yield.

PM Images

Cisco Systems (NASDAQ:CSCO) has got to be one of the most frustrating stocks for long-term investors. CSCO is still the poster child for the dotcom bubble, as shares have never gotten back to their all-time highs more than 2 decades later. CSCO finished 1999 with shares around $53, and they continued to climb higher, reaching around $80 in March 2000. CSCO finished the 1999 fiscal year, having generated $12.15 billion in revenue and produced $2.1 billion in net income. CSCO just wrapped up its fiscal year, and 25 years later, they have increased their annualized revenue by $41.65 billion (342.68%) to $53.80 billion and its net income by $8.22 billion (392.37%) as they generated $10.32 billion in profitability in their 2024 fiscal year.

CSCO hasn’t been rewarded for the continued growth in its business, returning an immense amount of capital to shareholders, or transcending being a pure-play hardware company to a 360-degree IT infrastructure leader. Shares of CSCO are basically flat over the past 5-years, having only appreciated by 4.57%, but I think that’s about to change. We have a great economic setup for business heading into 2025, and as the AI buildout continues, CSCO’s products and services will be in demand more. I think that CSCO is tremendously undervalued, trading at less than 15 times next year’s earnings, and there is an opportunity for shares to appreciate while continuing to grow the dividend going forward.

Following up on my previous article about CSCO

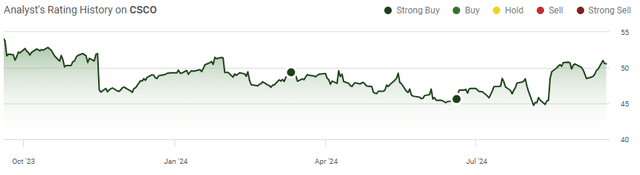

When shares of CSCO retraced over the spring, I became very bullish as the valuation got even cheaper. My previous article was written on June 19th, and I upgraded my investment thesis as shares fell below $46. Since then, shares of CSCO have increased by 12.05% while the S&P 500 has gained 3.88%. When CSCO’s dividend is taken into consideration, the total return since June 19th has been 13.01%. I had discussed why I thought the market was wrong and why I felt CSCO deserved a larger multiple. Now that we have more economic data and the Fed has started its rate-cutting cycle, I am extremely bullish on CSCO as we will need more IT infrastructure hardware and services to support future growth. I still think shares of CSCO are very undervalued, and I am adding to my position while shares have a dividend yield that exceeds 3%.

Risks to investing in CSCO

The biggest risk to CSCO at this point, in my opinion, is the perception the market and investors have on it. CSCO isn’t a stock that people have gotten excited about, and it missed out on the two largest technology catalysts prior to the AI boom. CSCO couldn’t capitalize on cloud or SaaS even though they operate in both areas. They were late to the party and didn’t do a good job of explaining to the investment community how they were operating in these sectors. CSCO is still predominantly known as a hardware company and the company that has never recovered from the Dotcom bubble. Investors have to be ready for CSCO to trade sideways or even decline and potentially never trade at a favorable multiple. There is also increased competition from many vendors, including Arista Networks (ANET) and Fortinet (FTNT). While I think shares of CSCO will rally and benefit from the current economic setup in 2025, I could be incorrect, and shareholders may experience a repeat of the last 5-years when the market ripped higher, and CSCO did basically nothing.

Why I believe that CSCO will benefit from a great business setup heading into 2025

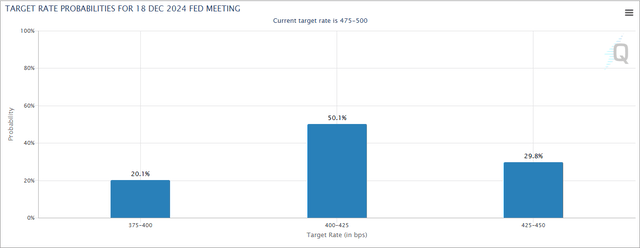

I don’t think you could ask for a better setup than we have today for CSCO. After increasing rates from 25 bps in February 2022 to 550 bps in July 2023, the Fed finally started its rate-cutting process after holding rates at 550 bps for more than a year. This week, Fed Chair Powell announced that the Fed had decided on a 50 bps reduction in rates. CME Group is predicting that the most likely scenario for 2024 is that the Fed reduces rates by another 75 bps, and there is a 20.1% chance that we get another 2 rate cuts of 50 bps each, which would take rates to 400 bps to close out 2024. In addition to the start of a rate-cutting environment, inflation has fallen for the 5th consecutive month and is at the lowest point since February 2021. We’re also seeing oil hovering around $70 per barrel, which is well below the $94.99 52-week highs.

The combination of lower rates, inflation, and commodity prices is a positive trifecta for business. When rates decline, businesses carrying floating-rate debt typically recognize lower debt servicing costs, improving margins. Companies are also able to refinance debt to more favorable levels, which can also improve their margins. This can free up capital to allocate toward expansion. The lending markets also become looser, and businesses are more likely to engage in borrowing as capital costs decline. The United States has experienced 8 consecutive quarters of economic growth, and this setup is likely to accelerate GDP domestically and internationally.

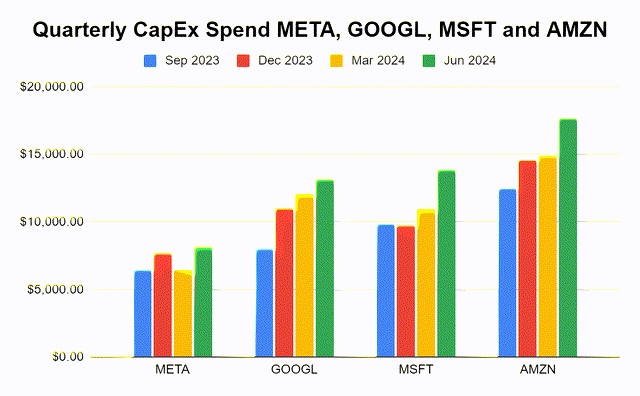

This setup is great for CSCO for many reasons. Unless you work in an IT department, many individuals don’t necessarily understand what it takes to not only build out a corporate IT infrastructure but also to secure it. The combination of Meta Platforms (META), Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN) have spent $177.14 billion on CapEx in the trailing twelve months (TTM). The quarterly CapEx spend has increased by 42.87% over the past 3 quarters from $36.99 billion to $52.85 billion in Q2 2024. As corporations expand, so do their corporate infrastructure needs. By now, everyone is familiar with how aggressively the largest companies are spending on GPUs from NVIDIA Corporation (NVDA), and as data centers expand, so does the need for networking hardware and security. Whether it’s a data center or more office space, companies must add more firewalls, switches, wireless access points, and security solutions. When you think about email, for instance, many people just log in to their M365 account or Outlook client, but so much goes on in the backend. The emails that end up in your inbox have likely been scanned by products such as the Cisco Secure Email Threat Defense platform, and when you’re going to websites, the web traffic is likely going through Cisco Umbrella as an additional layer of security.

Steven Fiorillo, Seeking Alpha

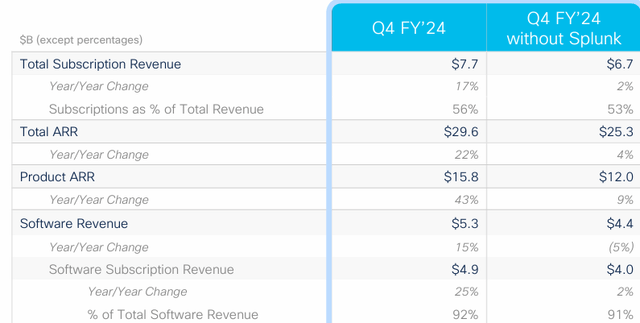

Business expansion by headcount of infrastructure likely means more networking hardware and services that are required. In 2024, CSCO generated $53.80 billion in revenue, which was comprised of $39.25 billion in hardware sales and $14.55 billion in their array of services. In Q4 2024, only 49.88% of CSCO’s revenue was tied to hardware, as CSCO has built a large recurring revenue business through security, collaboration, and software applications for business enterprises. CSCO already has $1 billion in AI orders to date and expects an additional $1 billion in AI product orders throughout the 2025 fiscal year. CSCO’s revenue was truly diversified in Q4 as 56% came from subscriptions, and in total, CSCO’s annualized recurring revenue increased 22% to $29.6 billion in the 2024 fiscal year.

My main thesis here is that when a client becomes a CSCO customer, they don’t just stop at the hardware. The hardware becomes the gateway into the CSCO ecosystem, and customers are spending more on subscriptions across security and software platforms than they are on actual hardware. As more infrastructure is built and global GDP expands, CSCO should be in a prime position to see sequential YoY growth at its top and bottom lines. CSCO is operating a high-margin business with gross profit margins of 64.73%, operating margins of 25%, and net income margins of 19.18%.

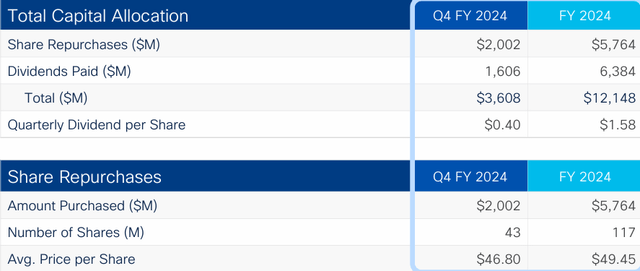

CSCO continues to return tremendous amounts of capital to shareholders and is still undervalued

CSCO has been a shareholder-friendly company over the years and continues to reward shareholders through dividends and buybacks. In Q4, CSCO returned just over $3.6 billion in buybacks and dividends to shareholders. During the 2024 fiscal year, CSCO paid $6.38 billion in dividends while buying back $5.76 billion worth of shares at an average price of $49.45. Over the past decade, CSCO has repurchased more than 1 billion shares and decreased the number of shares outstanding by 1.07 billion. Every share repurchased means less capital gets allocated toward dividend payments as there are fewer shares to pay a dividend on, and the earnings are dividends among fewer shares. This is bullish for future EPS and dividend growth.

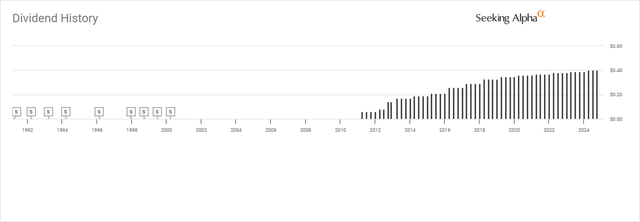

CSCO is paying an annual dividend of $1.60, which is a yield of 3.11%. CSCO has increased the dividend for the past 12 years on a consecutive basis and has a 5-year growth rate of 3.04%. There is more than $6 trillion in money market accounts, and the recent report from the Investment Company Institute shows that the total amount of capital in money markets decreased by $20.02 billion to $6.30 trillion. The 10-year T-bill is sitting at a 3.71% yield, and it’s signaling that the Fed is still offside and will continue reducing rates. I believe that CSCO will be a magnet for capital as it has a yield exceeding 3% with a dividend that has grown for over a decade. Investors are likely to reposition themselves into equities to generate yield rather than hang out in risk-free assets, and CSCO is one of the larger yielding tech companies in the market.

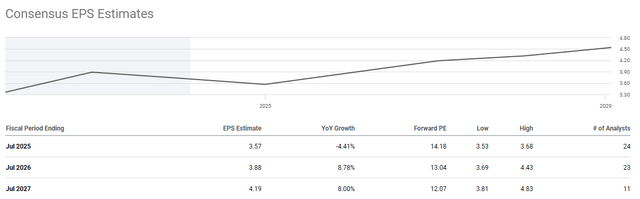

CSCO just started its 2025 fiscal year and is expected to generate $3.57 in EPS, which puts their forward P/E for 2025 at 14.18. Over the next 2 fiscal years, their EPS is expected to increase to $4.19, which puts their forward 2027 P/E at 12.07 times. CSCO doesn’t report on a calendar basis, and its fiscal year ends at the end of Q2 for calendar-based companies. I believe that CSCO trading under 15 times 2025 earnings and under 13 times 2027 earnings is a mispricing in the market of CSCO shares. Investors are likely to look for companies that are trading at value levels that pay a dividend. CSCO checks off both of the boxes, and I think that we will see a rally as capital returns to the market.

Conclusion

To many, CSCO is a forgotten stock whose best days are behind them, but the reality is that CSCO has grown into a company that is generating over $50 billion in annual revenue. CSCO’s subscription business now exceeds the amount of annualized revenue the hardware segment generates, and in an environment where infrastructure spending is still ramping up, enterprises will likely be allocating more capital toward IT infrastructure buildouts. I am very bullish on CSCO because as more data centers come online and businesses expand, more networking hardware will be needed, and as more hardware is deployed, companies will need to spend more on security and software to run their businesses.

CSCO has figured out a way to keep the revenue flowing after the hardware is purchased through its subscription models, and we’re entering a friendly business environment, which should increase the demand for their products and services. I think that investors will look for value companies as the market reaches all-time highs, in addition to companies that pay dividends as the Fed cuts rates. CSCO looks very undervalued, has growth on the horizon, and is growing its dividend. I think the market is wrong on CSCO, and I am adding to my position at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, META, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.