Summary:

- Meta Platforms is breaking out due to improved engagement and revenue from AI investments, with a fair market value target of $575.

- Meta’s AI initiatives are increasing user engagement and ad profitability, while maintaining strong free cash flow despite high capital expenditures.

- Meta’s core social media business continues to grow, with rising ad prices and user engagement driving revenue, supported by cost-cutting measures.

- Risks include lower revenue from Reels, political scrutiny, and potential ad revenue decline from Chinese companies, but the overall outlook remains positive with a 12-month price target of $625-$650.

Kira-Yan

Meta Platforms, Inc. (NASDAQ:META) is breaking out and likely to continue to perform well in the coming months on the strength of improved engagement and revenue due to its investments in artificial intelligence. I believe the fair market value of shares should be between $575 and $625, and this price range is likely to increase if the company can beat expectations when it reports quarterly earnings next month. Further, shares just broke out of a range and above a price level that acted as resistance over the last six months, which should also support a further move higher in price.

For the second quarter of 2024, Meta reported positive quarterly earnings where it beat estimates on the back of continued growth. Despite this, and partially due to reporting just prior to the market weakness at the start of August, Meta shares sustained a significant decline along with the broader market. Meta’s sizable capital expenditures in 2023 and early 2024 now appear to be reasonably well conceived investments in both existing product lines and new frontiers.

Moreover, Meta now seems to be one of few companies in the market that has a clear and definite return on invested capital relating to artificial intelligence. Meta’s unified video recommendation and ranking system that was implemented this summer is already increasing engagement and providing a product that will be more capable of supporting profitable advertisements. Further, Meta AI has become one of the most popular Artificial Intelligence-based assistants, with the potential to secure the top spot in usage within the next few quarters. At the same time, Meta’s existing social media products continue to perform well, with growth in daily active people and a proven capacity to deliver targeted advertisements that have allowed Meta to increase ad pricing.

Meta is not yet receiving substantial attention for its AI endeavors, even though the company appears increasingly likely to become one of the more important platforms for actual usage by both the platform and its user-base. While Meta is already using its AI to improve its products and user engagement, it is simultaneously building the capacity to service its multi-billion user base with AI for their own uses. Moreover, Meta’s development model will not require those users to acquire any new hardware, while many competitor platforms will require upgrading of PCs or smartphones to next-generation models. In contrast, Meta AI is simply another platform among the many it already offers users, and from which it can secure screen time when it will be able to push targeted ads.

While the development of AI capacity is incredibly costly, Meta remains one of a select few entities capable of servicing these costs from its already existing and sizable operating cash flow. Meta reported that it spent approximately $8.2 billion last quarter on property and equipment, where AI development was a significant portion and key driver of costs. Nonetheless, Meta generated approximately $19.4 billion in operating cash flow, and free cash flow of about $11.2 billion. Therefore, Meta is capable of remaining profitable while developing its AI infrastructure, which should subsequently increase revenue and profitability.

Meta’s current spending levels appear likely to lessen over time, though perhaps not immediately, as its capacity is developed. Further, it is possible that competition and supply expansion will lessen AI component costs in the coming years. While this is no certainty, even at existing rates of capital expense, Meta remains a highly profitable company with strong free cash flow. Further, Meta’s competency at eventually monetizing products is now hard to question, as is its willingness to listen to objections from the financial marketplace regarding when it is time to lessen spending, and instead promote revenue and earnings growth.

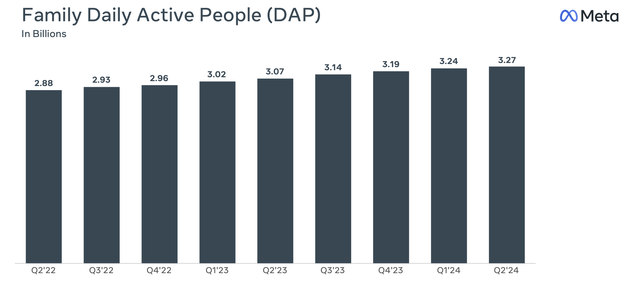

Meta’s core social media business also continues to perform above expectations. Meta reported 3.27 billion daily active people last quarter, with growth in each of the quarters for the last several years.

Meta’s daily active users (META Q2 2024 earnings presentation)

Meta’s capacity to continue to grow its user base is certainly maturing, and it is reasonably unlikely to maintain its prior trajectory. Nonetheless, Meta’s capacity to continue to grow is impressive. Further, despite various attempts to ban, delete, and otherwise boycott Meta’s services, the company has remained a relevant and seemingly important destination for billions of users.

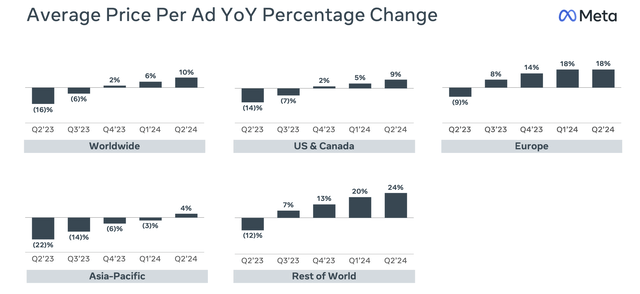

Beyond growing daily users, Meta’s true strength has been its ability to increase its advertising revenue. Meta’s strength there has recently been based upon its capacity to raise pricing to its advertiser base. This ability is true for every geography in which Meta does business. Meta’s ability to raise pricing is due to the success ad campaigns have on its platforms, and that success is premised on the company’s competency at targeting advertisements to prospective customers.

META price per ad YoY change (META’s Q2 2024 earnings presentation)

Advertisers continue to find Meta’s platforms as among the better performing choices for deploying marketing dollars, and there is little reason to presume that this will change in the near term. This is especially true for small and mid-sized companies that require targeted ad campaigns that benefit from Meta’s ability to push ads to highly specific locations or demographics. Of course, Meta also has the ability to reach large and disbursed groups for larger ad campaigns.

Meta now appears capable of raising the price it charges for ads, as well as increasing the number of ads it feeds to its billions of daily users. Meta has also shown the ability to cut costs as it develops its systems. Year over year, Meta’s sales and marketing expenses were $400 million less than in the same quarter last year, even as its systems and revenue grew. Similarly, general and administrative costs were down by about half a billion dollars last quarter compared to the same quarter one year earlier.

Beyond growing profitability, Meta also recently added a stock dividend. While the payout is low compared to many developed and value equities, this provides yet another reason to consider the investment. Given the company’s willingness to invest in all forms of its development, as well as its strong profitability and free cash flow, it appears likely that the company will only increase its dividend over time. While it is probably unreasonable to expect any increase to its dividend this year, an annual increase does appear somewhat possible. Similarly, Meta is likely to increase its allocation to stock buybacks in the coming quarters.

Meta appears likely to maintain sales growth of 12-15 percent in the second half of 2024 and throughout 2025. While the company’s revenue may not sustain double-digit increases in 2026 and beyond, such an outcome is not certain or obvious at this time. If Meta can continue to grow at such a rate and simultaneously maintain its profit margin in the high 30 percent range where it has recently been, it is likely that Meta’s free cash flow will grow to over $50 billion next year.

Meta’s capacity to increase sales will be based both on its ability to increase pricing, and its ability to deploy ads in new products, and the combination of these factors could yield substantially higher revenue than anticipated. Similarly, Meta’s increased usage and integration of AI to increase user engagement by recommending posts and videos is likely to be a powerful driver in pushing advertising budgets to Meta’s platforms. Success on all fronts could result in higher than expected margins and sales growth.

Meta’s valuation is also fairly reasonable from a price to earnings perspective. Based on current expectations for the full 2024 year, Meta is trading at a P/E of about 25-26x. At this level, Meta is already one of the lower priced mega cap tech stocks, with Apple and Microsoft sporting P/E multiples in the 30s, and NVIDIA and Amazon both sporting a P/E sitting slightly above 40. Google does have a lower P/E, at about 23, but does not appear to have Meta’s potential to grow revenue at the same rate, and its margins are lower. Meta appears likely to grow revenue by over 10% in 2025 and maintain its operating margin in the 35-40% range, while Google’s margin is in the low 30s.

Meta also just broke out from a trading range where it was stuck for the last six months. Meta made it to the mid $500s in April, only to fall to the low $400s. Meta subsequently returned to the mid $500s in July and August, but continued to bounce off prior resistance. Now, though, Meta finally broke through that resistance level, and it is possible that it will continue to appreciate from here.

Meta daily candlestick chart (Finviz.com)

It is also possible that Meta will now find that this prior level of resistance will now act as support in the case of a market downturn. If this is the case, Meta may find strong support at about $540, which is just a few percent below current levels.

Risks

While there are many reasons to consider Meta as an investment, the company is not without its fair share of risks. For example, Meta is increasingly focusing on Reels, which generates a lower rate of revenue than its more mature Stories and News Feed features. It is possible that a continuation of this trend will reduce Meta’s profitability, but it is also reasonably likely that the company will slowly ramp up its monetization of Reels.

Another risk is increased government scrutiny, where both the company actions and database of information are often targeted and politicized. It is reasonable to presume that Meta will continue to receive increasing levels of political scrutiny, and that this will occasionally affect its valuation. Thus far, any such politicization has provided buying opportunities. Moreover, while it appears unlikely that Meta will be broken up by a U.S. monopoly case, it is also not certain that such an outcome would result in a reduction to the value of Meta’s assets.

Another risk that Meta faces is that of Chinese weakness. Chinese companies are among the larger purchasers of advertising on Meta’s platforms. For example, advertisements from companies such as Shein and Temu are common. As a result, Meta could suffer a decline in ad revenue if such companies were to reduce their advertising. Similarly, Meta is attempting to derive revenue from platforms it offers within China, and weakness there, as well as domestic competition, could reduce Meta’s capacity to grow revenue.

Conclusion

Meta continues to outperform expectations and just broke out of a six-month trading range. I believe that shares are likely to continue to appreciate along with the market, as well as due to what is likely to be a positive earnings report next month. I expect Meta to have earnings per share of approximately $25 in 2026, and that a forward price to earnings multiple of 25 is reasonable for its growth and margins, which results in a price target of $625. Meta also presently trades at a P/E of about 26, which would result in a 2026 target of $650. Further, if Meta delivers a strong Q3 earnings report and/or adds to its share repurchasing plan, Meta’s EPS and price estimate should increase.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.