Summary:

- Morgan Stanley’s fee-based revenue structure and AI integration position them to thrive in a lower interest rate environment, making shares a strong buy.

- Lower interest rates are expected to boost deal-making activity, benefiting Morgan Stanley’s wealth management and investment banking divisions.

- Despite a higher forward P/E ratio, Morgan Stanley’s PEG ratio suggests market skepticism, which, I believe, is misplaced given their growth potential.

- Regulatory relief on capital requirements and AI-driven efficiency gains further enhance Morgan Stanley’s outlook, presenting a compelling investment opportunity.

Nikada

Investment Thesis

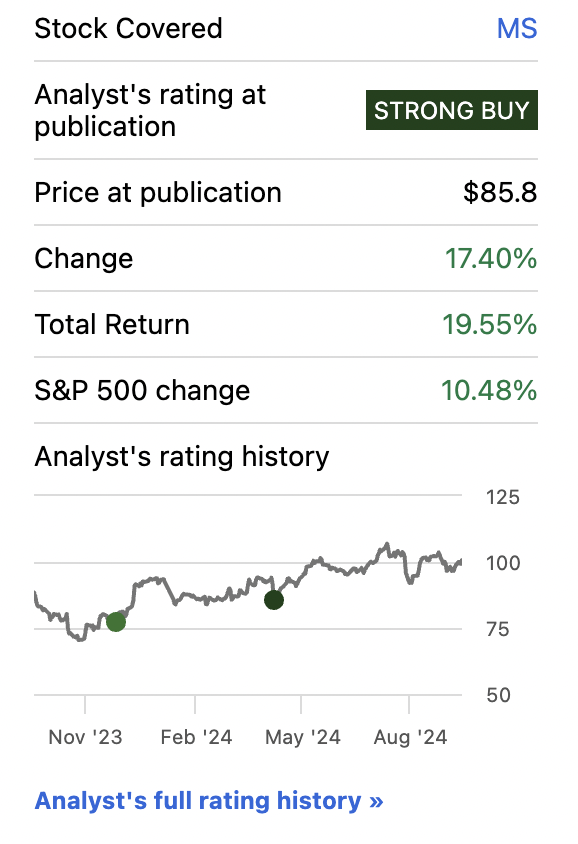

Morgan Stanley’s (NYSE:MS) recent performance has been strong, with shares outperforming the broader market and increasing almost 20% (including dividends) since I last wrote on them in the spring.

Morgan Stanley Stock Performance (Seeking Alpha)

What’s driven this growth? The market expectations that fee revenue will do well, post interest rate cut.

With Morgan Stanley’s revenue structure based heavily on fees rather than interest income (like other banks), this looks to be a huge advantage for the firm as interest rates head lower after the Fed meeting Wednesday.

Fee-based businesses tend to be more stable and less dependent on fluctuating interest rates compared to traditional banking models, which rely heavily on interest margins from loans.

As the Federal Reserve moves forward with an interest rate cut by half a point, Morgan Stanley is set to benefit as the US bank can capitalize on stable revenue streams tied to asset management and advisory services. The firm is also benefitting, thanks to their large-scale deployment of generative AI tools, as AI adoption in the financial sector reaches scale. Shares have moved up a bit, but I think there is more room to run.

With the expectation (and now reality) of lower interest rates on the horizon and the strong pace of their AI developments, Morgan Stanley is set to do well in this environment. With this, I think shares are a strong buy.

Why I’m Doing Follow-up Coverage

Morgan Stanley’s stock has surged roughly 20% since my last write-up in April, originally due to their strength and ability to thrive in a “higher-for-longer” interest rate environment. Now, with the Federal Reserve now shifting towards a cycle of interest rate cuts, the bank also seems well-suited to capitalize on this new environment.

The reason I am doing this follow-up coverage is because I think now that we are seeing rates actually move lower, the combination of lower interest rates and higher asset values will power deal making activity. Morgan Stanley’s wealth management business and the banking franchise are both setup well to benefit. The bank is uniquely positioned and has all the right pieces. Now they’re going to put it together. I believe shareholders will benefit.

Strong Tailwinds

While the decision was expected, the Federal Reserve’s recent move to lower interest rates by 50 basis points is a major shift in their monetary policy to promote maximum employment now that inflation has stabilized. The central bank’s move follows a period of sustained higher rates that helped curb inflation but also placed pressure on borrowing costs for consumers and businesses. This hurt Morgan Stanley’s fee divisions.

With inflation nearing the Fed’s 2% target, the rate cut signals confidence in their inflation outlook. The reduced borrowing costs are likely to spur a resurgence in mergers and acquisitions, which would positively impact investment banking margins.

With rate cuts helping the bank drive up business, their core divisions are now also more efficient.

During the 2024 Barclays Global Financial Services Conference, Morgan Stanley highlighted the increasing benefits from their integration of key AI technology. As Co-President, Dan Simkowitz, stated:

We are trying to leverage technology wherever possible, both on the client side as well as on the productivity side. So you’ve read a lot about the wealth management platform and the use of automation and next best action and now AI at the platform, but we’re also investing in the technology to continue to be a leader in electronic trading, but at the firm level, the use of technology to create not just productivity or client value, but to make the place safer and more durable for growth in the context of what I talked about earlier is really important -Barclays Conference.

With this, wealth management should benefit from the tailwind of lower interest rates and also from much higher efficiency levels.

Behind this, the bank’s deep integration of AI into their workflows has been an ongoing effort that is helping streamline operations and cut costs. The bank’s use of AI tools to assist financial advisors, such as the AI @ Morgan Stanley Assistant, is magnifying the efficiency of financial advisors by automating key research, note-taking, and client communications, and helping them save up to 15 hours a week. This technology also has the potential to drive better decision-making through deep analytics and data-driven insights.

While the firm’s wealth management net revenues grew modestly by just 2% to $6.8 billion in Q2, the division will excel as interest rates move lower, and asset prices move higher.

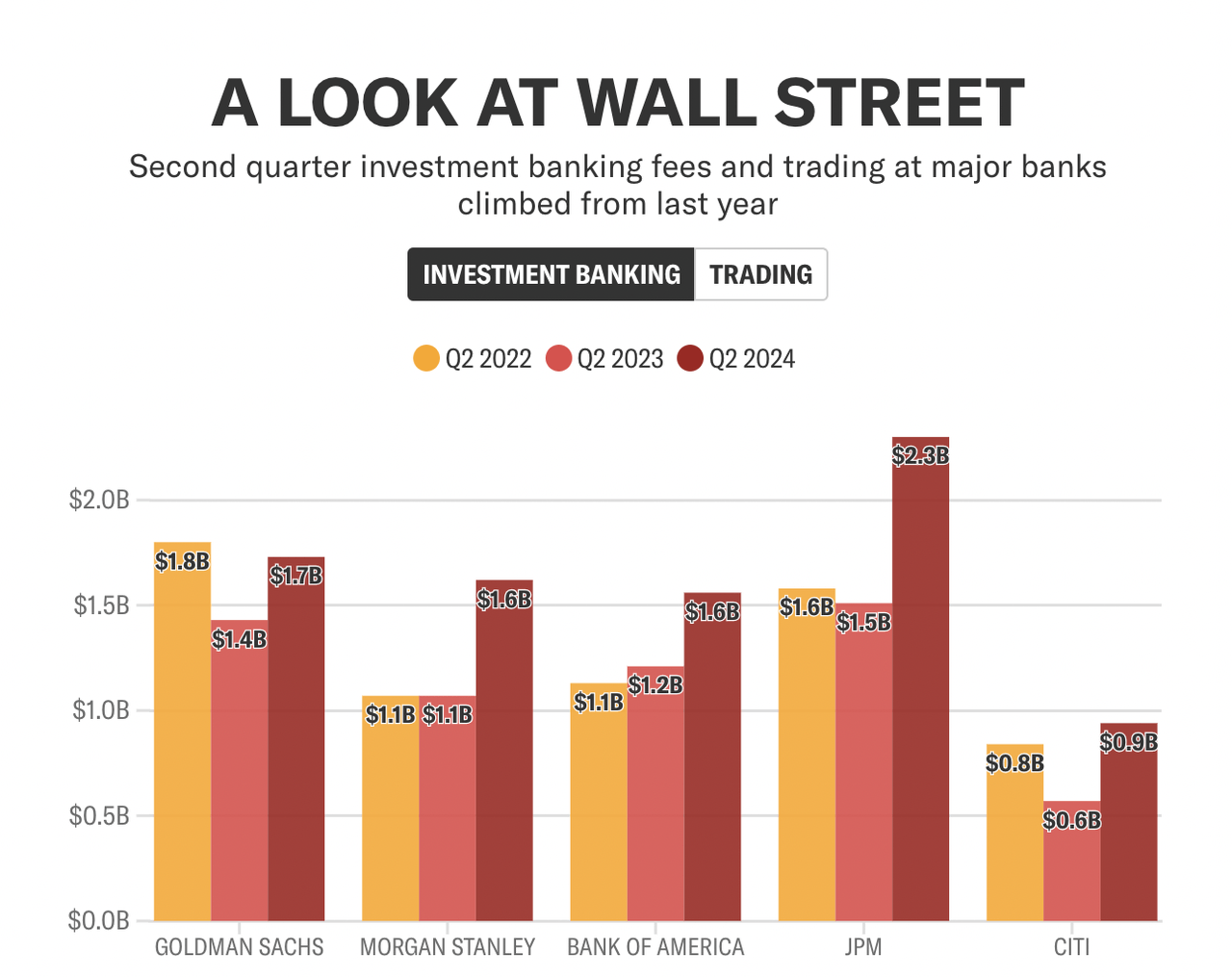

On the investment banking side, fees are already notably strong, rising by 51% year-over-year in Q2 through an improving deal-making environment, supported by their anticipation of lower interest rates.

Wall Street Q2 Fees (Yahoo Finance)

Co-President Simkowitz added:

I think the largest IPO in the last year or two has been a deal we did in July for lineage and logistics, almost $5 billion IPO. And the book was great. The aftermarket has been strong. And what’s great for us is we had raised capital for them well before going public.

Bringing it all together, Morgan Stanley is showing investors how a better investment banking market leads to a better wealth management market:

Amset is an investor and the leadership are big wealth management clients. So we brought the whole firm together. And that data point, I think, is encouraging a higher level of dialogue around IPO filings.

Valuation

Morgan Stanley is really starting to fire on all cylinders. Their business model is made for markets like this, in my opinion.

Yet while their forward P/E ratio is 14.23, or 18.82% higher than the sector median of 11.98, I actually think this is conservative given where the bank is heading. They are literally saving each of their financial advisors 10-15 hours a week after just a year’s worth of effort in terms of automation. That’s incredible, and I bet the cost savings here are just getting started.

What’s more interesting to me is that their PEG ratio of 1.17 sits below the sector median of 1.25 by approximately -6.94%. Here, I think the market is implying that it’s slightly discounting the probability of expected earnings growth materializing over the next 12 months.

I think this market skepticism is really misplaced. Given the Federal Reserve’s recent interest rate cuts, Morgan Stanley’s earnings growth is actually set to accelerate. Lower rates create a more favorable environment for their IPO and M&A divisions, which are already seeing a resurgence in activity as private equity firms and startups secure financing at more reasonable valuations. With their impressive performance in investment banking and their strong pipeline of IPOs, I feel confident they’re well set up to see fees accelerate.

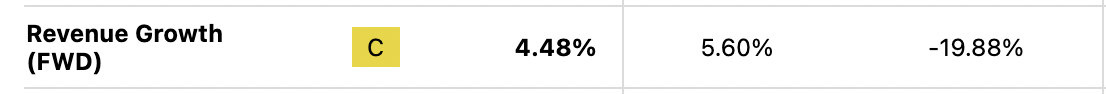

Keep in mind as well that their revenue growth over the next 12 months is really expected to be fairly muted, coming in at just 4.48% compared to the sector median of 5.60%. This is a 19.88% difference. This feels conservative. The bank’s fee revenue will likely outpace the broader financial sector, in my opinion, as other loan-driven banks contend with lower net interest income margins. I struggle to see how this means Morgan Stanley will grow slower than the median loan-deposit institution.

Forward Revenue Growth Estimate (Seeking Alpha)

If we see their PEG ratio converge on the sector median, this would represent a conservative upside of 6.83% (not including dividends), driven simply by the company performing in-line with earnings over the next 12 months (which I think they will beat).

Risks

At the end of the day, Morgan Stanley is still a bank, with deposits and loans on their balance sheet. It’s this part of the bank that I think harbors most of the risk. Over the last 12 months, US banks have faced an overhang from proposed capital requirement rules by the Federal Reserve that could put a crimp on their investment plans.

These regulations originally aimed to substantially increase capital buffers, potentially raising capital requirements by up to 19% for the largest banks.

Really, these measures threatened to slow innovation, dampen share buyback programs, and force banks to hold more capital instead of investing in growth.

Last week, big banks got a big break.

Regulators, including members of the Federal Reserve, scaled back these capital rules. The revised plan now only includes a 9% capital hike, a significant reduction from the original proposal of 19%.

Bottom Line

Morgan Stanley shares have been strong since the spring, driven by strong fee-based revenues and a lean operating model, both of which benefited from a deal making market that is starting to thaw, and a market that now can contend with lower interest rates.

Lower interest rates are expected to accelerate key fee growth, particularly in their wealth management and investment banking divisions. The firm’s disciplined approach to innovation, specifically with AI investments, puts them on a track to benefit exponentially from the upside of an uptick in fee revenue. With IPO and M&A activity likely to pick up in a lower-rate environment, I think the bank’s shares present a strong buy opportunity, as the market appears to undervalue their growth potential.

I expect the bank’s performance to even further improve from here as interest rates continue to drop as the Fed’s most recent cut gets priced in, and likely future cuts take place.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.