Summary:

- Palantir’s recent AI-driven contract wins and commercial growth have boosted its stock, yet its valuation appears severely overextended despite optimistic revenue and margin forecasts.

- Insider selling by key figures like Peter Thiel and Alex Karp raises concerns about potential overvaluation and insider knowledge influencing stock price.

- Our updated valuation model, even with optimistic assumptions, suggests a mere 5.01% IRR, making Palantir less attractive compared to broader market returns.

- Given Palantir’s high P/S and EV/EBITDA ratios and the potential macroeconomic risks, we believe it is certainly justified to reduce positions similar to insiders.

J Studios

Palantir Technologies Inc. (NYSE:PLTR), a big data company and provider of software for both commercial companies and government agencies, has recently made waves in the AI industry by expanding its highly sought after AIP product offerings.

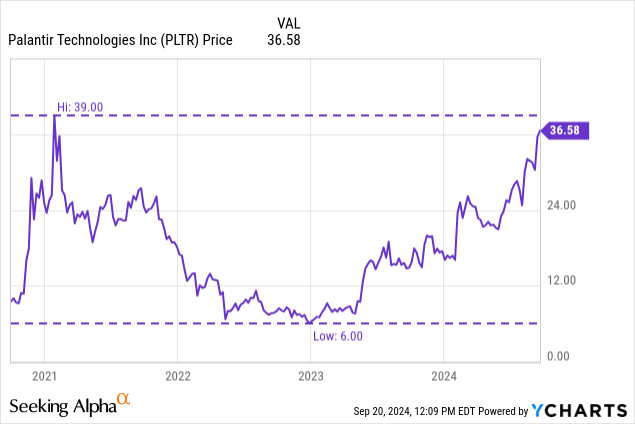

With AI software in high demand, everything seems to be running smoothly for Palantir, after the company won several contracts in recent weeks. Just today, Palantir announced that it had received a $99.8M contract from the DEVCOM Army Research Laboratory, which follows yesterday’s news that it had also received a $100M contract from the U.S. Army. Palantir shares also clearly reflect this momentum, with the stock heading for new highs relative to 2022 and 2023, and getting close to the all-time highs it reached in 2021.

But despite all these positive developments, we believe Palantir to be remarkably overvalued. Although we previously wrote about how Palantir’s AI prospects were likely not priced into the 2022 valuation, when the stock was trading at just $9.76, we re-evaluated the company using an updated valuation model and came to a different conclusion. We found that, even using highly optimistic estimates as a result of AI tailwinds, it is likely that most of Palantir’s future upside potential has already been priced into the stock at current prices.

Commercial Is On The Rise

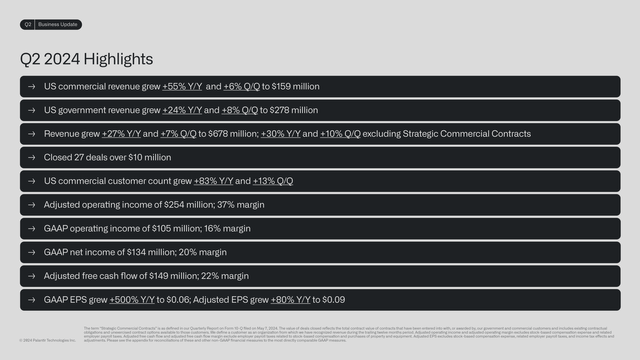

With AIPCon 5 just having concluded last week, highlighting all the in-depth use-cases for Palantir’s AI product suite, it’s perhaps important to look at the fundamentals underpinning this rally, especially in the commercial sector. With 6% quarter-over-quarter ((QoQ)) revenue growth, Palantir reached $159M in commercial revenue, and year-over-year growth ((YoY)) reached a staggering 55%.

This tremendous growth in commercial, we believe, was to be expected and should continue given the nature of disruptive technologies. In general, we often see innovation first being deployed by governments before being widely adopted by the public, similar to how the rollout of the Internet was preceded by the Department of Defense’s DARPA program. It is also at this latter stage where the greatest opportunities to make money usually lie. The fact that Palantir has only just begun this drastic shift from government to commercial revenue means, in our view, that the company is still in the early stages of its growth.

Perhaps the most notable highlight to emerge from the Q2 earnings report is the fact that the number of commercial customers grew by 83% YoY and 13% QoQ, raising expectations for continued further revenue growth, while revenue per customer increases as new use cases develop.

Palantir’s GAAP Operating Income came in at $105.34M for the second quarter, or $421.36M year-on-year, while operating margins continued to grow significantly from 12.8% to 15.5%. Free cash flow margins also remained steady at 20.8%, although we should add that this excludes the significant amount of non-cash share-based compensation, which was $141.76M in the second quarter compared to free cash flow of $141.31M.

With all of the above fundamentals aside, we should note from a qualitative perspective that we highly appreciate Palantir’s current positioning in the AI landscape. In a sense, Palantir is one of the very few companies that see immediate profitable results implementing AI, compared to companies that spend massively on AI Compute CapEx, only with the hope that future demand for AI Computing power remains robust and keeps growing at a relentless pace.

In previous articles, we have pointed out some of the trends we see happening in the AI landscape, particularly a possible shift from AI hardware spending to a broader focus on AI deployment and end-user applications. Palantir is also positioned in this regard to avoid a possible “infrastructure overbuild” of AI hardware, or could even benefit from excess hardware capacity, as computing costs would likely fall in such a scenario.

A Possible Signal From Insiders

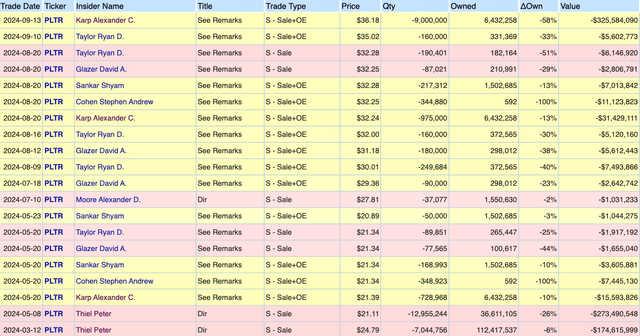

There have also been some significant insider trading developments regarding the stock, with both Peter Thiel and Alex Karp selling a significant number of shares or indicating they will do so in the future. According to recent failings, CEO Alex Karp has sold 9M shares after exercising options, accounting for a staggering $325.58M worth of Palantir shares. Peter Thiel, one of Palantir’s other founders, recently filed a notice to sell up to 28.6 million shares, which at current prices represents a value of more than $1 billion. This came after Peter Thiel had already sold more than $448M worth of shares earlier this year, according to Form 4 filings with the SEC.

Earlier this week, according to news on Seeking Alpha, Morgan Stanley would also sell 10 million shares of Palantir in a block sale for an unknown holder, offered at a discount of up to 2.5%. Given that these insiders, more specifically the founders, have been with the company since day one and have in-depth knowledge of almost every aspect of the business, it does raise some questions among investors as to whether we may be in overvalued territory.

Valuation Model Signals Overvaluation

To figure out where the long-term fair value for Palantir might lie, we developed a discounted cash flow analysis with a very optimistic valuation scenario. To give investors a small clue, before we dive into the details, we expect Palantir to still be overpriced even in a very optimistic scenario taking into account AI tailwinds.

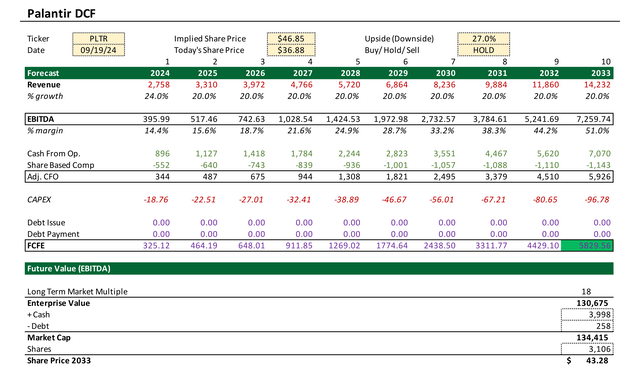

We started our valuation with assigning Palantir’s revenue at a 20% CAGR from 2025 onwards, which should grow revenues from an estimated $2.76BN this year to over $14.23BN by the end of 2033. This should be in-line with research we’ve evaluated, one report which is forecasting the AI market size to grow at an approx. 19.1% CAGR over the next 10 years. On top of which, we also forecasted EBITDA margins to expand all the way to 51%. For context, one of the most well-run software companies in the world, Microsoft (MSFT), for the last 12 months reported 52.80% EBITDA margins. At EBITDA margins of 51%, Palantir would be far above industry average, which is believed to be around 30%.

At this point, Palantir could be generating up to $7.26BN in EBITDA, which at a 18x EV/EBITDA multiple comes out to an Enterprise Value (EV) of $130.68BN. After accounting for Palantir’s cash position and deducting total debt, we’re at a $134.42BN market cap. Having modeled for future dilution/ share-based compensation at 3.11BN shares outstanding by 2033, we believe Palantir’s share price could be trading north of $43.28 by the end of the period.

We also valued Palantir on a free cash flow basis, where we modeled what adjusted cash flow from operations (CFO) could look like. Here, we believe Palantir could generate nearly $7.07 billion in CFO at nearly 50% margins. As for stock-based compensation, we see this metric gradually evolving but still sitting at 8% of revenue over the long term, which is in line with other Big Tech software players like Google (GOOG) and Meta (META). We even think this is optimistic, as stock compensation today still represents over 20% of revenue on a trailing 12-month basis.

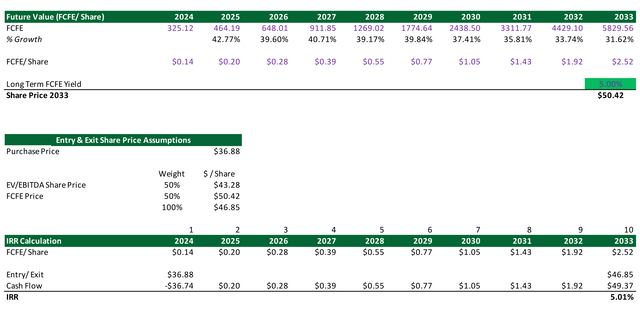

Finally, after accounting for CapEx, which should remain low at less than 1% of revenue, we arrive at Free Cash Flow to Equity (FCFE) of $5.83BN by the end of the period or $2.52 FCFE/Share. This time around, we apply an even more optimistic multiple, at 20x FCFE or a 5% yield, which gives us a $50.42 price target. When we put this into an IRR calculator, accounting for all the cash flow generation, it gives us an underwhelming 5.01% IRR when buying at $36.88 and selling at a blended average of both price targets of $46.85.

Given a 10-year treasury bond currently yields 3.72%, we believe Palantir to be far too overvalued at a 5.01% IRR, especially given the risks to the downside in case of Palantir missing any of the estimates in the very optimistic case we’ve laid out.

Virtually the only way we see Palantir being undervalued if it were to shock investors and deliver in excess of 20% compounded revenue growth over the next 10 years, or exceed the 51% EBITDA margins we’ve forecasted. And while some of the market research we’ve evaluated argues that growth in the generative AI software market could see growth at up to a 58% CAGR between now and 2028, these do just remain forecasts and in our view rely almost completely or too heavily on speculation.

How Extreme Is Too Extreme?

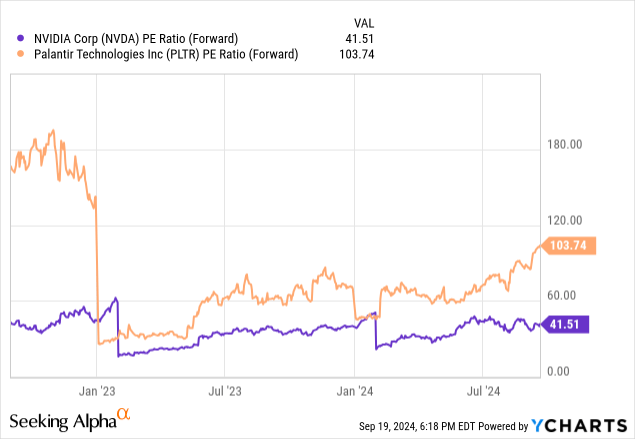

It makes us wonder how extreme valuations can actually get in the case of Palantir, as we’re not seeing the upside even with a 20%+ CAGR and great margins. In a way, it reminds us of when some investors initially labeled Nvidia as overvalued for a while, for example, given the multiply it was trading at on a trailing 12-month basis. In that case, we actually made that call correctly by taking the other side of the argument, but only because we knew that the valuation based on forward earnings and its growth rate made sense.

With Palantir, however, we aren’t in the same scenario where the stock is like Nvidia, trading at 30-35x forward earnings with triple digit revenue growth, which made it justifiable. For reference, Palantir is currently trading at over 100x forward earnings, with YoY revenue growth on a TTM basis somewhere around 20%. According to EPS estimates provided by Seeking Alpha, Palantir may even be trading as high as at a 19.15x 2033 Forward P/E ratio.

On the other hand, the argument could be made that it’s very hard to gauge where Palantir will ultimately be ending up in 10 years’ time. While our forecasted revenue of $14BN may be optimistic, it’s important to point out that other software providers like Microsoft still dwarf Palantir, currently doing $245BN+ of revenue annually. In other words, Palantir still has a lot of room left for exponential grow to challenge competitors.

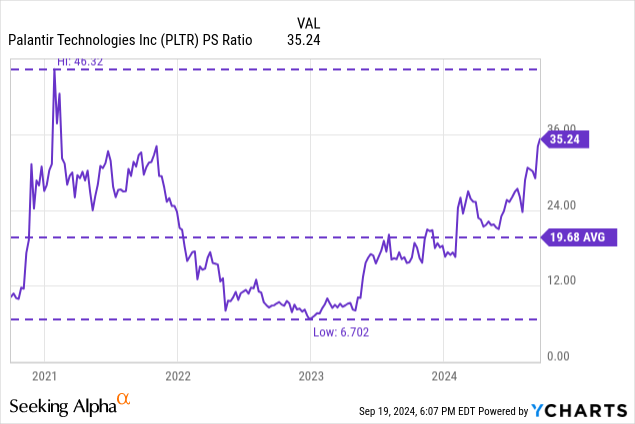

From a historical valuation basis, Palantir is as expensive as it has ever been, only being more expensive in 2021 for a brief moment, during the GameStop short squeeze and amidst the “everything bubble” peaking. Because Palantir was one of the shorted stocks that got targeted at the time, it experienced brief volatility, exceeding a P/S ratio of 46x. Palantir likewise has been trading far above its average 19.68x P/S ratio over the last couple of years.

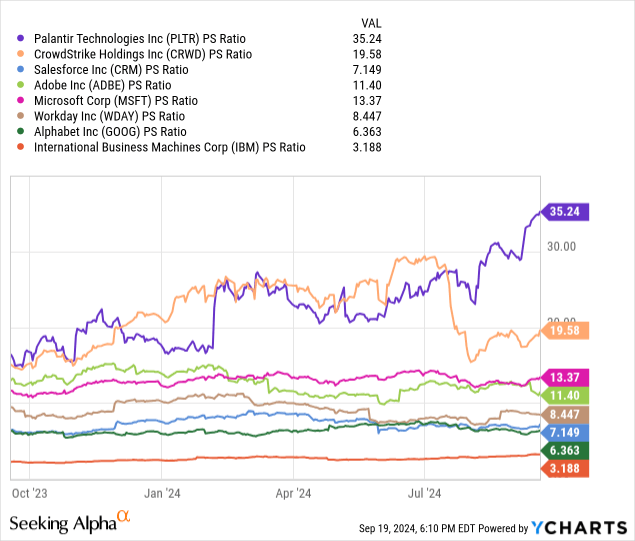

And while a price to sales ratio isn’t indicative of profitability, we still see it as a good yardstick to measure against other companies operating in the same industry, given margins are usually similar. In this regard, Palantir too sticks out like a sore thumb, with the only software company that we could find being close being CrowdStrike (CRWD) at a 19.58x P/S ratio. Plus, you can also see Palantir’s noticeable divergence from the rest of the software industry over the last few months. Even on an EV/EBITDA basis, Palantir sticks out to virtually all competitors at a TTTM EV/EBITDA on a GAAP basis of 190.83x.

Given we’ve spoken about what we believe an optimistic case could look like in terms of valuation, we’ll also quickly address what would happen if the opposite plays out. In terms of valuation, the average P/S ratio for the application software industry is 10.39x, which is a long shot away from Palantir’s current 35.24x ratio. If Palantir’s growth prospects were to falter, and the valuation gets compressed to the sector median, we would be looking at a mere $25.76BN market cap, or a staggering 68.76% drop from current levels.

And while this may seem like an extreme scenario, we would like to remind investors that Palantir bottomed in late 2022 to early 2023, which isn’t that long ago, at a $12.5BN valuation. Even looking at the downside scenario from a gross profit perspective, at a very optimistic 18x gross profits, Palantir should only be trading at a $40.4BN market cap, which is still a very steep drop from the current $82.46BN market cap Palantir is valued at. This 18x multiple does not even factor in any operating expenses and taxes that Palantir would have to pay.

The Bottom Line

Our updated valuation model, which we believe uses very optimistic estimates, suggests that the IRR that investors receive is likely to be in the neighborhood of 5.01%, which is much lower than the usual return that investors would get when investing in broad-based indices. These returns would even be only slightly higher than the current 10-year U.S. Treasury yield, which is widely deemed risk-free and stands at 3.74%.

As the predicted AI windfalls for Palantir begin to materialize and the stock has awoken from its 2022-2023 slump, we think it is time for investors to wind down their positions, just as insiders have done. Right now, we don’t see many ways Palantir, even with AI windfalls, could offset its ridiculous valuation of 35.24x P/S and 190.83x EV/EBITDA. Palantir’s valuation currently stands out compared to virtually all competitors and is close to the most expensive valuation ever on a historical basis when looking at the P/S ratio throughout history.

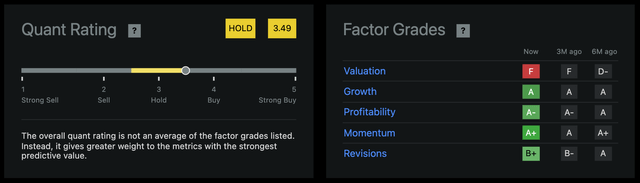

Palantir could also face unforeseen risks not related to the company, but rather to macroeconomic data, as the Sahm Rule has come into effect signaling a high rise in unemployment, as well as the yield curve recently turning positive after being inverted for more than 2 years for the first time since 2007. Unlike Seeking Alpha’s Quant Rating, which Palantir has at a “Hold,” we maintain a “Sell” rating on Palantir, giving much more weight to the “Valuation” factor which currently places Palantir at an “F.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.