Summary:

- TSMC’s first European fab in Germany, co-owned with Bosch, Infineon, and NXP, will focus on automotive and industrial chips, with production starting in 2027.

- Partnerships with Samsung and SK Hynix aim to leverage TSMC’s expertise, enhancing faster processing speeds.

- Silicon photonics, which could be critical to AI and data centers, is a key focus, with the SiPHIA alliance setting industry standards for future growth.

- TSMC’s strategic investments and collaborations underscore its commitment to innovation and leadership in the semiconductor market.

Robert Way/iStock Editorial via Getty Images

The TSMC Investment Thesis

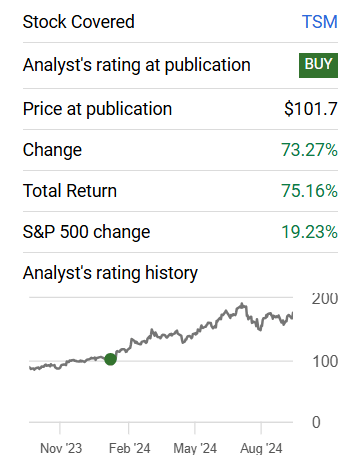

Seeking Alpha Rating History

The valuation history shown in the chart above is probably a good reflection of the sentiment that AI companies have had this year. Because when I wrote my first article on Taiwan Semiconductor Manufacturing Company Limited (OTC:TSMWF) (NYSE:TSM) in January 2024, called TSMC is probably the most important company in the world right now, I thought that AI would continue to be a very big topic. And that has proven to be true.

My thesis at the time was that despite all the subsidies, Intel could not match TSMC’s expertise, and Samsung also had less capacity and knowledge. In my opinion, both statements are still true, although Samsung is something of an alternative for 4nm and 5nm chips, but is still far behind in the advanced foundry market.

I mean, it looks like Intel is going to outsource some of its orders to TSMC. That alone should be a good indicator of how much of a competitive advantage TSMC has in terms of capacity and know-how.

And even after the rapid rise in the share price, I continue to believe that the stock is undervalued given TSMC’s future prospects and quality.

Construction Begins On TSMC’s First European Fab In Saxony, Germany

In late August, ground was broken for Europe’s first semiconductor factory, which will operate under the name European Semiconductor Manufacturing Company. And TSMC will own 70% of the company and Bosch, Infineon (OTCQX:IFNNY) and NXP Semiconductor (NXPI) will own 10% each.

Half of the planned $10 billion cost will be covered by the German government / EU, and the focus will be on chips for the automotive and industrial sectors. Production is currently scheduled to begin in 2027.

Unfortunately, one of Europe’s and the world’s largest car manufacturers, Volkswagen (OTCPK:VWAGY), announced today that 30,000 jobs could be at risk. It will be interesting to see how this will affect the Dresden plant, as Volkswagen would have been a large potential customer. In general, the German economy seems to be going through a difficult phase, but Dresden remains an attractive location. Because it is one of the cities in Germany with the lowest wages and living costs.

HBM4 And The Partnerships With Samsung And SK Hynix

Samsung (OTCPK:SSNLF) and TSMC have partnered to jointly develop a bufferless HBM4 memory chip. The plan here for Samsung is that by working together, they can get more customers and benefit from TSMC’s expertise, since some customers prefer TSMC’s logic dies.

Because at the moment, SK hynix (OTCPK:HXSCF), with whom TSMC also collaborates in the HBM area, is currently the largest supplier of NVIDIA’s AI chips with its HBM3.The advantage of HBM over traditional DRAM is that its faster processing speeds make it more suitable for today’s generation of chips.

Mass production of Samsung’s HBM4 chips is expected to begin in H2 2025.

Silicon Photonics + CPO

Silicon photonics is likely to be an important part of the future of AI, enabling faster data transmission with zero signal delay. Because silicon, photonics replaces electrical signals with optical signals to reduce signal loss.

Last September, it was reported that NVIDIA and Broadcom (AVGO) were working with TSMC on a solution, and this year the Silicon Photonics Industry Alliance, or SiPHIA, was formed. This is an alliance of 30 Taiwanese companies that aim to set the standard for design, manufacturing and testing in silicon photonics and co-packaged optics.

These technologies are expected to be deployed primarily in data centers and will grow at a CAGR of 40% through 2028.

TSMC’s Arizona Facility

At the U.S. facility in Arizona, where mass production is expected to begin next year, the trial production has produced fantastic results. In fact, the yields of these trials were very similar to the results of the Taiwanese fabs.

While these tests were conducted at 4nm, the second U.S. fab, which is scheduled to begin production in 2028, will produce chips at 3nm and 2nm.

And I think the Taiwan risk will be somewhat mitigated if the first fabs are up and running in the U.S. and can continue to produce high-performance chips even if the long-running China-Taiwan conflict escalates.

Jensen Huang’s Comments About TSM

Jensen Huang, CEO of Nvidia (NVDA), said at the Goldman Sachs Technology Conference that the demand is still huge, which is also reflected in the interview with the Oracle CEO, who said that he and Elon Musk had just begged Jensen Huang to get more GPUs.

Jensen also said in the interview that TSMC is by far the best chipmaker and that changing suppliers would degrade the quality of the chips. And one of TSMC’s advantages is its ability to respond quickly to requests. So I think that speaks volumes and shows that TSMC really has a strong moat.

TSMC’s Open Innovation Platform

Part of the reason for TSMC’s ability to react faster than the competition and respond to its customers’ needs may be that the company has created an ecosystem for advancing the semiconductor industry with its Open Innovation Platform.

Together with ecosystem partners, with some of whom they form alliances, they aim to reduce development times and the time it takes for customers to sell their own products.

And it is here that TSMC works with leading cloud, EDA, data center and semiconductor companies to learn, understand and solve their needs and challenges.

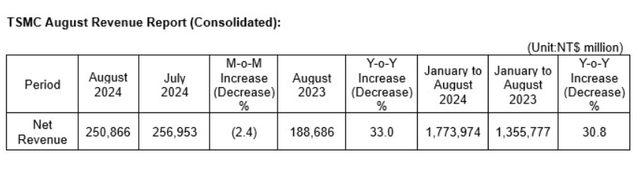

TSMC August 2024 Revenue Report

Compared to July, revenue declined slightly from NT$256 million to NT$250 million, but still grew strongly by 33% on an annual basis. And for the entire period from January to August 2024, there is also a 30% year-over-year increase in sales.

And all this even though you can expect 2025 to be even stronger than 2024. So I still see a lot of upside.

Where Do I See The EPS In December 2026?

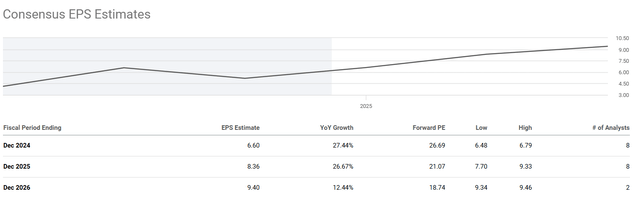

Seeking Alpha Earnings Estimates

The consensus of analysts is that EPS for FY26 will be $9.40, which at a multiple of about 30 would put the stock at $282. This represents an upside of 60% from the current price of $172.

But I think this is too low when you consider the huge impact of AI. The evolution of how fast LLMs are evolving is even faster than I thought, and I was very optimistic even 1 year ago.

OpenAI o1 now scores almost 100 points in the offline IQ test and 120 points in the online Mensa test. Klarna no longer needs Salesforce (CRM) and Workday (WDAY) because they can build equivalent solutions internally thanks to AI, and I think this is just the beginning.

And as more companies and individuals realize the benefits of AI, the demand for TSMC’s chips will grow. The only thing that could hold TSMC back is that it will simply not be able to meet all the demand because it may not have enough capacity.

As a result, I believe that TSMC could reach $12 EPS in FY2026, which would put the stock at $360 at a 30x multiple, or an upside of more than 100%. Because I see no competitor that could be a threat to them, and I believe that many still underestimate the benefits of AI and the way it will change our lives.

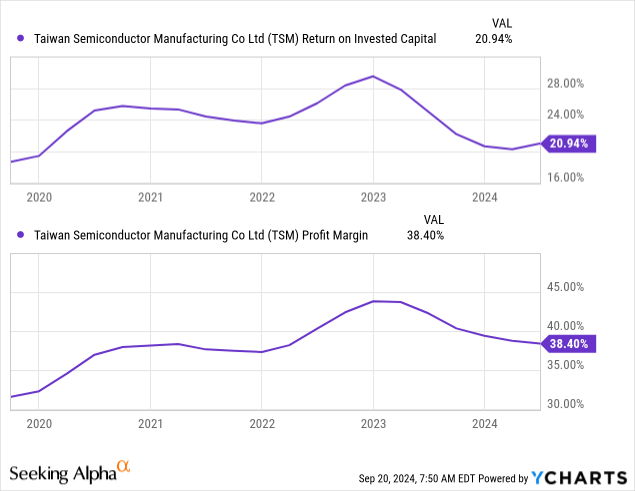

TSM’s Capital Allocation & Margins

The two metrics, ROIC and profit margin, are down slightly from their peaks in 2023, but are still well above average. In particular, a profit margin of 38% clearly shows that TSMC has outrageous competitive advantages. And at a WACC of 6%, TSMC achieves a ROIC-WACC spread of ~14%. This is also an excellent number. And I expect that in 2026+ we will see these levels rise back to the 2023 peak and maybe even higher.

So it is clear to see that TSMC has competitive advantages from both the qualitative and quantitative side.

TSMWF’s Balance Sheet

The balance sheet of TSMC is as strong as it can be. Long-term debt of $29 billion is backed by cash and cash equivalents of $55 billion. This means that long-term debt could be repaid at any time. In addition, TSMC has generated FCF of $19 billion in the last 12 months, further strengthening its liquidity position.

Conclusion

I think it is hard to find a company with more market power than TSMC has right now because the speed of AI development depends largely on TSMC’s ability to produce and deliver chips. So to conclude, why I think TSMC remains undervalued:

- Leading player in the world’s most important market, continuing to invest heavily in the future

- The best products by far, as well as pricing power, reflected in a 37% profit margin

- High barriers to entry through expertise and a network of leading players in the EDA, semiconductor, cloud and technology markets, as well as industry in general.

- Excellent capital allocation at a relatively cheap valuation, with a current FWD P/E of just 26x.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.