Summary:

- I reiterate my buy rating for Apple Inc. despite recent price declines due to lower-than-expected iPhone 16 orders, citing long-term prospects and strong brand identity.

- The stock fell 3% due to lower iPhone 16 demand, but I believe the delayed features and economic factors are temporary challenges.

- Apple’s upcoming software update will address missing features, boosting iPhone 16 sales, while improving economic conditions will enhance consumer spending.

- The current price decline offers a buying opportunity for long-term investors, as the issues affecting iPhone 16 sales are temporary and solvable.

Vadym Plysiuk/iStock Editorial via Getty Images

Investment Thesis

I am reiterating my buy rating for Apple Inc. (NASDAQ:AAPL) despite the recent price decline resulting from lower-than-expected iPhone 16 orders. In August, I wrote a bullish article on AAPL and since then, the stock has gained 7.50% with a total return of 7.62%. In that analysis, I expressed my optimism given the company’s approach to diversify its market to hedge the growing competition in the Chinese market. My bullish stance was also backed by the company’s innovations, particularly its product pipeline (the iPhone 16 series).

In this follow-up coverage, I will give my take on the recent market reactions to the lower-than-expected iPhone 16 sales, which have seen the stock lose about 3% on Monday. In my opinion, I don’t think the low sales are something that should trigger a sell decision because the long-term prospects are promising. AAPL has a strong brand identity and I believe its response to some of the concerns about their latest product will see the sales recover.

Market Reaction Amid Low iPhone 16 Orders

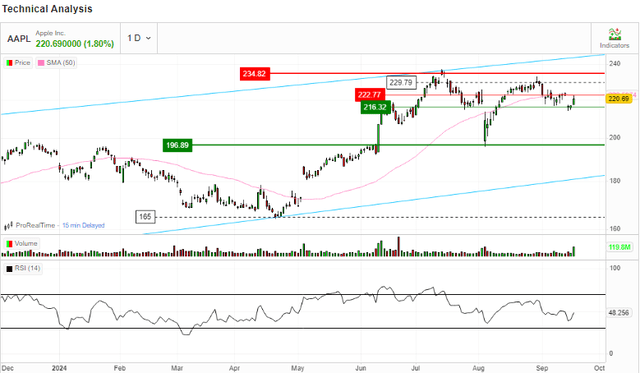

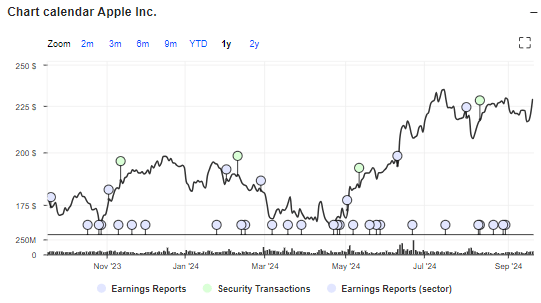

AAPL has fallen from more than $230 at the end of August to $216 on Monday. Its intraday share price fell on Monday to its lowest level since August 9. Shares plunged 3% by midafternoon, wiping off about $94 billion in market capitalization, but Apple remains the world’s most valuable public company with a market cap of $3.355 trillion. It is trading below its 50-day moving average and the RSI has dropped drastically, presently at 48.3 down from 63.2 at the end of August. This shows the intensity of the selling pressure the stock has been recently.

This selloff was mostly caused by lower-than-expected demand for iPhone 16. According to reports, pre-order sales of about 37 million units for the iPhone 16 fell by approximately 12.7% compared to the iPhone 15. This current sell-off reflects negative market sentiment on the new product release. While these may be worrying, let us delve deeper into why the sales were lower than expected and why I feel it is not worthwhile to sell your position in AAPL.

What Led To The Low Sales?

Given the lower demand mentioned above, I see three major potential reasons that can explain it. The first one is delayed features. Some critical features, such as Apple Intelligence, were unavailable at launch. The delay may have deterred early adopters, resulting in low sales. These missing features are very critical since it was anticipated to improve consumer experience and hence justify the price tag of the product. For example, Apple Intelligence brings powerful AI-powered capabilities such as text summarization, writing aid, and generative image creation. These technologies are intended to make daily tasks simpler and more efficient. Furthermore, Apple Intelligence incorporates a ChatGPT-powered Siri, which allows for more natural and contextual discussions, making device interactions smoother and more intuitive.

The lack of this crucial component has caused huge turmoil, primarily in the Chinese market, suggesting that the intended audience is dissatisfied with the latest edition. It led to the hashtag “’iPhone 16 Chinese version doesn’t support AI,” which received over 11 million views and over 1,500 comments. This overwhelming reaction illustrates how upset potential consumers were, which may explain why demand for the product was lower than in the previous series.

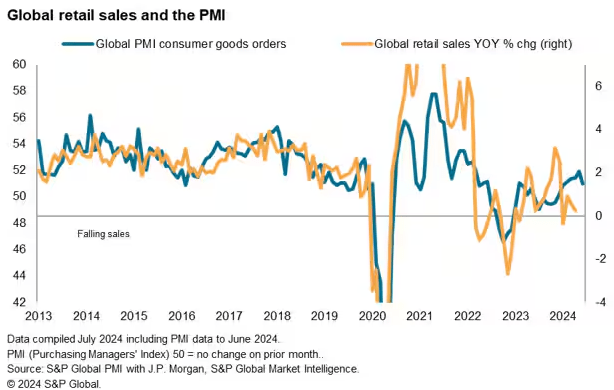

The second potential reason would be economic factors. A weak global economy can have a considerable impact on consumer purchasing patterns, resulting in lower sales of high-end products such as the iPhone 16. Currently, the global Purchasing Manager Index [PMI] is low compared to last year September when the iPhone 15 launched.

S&P Global

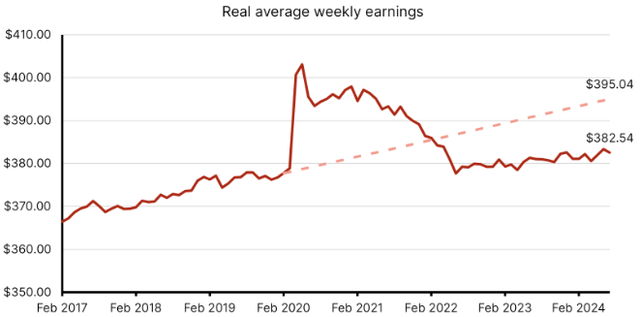

This low PMI indicates a reduction in new consumer product orders, which could be attributable to reduced consumer spending, possibly due to economic uncertainties and lower disposable income. Given the global economy’s inflationary nature, the average pay has fallen, resulting in low disposable incomes, which explains my assertion about low disposable income. The average worker’s wages have fallen by about 4% after inflation. The value is more than 3% lower than it would have been if wage growth had persisted at pre-pandemic levels.

Further, with a 35% probability of a global recession by the end of 2024 up from a 25% probability, there is a rising economic uncertainty which could be influencing consumer spending. Consequently, the tough economic conditions have led to low PMI which translates to low demand for consumer goods thus explaining why the iPhone 16 sales were lower than expected.

A Different Perspective

While the pre-order sales have shown to be significantly lower than the previous series (iPhone 15), in this section I will discuss why this is not a long-term concern and why the challenge could be short-lived. To begin, Apple intends to address the concerns about delayed features through a software update. Apple’s long-awaited intelligence feature will be included in iOS 18.1 update in October. Apple is likely to focus on these changes to improve the consumer experience and increase demand. This software upgrade adds advanced AI capabilities to the iPhone, including Smarter Siri, an improved voice assistant with better context understanding, and writing tools for editing and rewriting texts, among other AI features. The upgrade will give the iPhone 16 exclusive capabilities because the iPhone 16 models are designed to fully use Apple intelligence, making them more appealing to consumers seeking the latest technology.

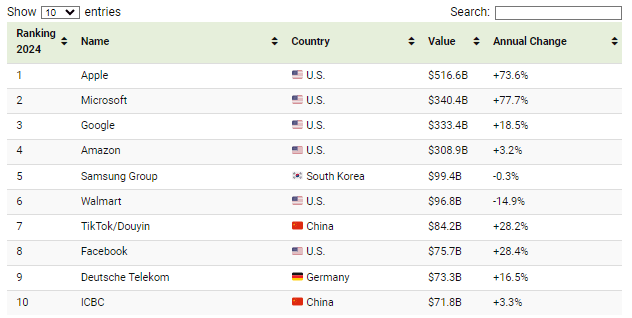

Once the update is implemented, I anticipate tremendous sales growth for the product, particularly considering the large market that exists. Furthermore, the company’s innovation culture, which now includes AI in mobile devices, will enable it to capitalize on the strong expected market growth for AI mobiles, which speaks well for its future growth. The global mobile artificial intelligence market is expected to increase at a CAGR of 28.95%, from 8.23 billion in 2024 to 62.89 billion in 2031. Aside from innovation, I believe the company’s strong brand identity and dedicated customer base constitute a three-pillar MOAT that will help it capitalize on market opportunities. Above all, statistics show that 81% of iPhone owners upgrade to new models implying that the market potential for the new model is high. Apple is currently the world’s most valuable brand, worth $516.6 billion and growing at a rate of more than 73% annually. Interestingly, its brand worth is 1.5 times that of Microsoft, the second-ranked strong brand. Undoubtedly, this is unmatched MOAT.

Visual Capitalist

It should be noted that the Apple intelligence feature is compatible with some of the iPhone 15 models, such as the iPhone 15 Pro Max A17 Pro and iPhone 15 Pro A17 Pro. While this may pose the risk of product cannibalism, I don’t think it will inhibit the sales growth of the iPhone 16 for the following reasons. Firstly, as mentioned above, statistics have shown a high rate of Apple’s consumers upgrading their old models with new models. I believe this is because the iPhone is a luxury product that, for the majority of its users, represents their social status and hence a sufficient reason to purchase the new model. Secondly, the new model has other unique features that make it distinct from existing models, such as the 5x optical zoom camera which enhances its photography experience, the iOS18 and enhanced battery life, and faster charging. In my view, blending these unique features with the Apple’s intelligence mitigates the risk of possible product cannibalism from the iPhone 15.

Secondly, from an economic point of view, there are signs of optimism. The Federal Reserve began its first cycle of rate reductions since the start of the pandemic on Wednesday by lowering its benchmark interest rate by half a percentage point and indicating that additional reductions would come. The previous instance of the Fed reducing rates by more than a quarter point occurred in 2020, during the devastating COVID-19 pandemic. According to the most recent projections, it is estimated that the policy rate would drop to 4.25 to 4.5% by the end of 2024, implying two quarter-point decreases or another significant half-point reduction at either of the two meetings left this year.

The interest rate cuts and the projected cuts will have an impact on consumer spending in the following ways. First off, with lower interest rates, consumers may feel more confident about spending rather than saving and this will boost the PMI index through increased orders. Again, consumers will benefit from lower interest rates on loans translating to cheaper financing. This may boost their liquidity, and thus their purchasing power. Above all, the Fed rate decreases signify a slowing of inflation, which will increase consumer disposable incomes because when inflation slows, commodity prices stabilize and even fall, allowing them to buy more with the same budget. Furthermore, when inflation is low, the real worth of wages rises. This implies that even if the nominal wage stays the same, the purchasing power of those wages goes up.

Given this backdrop, it appears that the two key roadblocks that contributed to low iPhone 16 orders are temporary, and I anticipate that sales will increase in the coming months. The upcoming October soft update tackles the major challenge of missing and critical features while decreasing Fed rates suggests improving economic conditions, which will stimulate more consumer spending.

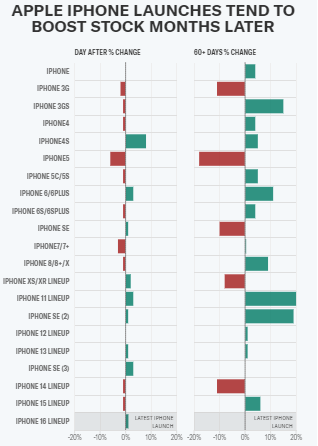

It’s Not Yet Payback Period

While most investors may be concerned about the stock’s decline, particularly given the iPhone 16’s dismal debut, I do not see this as cause for alarm. Apple stock usually performs better a month or two after its product launches. Last year, its stock fell 1% the day following the iPhone 15 launch. The stock had grown by 6% 60 days later. In 2019, shares rose 3% the day after Apple unveiled the iPhone 11 and increased 20% over the next two months. Going by this trend, I think it’s not yet time to see the positive impact of iPhone 16 on this stock.

BoFa

In my view, when the anticipated software update happens, the sales of this new product will improve significantly, especially given the demand and strong brand identity shared above. When this happens, then I believe we will be able to see the impact of the product on its stock in a couple of months. My outlook is optimistic because I believe the exclusive AI features will be a major selling point for the new iPhone model.

Volume Analysis

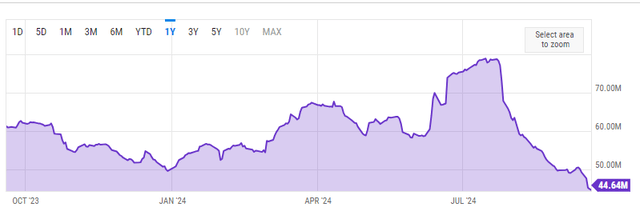

Apple’s average daily trading volume over the last 30 days is approximately 48.68 million shares. There are 44.64 million shares traded as of right now. This demonstrates that the volume is now lower than the 30-day average. Over the past year, there have been considerable fluctuations in the volume, with peaks and troughs coinciding with important occasions like product launches and earnings releases.

Despite the highly fluctuating trading volume, Apple’s short interest is 135.04 million shares, compared to the total outstanding shares of 15.20 billion. This means that the short interest is approximately 0.89%, indicating relatively low bearish sentiments among investors. With a beta value of 1.17, it follows that this stock is more volatile than the market average, something that can be explained by the highly fluctuating trading volume.

From this data, we can draw valuable insights. To begin with, while increased volatility carries risks, it also provides opportunities for traders trying to profit from price swings. Long-term investors can see the volatility as an opportunity to buy on dips. This can be supported by the much-anticipated software upgrade that will enable AI capabilities on the iPhone 16, as well as improving economic conditions, which point to a bright future for this stock. The low short interest rate shows an overall bullish sentiment among investors. This is a good indicator since it shows that most investors believe Apple’s stock will grow in the future.

My Final Thoughts

As I conclude, I believe that the current decline majorly orchestrated by the weak debut of the iPhone 16 is short-lived because the major reasons leading appear to be temporary. The company is responding to the AI aspect through a software update, while the weak economic environment appears to be improving. Notably, the low short interest points out a long-term bullish outlook. Given this background, I think the recent price decline offers a good buying opportunity for long-term investors. The long-term levers discussed in my previous article remain intact, and the weak debut of the iPhone 16 doesn’t affect my long-term bullish stance since I see it as a temporary challenge that has solutions already. For this reason, I reiterate my buy recommendation for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.