Summary:

- Eli Lilly’s long-term growth prospects have been secured by the improved supply in H2’24 and the incoming capacity additions from H1’25 onwards.

- This is on top of the introduction of its D2C channel for self-pay patients, with it offering the company a new growth opportunity through the uninsured patients.

- This is also why LLY does not appear to be expensive at current levels, with the FWD PEG non-GAAP ratio of 1.30x, well below its historical levels and sector peers.

- It goes without saying that the two horse GLP-1 race is likely to be met with intense competition, especially since “up to 16 new GLP-1 drugs could be launched by 2029.”

- As a result, while we may upgrade the LLY stock to a Buy, investors may want to time their entry points while sizing their portfolios according to their risk appetite.

choi dongsu/iStock via Getty Images

LLY’s Investment Thesis Has Improved Drastically, With Robust Growth Prospects

We previously covered Eli Lilly and Company (NYSE:LLY) in May 2024, discussing why we had reiterated our Hold rating, attributed to its overly expensive stock valuations and prices compared to its direct GLP-1 peer, Novo Nordisk A/S (NVO).

While the former’s capacity expansions and M&A activities would likely be top/ bottom line accretive as demand for GLP-1 remained robust, its moderately deteriorating balance sheet and higher debt leverage were alarming then, with it remaining to be seen when the supply tightness might ease.

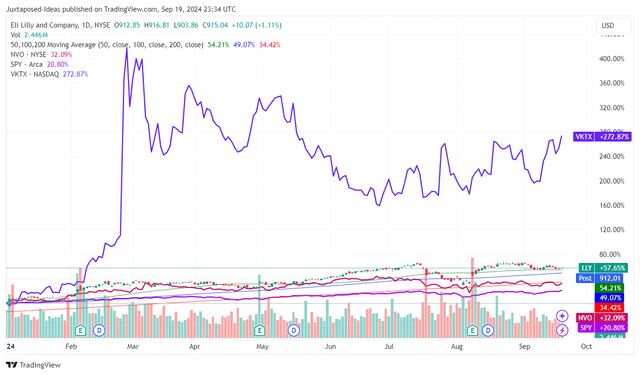

LLY YTD Stock Price

Since then, LLY has rallied by another +24.5%, well outperforming its pharmaceutical peers and the wider market, with the exception of Viking Therapeutics (NASDAQ:VKTX).

Much of the former’s tailwinds are attributed to the end of its weight loss therapy shortages by early August 2024, one that has previously triggered the impacted FQ1’24 Mounjaro results on a QoQ basis and to a smaller extent, FQ2’24 Mounjaro results on a YoY basis.

The previous shortages have also triggered numerous compounded GLP-1 headwinds from numerous pharmacies and telehealth platforms, including Hims & Hers Health (NYSE:HIMS).

Combined with the fact that part of LLY’s capacity expansions will come online from H1’25 onwards, we can understand why the market has gotten exuberant about its prospects as observed in the stock’s robust YTD performance, with H2’24 potentially bringing forth accelerated Mounjaro and Zepbound sales growth on a QoQ/ YoY basis.

These developments are also significantly aided by the management’s highly strategic decision to introduce a direct-to-consumer platform, LillyDirect in January 2024, along with the drastically slashed Zepbound prices for self-pay patients through the D2C platform.

While speculative, we believe that LLY’s decision may be partly attributed to “the company’s efforts to help protect the public from the dangers posed by the proliferation of counterfeit, fake, unsafe or untested knock-offs of Lilly’s medications” – i.e.: compounded versions.

If anything, the four-week supply of the 2.5 mg Zepbound single-dose vial at $399 (self-pay) is not too far from HIMS’ compounded GLP-1 injectables from $199 monthly (based on a 12-month plan).

This is compared to the commercial drug insurance with coverage for Zepbound at $25 monthly and up to $650 monthly based on commercial drug insurances that does not cover Zepbound, and NVO’s Ozempic at $1.79K monthly along with Wegovy at $1.99K monthly.

As a result of the improved supply and potential boost from self-pay patients, it is unsurprising that LLY has already raised their FY2024 revenue guidance to $46B (+34.8% YoY) and adj EPS guidance to $16.35 (+158.7% YoY), up from the original guidance of $41B (+20.1% YoY) and $12.45 (+96.9% YoY) offered in the FQ4’23 earnings call, respectively.

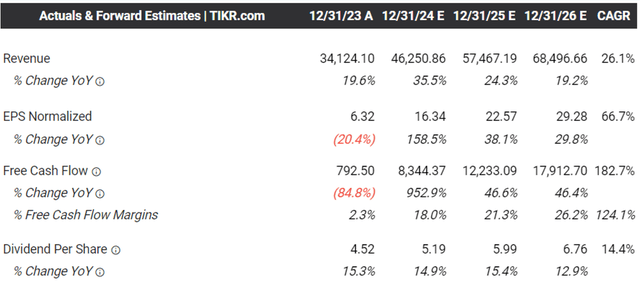

The Consensus Forward Estimates

As a result of these developments, we can understand why the consensus have already raised their forward estimates, with LLY expected to report an accelerated top/ bottom-line growth at a CAGR of +26.1%/ +66.7% through FY2026.

This is compared to the original estimates of +11.6%/ +42% and historical growth of +7%/ +8.7% between FY2016 and FY2023, respectively.

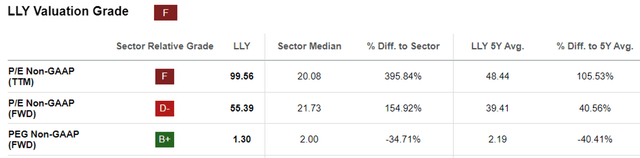

LLY Valuations

As a result of the accelerated growth prospects, we are belatedly coming to the conclusion that LLY may not be overly expensive at FWD P/E non-GAAP valuations of 55.39x after all, compared to the 5Y mean of 39.41x, 10Y mean of 28.33x, and the sector median of 21.73x.

This is attributed to LLY’s relatively low FWD PEG non-GAAP ratio of 1.30x, compared to its 5Y mean of 2.19x, its 10Y mean of 2.95x, the sector median of 2.00x, and NVO at 2.04x, with it offering interested investors with a decent margin of safety.

Risk Warning

While LLY (along with NVO) may be leading the GLP-1 therapy race, readers must note that VKTX is already pushing its candidate through Phase 3 clinical trials, with preliminary results expected in November 2024.

Tentatively, VKTX’s VK2735 has already reported -14.7% of weight loss from baseline by Week 13 (subcutaneous injection) and -5.3% by Day 28 (oral), with it excelling by the virtue of speed alone.

This is compared to LLY’s Mounjaro at -15.7% at Week 72, Zepbound at -15% by Week 72, and Retatrutide at -17.5% in the 12mg group by Week 24/ -30% in the 12mg group by Week 48, respectively.

While VKTX still needs to figure out its manufacturing strategy upon the speculative US FDA approval by the second half of the decade, it goes without saying that LLY’s two horse race is likely to be met with intense competition, especially since “up to 16 new GLP-1 drugs could be launched by 2029.”

As a result, investors may want to size their portfolios according to their risk appetite, with LLY is unlikely to retain its premium P/E valuations over the next few years, as similarly observed in the ongoing moderation from the peak FWD P/E of 67.20x observed in October 2023 to 55.39x by the time of writing.

This is also why we have opted to use the 5Y P/E mean of 39.41x for our fair value estimates and long-term price targets in our next segment for an improved margin of safety.

So, Is LLY Stock A Buy, Sell, or Hold?

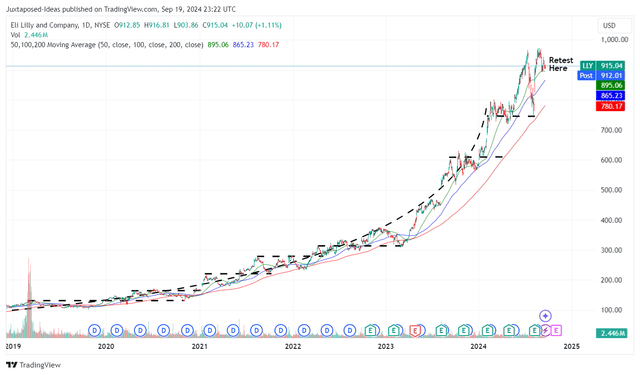

LLY 5Y Stock Price

For now, LLY has already charted an impressive recovery by +18.5% since the August 2024 market rotation, with the bullish support also observed in the stock running away from its 100/ 200 day moving averages.

Based on the 5Y P/E mean of 39.41x and the management’s raised FY2024 adj EPS guidance to $16.35 (+158.7% YoY), it appears that the stock has ran away (yet again) from our updated fair value estimates of $644.30.

Even so, based on the consensus raised FY2026 adj EPS estimates of $29.28, there appears to be a decent upside potential of +26.1% to our updated long-term price target of $1,153.90.

While minimal, LLY’s annualized dividend pay out of $5.20 per share allows long-term shareholders to subscribe to their DRIP program while accumulating additional shares on a quarterly basis.

As a result of the improved risk/ reward ratio, we are cautiously upgrading to a Buy rating, with numerous caveats.

One, as the Fed pivots by 50 basis points, market sentiments are undeniably exuberant as observed in the increasingly greedy stock market index and the rising McClellan Volume Summation Index to 1,655.39x (compared to neutral levels of 1,000x).

Interested investors may want to wait for a moderate pullback to LLY’s previous trading ranges of between $780s and $845s before adding, for an expanded upside potential.

Two, LLY’s high-growth investment thesis is partly attributed to the ongoing capex investments to expand its production capacities, one that has resulted in the increasing net debts of $25.53B (+8% QoQ/ +59.6% YoY) and annualized interest expenses of $734.4M (+2.2% QoQ/ +52.6% YoY) by the latest quarter.

While the pharmaceutical giant has been reporting richer profit margins with FY2025 likely to bring forth drastically improved FCF generations, readers may want to monitor its future balance sheet health since the ongoing capacity expansion may trigger near-term bottom-line headwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.