Summary:

- Caterpillar’s stock performs well, despite a challenging macroeconomic environment and manufacturing recession.

- The company’s profitable growth strategy, including expanded offerings and services, positions it well for long-term success, generating significant free cash flow.

- Despite a slight decline in sales and operating profit in Q2, Caterpillar’s robust dividend and share repurchase program make it attractive to investors.

- In this article, I share new macroeconomic data to put into the right context Caterpillar’s success and discuss its valuation.

Marc Bruxelle

Caterpillar Stock Is Up

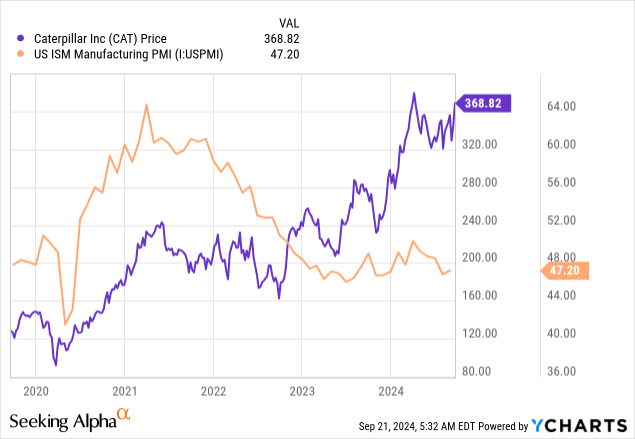

Earth-digging equipment manufacturer Caterpillar (NYSE:CAT) (NEOE:CATR:CA) defies gravity and soars to the moon. This could be the way to describe one of the few industrial equipment makers that is seeing no impact from the ongoing manufacturing recession that started in late 2022.

Caterpillar and Macroeconomics

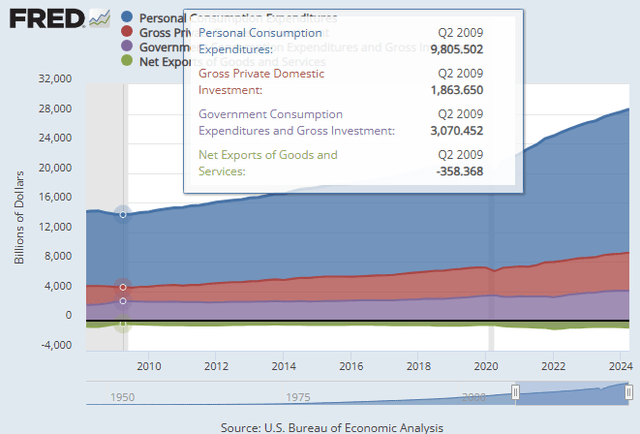

To tackle the issue, let’s recall a few key macroeconomic concepts. We surely all know that a nation’s GDP is the total value of the goods and services produced in a country within a certain period. Four main components form it: private expenditures, investments, government spending, and net exports. We can see the American GDP below as the result of these four components since the end of the Great Recession (by the way, the decline in personal consumption back then is barely visible from today’s perspective).

Why do we start from here? Because it is important to know that the economy currently does well because of personal consumption. After the pandemic, it simply took off, at first thanks to the stimulus checks and other measures and then because of a strong labor market and higher wages. Private investments and government spending gradually increase, but not at the same pace. Many talk about the multiplier effect, where each extra dollar of government spending leads to further increases in income and, as a result, in consumption. For example, a paper by the ECB titled “Understanding the effects of government spending on consumption” estimates that the multiplier range may go from 0.5 to 2, with the result that each dollar spent by a government can increase the economic output by $0.50 to $2.

What does this have to do with Caterpillar? Well, the company’s sales are not directly affected by higher consumption, but from private investments in equipment and government investments.

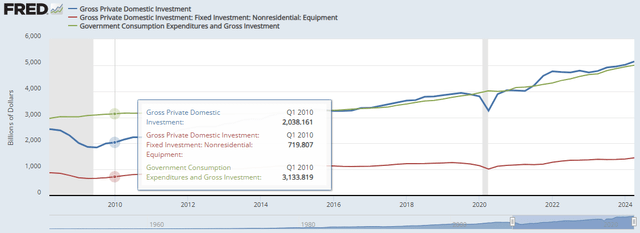

If we look at these components, we see that investment in equipment currently hovers around $1.5 and has grown by 50% since the pandemic.

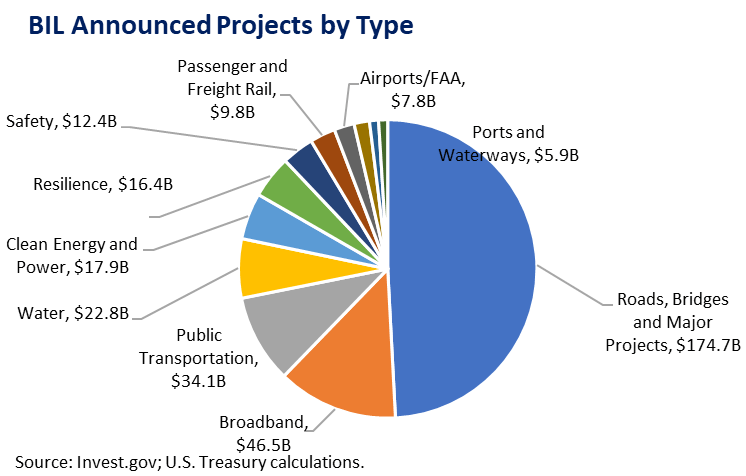

Compared to personal consumption or even the overall value of gross private investments, investments in equipment appear barely growing, but for over a decade they floated just above $1T. Therefore, the increase we are seeing right now is quite meaningful. It is also extremely needed, as infrastructure investment has trended down for decades, as per the U.S. Treasury calculations, showing that what is happening right now is a strong rebound that has yet to take the most recent peak touched just before COVID-19.

Unsurprisingly, only 44% of the nation’s bridges are in good condition and 32% of urban roads are in unsatisfactory condition. This is why about half of the Bipartisan Infrastructure Law (BIL) focuses on roads, bridges, and big projects where a lot of building and earth-digging equipment is needed. Moreover, this increases demand for minerals, metals, and other mining activities to which Caterpillar has large exposure, too.

US Treasury

We then have to consider that North America is currently seeing a 70% jump in data center supply and construction as AI and cloud computing are becoming an essential need for the economy.

Last, but not least, investments in energy efficiency and clean energy carry along yet another big boost for Caterpillar’s sales.

We can then understand why, although many of its peers are not performing great and have a book-to-bill ratio well below 100 for the rest of the year, Caterpillar, thanks to its large exposure to the U.S., has – so far – done much better. In truth, before the last earnings Q2 earnings report, I too wrote an article where I suggested the “good tale was coming to an end” and that Caterpillar would have met the struggles other manufacturers were facing.

Let’s then update my research in light of the most recent earnings report and what came out of the earnings call. Quick recap, I usually assigned Caterpillar a neutral rating, considering it a rather fairly valued stock. Before the last earnings report, I considered it a sell while I was collecting negative news from many peers. It proved me wrong, and those who held to their shares surely did well.

Caterpillar: Business Model and Financials

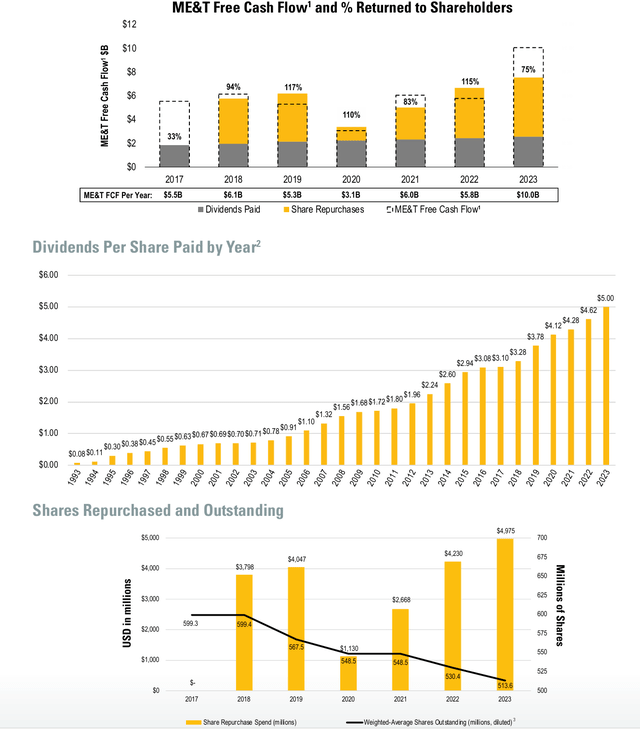

A few words need to be spent on the operating and execution model Caterpillar follows. The company aims at profitable growth through the combination of a lean and flexible cost structure and the creation of expanded offerings. This means that Caterpillar doesn’t only sell machinery, but it integrates the equipment with capabilities such as autonomy, customization, and similar. By doing so, Caterpillar makes each sale an opportunity to deliver as much value as possible to its customers in return for higher revenues and higher margins. But Caterpillar doesn’t stop here. The third pillar of its strategies hinges on services, which are projected to reach $28B by 2026 (currently $26B of the $63.9B in FY2023 equipment sales). This positions Caterpillar as perfectly fit to benefit through the whole cycle from the usage of its equipment, smoothing its top-line growth, and keeping its operating profit usually in the mid-teens if not the low twenties range. With this setup, we can understand why Caterpillar is a free cash flow generating machine that almost doubled from the $5.5B in FY2017 to $10B at the end of FY2023. Currently, Caterpillar generates more FCF than the industrial debt it carries ($9.6B at the end of FY2023), meaning it operates with no real leverage.

This leads us to the three graphs that make every dividend investor’s eyes shine. We see Caterpillar’s commitment to return almost all of its ME&T FCF to its shareholders, either via dividends or through share repurchases. The second chart proves why Caterpillar belongs to the Dividend Aristocrats and steadily climbs its way to the cohort of the Dividend Kings. The third chart shows how Caterpillar truly pounded on the table and retrieved almost 15% of its outstanding shares in just 6 fiscal years, not counting this ongoing fiscal year ($1.8B in Q2 alone).

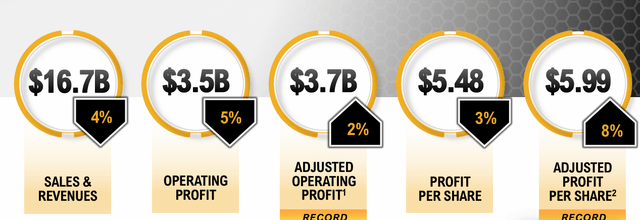

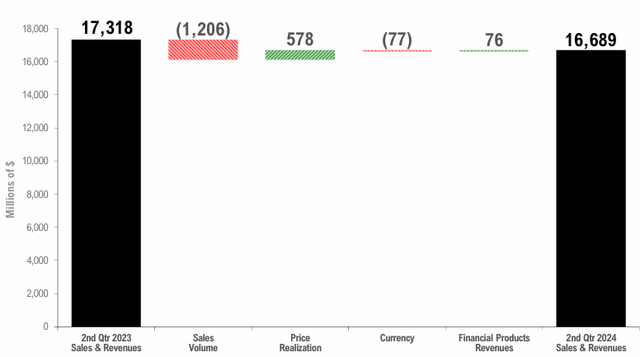

Now, in Q2, Caterpillar reported a small decline in sales and OP, by 4% and 5%, respectively. EPS declined only 3% thanks to buybacks offsetting part of the operating profit reduction.

The bridge graph shows that the main reason for the decline was lower volumes, partially offset by a favorable price realization of over $500M.

Regarding the three business segments, construction saw sales down 7% by $472M to $6.7B due to lower-than-expected rental fleet loading and a 3% operating profit deterioration thanks to favorable price realization of $178M and favorable manufacturing costs of $62M. Resource Industries (mainly mining equipment) reported a $357M or 10% decline in sales but only a 3% deterioration in operating profit. Energy and Transportation was, on the other hand, up $118M or 2% with oil and gas and power generation performing well, while industrial saw a sales decrease in EAME and North America. This is the most promising segment, and Caterpillar is investing to increase its capabilities to build large engines and parts for them. This, of course, is a multiyear project that will help Caterpillar meet the great need for solar turbines required by power generation.

Regarding the order backlog, we see it increased by $700M QoQ but was down $2.2B YoY.

As a result, Caterpillar anticipates its sales to be slightly lower than in 2023. This is quite important because, normally, the company sees higher sales in the second half of the year. So a decline during the second half has a larger impact on the company’s revenues.

Nonetheless, Caterpillar still expects its FY2024 FCF to be in the top half of the annual target range of $5B to $10B, that is, it should be between $7.5B and $10B. At the same time, we should expect the operating profit margin in 2H 2024 to be lower compared to the first six months of the year. This is true because Q3 – in particular – was particularly strong in 2023 and, as a result, Caterpillar will face tough comparables. But with sales still expected to be above $60B, we can be sure we will Caterpillar report an operating profit margin between 14% and 18%, quite incredible for industrial companies right now (think about the woes of the automotive world).

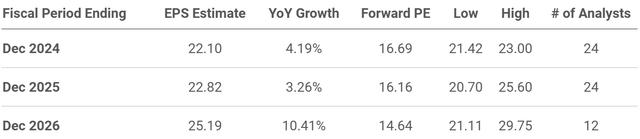

With this picture in mind, we see Caterpillar’s revenue estimates for 2024 to be down 2.6% with a rebound of 3.2% in FY2025. Analysts then expect 2026 to be rather strong with a 6% increase in sales, making the company top $70B.

At the same time, EPS should grow this year too, thanks to the $20B buyback authorization program that was announced by Caterpillar. With this in mind, we see the stock trading at a fwd PE between 16.7 and 14.6, depending on what year we are focusing on.

The multiple is not demanding and is lower than the market average. However, for the industry, it represents a true exception, as many similar or related companies trade in the high-single-digits or the low teens. Deere, for example, trades a discount to Caterpillar, with reason.

Seeking Alpha

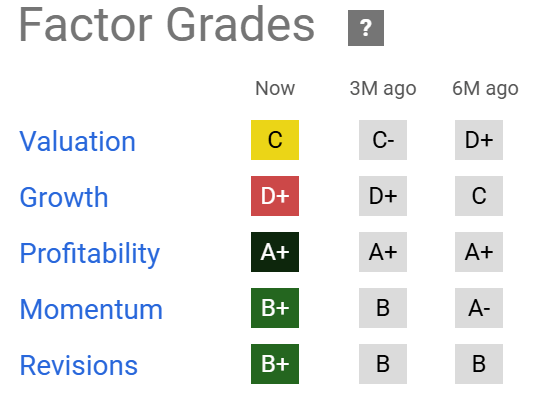

So, while Caterpillar has a C as its valuation grade and a dangerous D+ as its growth grade, it earns its premium thanks to its A+ as its profitability grade. Coupled with a 5.3% FCF yield, we have a stock that looks fairly valued. On one hand, it can’t expand its multiple given its poor growth outlook, on the other hand, if it traded down steeply, its yield would appear so cheap that it would immediately attract many investors (and the so-called smart money as well). So a valuation between $360 and $390 (a fwd earnings multiple between 16 and 18) seems fair. Currently, the stock trades close to $370 and, as a result, I don’t see a wide margin of safety to deeply buy the stock.

At the end of this update, where I have introduced more macroeconomic data to gauge what Caterpillar was reporting, I consider the stock worthy of an upgrade from a sell to a hold. I keep considering that, right now, Deere seems more promising and that’s where I have put my money. But Caterpillar is a stock with few paper hands, investors who have the right temper and mindset to hold on to their shares for decades. This also helps the stock from being too volatile. But, for now, I turn back to my neutral stance. While I like the company, I don’t see a screaming buy for Caterpillar right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.