Summary:

- Intel’s valuation appears overestimated; DCF analysis suggests a target price of $5 per share, far below current market cap.

- Aside from the unrealistic $90 billion price tag, the merger is likely to encounter significant regulatory, financial, and integration challenges.

- Intel struggles to harness the massive AI tailwinds, whereas Nvidia and AMD fully capitalize on them.

hapabapa

Introduction

I do not want to be boastful, but Intel’s stock (NASDAQ:INTC) has lost more than 30% of its value since I have shared my ‘Strong Sell’ recommendation back in May. My fundamental analysis update suggests that Intel is still unable to absorb massive AI trends while its rivals are thriving.

Wall Street analysts see unfavorable trends in the company’s performance which has led to multiple growth projections downgrades for Intel in recent months. Intel demonstrates some spikes in share price, but these do not look sustainable. The recent information about a potential $90 billion merger with Qualcomm (QCOM) was the recent positive catalyst, but I believe that this deal can happen only with a massive discount to Intel’s current market cap. The business keeps stagnating, and the stock appears significantly overvalued. Therefore, I believe that INTC is still a ‘Strong Sell’.

Fundamental analysis

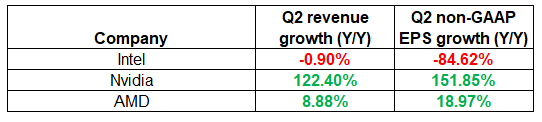

Intel continues disappointing investors with a quite weak financial performance compared to its rivals: Nvidia (NVDA) and AMD (AMD). All companies have released their calendar Q2 results over the past reporting season, and Intel once again looked much weaker than NVDA and AMD. While Nvidia’s key financial metrics continued skyrocketing, Intel’s revenue stagnated once again, and the non-GAAP EPS moved closer to zero. AMD demonstrated modest growth in revenue and EPS during the last quarter.

Compiled by the author

The upcoming quarter is unlikely to be better for Intel compared to rivals. The outlook is weak with revenue expected to continue its decline and the bottom line shrinking significantly. Nvidia’s top and bottom lines are expected to double once again in Q3, and AMD’s momentum is expected to accelerate. This is a clear indication that the company is unable to get benefits from positive trends in the industry, while rivals are successfully enjoying tailwinds.

Compiled by the author

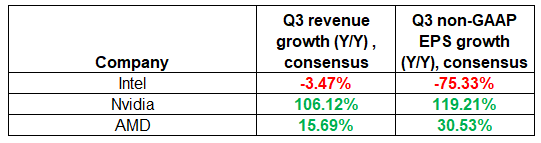

These forecasts appear to be fair. We all know that Nvidia and AMD outsource their manufacturing of chips to Taiwan Semiconductor Manufacturing Company Limited (TSM). In mid-July there was information that Nvidia increased its orders to TSM by 25%. From quarterly consensus estimates for TSM we can see that it is expected to deliver at least a 20% YoY revenue growth for the next six quarters. This is a robust indication that demand from Nvidia and AMD will remain strong. However, on the other hand, the below chart shows that Wall Street’s forecasts for Intel’s revenue growth have been getting worse and worse over the past 6 months.

SA

Shares gained more than 3% on Friday amid speculation that Qualcomm is reviewing a chance to buy Intel for $90 billion. I consider this deal as quite unlikely for a few strong reasons. Regulatory and antitrust constraints are the most apparent ones. Both companies operate globally and before the merger happens, it is likely that they will need to get regulatory approvals not only in the U.S., but also internationally.

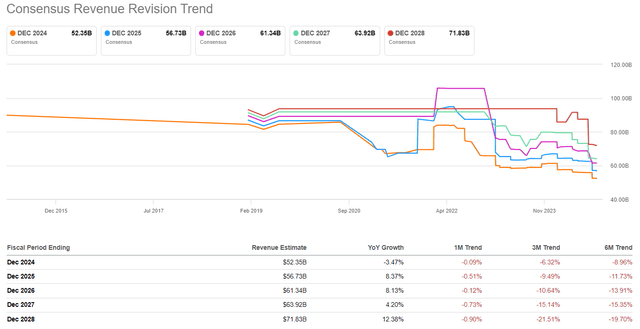

The financial aspect should not be discounted as well. Qualcomm’s balance sheet (below) looks healthy with relatively low leverage and a solid cash position. However, buying a $90 billion company is apparently a mega-deal and it will require QCOM to raise a vast amount of cash either through debt or equity to finance the acquisition. Qualcomm’s market cap is around $190 billion, meaning that the potential deal is material for the company. Shareholders apparently will not be happy with a massive new shares issue, meaning that chances of getting approval for such a deal from the Board of Directors is unlikely.

The Fed recently started cutting interest rates, but the monetary policy still appears not favorable to raise $90 billion in debt. Raising such a massive amount of debt to acquire a company with declining revenue and profitability looks like gambling and not business.

Yahoo Finance

Moreover, Intel is a giant company with a headcount of almost 125,000. This is around 2.5 times higher compared to Qualcomm’s headcount. Therefore, it is unlikely that the potential integration will be smooth and easy. Optimists might say that such a large Intel’s headcount provides big room for layoffs and increasing profitability. This might be true, but the positive effect from layoffs is deferred. Over the short-term layoffs lead to increased costs as companies pay severance packages to laid off employees. Moreover, Intel already laid off as many as 15,000 employees relatively recently.

As we see, risks and uncertainties are strong, and there are apparent regulatory and financial obstacles. Moreover, Intel is not a thriving business as its key financial metrics keep deteriorating. I think that Qualcomm might only be interested in this deal if it acquires Intel with a substantial discount on its current market cap. Therefore, I think that it is extremely unlikely that this deal might happen at a $90 billion price.

Valuation analysis

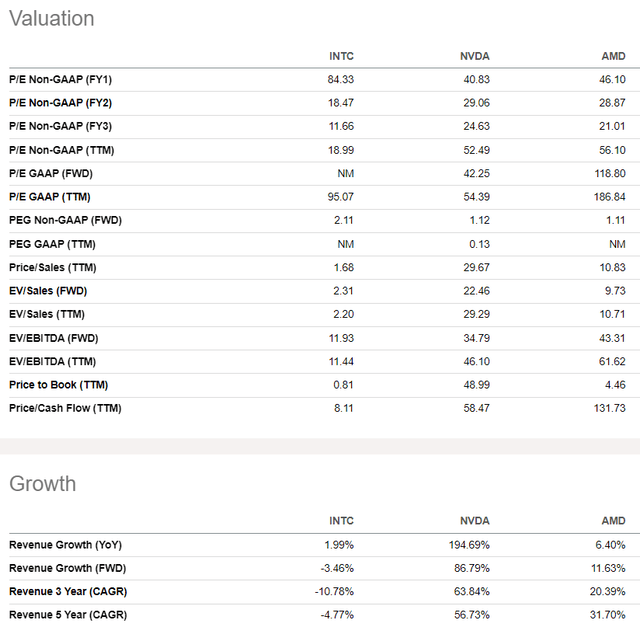

Comparing Intel’s valuation ratios to those of Nvidia and AMD seems pointless because their revenue and EPS growth are not comparable. Consequently, Intel’s mostly significantly lower ratios compared to its competitors are justified and do not reflect the appeal of Intel’s valuation. Intel’s sky-high short-term P/E ratios is explained by significantly deteriorated profitability.

SA

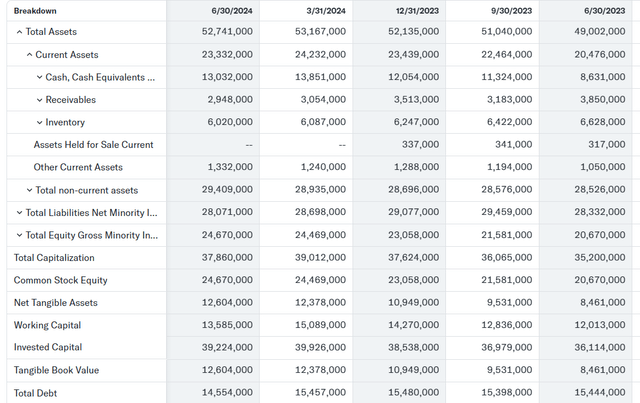

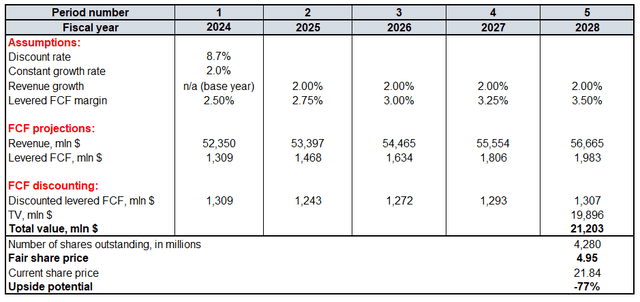

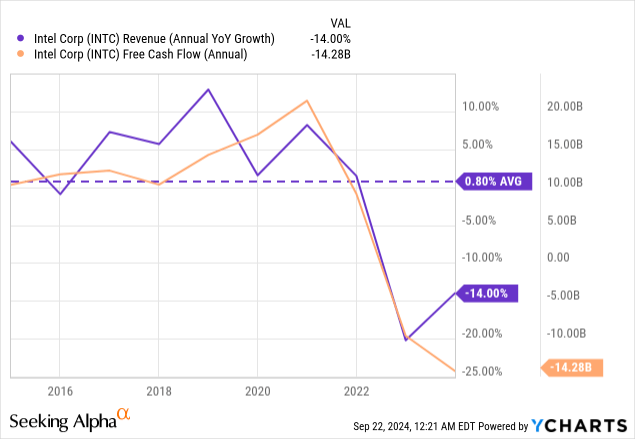

What I prefer to focus on is Intel’s discounted cash flow (‘DCF’) model. Future cash flows will be discounted using Intel’s 8.7% cost of equity. As shown above, Intel’s revenue CAGR has been negative over the past five years, and its future outlook remains uncertain. Therefore, I apply a 2% growth rate for both FY 2025-2028 and for the constant growth rate. The base year revenue aligns with consensus estimates. Intel’s average levered FCF margin has been 2.5% over the past five years, and I expect it to improve only by 25 basis points per year. According to Seeking Alpha, there are 4.28 billion INTC shares outstanding.

Calculated by the author

My target price is $5, a downgrade from the previous $7 per share. This is equivalent of a $21 billion market cap, and Intel’s bulls will apparently disagree with such a low valuation. The reasoning that I have seen multiple times from Intel’s bulls is that the company cannot be valued lower than its net property, plant, and equipment (‘PP&E’).

The net PP&E as of the latest reportable date was $33.2 billion. Even if I agree that this can be used as the company’s fair value estimate, it is still almost three times lower than Intel’s market cap.

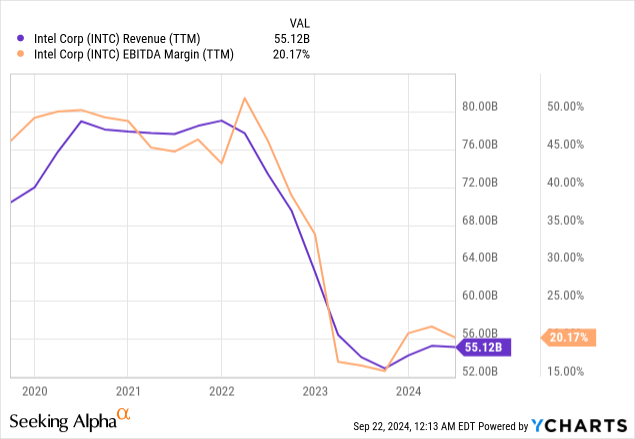

It is also important for the reader to take into account that DCF is a model to value future cash flows. I don’t have a crystal ball, but I am pretty sure that the way that the company has performed over the last years is quite informative for building expectations about the future. If I look at revenue and EBITDA margin evolution at Intel over the last five years, I think that it wouldn’t be fair to incorporate a growth beyond inflation rates for DCF.

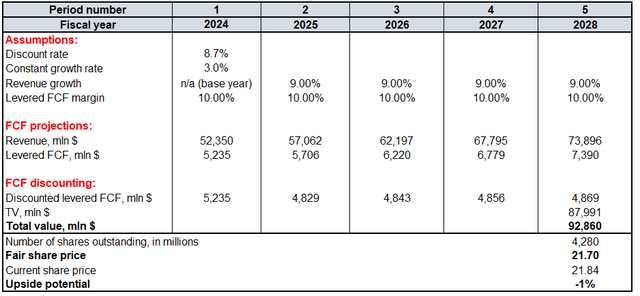

Last but not least, let me simulate a scenario where Intel’s current above $90 billion market cap is justified. For the company’s fair value per the DCF model, aggressive growth and profitability assumptions must be incorporated.

Calculated by the author

The fair value per share moves closer to $22 if I implement a 9% revenue CAGR for the next five years, and a 3% constant growth rate. Moreover, INTC needs to keep its FCF margin at least at a 10% level every year. These assumptions look unrealistic, in my opinion.

Intel’s annualized revenue growth rate over the last decade is 0.8%, which makes a 9% revenue CAGR for the next ten years highly unlikely. Moreover, Intel’s free cash flow has shown a sharp decline over the last ten years. It means that it is unrealistic to expect the company to maintain at least a 10% FCF margin over the long term.

Mitigating factors

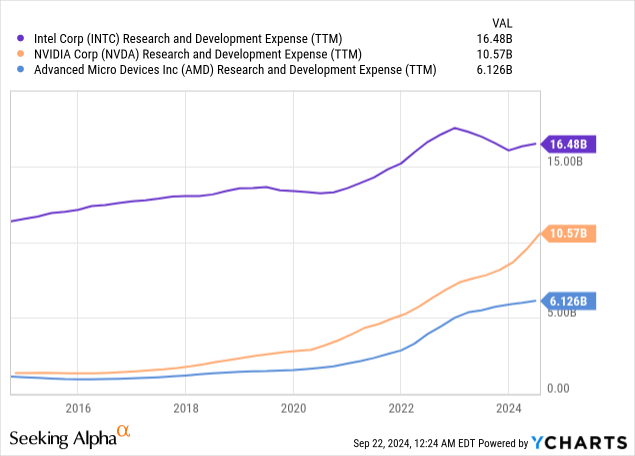

Although Intel trails Nvidia and AMD in developing chips for AI adoption, still invests significant amounts in developing new products. Intel’s R&D spending is 60% higher than Nvidia’s and more than double that of AMD in absolute terms. Thus, there is always the possibility that Intel could come up with a breakthrough product that could challenge Nvidia’s and dominance in the GPU market.

Intel’s rally last year was partly driven by the CHIPS Act, which aims to enhance domestic semiconductor research and manufacturing in the U.S. Since Intel is involved in operating and investing in its own foundries, it was a major beneficiary of this Act. As such, should the budget of the Act increase, it would likely further allocate more funding towards Intel and perhaps serve as a strong, bullish catalyst for the stock price. For example, the stock jumped on September 16 by 6% after there was a release that INTC would receive up to $3B in direct funding under the CHIPS Act.

Conclusion

The business keeps stagnating, and my valuation analysis suggests that Qualcomm is extremely unlikely to pay $90 billion to acquire INTC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.