Summary:

- AT&T stock has outperformed the S&P 500 markedly, as its surge likely stunned the bearish investors.

- Its market leadership in the convergence opportunity (wireless and fixed broadband) has likely bolstered investor confidence.

- AT&T’s lackluster growth profile presents a critical risk, suggesting investors shouldn’t throw caution to the wind.

- I explain that investors must be careful about chasing the recent surge too far ahead.

jetcityimage

AT&T: Outperformance Likely Stunned Bearish Investors

AT&T Inc. (NYSE:T) investors who ignored the market’s pessimism must have breathed a sigh of relief in not giving up when T fell to its July 2023 lows. Back then, I underscored my conviction why the stock of the battered telco leader seemed well-primed to bottom out. It occurred well before the Fed telegraphed its decision to reduce interest rates last week. As a result, the fallout from the lead-sheathed cables led to a significant bottoming process that preceded T’s long-term lows, affording high-conviction investors a golden opportunity to add more exposure. When adjusted for dividends, T has significantly outperformed the S&P 500 (SPX) (SPY) since then, justifying my bullish thesis.

I downgraded the stock in my previous AT&T update in June 2024, as I felt the risk/reward had reached more balanced levels. Notwithstanding my caution, T’s relative outperformance suggests I have been too circumspect as the market re-rated the stock further. As T re-tested its June 2021 high this week, it’s timely to reassess whether the stock could have momentum to rally further, given Jerome Powell’s “bullish” commentary that spurred the S&P 500 to an all-time high.

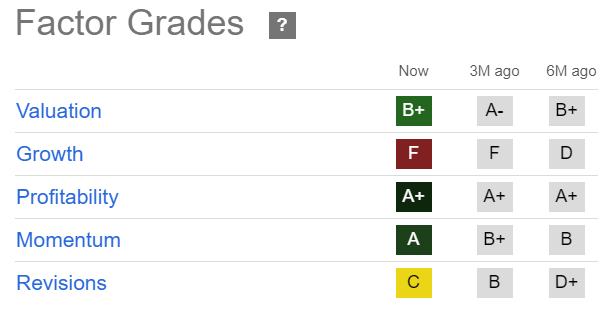

T Quant Grades (Seeking Alpha)

My assessment suggests several reasons to be optimistic about AT&T’s recovery cadence, although caution must still be exercised, given its tepid growth prospects. As seen above, T is still rated with an “F” growth grade, underscoring the challenges to convince the market that its best days are still ahead.

AT&T’s Convergence Opportunity Is Bolstered

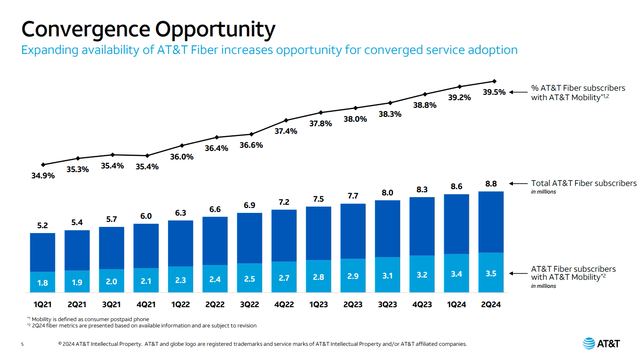

AT&T convergence opportunity (AT&T filings)

AT&T has demonstrated its market leadership through its fiber and 5G strategy. AT&T has championed the convergence thesis, seeing significant synergies and cross-selling strategies, leading to a more unified and seamless customer experience. Given the continued growth in “converged service adoption,” as seen above, the market is likely increasingly confident about the convergence strategy. Therefore, I assess that the company’s ability to potentially maintain its market leadership in fixed broadband access and wireless services has been bolstered.

Given Verizon’s (VZ) recent acquisition of pure-play fiber player Frontier Communications (FYBR), it should bolster the conviction of AT&T’s convergence thesis. The leading telco players have capitalized on the opportunity to gain traction with an expanded fiber roadmap, viewing the strategic imperative through the ability to deliver premium fixed broadband and high-quality wireless services.

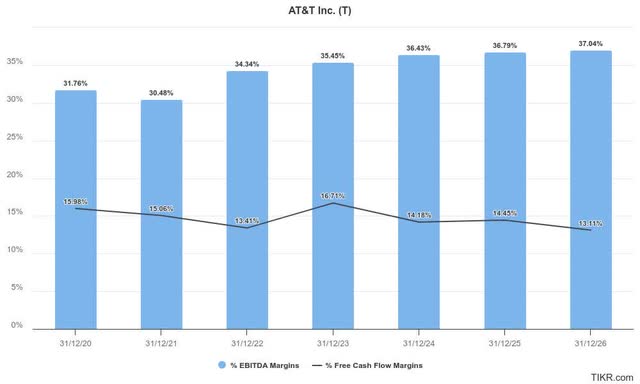

Furthermore, AT&T’s cost-cutting strategies should benefit as the Fed begins its interest rate reductions. While T’s relative outperformance has likely captured much of its near-term surge, the company’s robust cash flow and profitability (“A+” profitability grade) help improve the market’s confidence in its execution.

Accordingly, AT&T believes that its CapEx needs have peaked, improving the clarity over its free cash flow outlook. Therefore, it should also lift confidence in its capital allocation and dividend strategy, as income investors potentially reallocate from cash. The potential Apple (AAPL) Intelligence-driven iPhone 16 upgrade cycle could provide another significant growth opportunity for AT&T. While it’s still too early to ascertain the earnings accretion prospects, I urge investors to monitor the developments closely as the iPhone 16 launches.

Is T Stock A Buy, Sell, Or Hold?

As a result, I assessed that the improved clarity and execution should bolster the confidence in AT&T’s profitability estimates over the next two years. The rationalization of the industry’s competitive intensity is also expected to reduce unanticipated churn, allowing the company to push forward on its convergence strategy.

With interest rates expected to be lowered through next year, I assess lower execution risks in AT&T’s aim to move closer to its 2.5x target leverage ratio.

Notwithstanding my optimism, I consider turning bullish on the stock too aggressive. Although its “A” momentum grade suggests investors have returned with a vengeance, I find its lackluster growth profile as a critical risk factor in a more robust valuation re-rating opportunity.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!