Summary:

- AT&T’s Fiber Broadband growth and increased free cash flow make it a compelling option for passive income investors, with a low dividend payout ratio.

- The Telco’s reaffirmed 2024 free cash flow forecast and low valuation based on profits bolster the investment thesis despite recent 52-week highs.

- AT&T’s stock remains moderately valued at 9.5x leading profits, with an intrinsic value estimate of $23-$25, driven by robust FCF growth.

- The 5% dividend is solid and sustainable, supported by a payout ratio of less than 50%, making AT&T a buy.

jetcityimage

AT&T Inc. (NYSE:T) continues to considerable growth in its Fiber Broadband segment and profited from a nice jump in its free cash flow in 2Q24, both of which make the Telco a compelling option for passive income investors.

The Telco also reaffirmed its free cash flow forecast for 2024 in the last quarter and AT&T continues to pay out only a very low amount of its free cash flow.

Broadband growth and a still low valuation based on profits round out the investment thesis for AT&T even though the stock just hit a new 52-week high.

My Rating History

My last stock classification on AT&T was Buy primarily because AT&T made progress in terms of its net debt reduction and I think that an improving balance sheet and lower net debt could be catalysts for an ongoing rerating of the Telco’s stock.

I think that passive income investors have no reason to be concerned about the dividend, taking into account AT&T’s low free cash flow-based pay-out ratio, and Broadband execution will be key to sustaining a higher profit multiple.

Broadband And Free Cash Flow

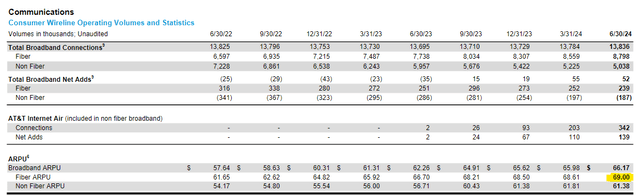

AT&T produced $4.6 billion in free cash flow in the second quarter, up 9% YoY as the Telco’s Broadband business is booming. AT&T’s Fiber Broadband sales skyrocketed 18% YoY in 2Q24 to $1.8 billion, primarily because the Telco is growing its subscribers as well as its average sales per customer.

In 2Q24, AT&T had 239,000 AT&T Fiber net adds compared to 252,000 net adds in the prior quarter. If the Telco adds more than 200K subscribers in the third quarter it would be the eighteenth quarter in a row in which AT&T reaches at least this level of net adds. Subscriber momentum is real and indicates that the company’s Fiber offer is competitive enough to ensure a steady stream of new sign-ups.

Further, AT&T’s is growing the number of Fiber connections rapidly and the Telco’s Fiber ARPU rose 3.4% to $69.00 as of June 30, 2024. ARPU is a good figure to use to evaluate how quickly a telecommunications company is growing its sales internally, for instance via price increases.

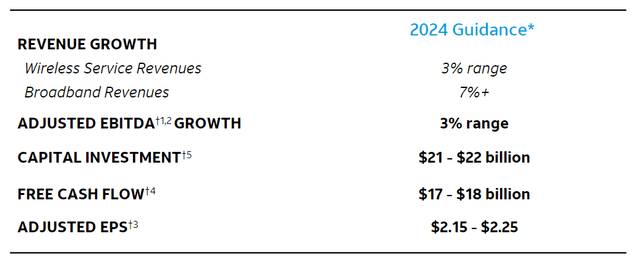

AT&T is anticipated, based on its reaffirmed forecast for 2024, to rake in $17-18 billion in free cash flow in 2024. AT&T’s dividend runs up a tab of a little less than $8.0 billion annually, so AT&T’s free cash flow forecast reflects back to us an estimated dividend pay-out ratio between 44% and 47% in 2024.

Obviously, the forecast already accounts for approximately $21-22 billion in investment spending, a huge chunk of which will go to the further build-out of the Telco’s Fiber Broadband business.

New 52-Week Highs, Technical Analysis

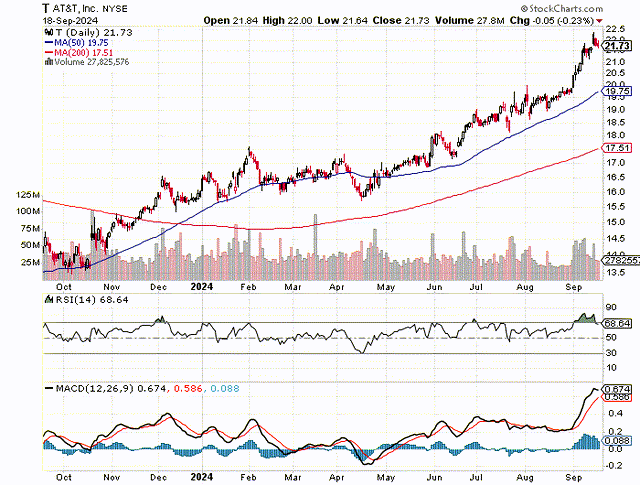

AT&T crossed above the 200-day moving average line, an important trend indicator, in November of 2023 and has remained above this trend-line ever since.

In April 2024, AT&T’s stock crossed above the 50-day moving average line, creating a new short-term up-channel on growing, positive investor sentiment. This sentiment may be related to a growing appeal of income stocks in a market that anticipates the central bank’s first rate cut this month.

The stock has recently been overbought based on the Relative Strength Index, but is presently neutral in terms of buying sentiment. There is theoretically the possibility for AT&T to fall back to the 50-day moving average line which presents important support for the Telco’s stock and which presently runs at $19.75. If this key level holds, then the stock could go into a new up-channel.

Moving Averages (Stockcharts.com)

AT&T Is Still Rather Cheap

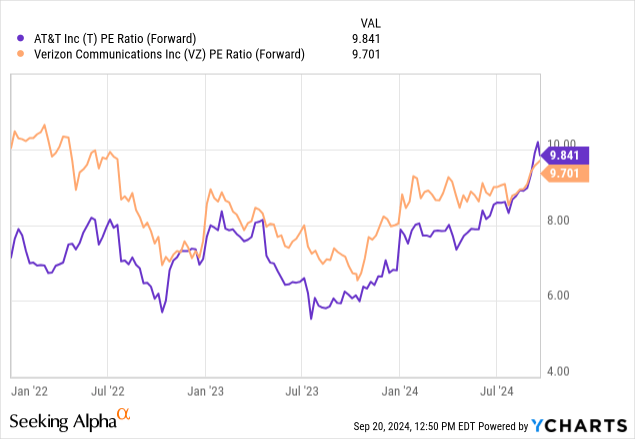

Though investors have piled into AT&T as of late, pushing the stock to new 52-week highs, AT&T’s stock is still quite moderately valued. The Telco’s stock is selling for 9.5x leading profits whereas AT&T’s largest U.S. peer, Verizon Communications Inc. (VZ), is selling for 9.4x 2024 estimated profits.

AT&T, just like Verizon Communications, has also enjoyed a rather substantial price surge as of late, primarily because the Telco proposed the acquisition of Frontier Communications in a $20 billion deal in order to grow its available Fiber network.

Taking into account AT&T’s enormous free cash flow and robust growth in FCF in 2Q24, AT&T could be selling for a profit multiple of 10-11x, in my view, which leads us to an intrinsic value of $23 at the low end and $25 at the high end.

Why Passive Income Investors Might Get Disappointed

Verizon Communications made an offer to buy for Frontier Communications at the start of September to buy the Telco for its Fiber Broadband assets. Frontier has 2.2 million paying subscribers and could help Verizon Communications to compete with AT&T more effectively which could lead to stiffer competition in the Broadband market.

On the flip side, Verizon Communications clearly sees an expansion opportunity in Fiber Broadband, a segment in which AT&T is also producing very good results.

In my view, Broadband will remain a big opportunity for both AT&T and Verizon Communications and a key sales driver moving forward.

My Conclusion

AT&T’s stock has surged as of late and just clocked in at a new 52-week high, buoyed by improving sentiment towards Telcos in the context of the Frontier Communications deal with Verizon.

Though it is true that AT&T is not growing its dividend, as opposed to Verizon Communications, the Telco has a sizzling Fiber Broadband business in which AT&T is growing its customers and its ARPU. In my view, AT&T is not too expensive given its growing, underlying free cash flow and reaffirmed FCF forecast.

I think the 5% dividend, taking into account the Telco’s dividend pay-out ratio of less than 50%, is quite solid and sustainable. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.