Summary:

- ABMD had a decent quarter where revenues grew nicely but profits languished due to sudden growth in R&D spend.

- Companies like ABMD have to expense R&D, which is not a problem, but a lack of profit growth isn’t great given its valuation.

- The multiple doesn’t offer much of a margin of safety, but we recognise the premier product portfolio.

- Overall, there is a defensive angle for the stock given rate increases, but the valuation is too much of a concern.

Eoneren/E+ via Getty Images

Originally published on the Value Lab 14/5/22

Abiomed (NASDAQ:ABMD) makes the Impella portfolio of heart pumps used in various cardiovascular surgeries. The secular angle is strong on the basis that COVID-19 can create cardiovascular issues, but also that lifestyles have contributed to greater incidence of cardiovascular disease. The latest quarter continues to demonstrate that they can grow revenues and that the markets are strong, and they continue to make headway in terms of iterating the product and creating better outcomes. However, the valuation is too stretched, and profit growth being limited by necessary R&D spend is somewhat of a concern. Long periods of outstanding growth are possible, but also required in order for the current multiple to make sense. While the markets are defensive and in principle attractive given economic concerns, we’d look elsewhere on account of the valuation.

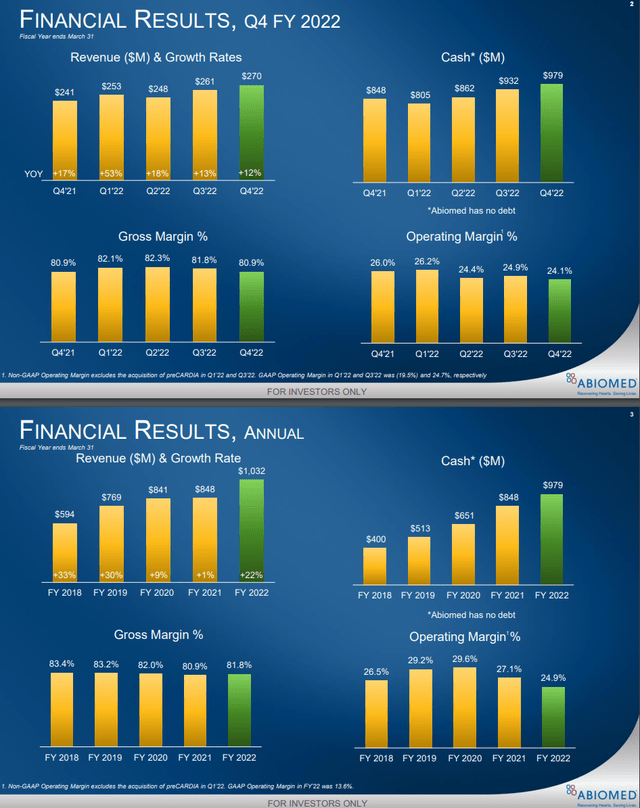

Q4 Note

The company just reported their Q4 results a couple of weeks ago. Sequentially, gross margins suffered a bit, but remained strong on a YoY basis. Revenue growth also persisted despite issues with labor shortages in hospitals, which has been a recurring theme for any company that depends on diagnosis or procedure volumes to make sales. The Impella markets are strong, and the strategy of expanding the indications for which they can be used continues unabated, and new products enter the portfolio.

While revenues are growing in the comfortable double digits, and the guidance states that they should continue to do so, profits have languished because of the broadening product initiatives. Impella ECP, but also other clinical trials, are creating R&D expenses that cannot be avoided. In the case of Impella ECP, the return of this R&D investment will likely be high, with the product receiving special FDA designation to fast-track its development and iteration as the smallest and least invasive heart pump for cardiological surgeries ever invented. Gross margin declines have been the other driver of reduced profits, starting already in 2021 year-ending in March. However, the incremental effect has primarily come from the fixed cost base.

Valuation & Conclusions

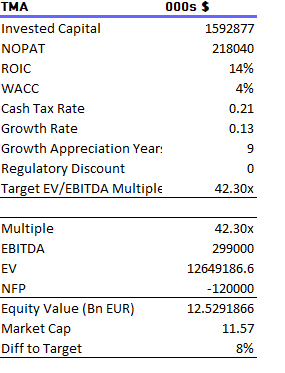

Having done a TMA analysis on ABMD in our last article, we run it again with the updated figures. Guidance is lower in revenues than what was achieved in 2021, and the profit margins are likewise lower. The former is likely a consequence of the hit to procedure volumes, with 2021 also being a year that was more harangued by COVID-19 and therefore providing a weaker comp. The latter should be due to the R&D ballooning as more work is done to support clinical trials for new indications as well as for the new heart pumps coming to the market. Updating the figures for our TMA with the lower market cap since our last neutral coverage, we get the following results.

TMA for ABMD (VTS)

In order to justify the current valuation, 9 years of outstanding reinvestment fueled growth is required at the current ROIC-WACC spread in order to justify the current valuation. Is this reasonable? Somewhat. When you get very high multiples like this, it’s not by definition overvalued, and it appears to us that the end-markets for heart pumps remain robust in terms of growth, and the patent protected portfolio of special class medical devices is not one to lack in pricing power or be vulnerable to threats from industry structure. ABMD is a top-quality company, and it is continuing to perform as an innovator and designer of heart pumps. However, given the difficulties in growing profits as R&D expenses mount, and also due to the challenges generally faced by the market, a stretched valuation that depends on perfect execution is not one we’d prefer in the current environment. While the end-markets are resistant to rate hikes and inflation, both of which can hurt disposable income and demand for most products, we are going to continue looking elsewhere for investments.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.