Summary:

- A DCF model indicates Alibaba is undervalued by nearly 40%, with potential returns exceeding 15% annually, making it an excellent long-term investment.

- Despite stagnant domestic commerce, Alibaba’s international commerce and cloud segments show good growth, with cloud revenue increasing by 6% and international sales up 32%.

- Risks include Chinese regulatory environment, fierce competition, and geopolitical tensions, but Alibaba’s market position and potential for recovery make it a compelling investment.

IrisImages/iStock via Getty Images

Since I have been writing for Seeking Alpha, I have always expressed a strong buy rating for Alibaba (NYSE:BABA) as I believe this company is extremely undervalued based on its financial results; this time will be no different. Since my last article 5 months ago, the stock has achieved a total return of 25.64%, vastly outperforming the 9.64% of the S&P500. Is there any chance that this trend can continue? And for how much longer?

Within this analysis I will try to answer these questions, providing you with an investment thesis based on both Alibaba’s numbers and the Chinese macroeconomic environment. Unlike previous dead cat bounces, this time I believe the price per share has the potential to continue its uptrend and reach its fair value.

After years of shareholder pain, this late 2024 may finally chase away the negativity and end a bearish trend that has lasted too long. In my view, the performance of the past few months is just the beginning, so it is still not too late to go long on this company.

China commerce

China commerce is responsible for 49% of the company’s total revenues, so it is currently the most important business segment and the one for which most people know Alibaba. To date in the West the company operates through AliExpress, a direct competitor of Amazon, while in China sales come from the Taobao and Tmall platforms.

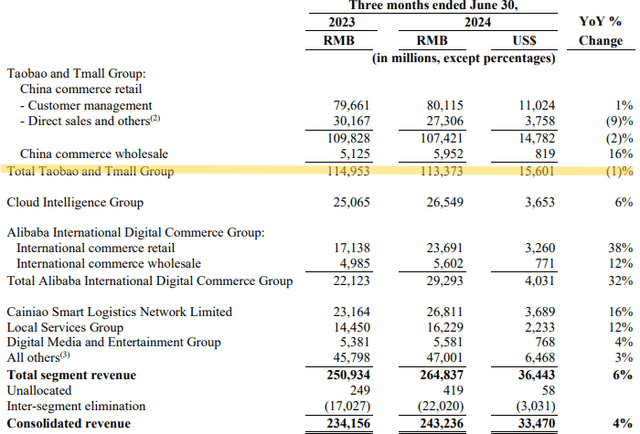

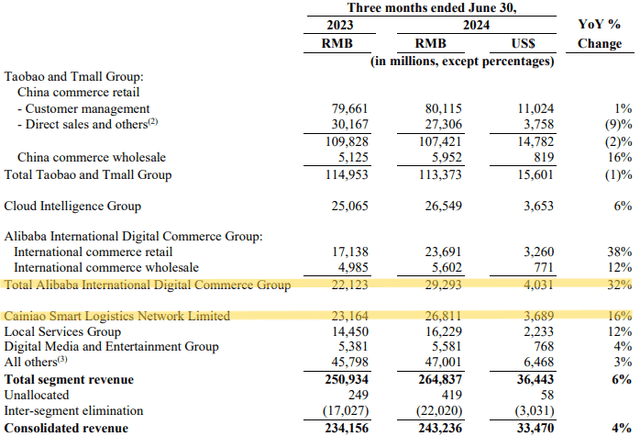

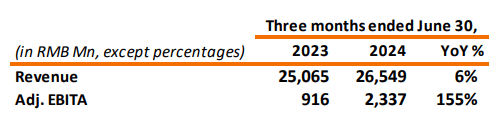

Alibaba Group June Quarter 2024 Results

Based on the latest available data, Taobao and Tmall have stopped growing; in fact, revenues decreased by 1% compared to the same quarter last year. This negative data is the basis for many bearish theses about Alibaba, as it is seen as a company whose core business is now mature and in decline. Objectively, the data cannot be disputed, but understanding the reasons why growth is stagnant is crucial to getting a more complete view of what is happening.

There is no doubt that domestic competition over the past few years has become fierce, but in my opinion this is not the main reason why Taobao and Tmall revenues are struggling.

The elephant in the room in this case is China’s real estate crisis and the consequent reduction in Chinese people’s propensity to consume: this would explain why other giants such as JD and Tencent are also struggling to grow domestically.

Perhaps investors may have underestimated this aspect, but I think it is more important than you might think. Would you ever expect Amazon to grow in a macroeconomic environment like 2008? Probably not, because many people would struggle financially and Amazon purchases are the last thing on their minds. Well, that is roughly what is happening in China right now.

Federal Reserve of St. Louis

Taking a look at the Real Residential Property Prices for China, a sharp slump from 2022 is evident, and the bottom has not yet been reached. This is not the only index showing a sharp decline in the real estate market, there are many others.

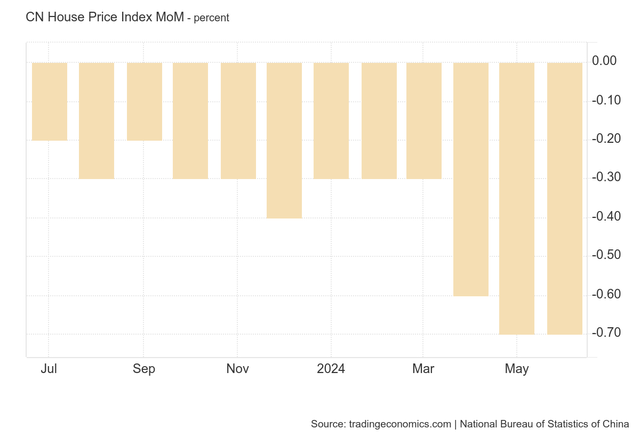

National Bureau of Statistics of China

For example, the China House Price MoM is an index that measures the monthly difference of newly built residential apartments in 70 medium and large cities in China. As you can see, the situation is getting worse and worse and there are no glimmers of recovery.

A group of 1,500 families said they paid for their houses 8 years ago but as of today their construction has not been completed; most of the average Chinese family’s wealth depends on housing, so think about how much in trouble they are right now. Stories like these make it clear how serious this crisis is and why we cannot expect Taobao and Tmall to grow today as they have in the past. In any case, it is worth pointing out that their decrease in revenue has not implied a loss of market share in China, quite the contrary:

- GMV, or the total value of goods sold within a platform in a given period, had high single-digit growth.

- Order growth was in the double digits.

These two figures, combined with the decrease in revenue, implies that on Taobao and Tmall customers purchased more but cheaper products. In fact, these figures are in line with the macroeconomic environment where the Chinese can no longer spend as much as they did a few years ago. Anyway, the market share is not declining at all; therefore, once there is a Chinese economic recovery, Taobao and Tmall will benefit greatly.

I take it for granted that China will recover from this crisis, after all it is the world’s second largest power and aims to become the largest in the not-too-distant future. Figuring out when the turnaround will really occur is impossible, but I think there are some conditions to believe that the bottom has been reached.

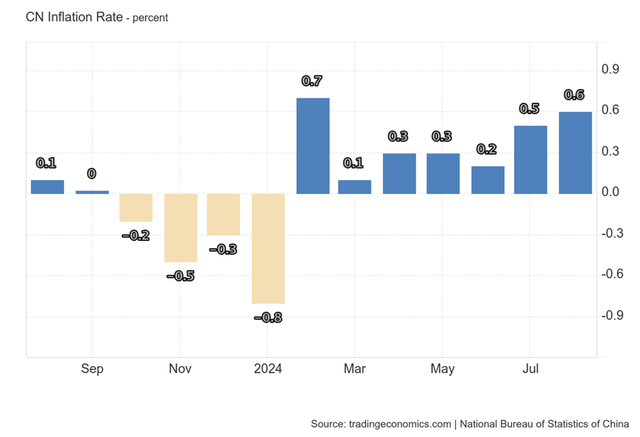

National Bureau of Statistics of China

First, the deflationary spiral of late 2023 now seems to be behind us, and this may be the first major achievement; deflation is the worst enemy of an economy and as long as it persists it is difficult for the country to recover.

Second, the Chinese government has set the GDP growth target at 5% for 2024 and will do everything possible to achieve it. There should be no further fiscal stimulus in the second half of the year, but monetary policy has the potential to become more expansionary.

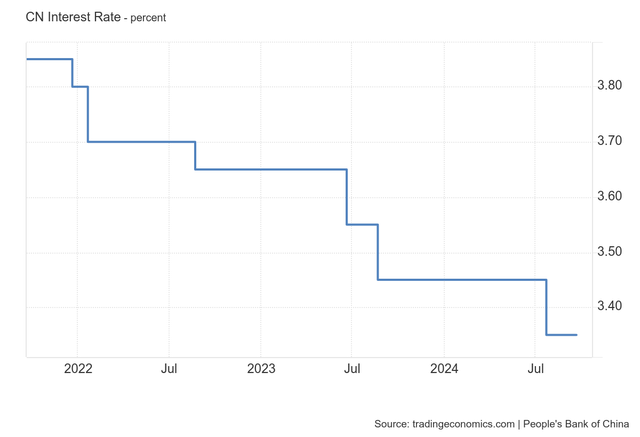

People’s Bank of China

Surprisingly, a few days ago the People’s Bank of China decided to keep rates unchanged despite the Fed’s large cut. In any case, this decision should not be understood as a change in monetary policy, rather as a pause to think about next steps. According to Xing Zhaopeng, senior China strategist at ANZ, “The rate cut is likely to be included in a larger policy package, which is being reviewed by senior officials.”

Overall, fiscal stimulus, deflation likely beaten and potential further rate cut are the reasons that lead me to think that the real estate crisis will be over in a few quarters or a little more than a year. Currently, the valuations of Chinese companies still discount strong pessimistic sentiment, but as time goes on, it will fade and they will eventually reach their fair value. Waiting for China to fully recover and then buying Alibaba is in my opinion a strategy to avoid, as the potential return on investment would drop dramatically: by that time Alibaba will no longer be trading at $90 per share.

This process of normalizing sentiment toward the Chinese stock market may already be underway, in fact Alibaba (as well as other companies) is moving further and further away from its low. Until a few weeks ago to think that Alibaba could reach $100 per share was unlikely; today it is difficult to think that it could fall back to $70 per share.

With the Chinese economic recovery both Taobao and Tmall will grow again, but I don’t think they will ever return to the same levels as a few years ago. There are many competitors today, the market is saturated, and even getting 5% growth per year is a good result in my opinion.

Different discussion for International commerce, where sales reached $4.03 billion, up 32% from the same quarter last year.

Alibaba Group June Quarter 2024 Results

Revenues in this sector come mainly from AliExpress and Lazada, which are booming in the Western and Southeast Asian markets. However, at least for now, management is sacrificing profitability to gain market share: operating income deteriorated by RMB 3.28 billion from last year. These businesses are likely to be unprofitable in the coming quarters, but there is no need to worry since they are still in an early growth phase.

The goal is to make them profitable by leveraging Cainiao’s logistics potential, moreover, with revenues up 16% from last year. Maybe not many people know about Cainiao, but its extensive logistics network operates in 200 countries worldwide and works with 500 logistics partners. It is one of the world’s leading companies in its field and is making Alibaba’s widespread expansion around the world possible, which is why AliExpress shipments take much less time today than they did a few years ago.

Cloud intelligence Group

If China commerce represents the past and the present, Cloud Intelligence is definitely the operating segment with the greatest potential going forward. Taobao, Tmall, and international commerce will continue to be the most important segments in terms of revenue but not for operating income. The Cloud may allow Alibaba to achieve significantly higher profit margins, and its growth may reach double digits.

The real estate crisis is not helping this segment, but its potential remains very high.

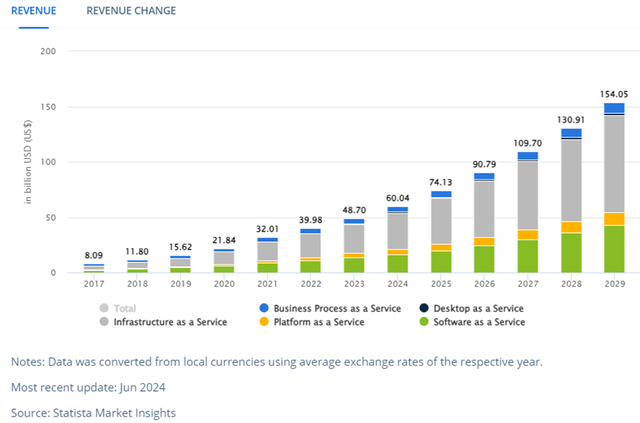

Statista

According to Statista estimates, by 2029 the Cloud market may be worth $154.05 billion in China, registering a 2024-2029 CAGR of 20.75%. Since Alibaba is the cloud leader in China, it is highly probable that it can benefit from this trend.

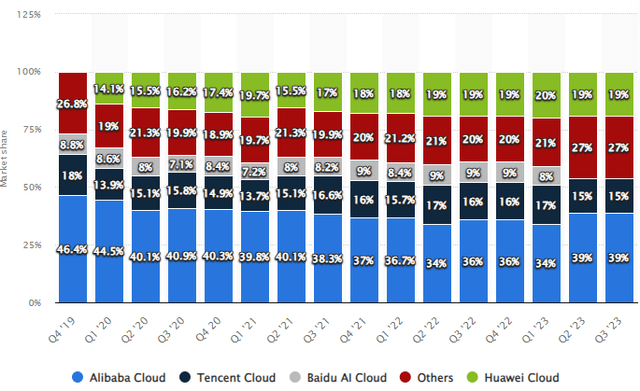

Statista

Until last year its market share remained stably close to 40%, and there is no reason to think that the situation is so different today; updated figures will be released soon.

Cloud revenue growth was only 6% over last year, but it represents a major improvement: it doubled from the previous two quarters. Certainly investors expect something more, at least double-digit growth, but the conditions are in place to achieve these goals. Beyond the potential recovery of the Chinese economy, Alibaba is investing heavily in the Cloud infrastructure.

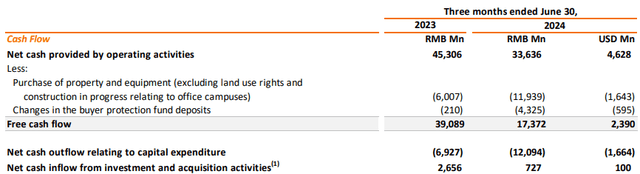

Alibaba Group June Quarter 2024 Results

What has just been said finds evidence in the latest recorded free cash flow, where net cash outflows related to capital expenditure reached RMB 12.09 billion. Much of this huge amount was used to improve the Cloud business:

Free cash flow decreased by RMB21.7 billion to RMB17.4 billion. This year-over-year decrease mainly reflected the increase in expenditure related to our investments in Alibaba cloud infrastructure and other working capital changes related to factors, including our planned reduction of direct sales businesses.

When we talk about AI the first companies that come to mind are Alphabet, Microsoft, and Meta, but on the other side of the world there is another giant ready to take a slice of the world market:

Over the next several quarters, we expect to continue to be investing in AI CapEx at that kind of pace. And it’s simply because we see a lot of demand, a lot of unmet demand from many clients and you look at the pipeline those clients have, you know there’s going to be ongoing demand.

The results are already tangible as 100 open-source artificial intelligence models have recently been released and can be used mainly in the automotive industry and scientific research.

With a net cash position of $55.83 billion, Alibaba can potentially compete with the major big tech companies and continue to dominate in its home country. Moreover, the company is already scaling this business and operating income is likely to grow much faster than revenues.

Alibaba Group June Quarter 2024 Results

In the latest quarterly report, the Adj. EBITA was RMB 2.33 billion, up 155% from last year. But there’s more, the number of paying users to Alibaba’s cloud service increased by 200% over the previous quarter: this business is growing very strongly even though the entire country is facing one of the worst crises in recent history.

It is tough to know in a couple of years how much Alibaba’s cloud operating margin will amount to, but we can make comparisons with major global players. AWS is the most important and has an operating margin just under 35%; I don’t see why Alibaba cannot reach a similar figure in the future if it continues to grow in this way.

Dividends and valuation

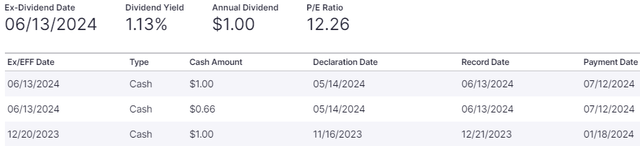

At the end of 2023 one of the major changes for Alibaba was the decision to issue a dividend, the first of a long series probably. This dividend is issued on an annual basis and often goes by the wayside given its low yield: 1.13%.

Nasdaq.com

Currently the cash amount is only $1, but there is potential to increase it significantly in the coming years. Consider that the estimated EPS for FY2025 is $8.86, so there is ample room for improvement.

I would not be surprised if the dividend per share grows even 20% per year in the next few years, after all, management is also buying a huge amount of its own shares.

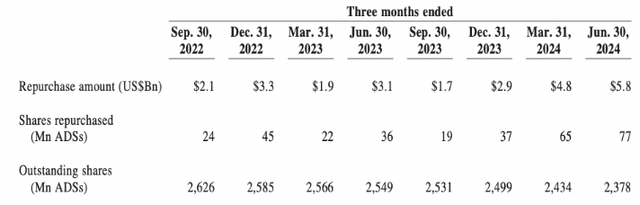

Alibaba

The repurchase amount is increasing more and more and has reached $5.80 billion in the last quarter; before long we will also know how many shares it bought from June to September. For those who want to get more info regarding Alibaba’s buyback, I wrote a dedicated article.

So, potential to increase cash amount and fast growing repurchase amount are the two main factors that make Alibaba’s dividend much more attractive than you might think: potentially this company can be an excellent dividend growth.

Assuming dividend per share growth of 20% per year over the next 10 years, buying Alibaba at $89 per share would result in a dividend yield on cost of nearly 7% over 10 years. Moreover, the withholding tax is not that high, 10% in most cases.

Turning to valuation, things get even more interesting.

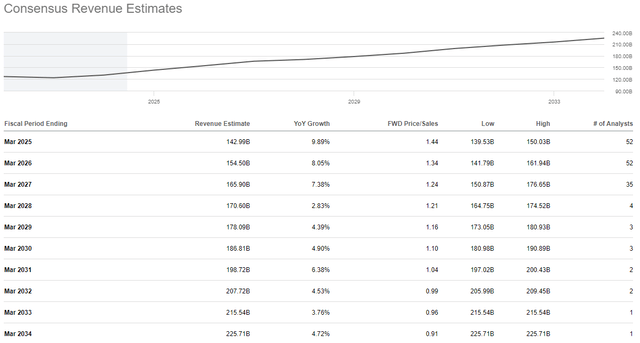

To calculate Alibaba’s fair value, I used a DCF model, whose cash flows are derived from Street Estimates of revenues.

Seeking Alpha

From these estimates, I have considered a free cash flow margin of 18% for each year, which I believe is more than achievable for Alibaba. Over the course of a few years, the housing crisis will be behind us and the strong improvement in cloud profitability give me hope.

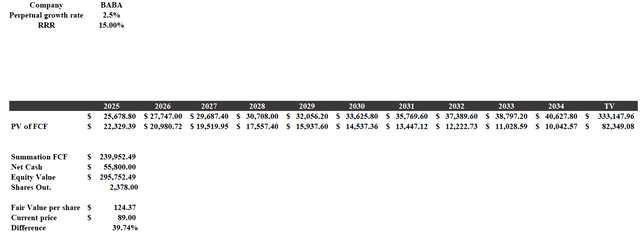

Discounting these cash flows for a high RRR of 15% given the riskiness of the investment, this results in a fair value of $124.37 per share.

DCF model

Thus, although the RRR is huge, Alibaba is undervalued by almost 40%. In other words, at the current price there is the potential for an investment that could generate a return of more than 15% per year, beating the average historical return of the S&P500.

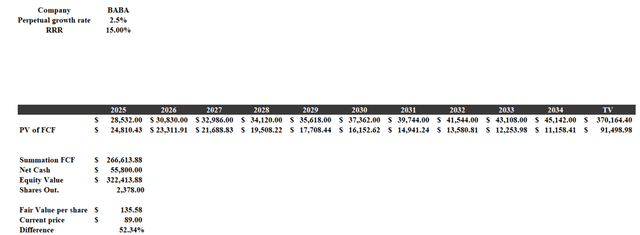

For the more optimistic, if Alibaba achieves a free cash flow margin of 20%, the fair value would increase to $135 per share, thus an undervaluation of 52%.

DCF model

Obviously there is nothing certain in these assumptions, but objectively it is really complicated to make Alibaba look overvalued. The amount of cash flows is outsized relative to the current market capitalization, which is why this company remains one of the best strong buys at the moment in my opinion. By the way, I would like to point out that the Street Estimates considered are quite conservative, in fact in no year the revenue growth rate is in double digits.

Risks

As already anticipated, Alibaba is an investment with a high degree of risk and is not suitable for the most risk-averse. In order to achieve an annual return of 15-20%, one must take risks, and I have identified three in the case of Alibaba.

The first and also the most relevant concerns the geographic area in which Alibaba resides; investors are not entirely irrational and there is a reason why most Chinese companies are at a steep discount currently. The CCP’s policy maneuvers in recent years have been much discussed; in fact, numerous regulations have been introduced that have hurt the country’s major big tech. In addition, the “common prosperity” directives and the blocking of Ant Group’s IPO have raised quite a few questions about how autonomous the company actually is; other companies involved in the education sector have been wiped out in the course of a few days.

Overall, investing in a Chinese company means taking the risk that something earth-shattering could happen at any moment. What keeps me calm is that Alibaba is one of the leading companies in the country, and I don’t think anyone has an interest in destroying it. Anyway, even if the situation is quiet today, there may be new laws and more fines to pay in the future.

The second risk concerns competition, especially regarding China commerce and International commerce. In its territory, competition is fierce and people have scaled back their spending; internationally, growth is high but profitability needs to be improved. Cainiao is an important lever to exploit, but it may not be enough to dominate an already saturated market.

The third risk is the least likely, but potentially the most damaging. The geopolitical environment in recent years has worsened considerably due to the war in Ukraine and Palestine, and to date it is unclear how these conflicts will be resolved. In addition, the trade war between China and the U.S. is not helping, as well as differing stances on Taiwan.

We do not know the future, but what we do know is that some U.S. interests collide with China’s; after all, we are talking about the world’s first and second largest economies. Alibaba is a Chinese company that is expanding to the West, so it is in the middle of these two fires. The geopolitical tension between the two countries is obvious, but as far as I’m concerned, I don’t think either one of them benefits from antagonizing the other too much, which is why I’m rather optimistic.

Conclusion

Alibaba is one of the best Chinese companies around; it dominates on a domestic basis with Taobao, Tmall and Alibaba Cloud; on an international basis it continues the expansion of Lazada and AliExpress by leveraging the logistics of Cainiao.

Needless to mention, the company is going through a difficult time; it has been in decline for years now. However, there has been a reaction in recent months and I believe this is the beginning for a new bullish cycle. The market has already discounted the most negative scenarios in the current price and the bottom has now been touched. Based on a DCF model, Alibaba is highly undervalued even including very conservative estimates.

I strongly believe in the potential of this company, especially at this price. It has been an important part of my portfolio for some time now and I am intent on holding it for a long time to come. Besides the capital gain, the dividend could be the icing on the cake and make it an excellent dividend growth stock.

I don’t see similar opportunities in the financial markets right now, which is why I definitely consider it a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.