Summary:

- Meta Platforms is recommended as a buy due to its AI success, attractive valuation, clean balance sheet, and potential in VR technology.

- Recent earnings showed strong growth with a 22% revenue increase and 73% EPS growth, driven by effective cost management and AI investments.

- META’s AI-driven advertising tools, like Advantage+, enhance advertiser returns and position Meta to capture more digital advertising spend.

- Despite risks from AI investments and Reality Labs losses, Meta’s core business remains highly profitable, making it a compelling investment.

Kira-Yan

Introduction

Meta Platforms, Inc. (NASDAQ:META) is a well-known internet social media giant. Since its founding as Facebook in 2004, the last 20 years have seen the firm undergo a rapid ascent. Laden with successful strategic acquisitions and public controversy along the way, the firm is entering a new phase. This next phase, in my opinion, is where Meta and its big tech peers pivot to being AI first companies. Based on recent earnings, Meta’s early AI efforts look to be bearing fruit in boosting user engagement on its platforms.

Additionally, shares trade at an attractive valuation relative to recent history and against big tech peers. Investors have expressed concerns in recent years about the substantial losses at the virtual reality segment known as Reality Labs. The Reality Labs losses are well understood now by the market and suitably baked into the stock price. While I don’t expect a near-term takeoff of the virtual reality business, I view Meta’s positioning as an interesting call option on the tech. I initiate Meta as a buy given its tangible AI success today, attractive valuation, clean balance sheet and VR tech positioning.

Recent Earnings

Meta reported Q2 earnings on July 31st, with positive numbers sending the shares higher by more than 4% on the day. Markets were pleased with a clean top and bottom-line beat, as revenues grew 22% and EPS grew 73%. Importantly for analysts, the firm saw huge operating leverage as costs grew just 7%, boosting margins by 9% to 38% for the quarter. The cost discipline in the quarter stood in sharp contrast to Q1 numbers, where shares fell over 10% as Zuckerberg expressed commitment to spending heavily to build out AI capabilities.

Q2 looks to have proven that, for now at least, AI capex will be backed up with tangible revenue growth. As investors get increasingly nervous about the visibility of ROI on AI capex, nicely expressed by Sequoia, Meta can at least stand over its spending and point to tangible revenue numbers.

A nice bonus in the release was news that Threads, Meta’s Twitter alternative, had hit 200 million monthly active users. I am skeptical about whether Threads will ever becoming a meaningful long-term profit contributor for Meta. My base case is users will grow for a few more quarters before topping out, making it hard for the platform to scale to profitability. However, unlike the Metaverse ambitions, Threads is a relatively low-cost call option on a potential Twitter alternative. It is a low risk to reward circumstance, so I am unconcerned if it fails, as it is not a core part of my buy thesis.

AI-Driven Advertising

Moving beyond traditional advertising, Meta offers their Advantage+ suite of AI-powered advertising tools. An internal company study found that advertisers availing of Advantage+ saw a 32% increase in their return on advertising spend. AI-driven ad campaigns allow users quicker time to market, as they avail of automation across functions like budgeting and creative direction.

Meta is a clear leader in advertising technology, a trend I expect to continue as they continue to innovate. Advertising dollars are increasingly up for grabs as demographic shifts are moving traditional advertising away from linear TV to new digital mediums. This ongoing shift in spending should create ample opportunity for Meta to pick up an incremental share of global advertising spend.

Zuckerberg spoke at length during the call about the use of AI, one point that stood out to me was the trajectory of AI in advertising.

In the coming years, AI will be able to generate creative for advertisers as well — and will also be able to personalize it as people see it. Over the long term, advertisers will basically just be able to tell us a business objective and a budget, and we’re going to go do the rest for them” (Mark Zuckerberg, Q2 Earnings)

Valuation

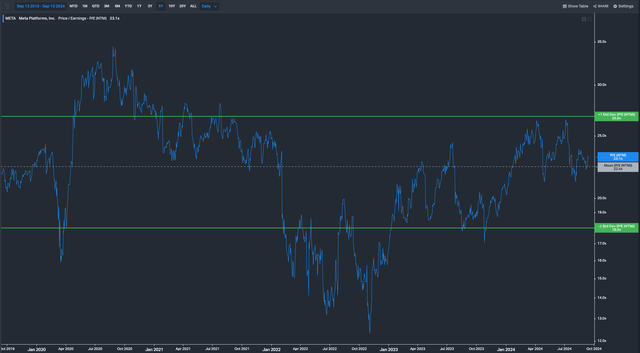

For me, the valuation of Meta is undemanding given the historical valuation, peer valuations, broader market valuation and Meta’s expected growth. Per Refinitiv, the S&P 500 currently trades on a forward P/E of 22.1x with an expected EPS growth in 2024 of around 11%. Meta by contrast trades at a slight premium to the index with a P/E of around 23x, for paying this slight premium investors are buying into a firm with 2024 earnings growth of 43% and medium term EPS growth of over 17%.

When we account for Meta’s net cash on the balance sheet and significantly higher Return on Equity than the index, it is clear that for the slight premium valuation we are getting significantly higher quality.

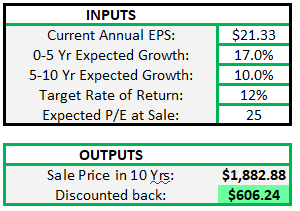

My DCF modeling suggests Meta is about 8% under-priced when targeting a 12% return. I would always advise readers to take DCFs with a pinch of salt, given their sensitivity to inputs. However, I think they are a useful tool for illustrating an estimate of what a stock price should be for a reasonable set of assumptions. I am assuming a medium term EPS growth rate as per analyst consensus and for the long term EPS I assume Meta falls to around a 10% level, which, I think, is reasonable given the firms high margins and ability to ramp share buybacks in future to juice the bottom line, much like Apple has done as it reached maturity.

Author

Risks

AI surely represents both a tremendous opportunity and a threat for Meta. I see AI as a threat for two reasons. Firstly, Meta is investing heavily in AI, an investment which will need to meaningfully bear fruit in the future. They are at the leading edge of AI model development with their Llama class of models. There is a train of thought among some observers that AI models will become commodity products, meaning differentiation between models becoming impossible because they are all so similar. If this were to happen then economic theory suggests excess pricing would be impossible as margins are competed down to marginal cost, such an outcome would mean AI becomes dilutive to profit margins long term rather than accretive.

The second risk I see from AI is fundamental disruption to existing business models. This fear clearly runs through all of Big Tech, a host of firms that have their genesis in disrupting others. Even with the ROI on AI, firms such as Meta feel they have no choice but to step up and spend on capex, knowing fully that they might be overspending. The risk of falling behind in the AI game is bigger than the risk of overspending with an unclear ROI.

Reality Labs stands out as another notable risk for Meta. The unit has recorded losses of $6B in 2020, $10B in 2021, $13B in 2022 and $16B in 2023. Year-to-date losses in the division are around $8B in 2024. The division accounts for about 1% of Meta’s total revenue despite the enormous level of investment, and sales of the Quest 3 headset have been meager to say the least. As I stated previously, one could reasonably look at the Reality Labs division as an interesting call option on the future of technology. Meta is clearly very well positioned in the space, but with nothing but more losses predicted for the foreseeable future, investors would be right to watch this space with plenty of caution.

Conclusion

Meta is a leading mega-cap tech player which is already seeing early tangible benefit from integrating AI into its recommendation engine. The firm is trading at very attractive levels relative to the broader market, with a superior growth and quality profile. The stock is certainly not without reasonable concerns for investors, primarily regarding its high level of spending on Metaverse ambitions, spending which, quite frankly, they have very little revenue to show for.

Concerns about the stock are well understood however by markets and I think fully reflected in the current discounted valuation to history. Meta has proven itself to be a long-term compounder, its core business is massively profitable, the balance sheet is clean and returns on investor capital are excellent. Taking account of the risks and potential reward, I am happy to recommend Meta as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.