Summary:

- Target’s fundamentals are improving with positive comparable sales, driven by digital growth and innovative merchandising in categories like Apparel, Home, and Beauty.

- The Target Circle loyalty program is a key growth driver, enhancing customer insights and enabling personalized offers to boost purchase frequency.

- Strong operating rigor, prudent inventory management, and a new CFO position Target for margin expansion and continued profitability growth.

- Despite potential risks like declining ASPs and a shorter holiday season, Target is well-positioned for upside with a strategic focus on affordability and newness.

Daniel Grizelj

Introduction & Investment Thesis

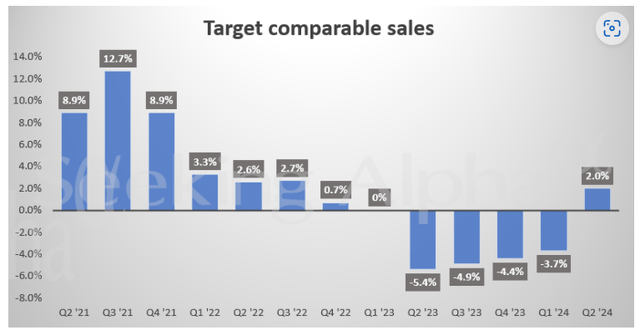

With comparable sales turning positive in Q2 FY24 after four consecutive quarters of decline and operating margins steadily rising, Target (NYSE:TGT) is showing improving trends in its fundamentals with strength in its digital business and categories such as Apparel, Home, Beauty and others.

With the management focused on affordability, newness, seasonality, and convenience, it is already seeing success in driving higher traffic and purchase volume in an environment where customer budgets continue to be constrained from an extended period of high inflation and interest rates. Moving forward, I believe that Target will continue to leverage its Target Circle loyalty program as a growth driver to onboard new members in order to unlock customer insights and drive personalized offers to accelerate purchase frequency, while innovating on its owned brands where it has higher control over quality and costs.

However, with the holiday season around the corner, there are concerns regarding sales impact to Target and retailers in general given five fewer shopping days this season. In this post, I will discuss the 3 reasons why I believe Target is positioned to smash the holiday season.

Reason 1: Comparable sales turn positive, driven by digital and newness in assortment

Target reported its Q2 FY24 earnings, where total revenue grew 2.7% YoY to $25B, beating estimates. What is particularly noteworthy is that its comparable sales turned positive in Q2 after four consecutive quarters of decline. This was led entirely by increased traffic, which managed to offset the decline in average selling price (“ASP”) when compared to a year ago.

Seeking Alpha: Improving comparable sales

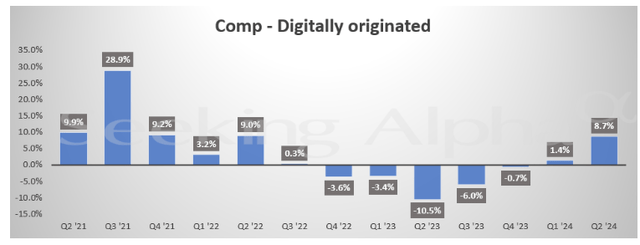

Particularly, Target saw strength in its digitally oriented comparable sales that grew 8.7% YoY, led by Drive Up and Target Circle 360, showcasing a steady improvement in trend over the last year.

Seeking Alpha: Strengthening Digital Sales

With a strategic focus on affordability, newness, seasonality, and convenience, the management is pleased with how their customers resonated with their multi-category merchandising assortment. For instance, the comparable sales in apparel saw a 3% YoY growth as the team innovated on design, newness, and value, resulting in customers embracing owned brands such as All in Motion and Wild Fable. Simultaneously, Beauty was another standout category, with comparable sales growth of 9% YoY. Meanwhile, Target continued to see traffic growth in categories where they are focused on value, such as food and beverage, with customers responding to newness in candy and brands like bubbly sparkling water.

It is worthwhile noting that Target is experiencing an improvement in its sales trends at a time where consumer budgets have been constrained by high inflation over the last few years, which showcases that the management’s strategy to focus on affordability, newness, seasonality, and convenience is working well so far, positioning it for continued growth in the coming quarters. Furthermore, the company also saw its own brands grow at a faster rate than overall revenue, given that Target has higher control over its quality and costs from its industry-leading design and sourcing capabilities.

Furthermore, this is what Rick Gomes, Chief Commercial Officer at Target, said during the earnings call, which demonstrates that the management is confident of their approach to driving growth in an uncertain macroeconomic environment.

“And yet, while the economic data remains mixed, we see a consumer that is still willing and able to spend. Yes, they’re still being choiceful. Yes, they’re budget conscious. And yes, they’re hunting for deals and everyday value. But they’re also willing to shop when they find that right combination of fashion and newness at the right price. This was on full display in our second quarter results.”

Reason 2: Target Circle loyalty program to drive higher purchase volume with its personalized offers.

Meanwhile, the company’s Target Circle loyalty program continues to see momentum with over 2M members that were added during the quarter, totaling the size of the program to 100M members. Plus, the company also added hundreds of thousands of Target Circle cardholders and Target Circle 360 members during its July Target Circle week.

I will quickly point out the difference between Target Circle and Target Circle 360 for readers here. While Target Circle is a free loyalty program that allows customers to earn rewards every time they make eligible purchases along with exclusive deals, a Target Circle card is a store card that enables customers to earn even higher rewards on Target purchases along with benefits such as free two-day shipping and more. On the other hand, Target Circle 360 is a paid membership program that is designed to expand upon the retailer’s free-to-join Circle membership, with additional perks such as same-day delivery and more.

Turning back to Target’s July Circle week, the company saw over two-thirds of total transactions driven by Target Circle members, showcasing strong customer engagement. But what is even more important with a loyalty program like Target Circle is that it helps Target gain deep consumer insights, thus enabling them to extend more personalized offers through their advertising business, resulting in higher purchase volume.

With five fewer shopping days in November than in 2023, Target is making sure it positions itself for the shorter than usual pre-Christmas shopping season as it laid out its holiday plans by announcing that it will hire 100,000 additional seasonal team members as it prepares for the upcoming holiday season. Meanwhile, it has set its Target Circle Week event for October 6-12 as part of its holiday plan, along with bringing back its Deal of the Day program, which will return November 1 through the rest of the season for Target Circle members.

Given the steady growth in its Target Circle members, along with enrollment in its Target 360 program, I believe that it should be able to continue its momentum of growing purchase volume per customer. This will be made possible with its access to customer insights on its loyalty program, enabling them to drive targeted offers, while it continues to innovate on its assortment and price points.

Reason 3: Strong Operating Rigor, Prudent Inventory Position, New CFO

During Q2, Target saw its gross profit grow 8.8% YoY on a GAAP basis with a margin expansion of 190 basis points to 28.9%, driven by their merchandising strategies, optimized category sales mix, and lower inventory shrink. Meanwhile, its operating income grew 36.5% YoY to $1.63B with a margin expansion of 160 basis points to 6.5%, showcasing management’s commitment to building back their profitability after significant headwinds that they have encountered over the last couple of years.

At the same time, the company continues to maintain a prudent inventory position, with total inventory slightly lower than the previous year. With its focus on delivering on their reliability goals, they are ensuring that they maintain inventory in categories where demand is strong while streamlining in areas where it isn’t in order to best manage its working capital position.

Finally, Target nabbed Jim Lee away from PepsiCo (NASDAQ:PEP) to be the retailer’s new CFO. This could be a bullish move as Lee will likely focus on expanding Target’s margins to their pre-pandemic levels, with Target on track to invest $3-$4B in its business to open new stores, remodel projects, and expand new supply chain facilities to boost purchase volume per customer while it innovates on newness and value.

3 possible ways Target’s recovery may halt

-

Declining ASPs can bite profit margins: It is important to note that one of the tactics Target is using to boost traffic is through discounting. For instance, during the summer, they reduced prices on about 5000 frequently purchased items, resulting in both unit and dollar sales trends in these businesses. The decision is driven by the state of consumer health, where there is increasing evidence that they continue to focus on value as they work hard to manage household budgets. With many customers delaying purchases until the moment of need, their strategy to provide “unbeatable value” makes sense. However, in doing so, the management is banking on driving traffic to offset the decline in average selling price. While this strategy can continue to benefit Target in the short term, there is a growing risk that it may ultimately come to hurt its profit margins should traffic decline from a macroeconomic slowdown.

-

Contracted Christmas shopping to hurt holiday season: There is no denying that Christmas shopping season is indeed contracted this year, given that Thanksgiving falls on November 28 in the US, which leaves five fewer shopping days between Black Friday and Christmas Eve. At the same time, Deloitte has also issued a report saying that it predicts a slower holiday sales season compared to last year with an expectation of growth between 2.3% and 3.3% on a year-over-year basis, compared with 4.3% YoY growth in the previous year. While retailers like Target and Amazon (NASDAQ:AMZN) are already moving up holiday shopping to counteract these headwinds, there is still uncertainty given the state of consumer health.

-

Uncertain consumer health: With the Fed cutting rates by 50 basis points last week as it sees early signs of economic weakness, it should ideally ease consumer finances, especially if the labor market conditions remain steady. However, with consumer credit card debt sitting at a record $1.4T, there are concerns about the enthusiasm of holiday shoppers. Should the labor market continue to soften from current levels, consumers may continue to be discerning or, worse, cut back spending, which can put brakes on Target’s recovery trajectory.

Tying it together: Positioned for upside

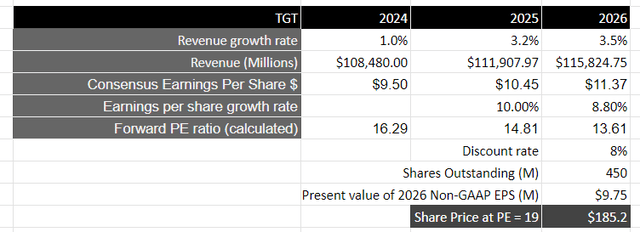

Looking forward, the management has guided comparable sales to grow 0-2% for the full year FY24. Taking the midpoint of 1% YoY growth in comparable sales as a proxy for revenue growth, Target should generate close to $108.48B in revenue. I would like to note that consensus estimates for FY24 revenue target are lower on Seeking Alpha, where it calls for a decline of -0.5%, which, I think, is overly pessimistic, especially given that its peers such as Walmart (NYSE:WMT) and Costco (NASDAQ:COST) are projected to grow in the low to mid-single digit in revenue growth on a year-over-year basis. Taking the consensus estimates for FY25 and FY26 in the low single digits, we arrive at an approximate revenue of $115.8B by FY26.

From a profitability standpoint, the management has raised its guidance for its Adjusted EPS to a range of $9.00-$9.70, thus indicating its commitment to expanding its profitability back towards its pre-pandemic levels. When looking at consensus estimates for Adjusted EPS, we can see that it is expected to grow faster than overall revenue growth, which once again points to Target continuing to expand its margins in the coming years from its current levels as it leverages its merchandising strategies and category mix, with a focus on its owned brands, to drive user engagement, higher purchase frequency, and volume from its loyalty program. This will translate to an Adjusted EPS of $11.37 in FY26, which will be equivalent to a present value of $9.75 when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Target should trade at par or slightly higher given its improving fundamentals. This should result in a PE ratio of 18-19, or a price target of $175-$185, that represents an average of 15% upside from its current levels.

My final verdict and conclusions

I believe that Target will continue to gain from its current levels and is well positioned to outperform during the holiday season. With improving fundamentals on both the top and the bottom line, I like the management’s strategic focus on affordability, newness, seasonality, and convenience to drive purchase volume. Particularly, I am impressed by the company’s ability to continue to innovate on relevant category assortment at value while expanding its profit margins at the same time. This is tied to its momentum in member addition to its Target Circle loyalty program, along with enrolling Target 360 members, enabling them to drive targeted offers, resulting in faster conversion and higher purchase frequency. At the same time, it continues to expand its owned brands across categories to have higher control over quality and costs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.