Summary:

- U has finally terminated the controversial runtime fees, while reverting to the typical SaaS subscription price hikes effective 2025 onwards.

- However, it remains to be when we may see the erosion in its customer base/topline/remaining performance obligation ends, as the management works hard to restore trust in the gaming community.

- Combined with the lowered FY2024 guidance and the expensive stock valuations, we believe that it may not be wise to chase U’s rally over the cliff.

- Things may get worse in H2’24, before eventually improving from FY2025 onwards, thanks to the price hikes.

DNY59

U Does Not Offer A Consistent Investment Thesis – Downgrade To Hold

We previously covered Unity Software Inc. (NYSE:U) in July 2024, discussing why its prospects remained highly speculative going into FQ2’24 earnings call, despite the reiterated FY2024 guidance and the promising new management team after the previous runtime fee debacle.

Despite the still elevated short interest and the potential volatility, we had believed that the stock appeared to be relatively cheap then, with it offering a speculative growth play assuming a successful turnaround ahead.

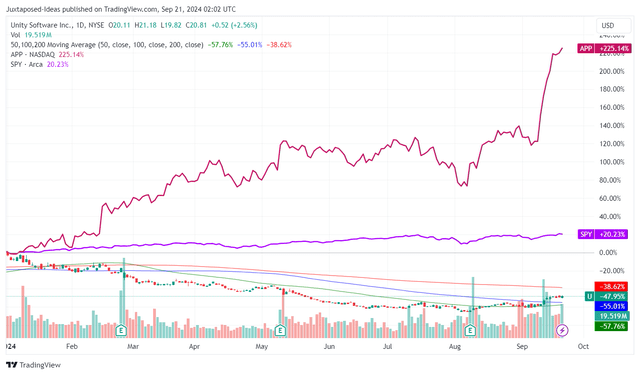

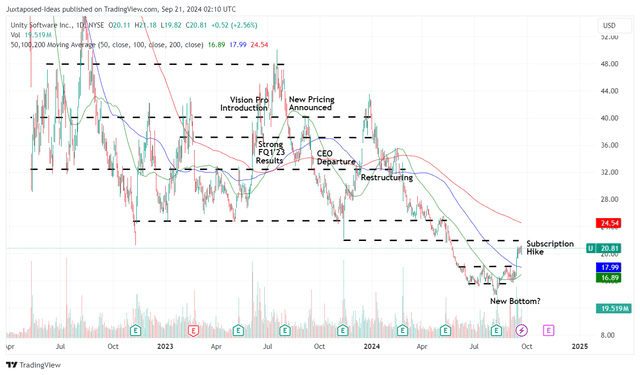

U YTD Stock Price

Since that Buy rating, U has recovered drastically by +32.2% compared to the wider market at +2.9%.

Part of the tailwinds are naturally attributed to the new management’s “intention to revert to a more traditional cycle of considering any potential price increases only on an annual basis,” particularly:

- Unity Personal will remain free with annual funding ceiling doubled to $200K and the “Made with Unity” splash screen to become optional for Unity Personal games made with Unity 6 upon launch.

- Unity Pro – funding ceiling raised to $200K and annual subscription fee per seat increased by +8% to $2.2K from January 01, 2025 onwards.

- Unity Enterprise – funding ceiling fixed at over $25M and annual subscription fee per seat increased by +25% on a customized basis from January 01, 2025 onwards.

Most importantly, U has decided to cancel the runtime fee in an effort to “reaffirm our mission and partnership with the (gaming) community,” with “no new or existing Unity games have been, or will be, subject to the Runtime Fee.”

For reference, the previous runtime fee was the biggest issue that game developers had opposed last year, since it implied that they would have to pay variable fees (potentially higher depending on the pay-per-download numbers), instead of the typical monthly/ annual subscription rate per seat.

With this issue finally out of the way, we can understand why the market has decided to award the U stock with the immense rally since it may actually trigger a new growth opportunity.

The same development has already been observed in another SaaS company, Shopify (SHOP), with the subscription price hikes already flowing into the drastically improved top/ bottom-line performance thus far.

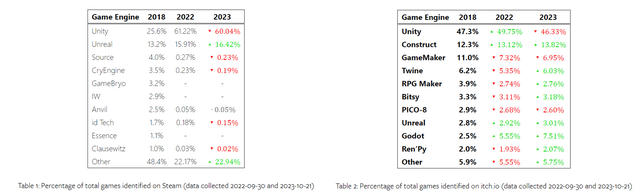

Unity’s Game Engine Market Share

On the other hand, we are less optimistic since the U management still has the immense task of restoring the gaming developers’ lost trust, one that may erode its market leading game engine share from those observed in 2023.

For now, the company already reports mixed FQ2’24 earnings call, with impacted revenue from strategic portfolio of $426M (inline QoQ/ -6% YoY) albeit with expanding adj EBITDA of $113M (+43% QoQ/ +28.4% YoY), with the latter attributed to headcount reductions.

U’s top-line is currently kept relatively stable on a QoQ basis, thanks to the Create Solutions SaaS revenue of $129M from strategic portfolio (-2% QoQ/ +4% YoY) well balancing the mixed Grow Solutions advertising revenue of $296M from strategic portfolio (+1% QoQ/ -9% YoY).

Even so, readers must note that the management has already lowered their FY2024 revenue guidance to $1.685B at the midpoint (-2.6% YoY) and adj EBITDA guidance to $345M (+25.9% YoY). This is compared to the previous guidance of $1.78B (+2.8% YoY) and $412.5M (+50.5% YoY), respectively.

The same has been observed in U’s moderating multi-year remaining performance obligation of $352M (-1.4% QoQ/ -43.5% YoY), with these developments implying further market share losses as game developers likely transition to other platforms.

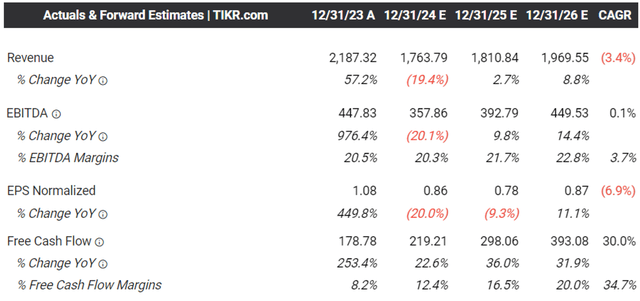

The Consensus Forward Estimates

As a result, we can understand why the consensus have lowered their forward estimates, with U expected to generate an underwhelming top/ bottom-line growth at a CAGR of +4.3%/ -14.1% between H1’24 and FY2026, respectively.

This is compared to the original estimates of +26.6%/ +72.25% of between FY2023/ FY2026 and the historical top-line growth of +36.9% between FY2019/ FY2022, respectively, with it exemplifying the market’s uncertainty about its intermediate term prospects despite the recent stock rally.

The only silver lining to U’s investment thesis will be the still healthy balance sheet with lower net debt of -$0.97B by FQ2’24, compared to -$1.06B in FQ1’24 and -$1.06B in FQ2’23.

This implies its ability to weather the near-term uncertainty, with the convertible notes of $1.2B only due by 2026 and $1B by 2027, significantly aided by the relatively rich Free Cash Flow generation of $65.04M in H1’24 (+362.2% YoY).

Even so, we believe that things may get worse in H2’24, before eventually improving from FY2025 onwards thanks to the price hikes.

So, Is U Stock A Buy, Sell, or Hold?

U 2Y Stock Price

For now, the market has reacted positively to the subscription hike, with U enjoying a nearly vertical rally of +20.8% after the announcement while breaking out of its 50/ 100 day moving averages.

Even so, given the minimal top/ bottom-line growth prospects over the next few years and the stock’s rather expensive valuations at current levels, we believe that there is a minimal margin of safety here.

At the same time, after U’s previous runtime debacle and the sudden reversal by “canceling the Runtime Fee for its games customers while increasing subscription fees for its largest customers,” it goes without saying that there is little consistency in their monetization strategy.

We are inclined to think that developers may have a hard time sticking to Unity’s gaming platform after the numerous back and forth in pricing changes, with investors likely to remain uncertain about its long-term prospects until the critical show-me-the-money moment occurs by FY2025.

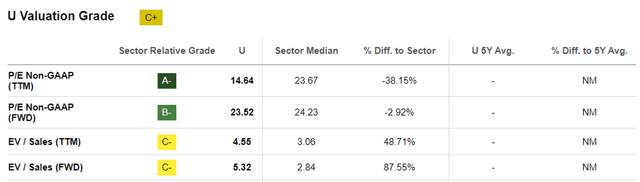

U Valuations

In addition, U continues to be rather expensive at FWD P/E non-GAAP valuations of 23.52x, albeit moderated from the 1Y mean of 31.03x while nearing the sector median of 24.23x.

Even if we are to compare U’s FWD EV/ Sales of 5.32x to its direct competitor, Epic Game’s approximate FY2023 EV/ Sales of 4x, based DIS’s latest $1.5B investment, estimated enterprise value of $22.5B, and estimated $5.62B in 2023 gross revenues, it is undeniable that there is a minimal margin of safety for those looking to add the former here.

Furthermore, based on its 1Y P/E mean of 31.03x and the consensus lowered FY2026 adj EPS estimates of $0.87, U appears to have pulled forward part of its upside potential to our updated long-term price target of $27.00.

This is on top of the ongoing equity erosion, based on the 392.53M of shares outstanding by FQ2’24 (+5.38M QoQ/ +12.18M YoY/ +278.09M from FY2019 levels).

Combined with the elevated short interest of 6.86% at the time of writing and the ongoing insider selling, we prefer to downgrade our previous Buy rating for the U stock to a Hold instead.

Do not chase this rally over the cliff.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.