Summary:

- Since we initiated on Unity Software, the company has faced major growth and profitability issues.

- With significant management changes and new leaders focused on profitability and growth, we believe the worst is behind us.

- Unity 6 upcoming release and the cancelation of the recent Runtime Fees could fuel a new growth phase.

- We updated our models based on our expectations and management guidances.

- We maintain a STRONG BUY rating, with a target price of $25.47, representing a 22.41% upside potential.

aislan13/E+ via Getty Images

Introduction

On January 11th, 2023, we initiated coverage on Unity Software (NYSE:U) with a strong buy rating and a $35 price target, citing key growth opportunities in both gaming and non-gaming sectors. We also highlighted potential synergies from the IronSource acquisition in the advertising space. However, since then, Unity’s performance has fallen short, delivering a -35% return, while the Russell 2000 (IWM) gained +18% over the same period. In this article, we’ll explain this decline and evaluate whether it presents a new buying opportunity. Then we will examine potential catalysts that could drive Unity’s recovery to finish with an updated valuation based on our assumptions and company guidance.

Unity’s Profitability Struggles and 2024 Outlook

In our previous article, we expected the company to become profitable in 2024. We were wrong. This won’t be the case due to a strong slowdown in growth especially on the digital advertising solutions business and higher than expected costs which weighted heavily on margins.

We acknowledge that it has been a recurring problem for Unity. Initially, only issues related to profitability remained. Unfortunately, some related to growth also appeared. As a matter of fact, for the year 2024, the firm forecasted revenues between $1.68-1.69bn marking a 29% decline versus the $2.19bn generated in 2023 and an adjusted EBITDA of $340-$350m versus $ -200 for the year 2023.

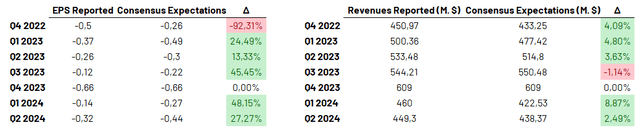

Facing a tough environment, the company revised several times its outlook and guidance after the catastrophic quarter of Q4 2023 where the group missed by 92% on EPS, printing a $-0.5 EPS versus $0.26 expected.

Since then, the consensus has revised downward its expectations.

The company has been delivering better than expected on the profitability side but the path is still long as issues remains on the top line.

The Runtime Fees Backlash and Leadership Changes

Unity’s growth challenges were, in our view, not solely due to a complex market but also a series of poor decisions.

A clear example: The introduction of the Runtime Fee.

In September 2023, Unity shifted from its original subscription model, where developers paid fees based on revenue thresholds, to a model charging fees per game install, including retroactive charges. This decision sparked rightful backlash, particularly from indie developers.

In our opinion, this decision was terrible and clashed with Unity’s philosophy of supporting developers, potentially penalizing unprofitable games and damaging even more the firm reputation by creating instability and disproportionate costs.

After the negative reaction to the Runtime Fee model, CEO John S. Riccitiello was dismissed just a month after its introduction. This explains how bad this buzz was, especially after considering that Riccitiello has been CEO at Unity for more than 9 years! Under his leadership, Unity saw significant growth but remained unprofitable. The slowdown in growth combined with a poor profitability were already problematic. This unpopular decision came as the straw that broke the camel’s back.

Bromberg’s Strategic Vision and Growth Catalysts

Since then, the company has appointed Matt Bromberg, who previously served as COO at Zynga. During his tenure, the company saw a 6-fold increase in value just before its acquisition by TTWO for $12.7 billion.

We view this positively, especially after he announced the cancellation of the Runtime Fee and reverted to the previous subscription model. Not only he cancelled run time fees, he also initiated price increases of 8% for Unity Pro and 25% for Unity Enterprise for larger customers.

As shown by this decision, we have the conviction that Bromberg is and will be mostly focused on enhancing execution and profitability which we view as positive.

On the growth side, we think that positive catalysts stand in the horizon with the upcoming launch of Unity 6, which is set to be its most stable and high-performing version yet with key improvements and new features.

According to Bromberg’s intervention Unity’s Q2 Shareholders’ letter:

Unity 6 empowers developers with faster rendering and lighting capabilities, end-to-end workflows for building, testing and running multiplayer games, extended AI capabilities and deeper support for growing platforms like mobile web and spatial computing.

Company Website Unity 6 demonstration

The company continues its expansion into sectors like healthcare and automotive, securing key clients.

Simultaneously, there is whole review of the firm leadership to implement all the changes that are needed.

The company is also rebuilding its machine learning stack to enhance its advertising business. To drive this effort, Unity recently appointed Jim Payne as Chief Product Officer for Advertising. Payne, who founded MoPub in 2010, which was acquired by Twitter in 2013, brings extensive experience to the role.

We believe these major changes are a positive signal highlighting management’s commitment to accelerate innovation in its ad tech capabilities, a sector that hasn’t delivered as expected especially when looking it’s potential.

Financials and Valuation

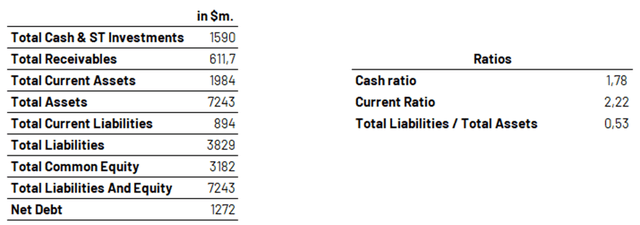

We wanted to have another look at the firm financial statement. When we initiated on Unity, the firm already had a robust balance sheet and we wanted to be sure that it was still the case. By analyzing it another time, we haven’t seen anything worrying. The firm still has a robust liquidity position with a cash ratio close to 1.8 and a current ratio of 2.22. On the other hand, total liabilities represent only 50% of the firm Total Assets.

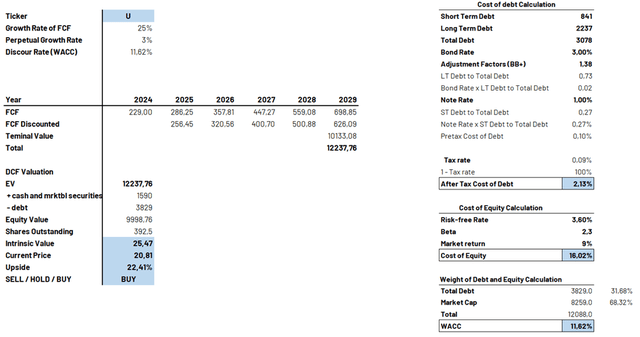

We’ve updated our valuation using a DCF model, incorporating both the company’s guidance and our own projections. Over the next five years, we foresee top-line growth in the low teens, while SG&A and R&D expenses are expected to gradually decline by 15% annually, stabilizing around $900 million and $750 million, respectively. These estimates are based on the three-year historical averages.

Management has reaffirmed its commitment to cost-cutting and operational efficiency, taking decisive action by reducing the workforce by 25% in 2024.

We anticipate further cost-saving measures in the near future.

The company has made significant investments in R&D, particularly in developing Unity 6 and enhancing its AI capabilities. With the conclusion of this R&D cycle, we expect a reduction in spending, leading to a more sustainable expense structure.

We believe the company’s strong product lineup and upcoming innovations position it well to meet these targets.

Additionally, we expect depreciation, amortization, and capital expenditures to stabilize as well.

All these elements lead us to expect a 25% Growth Rate of FCF for the 5 upcoming years.

Discounting these figures with an 11.62% WACC and using a 3% perpetual Growth Rate, we reach a target price 25.47 representing a 22.41% increase potential

Seeking Alpha, Author Forecasts

Risks and Opportunities to Watch for the Future

Our forecast will largely depend on management’s ability to reduce costs while still attracting and retaining customers, particularly with the upcoming release of Unity 6. That’s where we are seeing the majority of risks.

We also want to clarify that Unity’s valuation has always been a tricky subject, especially considering that the company had its IPO in 2021, a unique period with near-zero interest rates and, as a result, inflated valuations. The recent rate hikes have significantly penalized the company, but we believe that this pressure is now behind us, especially after the Fed’s pivot.

Furthermore, following the partnership with Apple (AAPL) on the Vision Pro, we are convinced that Unity has a unique product that appeals to even the biggest names in tech. Considering these elements, we also see Unity as a potential M&A target, which could further support the stock price in the future.

Conclusion

Despite recent underperformance, we remain confident in Unity’s ability to rebound. The challenges of the past year, including the misstep with the Runtime Fee and weaker financial results, have been significant, but we still see substantial opportunities ahead. The leadership change and strategic shifts under Matt Bromberg represent, in our view, a positive step toward profitability. With the launch of Unity 6 on the horizon and continued expansion into non-gaming sectors, we believe the company is well-positioned for growth. We trust management’s ability to control expenses and focus on high-potential areas like the non-gaming “create business”. After updating our model and assumptions, we maintain a STRONG BUY rating, with a target price of $25.47, representing a 22.41% upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.