Summary:

- When I last covered Tesla, I rated it a sell. Though I discouraged shorting the stock, I nevertheless maintained that it faced downside if fundamentals mattered.

- Today, Tesla has a catalyst, one that could potentially ramp up its revenue growth: the upcoming Robotaxi event.

- In a best-case scenario with the Robotaxi, where it achieves a wide release in dozens of cities, Tesla may have upside.

- On the other hand, if the Robotaxi either doesn’t launch or gets released in only a handful of cities like Waymo, then Tesla faces considerable downside.

- In this article, I explain why I’m upgrading my TSLA rating to hold.

Elon Musk Apu Gomes

Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) is currently preparing for its October 10 Robotaxi event, and investors’ eyes will be on what’s announced there. TSLA stock trades at a truly nosebleed valuation when using trailing earnings and growth rates, but if the company can really launch a fully autonomous global Robotaxi fleet, then it may start growing again.

Tesla is trying to build truly autonomous EVs that can run anywhere in the world, including in cities that it has never been specifically trained on. Competing services like Google’s (GOOG) Waymo have taken a more conservative approach, launching robotaxis only in cities where they were rigorously pre-trained. This distinction makes the FSD project more ambitious than competing ones, but it has also resulted in Tesla Robotaxi failing to launch, when Waymo’s comparable service is a reality in three cities.

So far, operational news about Tesla FSD has mostly come in shy of investors’ expectations. However, there have been occasional glimmers of hope. After its first quarter earnings came out, Tesla experienced its strongest open since the COVID-19 period, rising 12% in a single trading day. Hopes for the new FSD Robotaxi ran high.

The enthusiasm didn’t last long. On July 11, Tesla announced that the Robotaxi event, previously scheduled for August 8, would be postponed until October. TSLA stock crashed 7% on that day.

Now, with enthusiasm for the Robotaxi event running high again, TSLA stock is again rising. It’s not clear how much of this is event hype and how much is the post-FOMC rally in everything tech, but it’s at least plausible that the event is playing a role in how Tesla is trading. Although tech stocks in general rallied on Thursday, Tesla easily outperformed the pack, rising 7.36%. That would seem to indicate that the upcoming Robotaxi is a potential catalyst that investors see driving future returns.

It’s for this exact reason that investors ought to tread carefully with Tesla right now. The stock appears to be generating enthusiasm because of an expected future catalyst, but nobody actually knows whether the outcome on October 10 will be a positive one. If it is revealed at the event that the Robotaxi is not actually ready to launch on a specific date, that may well turn the mood pessimistic again.

This is significant because FSD and the Robotaxi are both enormous factors in Tesla’s future value. If Tesla can actually launch a Robotaxi fleet that runs in any city in the world, even in areas that it hasn’t been pre-trained on, then it will be leaps and bounds ahead of its competitors, who mainly only operate in a few select cities. If, on the other hand, Tesla cannot get FSD ready for prime time, then the company will probably continue to face declining margins due to rising competition. This is not just one author’s opinion: Elon Musk said as much himself.

When I last covered Tesla, I called the stock a sell because the stock price had run up on deteriorating fundamentals. I still think that the stock will prove to have been a sell at today’s prices if the business remains in the situation that it is in now: one of declining margins and increased competition. However, the upcoming Robotaxi event introduces an element of uncertainty about Tesla’s future prospects. If the news is very good (as in “the Robotaxi launches on this specific date” good), then TSLA stock could rally. For this reason, I think that either avoiding TSLA (for those who have no position now) or holding it at index weighting (for those who already hold the stock at a heavy portfolio weighting), is preferable to shorting it or exiting completely.

What I See Happening With Tesla

One of the reasons why I see Tesla stock as a hold, is because there are basically two outcomes with the FSD robotaxi, one where Tesla is worth much less than it’s worth today (as Elon Musk put it, “basically nothing”), and another where it’s worth considerably more than it trades for today. To illustrate what I mean by this, I need to explain two scenarios: one where Robotaxi launches successfully and another where it doesn’t.

If Tesla can pull off a wide Robotaxi release, then it will be the only such service in the world. As mentioned previously, existing Robotaxi services operate only in select cities. FSD is unique in its ambitious goal of being able to run in any city, even ones in which it has not been explicitly trained. This fact implies that the Robotaxi could make a significant revenue impact and perhaps even change the game for Tesla. Waymo’s revenue is estimated at $1.4 billion per year, and its Robotaxi service is only available in three major cities. If Tesla can get Robotaxi into thirty cities and with the same amount of revenue per ride/delivery as Waymo, then it should get $14 billion in new revenue from the service. An extra $14 billion in revenue would imply 14.6% revenue growth for Tesla going by TTM revenue. Additionally, Tesla is aiming to have Robotaxi live in far more than 30 cities, although in a later section on risks, I don’t think it would be wise to model TSLA’s revenue assuming that that can be done.

In addition to the scenario where Robotaxi can achieve a wide release, there are also scenarios where it either can’t launch at all, or only launch in a very small number of cities, like Waymo. The possibilities in this scenario range from $0 billion in revenue (service doesn’t launch at all) to $1.4 billion (service achieves Waymo’s scale). In this set of scenarios, the revenue impact to Tesla is small or non-existent. $1.4 billion in new revenue is only 1.46% revenue growth for Tesla.

The above scenarios explain why I consider Tesla a hold prior to the Robotaxi event. If the news at the event is good, then Tesla’s growth and margins can ramp up and result in forward multiples lower than those we have today: in this scenario, the stock is not as expensive as it looks. On the other hand, if the news is bad, then there is little reason to think the company’s growth will resume, as in this scenario the company is just a car company facing rising competition. We need to see the results of the coming announcement before we can actually say what the company is worth. So the stock should either be avoided or held at index weighting; the lack of availability of crucial information makes it unsuitable for an overweight position.

Valuation

A great way to get a grasp of how important the results of the Robotaxi event are to Tesla’s fortunes, we can attempt to value the stock.

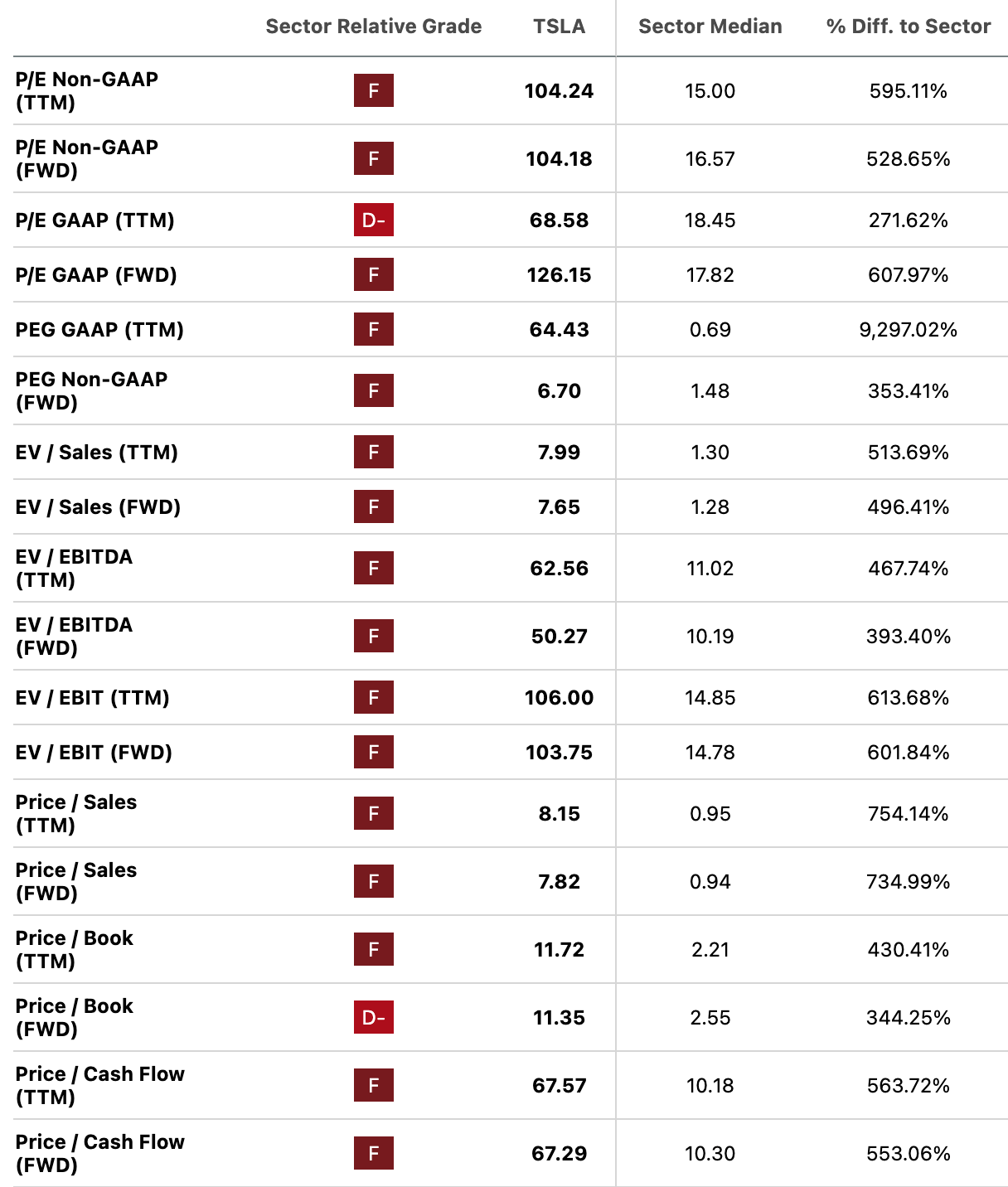

Going by multiples, Tesla is a pricey stock. Below, you can see the multiples that Seeking Alpha Quant has on file. The P/E, price/sales, price/book, and price/cash flow are all above the sector median–in many cases, five or six times higher!

Tesla multiples (Seeking Alpha Quant)

One multiple here is particularly worth paying attention to: the PEG ratio. It is a full 9,297% higher than that of the consumer discretionary sector! If Tesla is to be valued like a typical consumer discretionary stock with no growth, then its price ought to fall. Additionally, if the lack of growth persists, then Tesla’s cash flows simply do not justify the current stock price. $0.54 in FCF per share, under a no-growth assumption and a 1% discount rate, is worth $54. That’s about 75% downside to today’s price, and I’m using a discount rate here that is far less than the 10-year treasury yield. For even this $54 estimate to hold requires the Fed to cut rates to near-2021 levels and for “0% growth” to be a risk-free proposition for Tesla, justifying the lack of a risk premium in the discount rate. Given the -27% EBITDA growth actually observed in the TTM period, Tesla growing at 0% does not a pear to be a riskless “sure thing.” So actually, in a no-growth scenario, Tesla’s cash flows should be discounted at a rate higher than 1% and be valued at less than $54.

However, there is another possible scenario here, which is the one where the Robotaxi event delivers the goods. If Musk gets on stage at the event and says, “FSD has been perfected, and 30 cities have given us all the regulatory approvals we need to launch it,” and if officials from the 30 cities later say that he was telling the truth, then as mentioned earlier, that’s something like $14 billion in new revenue. The “no growth” assumption proves unwarranted here, and upside is theoretically possible.

A Note on Risk

Earlier in this article, I modelled Tesla’s marginal revenue in a “Robotaxi turns out to be legitimate” scenario as $14 billion. This depended on the assumption that the Robotaxi could be launched in 30 cities in a reasonable timeframe. A Tesla bull might look at this and say, “you’re lowballing the estimate, Tesla’s ambition is to launch the Robotaxi worldwide.” The reason why I went with a relatively conservative 30 cities is because there is a lot of red tape in launching a product with major public safety implications, and a serious risk of the launch being cancelled by politicians.

Autonomous taxis require regulatory approvals. In California, for example, manufacturers require the “driverless deployment permit”–and California is known for being relatively friendly to driverless cars. It would not be prudent to assume that Tesla can get the Robotaxi out to hundreds of cities, but 30 appears do-able, as that’s close to the number of cities with over 500,000 inhabitants in the U.S., Tesla’s home turf and the country whose legal system the company is most familiar with. Any thesis based on the assumption of a launch in 100+ major cities worldwide faces the risk of the actual launch coming in below estimates.

The Bottom Line

There is definitely a scenario in which Tesla has upside. If the Robotaxi: a) becomes a reality; and b) achieves a wide release; then Tesla will likely start growing again. It could have upside here. But the downside in a scenario where growth remains stuck at 0% is immense. For this reason, investors will need to see what happens at the upcoming event before they can justify being long TSLA at greater-than-index weighting. The critical information for analyzing the stock is not in the public domain right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.