Summary:

- Devon Energy’s strategic acquisition in the Williston Basin diversifies its production footprint and is expected to drive earnings growth.

- The company has increased its stock buyback authorization to $5B, enhancing its appeal as a top capital return play.

- Devon Energy’s valuation remains attractive with a forward P/E ratio of 6.9X, offering potential long-term capital upside.

Torsten Asmus

Devon Energy (NYSE:DVN) announced a strategic acquisition in the Williston Basin in the third quarter, which is further diversifying the independent E&P company’s production footprint. Devon Energy is also set to buy back more of its own shares in the market, which could make DVN interesting for investors that look for higher capital returns. In addition to a 4% dividend yield, the E&P company has guided to buy back $5B of its own shares. OPEC+ members also have proven to be highly accommodating with voluntary production cuts so far in FY 2024, propping up petroleum prices. Devon Energy obviously faces attractively long-term free cash flow prospects as its production base is growing, and the latest acquisition is set to be accretive to earnings as well.

Previous rating

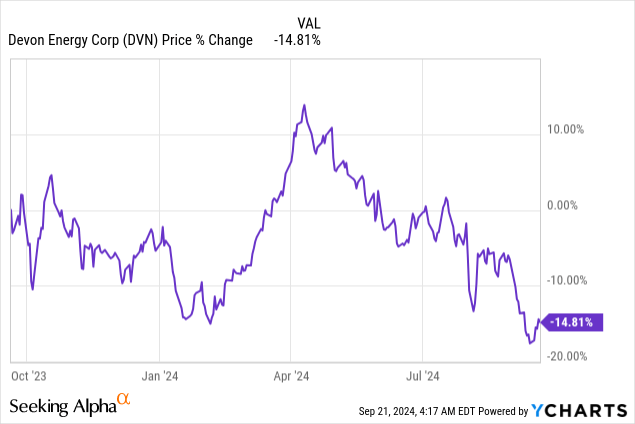

I rated shares of Devon Energy a buy in July, as the consolidation at the time presented an opportunity for growth investors: Consolidation Creates Buying Opportunity. Since my last recommendation, the share price of Devon Energy has decreased by 12% which makes a purchase in the context of the firm’s latest acquisition only more attractive. Devon Energy is set to become a top capital return play following the acquisition of another company in Q3, and shares are trading for a very reasonable forward P/E ratio.

Broadening portfolio footprint

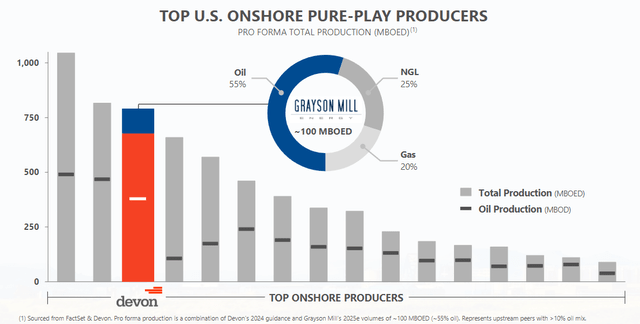

Devon Energy is one of the largest independent E&P companies in the U.S. and the proposed acquisition of Grayson Mill — which adds acreage in the important Williston Basin and which was announced in the third quarter — is set to make DVN the third-largest producer in the industry. Besides acreage in the Powder River, Anadarko, Delaware and Eagle Ford basins, the Williston Basin is an important shale area in the U.S. and as of the June quarter represented 9% of the company’s total production.

A few months ago, in July, Devon announced the acquisition of Grayson Mill, a shale player active in the Williston Basin for $5.0B: $3.25B were arranged as cash payment + $1.75B in stock. The deal is meant to broaden Devon Energy’s production footprint — it added 307,000 net acres — and further geographically diverse its revenue streams. The acquisition is expected to add 100k BOE/D to Devon’s production in FY 2025 with an approximate mix of 55% oil, 25% NGL and 20% gas. The deal is expected to close by the end of the third quarter.

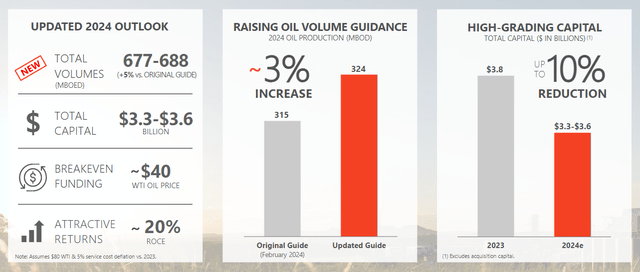

The transaction allowed Devon Energy to revise its production guidance for FY 2024: the company now expects total oil production of 324 MBO/D, showing a 3% increase compared to the previous outlook. Total production (including NGL and natural gas) is set to hit 677-688 MBOE/D, showing 5% growth compared to the earlier projection.

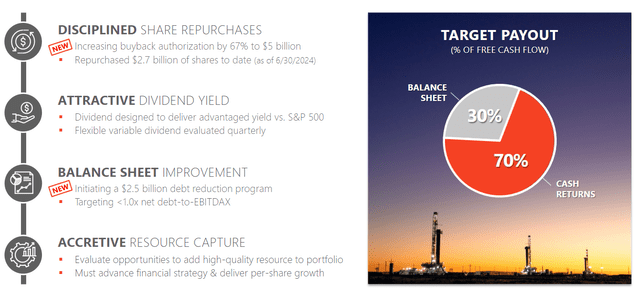

Investors can expect accelerating capital returns

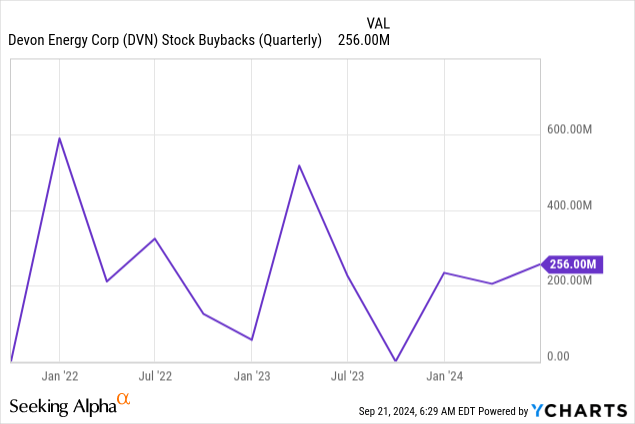

I like Devon Energy more than I did two months ago because Devon Energy raised its stock buyback authorization from $3B to $5B, showing an increase of 67%. Devon Energy has guided for a 70% free cash flow payout ratio and was a respectable capital return play even before it announced the acquisition of its latest acquisition target. The raise in the stock buyback authorization is set to make the company that much more attractive as a capital return play: the $2B incremental buyback allows the company to retire an additional 8% of its currently outstanding shares.

In the second-quarter, Devon Energy completed $256M in stock buybacks, and the company has consistently bought back its shares in the market in the last several years. Additionally, the E&P company announced $276M in dividends (including a variable dividend of $0.22/share to be paid at the end of September). In the second-quarter, Devon Energy also achieved total shareholder distribution of $532M, also showing a free cash flow payout percentage of 70%.

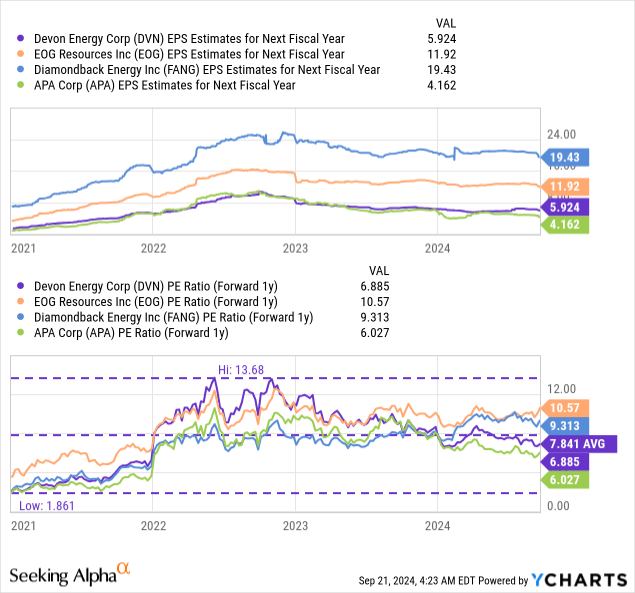

Devon Energy’s valuation

Devon Energy is trading at an attractive earnings multiplier compared to other independent E&P companies, potentially providing investors with long term capital upside. Devon Energy is currently trading at a forward P/E ratio, based off of FY 2025 estimates, of 6.9X which compares against a longer term, 3-year price-to-earnings ratio of 7.8X.

Rival E&P companies include EOG Resources (EOG), APA Corp. (APA) and Diamondback Energy (FANG) which trade at P/E ratios between 6.0X and 10.6X. The industry group average price-to-earnings ratio is 8.2X. If Devon Energy were just to revalue to the average P/E ratio in the E&P group, shares could have a fair value of $49. In the longer term, considering that Devon Energy can grow its portfolio, free cash flow and earnings related to the Grayson Mill acquisition and maintain a 70% free cash flow payout ratio, I believe a 10X earnings multiplier is not unrealistic for the company to achieve: this would lift Devon Energy’s fair value estimate to $59, implying up to 44% revaluation upside.

Risks with Devon Energy

Devon Energy is focused on the most important shale plays in the U.S. which makes the company a concentrated producer with significant earnings and free cash flow upside in a rising-oil world, but it also has significant and outsized earnings risks if energy prices start to fall. What would change my mind about Devon Energy is if the acquisition of Grayson Mill does not yield the expected incremental production benefits and synergies or if the energy company were to see a drop in its production volumes going forward.

Closing thoughts

Devon Energy is a promising shale energy play that is set to become the third-largest onshore producer in the market after the transaction with Grayson Mill closes. I specifically like that Devon Energy is still trading at a relatively low valuation based off of earnings and that the company raised its stock buyback authorization to a solid $5B. I believe Devon Energy’s dividends (currently implying a 4% dividend yield) and stock buybacks make the company an attractive capital return play for growth and dividend investors. With Devon Energy also raising its production guidance and buying back a ton of stock on a recurring basis, I also believe that the downside potential here is quite limited.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.