Summary:

- Johnson & Johnson (JNJ) is showing signs of a topping pattern with negative divergences in momentum indicators, suggesting potential price weakness ahead.

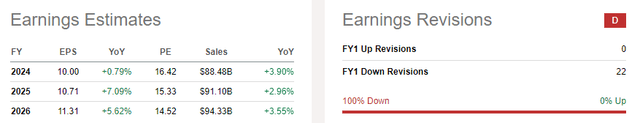

- The stock is expensive based on forward P/E and free cash flow yield, with poor growth prospects and negative earnings revisions.

- Despite favorable seasonality, JNJ may underperform in a risk-on market environment as defensive sectors lag.

- The dividend yield is attractive, but overall, JNJ is a sell due to limited growth and high valuation.

yuelan

The bout of selling we’ve seen in the equity markets since the summer months have created a new set of winners and losers in the equity markets. Typically during periods of weakness, we see defensive areas like consumer staples and healthcare lead the market. This bout is no different, and one big beneficiary has been dividend legend Johnson & Johnson (NYSE:JNJ). The stock has performed quite nicely in the past three months, but it is my belief that is about to end and that if you’re in the name, you might consider the possibility that we see lower prices in the coming weeks.

Topping is likely in progress

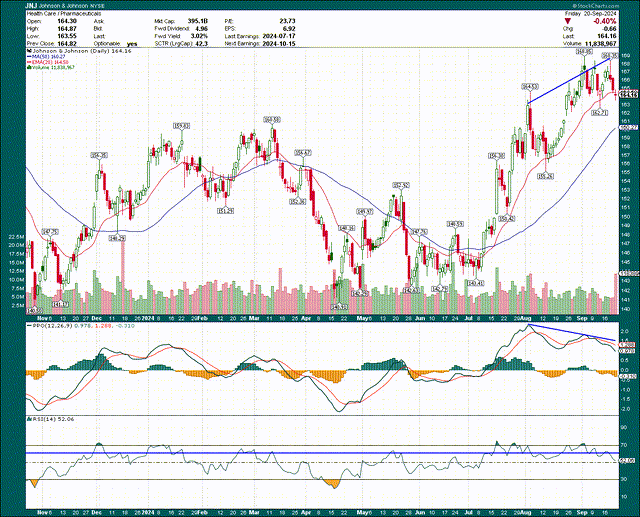

We’ll start with the price chart, which shows what, I believe, is a topping pattern ahead of relative weakness in the coming weeks. Here’s the daily chart, onto which I’ve drawn a negative divergence on the PPO.

The blue lines connecting the move from early August to mid-September on the price chart correspond to a much lower high on the PPO (second panel). That generally portends price weakness as it shows we have a higher price without confirmation of higher momentum. Essentially, it can mean buyers are drying up. As negative divergences go, this one is quite glaring, so I’m inclined to heed the warning.

The RSI is also below the 60 level, which is generally resistance during weak periods. I suspect that we won’t see the RSI go over 60 for some time now, but if I’m proven wrong about the direction of JNJ going forward, an RSI over 60 or 65 would be an early warning sign that the bulls are back in charge.

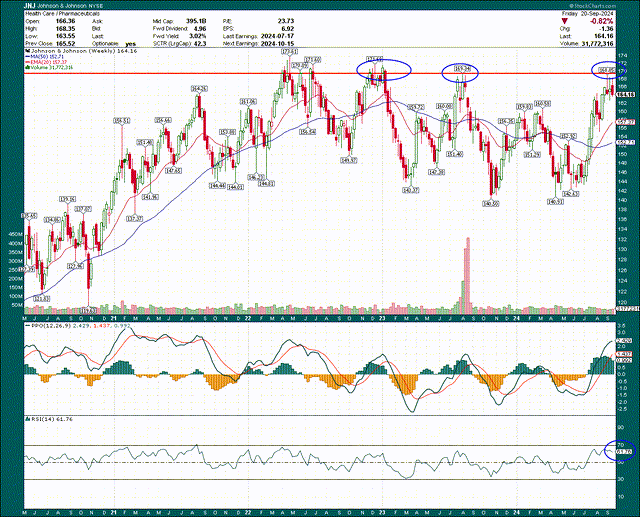

Let’s look briefly at the weekly chart, which in my view, lends more credence to the bearish case.

We can see that the high-$160s have been a brick wall for the bulls for years. That level failed yet again in recent weeks on multiple attempts. We also have the RSI right at that 60 level and rolling over, while the PPO is extremely overbought and also rolling over. All of these points, in my view, to lower prices ahead. In essence, the bulls are looking quite tired right now and that means that if you want to own JNJ, I’m thinking you can get a better price in the coming weeks.

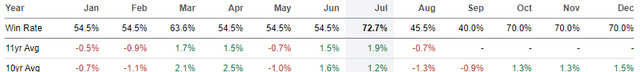

To balance this, we do have quite a favorable seasonality ahead.

The next three months all have 70% win rates, and all have mid-1% average returns. These are hardly massively bullish numbers, but it does mean the odds from a seasonality perspective are in the favor of the bulls.

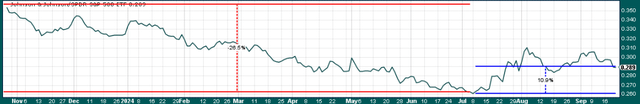

Now, to be fair, JNJ ignored seasonality in August and September so it’s totally possible we see that again in the coming weeks or months. Indeed, I think we see a reversion of the move we’ve seen in the past several weeks as illustrated below.

I mentioned defensive areas tend to outperform during weak periods, and there’s a clear delineation between the bullish and (relatively) bearish equity market periods above. JNJ underperformed the S&P 500 by 26% from last October’s low to the July peak, but has reclaimed 11% since the July peak. I think the equity markets are going to rally into year-end, and if that’s the case, JNJ will almost certainly underperform once again. In short, the time to own JNJ was three months ago; not today.

Not enough growth, and too expensive

Looking forward at a fundamental basis, we can see anemic movement in both the top and bottom lines and no justification from where I’m sitting to run out and buy this stock.

Earnings are expected to be flat this year, and modest mid-single digit growth in the coming years. The problem is that revisions have been awful, with a full 100% of the past 22 revisions coming in negative. In other words, while estimates just aren’t very good right now, they’re getting even worse. Unless and until that situation improves, why would you want to put money to work here?

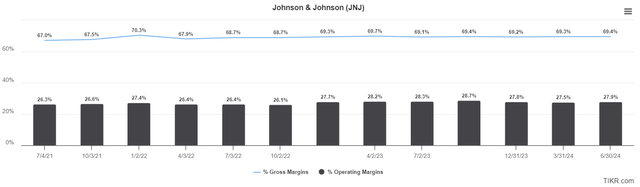

JNJ has always shown modest sales growth given the products it sells are generally consumer staple-oriented or healthcare, obviously, so demand is pretty stable. That leaves margins as a primary growth driver, but we don’t see a lot there either. Below are trailing-twelve months gross and operating margins to illustrate this point.

Gross margins haven’t moved for years, and neither have operating margins. While there isn’t ground being lost, it’s not exactly inspiring the bulls here. We often see this with conglomerates like JNJ because there are so many moving pieces (hundreds or thousands of products) and we see periods of strength in certain lines of business offset weakness in others. While that’s the entire point of having a conglomerate, it also means growth options are limited.

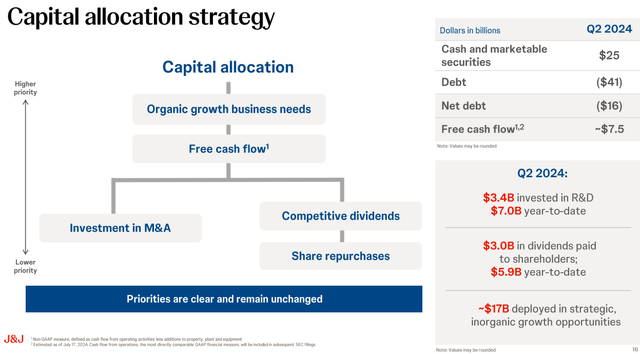

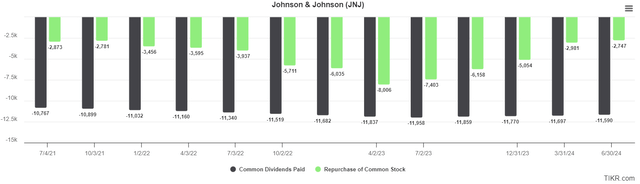

We know that as growth options go, sales and margins aren’t likely to amount to much. The final option is reducing the float, such that earnings are spread over fewer shares. JNJ has done a fair amount of buying back stock, but we can see below that buybacks simply aren’t a priority.

JNJ’s priorities haven’t changed so it’s not like this is news, but with repurchases at the bottom of the capital allocation totem pole, it’s quite unlikely to be a meaningful source of returns in the coming years.

Indeed, we can see that trailing twelve months of buyback spending has dwindled to just $2.7 billion, which is just six-tenths of one percent of the market cap. It’s meaningless.

If we sum up the company’s growth prospects, we’re looking at almost nothing from the buyback, almost nothing from margins, and maybe 3% from the top line. What’s more, with what I would characterize as a weak backdrop in growth prospects, the stock is too expensive.

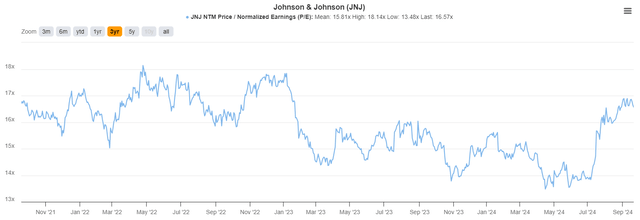

Below we have three years of forward price-to-earnings data, which in my view, shows this rally has come too far for the time being.

We’re at 16.6X forward earnings, which is ahead of the three-year average of 15.8X, but also ahead of the entirety of 2023 and 2024. On this measure, I’d say JNJ is quite expensive.

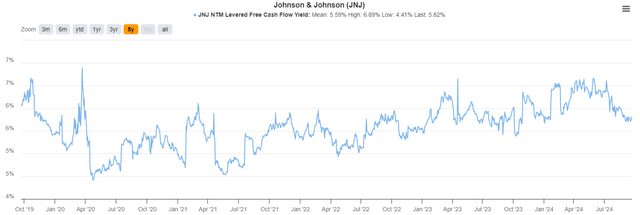

If we measure the stock’s valuation on a free cash flow yield basis, the picture isn’t a lot better.

JNJ’s FCF yield is 5.8%, a ~4% premium to its five-year average. Is it ludicrously expensive? No, but given a massive slate of negative earnings revisions, this stock should be trading near its low in terms of valuation metrics, and it simply isn’t.

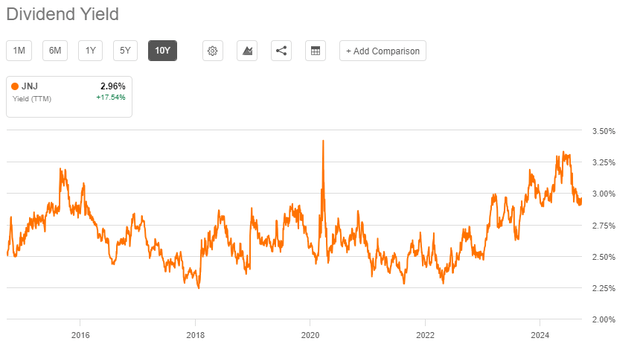

Finally, the one place where it does seem more positive for the bulls is the dividend yield. Obviously, JNJ is a legendary dividend stock and its yield is extremely important to shareholders.

The stock has been nearer to the top end of its yield range over the past five years than the bottom, so that’s one balancing factor in the valuation discussion.

Slapping a sell on JNJ

While the yield is decent, I simply cannot ignore the balance of evidence. We have the forward P/E ratio and free cash flow yield as valuation metrics showing the stock is too expensive. If JNJ were on a growth tear, those things would be fine. However, analysts seem not to be able to cut estimates quickly enough, so it’s simply too expensive.

In addition, it is my view we’ll see the equity markets show more risk-on behavior into the year-end period, meaning consumer staples and healthcare – defensive-oriented names – will underperform again. Putting this all together, JNJ is a sell as there are countless better places for your money to be heading into year-end.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.