Summary:

- Despite declining mortgage rates, Opendoor’s share price remains under pressure due to economic uncertainty and its dependence on home price stability.

- The housing market’s current illiquidity and poor price discovery increase the risk of Opendoor struggling to move inventory.

- Opendoor’s balance sheet is probably strong enough for the company to weather a downturn but access to outside capital may be needed if/when the company returns to growth.

Phillip Spears/DigitalVision via Getty Images

Despite declining mortgage rates, Opendoor’s (NASDAQ:OPEN) share price remains under pressure due to the uncertain state of the economy. This is most likely because Opendoor’s business is far more dependent on home price stability than market transaction volumes. While lower rates should help to stimulate volumes, there is an elevated probability of this coinciding with economic weakness and lower home prices.

The last time I wrote about Opendoor I suggested that expecting the stock to rise as rates declined was overly simplistic thinking. While mortgage rates are down over half a percent since then, Opendoor’s share price has fallen more than 50%.

Opendoor can likely weather an extended downturn, provided it is not overly severe, but it still needs to demonstrate the long-term viability of its business model. Partnerships appear to be lowering customer acquisition costs, which have been a problem. Improved brand recognition and a healthier housing market should also help in this regard. Opendoor also needs significantly greater scale to reach breakeven, but this will be difficult to achieve while the housing market remains volatile.

Market Conditions

Home sales remain at extremely depressed levels, down almost 50% compared to the 2021 peak. While there has been an expectation that lower rates would strengthen the market, Opendoor recently suggested that it has seen evidence of softening. This includes clearance rates, which are 30% lower than last year, and an increased number of sellers who are delisting. Opendoor also suggested that home price appreciation entered negative territory in June, two months earlier than a typical year. Opendoor has responded to this situation by widening its spreads to ensure that it is pricing effectively.

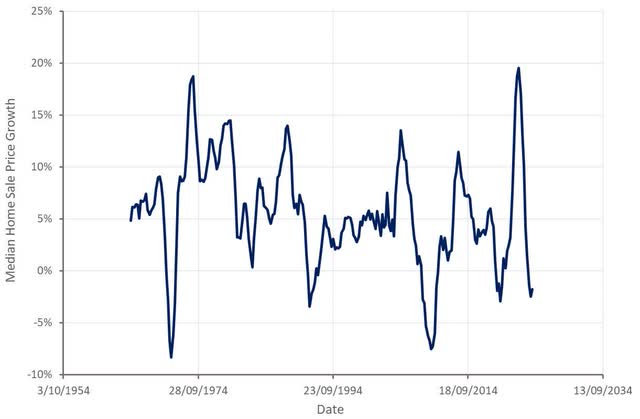

The housing market is illiquid at the moment, and price discovery is poor as a result. While home price indexes are generally showing rising home prices, median home sale prices are declining. This is a result of demand shifting to more affordable housing. This situation probably means that there is an increased risk of Opendoor having trouble moving inventory.

Figure 1: Median Home Sale Price Growth (source: Created by author using data from The Federal Reserve)

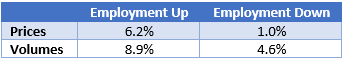

Opendoor needs predictable prices more than it needs strong transaction volumes. As a result, Opendoor doesn’t necessarily stand to benefit that much as mortgage rates decline. If unemployment rises, home prices will come under pressure, which would be very bad for Opendoor. As a result, macro uncertainty is more important to Opendoor at the moment than declining interest rates.

Table 1: Impact of Employment on the Housing Market When Rates are Declining (source: Created by author using data from The Federal Reserve)

Opendoor Business Updates

Opendoor is trying to simplify the home buying/selling process and provide certainty to sellers. It does this by purchasing homes directly from sellers, using data and machine learning to determine its offers. After purchasing and renovating a home, Opendoor aims to sell it as quickly as possible at a small profit. While iBuying presents a large opportunity, margins are low, and no company has really proven the viability of the business model. To be successful, iBuyers need scale, operational efficiency and low customer acquisition costs.

In terms of customer acquisition, Opendoor is focused on partnerships to reduce costs. This includes homebuilders, agents and online real estate platforms. Customer acquisition costs through these channels are fixed, which should help Opendoor to reach more sellers in a cost-efficient manner. In total, over 40% of Opendoor’s volume is now coming through partners. Opendoor believes there is still room to increase its share with homebuilders and is trialing a List with Opendoor solution with one of its largest homebuilder partners at the moment.

Opendoor is also shifting its marketing mix to try and strengthen its brand. This makes sense given that in the markets where Opendoor’s aided awareness is 45%, it sees a 33% higher offer to contract conversion rate compared to markets with an awareness of 26%. Over half of Opendoor’s markets were launched in 2021 and 2022 and Opendoor’s awareness rate could reasonably be expected to rise over time as a result.

Sellers can now also choose to sell directly to Opendoor, or they can List with Opendoor and partner with an agent that Opendoor has prequalified and trained. The agent lists the home, while still providing the seller a 30-day window in which it can choose to accept Opendoor’s offer. This provides sellers with price discovery while allowing them to keep the certainty provided by Opendoor’s cash offer. List with Opendoor has led to a 10-point improvement in Opendoor’s Net Promoter Score in the relevant markets. List with Opendoor could be risky, though, as it increases the probability that sellers will only accept Opendoor’s offer when it is too high. List with Opendoor was expanded to nearly all of Opendoor’s markets in the second quarter.

Opendoor is also divesting its Mainstay market intelligence and data platform, allowing it to focus on its core business and simplify its cost structure. Mainstay will operate independently, and Opendoor will retain less than 50% ownership on a fully diluted basis. Opendoor doesn’t anticipate recognizing Mainstay’s financial results going forward. Mainstay has been contributing minimal revenue while adding around $17 million USD of adjusted operating expenses.

Financial Analysis

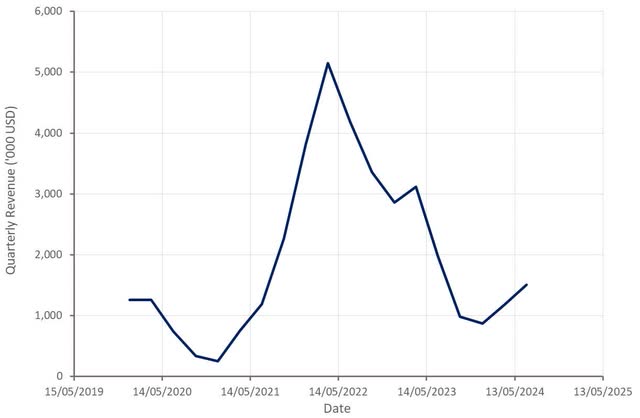

Opendoor generated roughly $1.5 billion USD revenue in the second quarter, a 28% sequential increase, driven by higher acquisition volumes in recent quarters. Opendoor has been ramping its business after a period of softer acquisitions in 2023. The company purchased 4,771 homes in Q2, up nearly 80% YoY due to lower spreads, increased marketing and larger contributions from partnership channels.

In response to weaker market conditions, Opendoor is now widening its spreads to ensure that it is pricing effectively. This will impact acquisition volumes going forward, and eventually sales. As a result, third quarter revenue is expected to be between $1.2 billion and $1.3 billion USD, representing close to a 30% YoY increase.

Figure 2: Opendoor Revenue (source: Created by author using data from Opendoor)

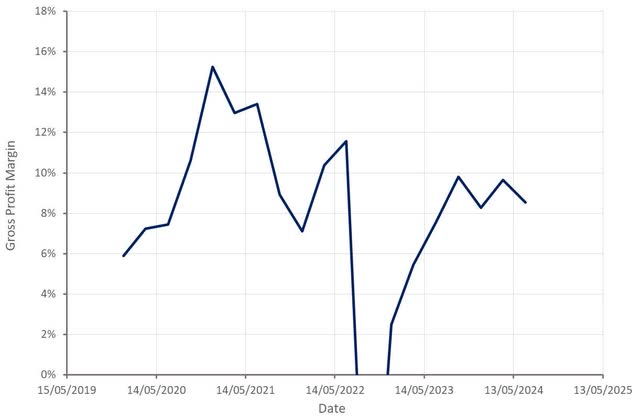

Opendoor’s contribution margin was 6.3% in the second quarter, with outperformance driven by Opendoor selling more newly listed homes with shorter holding times than anticipated.

Opendoor has responded to market weakness by lowering prices to maintain clearance levels within target levels, which will impact contribution margin going forward. As a result, Opendoor expects its third quarter contribution margin to be between 2.9% and 3.5%. If current macro trends persist, Opendoor may not meet its full year 5% – 7% contribution margin target.

On a more positive note, the NAR settlement could lead to lower commissions, which could benefit Opendoor by lowering its selling expenses. Opendoor suggested that between April and August, there were 15 basis points of compression on the commission side. It will take time for the impact of this change to become apparent, though. Lower commissions will reduce Opendoor’s costs, but this may just end up being passed through in the form of lower home prices, depending on market structure.

Figure 3: Opendoor Gross Profit Margin (source: Created by author using data from Opendoor)

Opendoor’s adjusted operating expenses totaled $100 million USD in the second quarter, down from $107 million USD in the first quarter. This was largely the result of Opendoor reducing advertising spend by around $6 million USD.

Adjusted EBITDA loss was $5 million USD in Q2, compared to an adjusted EBITDA loss of $50 million USD in the first quarter. Adjusted EBITDA loss is expected to be between $60 million and $70 million USD in Q3.

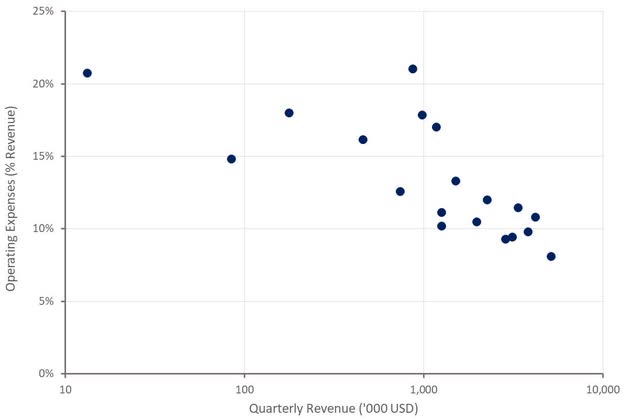

While Opendoor has had some success controlling its operating expenses in recent quarters, it remains a long way from breakeven. The company probably needs to be generating around $3 billion USD revenue a quarter to achieve GAAP operating profitability. This is unlikely to occur while concerns about mortgage rates and housing affordability persist.

Figure 4: Opendoor Operating Expenses (source: Created by author using data from Opendoor)

Opendoor ended the second quarter with $1.2 billion USD in total capital, including $809 million USD in unrestricted cash and marketable securities and $300 million of equity invested in homes and related assets. The company also has $7 billion USD in non-recourse asset-backed borrowing capacity, of which total committed borrowing capacity is $2.3 billion USD. While this provides Opendoor with substantial capacity to weather a downturn, the company could rapidly consume this cash and borrowing capacity if/when it returns to rapid growth.

Conclusion

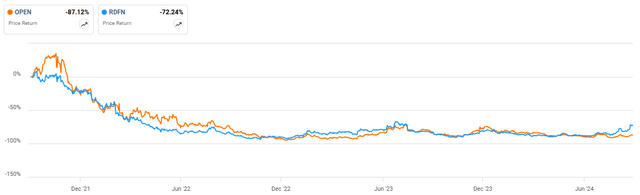

Opendoor’s share price has diverged from companies like Redfin in recent weeks due to the likely impact of evolving macro conditions. While companies exposed to transaction volumes should benefit from a decline in rates, even if it occurs alongside a recession, Opendoor needs home price stability for its business to function.

Figure 5: Opendoor and Redfin Share Price Returns (source: Seeking Alpha)

Opendoor has managed recent market conditions relatively well, but it hasn’t been properly challenged yet. Changes in home prices are an important determinant of risk and profitability, and home prices have been fairly stable, despite a large drop in transaction volumes.

An extended housing market downturn may not be a death sentence for Opendoor, though. Similarly, a strong housing market is unlikely to help Opendoor achieve profitability. The company still needs greater scale, while maintaining efficient operations, and it needs to lower customer acquisition costs.

Opendoor’s high Net Promoter Score indicates that users value its service and there is a large opportunity in adjacent markets, like title and escrow, loans and insurance. While these markets are not as large, they offer far better margins. Success in adjacent markets is likely a necessity given the low margin and volatile nature of Opendoor’s core business.

Opendoor believes that its serviceable addressable market is currently around $650 billion USD, compared to a total real estate market of $1.6 trillion USD. Based on this serviceable addressable market, Opendoor is probably targeting something like $20 billion USD revenue under normal market conditions. Even with low margins, this could provide significant upside. The path to this type of outcome appears increasingly narrow, though.

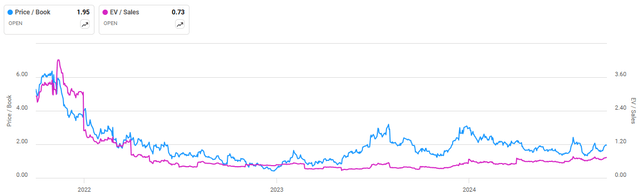

Figure 6: Opendoor P/B and EV/S Ratios (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.