Summary:

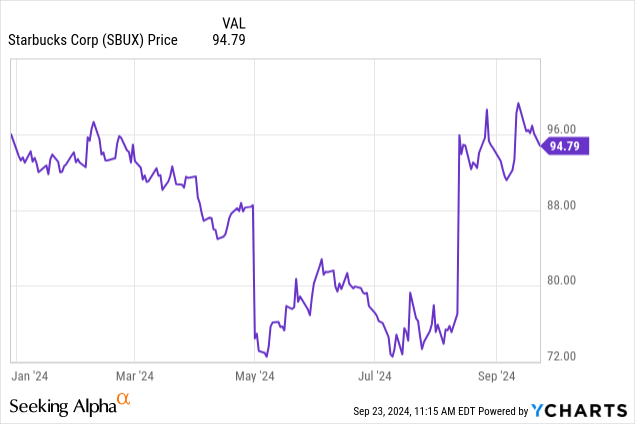

- I’m initiating Starbucks with a sell rating, as the stock has soared to unsustainable premiums in the wake of Brian Niccol’s hiring as CEO.

- Declining comparable sales and weak international performance, especially in China, underscore Starbucks’ weak competitive positioning and operational challenges.

- The chain also lags behind many fast-food and restaurant peers in automation, which could be a long-term solution to the company’s declining operating margins.

- Investors should consider selling Starbucks at $95 and look for better opportunities to buy back in the future.

JohnFScott

With the S&P 500 continuing to soar toward new all-time highs, the core question for investors to answer now is: how can we position our portfolios to cushion for a potential fall? Though it’s true that lower interest rates provide for less competition against stocks, the market is trading at dangerous premiums.

Even many large companies that are truly struggling are trading at elevated multiples, including and especially Starbucks (NASDAQ:SBUX). The global coffee giant has been a firestorm of news lately, especially with former Chipotle (CMG) CEO Brian Niccol being helicoptered in to stage a turnaround for Starbucks.

I am initiating Starbucks at a sell rating. In my recent article on rival Dutch Bros (BROS), I noted how Dutch Bros is gaining share against Starbucks domestically, thanks to its faster drive-through format and simpler menu offerings. Elsewhere, both in the U.S. and nationally, Starbucks faces immense competition from “third wave” coffee roasters.

As an avid coffee drinker and a habitual Starbucks customer, it’s fairly easy to see that the coffee industry is having its version of a craft beer moment: customers are eschewing larger brands and turning more toward local, homespun roasts. In grocery store aisles, though Starbucks pre-ground Pike Place blends tend to retail for $7-8 per 12-ounce bag, versus $14-$15 for specialty roasts, the latter appears to be taking up more and more shelf space.

And though the specialty coffee trend started in the U.S., from Starbucks’ incredibly weak international results we can see that this trend is likely playing out overseas as well. In my view, it’s time to sell Starbucks and invest elsewhere.

Declining trends, everywhere we look

Let’s first laser in on what’s paining Starbucks the most: weak comparable sales, which is a measure of revenue growth that strips out the impact of store openings and closures.

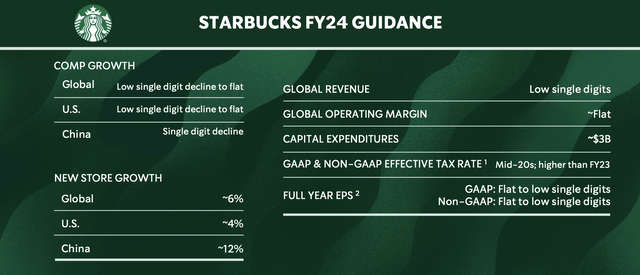

Starbucks FY24 outlook (Starbucks Q2 earnings deck)

As shown in the snapshot above, the company is guiding to low single digit declines in comparable sales globally, with weak performance especially in China. Its primary strategy to counteract weaker comp sales is, naturally, to open more stores, with the company planning to end FY24 (which will complete in September 2024) with 12% location growth in China.

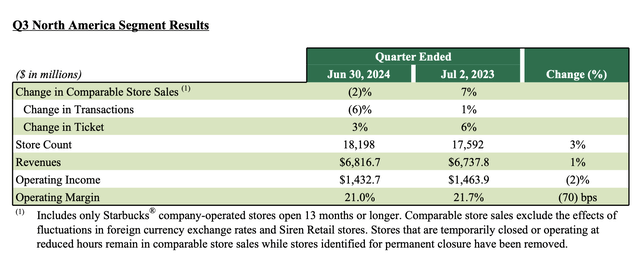

In North America, as shown below, comparable sales declined by -2% in the most recent (June) quarter. And yet when we strip out the impact of price hikes and sales mix (contributing to 3 points of y/y revenue growth), transaction counts were even weaker at a -6% y/y decline.

Starbucks North America results (Starbucks Q2 earnings deck)

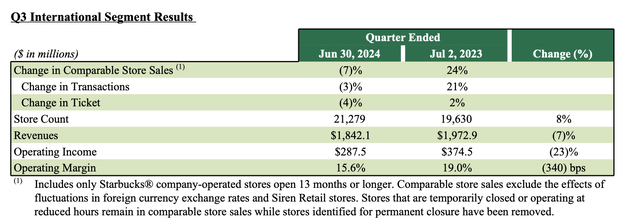

Results were even weaker overseas, with comparable sales down -7% y/y. Here, poor FX translation impacts with a stronger U.S. dollar cut even further into the company’s revenue.

Starbucks international results (Starbucks Q2 earnings deck)

But what’s startling here is the fact that operating margins overseas shed 340bps y/y to 15.6%, worse than the operating margin decline in North America.

Company-wide operating income fell -4.2% y/y in the most recent quarter to $1.52 billion (a -50bps y/y reduction), with weaker store performance partially offset by stronger margins in the company’s “channel development” segment which sells beans (both ground and whole bean) to wholesalers, after the company divested its low-end Seattle’s Best Coffee segment.

Still: this is a bleak story to tell, and one that underscores Starbucks’ weak competitive positioning both domestically and abroad. In the U.S., Starbucks faces sharp competition from third-wave local labels, while overseas, Starbucks faces the same competition plus has the added burden of typically being viewed as a pricey tourist brand, which certainly doesn’t help amid global consumers pinching their wallets and being more careful about their budgets.

Here is helpful anecdotal context from outgoing CEO Laxman Narasimhan’s remarks on the recent Q3 earnings call, detailing the company’s international struggles particularly in China:

“Looking outside the US, we continue to see weakness in parts of our international business and strength in others. Headwinds persist in the Middle East, Southeast Asia, parts of Europe, driven by widely discussed misperceptions about our brand. In some European markets, consumers are stretched. At the same time, we see significant strength in markets like Japan and parts of Latin America.

China is one of our most notable international challenges and an area I’d like to talk about in more detail. The competitive market dynamics in China are reflected in our recent results. We continue to face a more cautious consumer spending and intensified competition. In the past year, unprecedented store expansion and a mass segment price war at the expense of comp and profitability have also caused significant disruptions to the operating environment. Still, we have made progress in important areas.

Through Q3, metrics like average daily transactions, weekly sales and operating margin improved sequentially quarter-over-quarter. Starbucks Rewards members grew by 1.6 million to a record high 22 million active members and customer connection scores reached a new high, while partner turnover reached a new low. We’ve built an amazing business in China over the past 25 years, a business for China built by an outstanding local team. We’ve pioneered the growth of the premium coffee industry in market with our Starbucks and Starbucks Reserve brands and brand equity remains distinctive. We have incredibly committed and expert partners with an unmatched depth in coffee and craft.”

In short: with “misperceptions” plaguing the Starbucks brand, this company’s issues aren’t likely to be a short-term fix.

What’s the value of a new CEO?

And yet in spite of Starbucks’ deep and complex problems, the stock market has treated the arrival of new CEO Brian Niccol (credited with a turnaround at Chipotle) as a magic silver bullet. Since news broke on his hiring on August 14, Starbucks stock has shot up more than 25% (versus a ~5% gain in the S&P 500 on the recent rate-driven rally), adding roughly $22 billion in market value. We have to ask ourselves: is a new leader at the top worth that much?

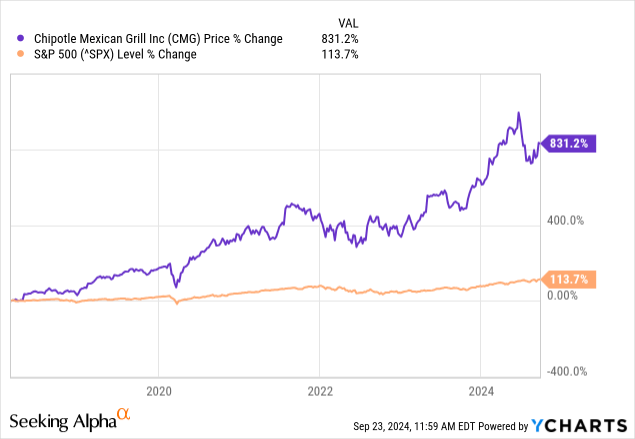

Of course, Niccol’s track record at Chipotle can’t be argued with. Since his hiring as the burrito giant’s top boss in March 2018, Chipotle stock has delivered 800%+ cumulative gains (versus the S&P merely doubling along that same timeframe).

But of course, the Chipotle he inherited in 2018 wasn’t nearly the same as the Starbucks of today. Chipotle is largely a domestic brand, whereas Starbucks’ woes are international. Chipotle’s revenue in the fiscal year 2018 was merely $1.2 billion (consensus for the current year is at $11.3 billion now); Starbucks, meanwhile, is a much larger and more complex giant, with $9+ billion in quarterly revenue. It’s not a growth story anymore; it’s not disrupting an industry like Chipotle was in 2018 (more likely is the notion that Starbucks is the incumbent that’s being disrupted).

There’s also the question of the new CEO’s pay package. His signing bonus of $10 million in cash plus $75 million in restricted stock is much higher than current CEO’s $1.6 million signing bonus plus $9.25 million initial grant. Niccol’s annual compensation is $1.6 million in base (versus $1.3 million for Narasimhan) and $23 million in stock, which is $10 million higher than the Narasimhan’s pay (as reported by Seattle Times). It’s worth noting that with 1.1 billion shares outstanding, this ~$10 million bump in annual incremental CEO expense works out to just under $0.01 in EPS. That’s not to mention the unusual and lavish commute arrangements that Niccol managed to secure (which has been heavily reported on), in which Niccol plans to commute to Starbucks’ Seattle headquarters via private jet from his Southern California home.

One last note here: with operating margins lagging at Starbucks stores, one key piece missing is robotics and automation. Beyond introducing an “Autocado” machine this year that simply peels (but doesn’t mash) avocados for guacamole, Chipotle wasn’t really known for robotics and automated order taking either, even as rivals like McDonald’s (MCD) and Shake Shack (SHAK) have almost fully rolled out touch displays for ordering in many locations. Even smaller startups like Sweetgreen (SG) have introduced fully-automated kitchens that are capable of delivering an entire meal without human intervention.

Starbucks is arguably more complex to fully automate than Chipotle, given so many customers choose customized options for their handcrafted drinks. With this in mind, advances in automation probably won’t be high on the new CEO’s priority list.

Valuation and key takeaways

Overall, while it’s impossible to downcast Brian Niccol’s fantastic track record at Chipotle, the Starbucks he’s inheriting has much larger, global issues – and the stock has already shot up significantly to cheer his coming.

For next year FY25 (the year for Starbucks ending in September 2025), Wall Street is optimistically expecting Starbucks to drive 7% y/y revenue growth to $39.0 billion, and generate $3.96 (+11% y/y) in pro forma EPS. This already puts Starbucks at a 24.0x FY25 P/E multiple – a premium to the S&P 500 despite the multitude of challenges that this company faces, not to mention the fact that current EPS is contracting in the mid single digits.

If Starbucks’ new CEO does stage a turnaround in the massive coffee chain, it will take time to play out. In my view, investors will have a better price to buy back into Starbucks in the near future, but at the moment $95 makes for a great selling price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.