Summary:

- By now, investors are probably tired of reading about the repeated bearish arguments against Nvidia Corporation, including over-reliance on few customers, competitors catching up, and the repetitive comparisons with the stock history of Cisco Systems.

- However, there is actually a much greater risk, backed by a more apt historical comparison, that poses a significant threat to Nvidia???s most powerful moat factor.

- As an existing shareholder, I would no longer advise investors to buy the stock at these levels, given how this growing risk impacts the long-term growth story.

JasonDoiy/iStock Unreleased via Getty Images

Followers will be aware of the fact that I have been bullish on NVIDIA Corporation (NASDAQ:NVDA) since early 2023, advising investors to buy the stock amid the onset of the AI revolution. One of the key elements of Nvidia’s moat has been the CUDA software offering that continues to fortify the value proposition of its chips, cementing its wide leadership position over competitors. However, as Nvidia progresses with its product roadmap to launch Blackwell, the company is already showing signs of diminishing pricing power, indicative of the advancements that rivals are making in challenging the market leader’s moat. More concerning, Nvidia’s biggest customers, suppliers, and competitors are all teaming up to develop an open-source alternative to CUDA, and historical technology waves suggest that the rise of open-source tends to become a force to be reckoned with. I am downgrading NVDA to a ‘hold’.

Demand still strong for Nvidia’s GPUs

In the previous article offering an earnings preview before the Q2 FY2025 results, I discussed how investors should not be concerned about any Blackwell delays, as demand for its Hopper series should remain robust. And on the Q2 2025 Nvidia earnings call, executives quelled any concerns by noting that the Blackwell alterations are complete, and that demand for both its latest series GPUs is visibly strong.

CEO Jensen Huang

The change to the mask is complete. There were no functional changes necessary??? The functionality of Blackwell is as it is, and we expect to start production in Q4.

???

CFO Colette Kress

In Q4, we expect to ship several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025. Hopper supply and availability have improved. Demand for Blackwell platforms is well above supply, and we expect this to continue into next year.

More importantly, in the previous article, I had also extensively covered Nvidia’s CUDA software moat, because of which customers will continue having to purchase the semiconductor giant’s chips given the unmatched performance capabilities of its holistic platform.

And Nvidia once again proved the demand strength for its product offerings last quarter, delivering solid revenue growth in Q2, and guiding continued growth for Q3, albeit at a slowing pace.

Q2 was another record quarter. Revenue of $30 billion was up 15% sequentially and up 122% year-on-year and well above our outlook of $28 billion.

???

Let me turn the outlook for the third quarter. Total revenue is expected to be $32.5 billion, plus or minus 2%. Our third-quarter revenue outlook incorporates continued growth of our Hopper architecture and sampling of our Blackwell products.

– Nvidia CFO Colette Kress, Q2 2025 Nvidia earnings call.

Guidance of $32.5 billion would imply year-over-year revenue growth of 76% in Q3 FY2025. This would mark a significant slowdown from the three-digit top-line growth rates the company has been delivering over the past several quarters. While a growth rate of 76% is still impressive considering the tough comparatives from last year, note that decelerating revenue growth tends to be a major red flag for high-flying growth stocks (which Nvidia has essentially turned into over the past 18 months), conducive to stock price volatility.

Furthermore, the company’s profitability is also under threat as competitors catch up.

Diminishing pricing power undermines Nvidia’s profitability

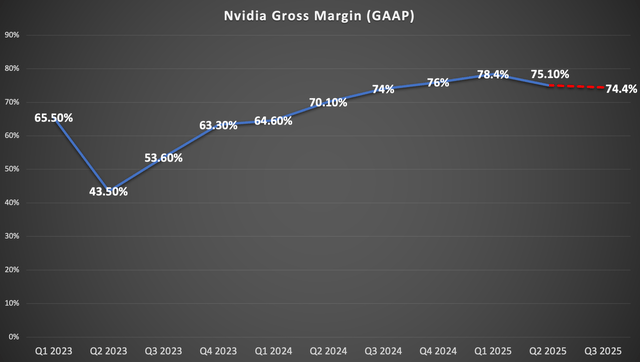

In addition to guidance implying slowing top-line revenue growth, the market was also disappointed by the contraction in gross margin last quarter, and the outlook suggesting further margin compression ahead.

GAAP gross margins were 75.1% and non-GAAP gross margins were 75.7%, down sequentially due to a higher mix of new products within the data center and inventory provisions for low-yielding Blackwell material.

Let me turn the outlook for the third quarter???GAAP and non-GAAP gross margins are expected to be 74.4% and 75%, respectively, plus or minus 50 basis points. As our data center mix continues to shift to new products, we expect this trend to continue into the fourth quarter of fiscal 2025.

???

We provided that we’re still on track for the full-year also in the mid-70s or approximately 75%. So we’re going to see some slight difference possibly in Q4. Again, with our transitions and the different cost structures that we have on our new product introductions. – CFO Colette Kress, Q2 2025 Nvidia earnings call

For context, Nvidia’s gross margin was 78.4% in Q1 2025, and 75.1% in Q2 2025. For Q3, the company has guided the gross margin to be 74.4%, and that the full-year margin will be around 75%. Now in order for the gross margin to average out in the mid-70s for FY2025, it would imply a further drop in Q4 gross margin from current levels amid the Blackwell launch, indicating diminishing pricing power.

Note: the red dotted line indicates guided gross margin trajectory for Q3 FY2025 (Nexus Research, data compiled from company filings)

In a recent article upgrading Advanced Micro Devices, Inc. (AMD) stock, we discussed how despite the hype around large, complex generative AI models, companies are sticking to simpler, traditional AI workloads, for which AMD’s chips prove sufficiently powerful. Additionally, AMD’s GPUs are also gaining prominence for inferencing Meta’s largest open-source models, and Microsoft has been deploying AMD’s MI series chips for their inferencing workloads to run the Copilot assistants.

Furthermore, in my latest article on Alphabet Inc. (GOOG) (GOOGL), we covered how Google Cloud’s TPUs are proving increasingly competitive at processing generative AI workloads, given the large enterprises that have opted for its custom chips over Nvidia’s GPUs.

The growing competency of rival chips is clearly strengthening customers’ negotiation power, and in turn, undermining Nvidia’s pricing power, conducive to slowing top-line revenue growth and profit margin compression.

Although one could argue that the contraction in profit margins is natural and widely expected, as no single company can be expected to sustain mighty pricing power and incredibly high profit margins in perpetuity.

That being said, the outlook for Nvidia’s future revenue growth and profitability could be even further undermined from here, amid the rising threat from open-source software.

The growing risk of open-source challenging Nvidia’s CUDA moat

To understand how the growing open-source efforts around AI chips threaten Nvidia’s closed ecosystem, and subsequently its future revenue and profit growth, it is worth covering the rise of an open-source operating system during the computing revolution of the 1990s and 2000s. It posed a big threat to Microsoft Corporation’s (MSFT) closed-source Windows server operating system.

AI technology is undoubtedly expensive today. And the human brain is 10,000x more effective per unit of power in performing cognitive tasks vs. generative AI. But the technology’s cost equation will change, just as it always has in the past. In 1997, a Sun Microsystems server cost $64,000. Within three years, the server’s capabilities could be replicated with a combination of x86 chips, Linux technology, and MySQL scalable databases for 1/50th of the cost. And the scaling of x86 chips coupled with open-source Linux, databases, and development tools led to the mainstreaming of AWS infrastructure. This, in turn, made it possible and affordable to write thousands of software applications, such as Salesforce, ServiceNow, Intuit, Adobe, Workday, etc. These applications, initially somewhat limited in scale, ultimately evolved to support a few hundred million end-users

– Kash Rangan, Senior Equity Research Analyst at Goldman Sachs (emphasis added).

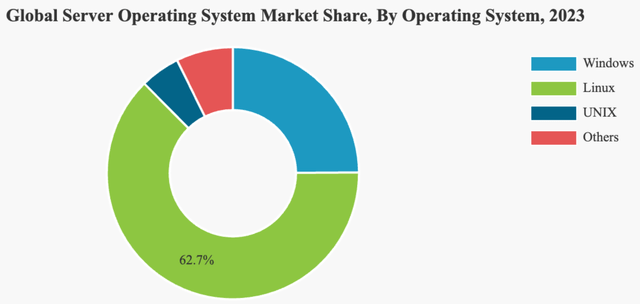

Indeed, the growing prominence of the open-source Linux operating system throughout the 1990s and 2000s helped significantly lower the cost of computing and still holds the largest share in the Server operating system market, which was estimated to be 62.7% in 2023.

Moreover, Amazon had cleverly leveraged the growing popularity of open-source Linux software by building its cloud computing segment, AWS, on a Linux-based architecture during the 2000s. This induced enterprises that used Linux-based servers on-premises to shift their IT workloads to the cloud.

AWS remains the largest cloud provider until date, with a 32% market share in Q2 2024, as per data from Synergy Research Group. Meanwhile, Microsoft has been striving to capitalize on its relatively smaller Windows server installed base, encouraging customers to migrate to its Azure cloud service, but remains in second place with a 23% market share last quarter.

The way the server market and subsequent cloud market dynamics have played out over the last two decades is testament to the fact that open-source software tends to dominate over the long term.

In fact, having found success with its own open-source endeavors, The Linux Foundation has also made available the “Joint Development Foundation.” That is an openly available corporate structure that makes it easier for other enterprises to start their own open-source projects.

And this is where the threat to Nvidia’s moat arises.

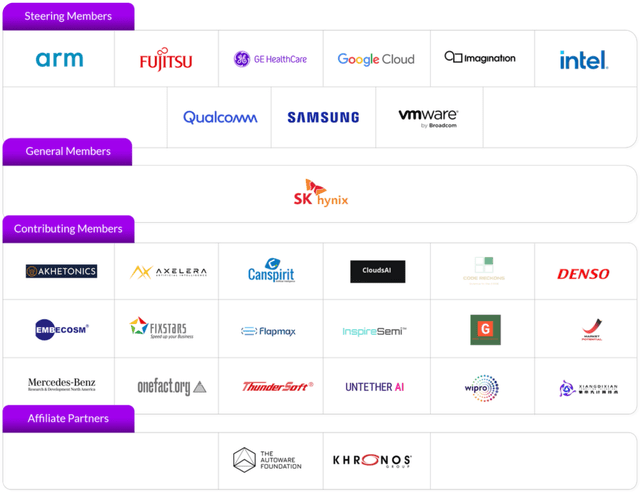

In September 2023, a group of tech giants came together to form the Unified Acceleration Foundation (or the “UXL Foundation”), based on Linux’s foundational structure.

The main goal of this foundation is essentially to create an open-source alternative to Nvidia’s CUDA software platform. Some of the key founding members of this initiative include Alphabet Inc. (GOOG) (GOOGL) Cloud, Arm Holdings plc (ARM), Intel Corporation (INTC), QUALCOMM Incorporated (QCOM), Samsung and VMWare, which is now owned by Broadcom Inc. (AVGO).

Our members unite behind open standards and open source to build a multi-architecture and multi-vendor software ecosystem for all processors, including CPUs, GPUs and AI processors.

Google’s leading position in the UXL Foundation is significant given the rich experience it already possesses in running the open-source Android operating system, which allowed it to dominate the smartphone revolution during the 2010s. For context, Android still holds over 70% market share in 2024, as per Statista data, and serves as yet another example of how open-source tends to dominate over the long term.

A key Nvidia customer like Google Cloud leading such an effort to create an alternative to CUDA is a force to be reckoned with. This is particularly true given the fact that out of all the three major cloud providers, Google possesses the most powerful custom chips to process generative AI workloads. It is best-positioned to build its own software ecosystem around the in-house AI processors thanks to this lead. Google Cloud already boasts customers like Apple and Salesforce as users of its TPUs.

Regardless of this lead among the cloud providers, the fact that Google is contributing its expertise to the development of this open-source software reflects just how reluctant the company is to continue paying premium prices for Nvidia’s GPUs.

Beyond the initial companies involved, UXL will court cloud-computing companies such as Amazon.com and Microsoft’s Azure, as well as additional chipmakers. – Reuters.

The other two big cloud providers also potentially joining UXL Foundation will only exacerbate the threat posed to Nvidia’s leadership position, particularly Amazon given its decades’ worth of experience in leveraging the open-source Linux software to build AWS.

Over the past year, more and more companies have joined the foundation, including GE HealthCare and India’s software consulting giant “Wipro,” which plays a similar role to Accenture plc (ACN) in facilitating deployments of new technologies across enterprises. The UXL Foundation currently boasts 30 members.

The fact that key Nvidia semiconductor suppliers like Arm Holdings and SK Hynix are partnering with top customers like Google Cloud, and chief rivals like Intel, further intensifies the enormity of this threat. It enhances the prospects of the foundation succeeding at creating a commensurate alternative to CUDA.

“We’re actually showing developers how you migrate out from an Nvidia platform,” Vinesh Sukumar, Qualcomm’s head of AI and machine learning, said in an interview with Reuters.

Similar to how Linux dominates the server operating system market, and Android dominates the mobile operating system market, there is ample historical evidence to foretell the fate of Nvidia’s CUDA. Open-source software is likely to also gain greater prominence in the chips-programming market.

In fact, the UXL Foundation is not the only endeavor to tackle Nvidia’s CUDA moat.

The UXL Foundation’s plans are one of many efforts to chip away at Nvidia’s hold on the software that powers AI. Venture financiers and corporate dollars have poured more than $4 billion into 93 separate efforts, according to custom data compiled by PitchBook at Reuters’ request.

Open-source by nature incurs complete code transparency which essentially allows any third-party developer to customize and build upon the software, enabling speedier advancements and innovations.

Meanwhile, Nvidia is still spending heavily on internal developers to innovate new products and services, and extend the capabilities of its platform.

Sequentially, GAAP and non-GAAP operating expenses were up 12%, primarily reflecting higher compensation-related costs.

???

Full-year operating expenses are expected to grow in the mid-to-upper 40% range as we work on developing our next generation of products. – CFO Colette Kress, Q2 2025 Nvidia earnings call

Innovating increasingly more powerful AI solutions indeed incurs higher operating expenses.

Simultaneously, Nvidia has not been able to charge commensurate premium prices for its Blackwell product to cover the rising costs of developing such powerful AI technology. And the company’s pricing power is only likely to deteriorate further from here as rivals’ chips catch up to become compelling alternatives, and the rise of open-source software erodes Nvidia’s biggest moat.

Therefore, the combination of slowing top-line revenue growth and profit margin contraction henceforth should finally curb the euphoria around NVDA, conducive to a major pullback in the stock price.

Nvidia’s moat extends beyond CUDA

Now despite the growing threat of open-source software, note that CUDA is not the only software service that Nvidia provides. It has a range of software offerings across different layers of the data center technology stack, as discussed in a previous article.

Out of all the different software services that the Jensen Huang-led company boasts, perhaps the most promising is the “NVIDIA AI Enterprise” operating system. Indeed, Nvidia was so well-prepared for this AI revolution, that it had even developed its own operating system for running complex AI workloads.

In a previous article, we had extensively covered the company’s lucrative positioning to capitalize on its massive hardware installed base through “NVIDIA AI Enterprise.” We showed how the market leader has set itself up to earn recurring revenue from this software play, to the tune of $4,500 per GPU/per year.

Moreover, the citation from Goldman Sachs earlier in the article mentioned how the rise of Amazon’s Linux-based AWS subsequently also gave rise to new Software-as-a-Service (SaaS) companies.

Though it is worth noting that several of these SaaS companies have already become prominent customers of Nvidia’s AI operating system.

In fact, software giants like ServiceNow, Inc. (NOW) and Adobe Inc. (ADBE) have been one of the earliest adopters of “NVIDIA AI Enterprise.” And while Salesforce, Inc. (CRM) had been mainly relying on Google Cloud TPUs for training its own AI models, the enterprise software behemoth ultimately also revealed a partnership with Nvidia last week to build AI agents. This is testament to just how far ahead the chips giant is relative to other key AI players to facilitate the next stages of this revolution.

Now there is no doubt that just like how the UXL Foundation is striving to create an open-source alternative to CUDA, there will also be endeavors to develop open-source competitors to “NVIDIA AI Enterprise.”

What we are going to witness over the next decade is a tug-of-war. Nvidia will strive to keep customers deeply entangled in its ecosystem through value proposition enhancements, while open-source vendors will seek to pull customers away by easing the switching process and proclaiming advantages like cost efficiencies and code transparency.

Keep in mind also the fact that generative AI-powered coding assistants (e.g., Microsoft’s GitHub Copilot, Amazon Q, etc.) and other automation tools provided by cloud providers in this new era are making it much easier for businesses to develop their own customized AI software applications. This subdues the need for standardized enterprise software applications from traditional SaaS companies.

For example, while Salesforce recently introduced its generative AI-powered “Agentforce” (powered by Nvidia technology), there is an ongoing debate among software investors over whether such product rollouts will be sufficient to discourage customers from creating their own tailored services internally, the way Klarna made Salesforce redundant recently.

As the development process becomes increasingly easier, organizations are increasingly likely to create internal, customized tools and applications to support their workloads, instead of relying on traditional enterprise software. Moreover, not all businesses will be able to afford Nvidia’s AI technology to build their own solutions and instead are likely to opt for open-source alternatives.

Therefore, while Nvidia is currently winning partnership deals with the largest enterprise software companies like Salesforce, as well as other large enterprises with sizeable balance sheets, it does not guarantee that “NVIDIA AI Enterprise” will hold the dominant share in the ‘AI operating system’ market over the longer run.

So long-term investors should not be negligent of the rise of open-source software over the next decade, and how it will inevitably subdue Nvidia’s pricing power, revenue growth, and profitability going forward.

Is Nvidia stock still worth buying?

NVDA currently trades at almost 41x forward earnings, which is below its 5-year average of around 47x. Though the Forward Price-Earnings-Growth (Forward PEG) multiple tends to be a more comprehensive valuation metric, as it adjusts the Forward PE by the expected earnings growth rate.

Nvidia’s anticipated EPS FWD Long Term Growth (3-5Y CAGR) is 36.56%, resulting in a Forward PEG multiple of 1.12x.

For context, a Forward PEG multiple of 1x would imply that a stock is trading roughly around fair value. So Nvidia stock is not expensive based on current EPS growth projections. Although growth expectations can continue to fluctuate as the dynamics of the competitive landscape evolve.

Despite intensifying competition and the foreseeable rise of open-source software, I am not selling the stock, given Nvidia’s strengths beyond CUDA and the time lag until alternative platforms commensurately catch up to the market leader’s holistic ecosystem solutions.

Although putting myself into the shoes of investors that have no position in NVDA and are considering whether to buy the stock at these levels, I would not advise purchasing shares now despite the reasonable valuation. The slowdown in top-line revenue growth coupled with profit margin compression due to weakening pricing power could set the stage for a pullback in the stock price. It can be difficult to time these things, but we do know that the seeds have been planted for a major stock price drawdown.

Nvidia stock has been downgraded to a “hold.”

Analyst???s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.