Summary:

- Starbucks shares surged 22% with the announcement of Chipotle’s CEO Brian Niccol as the new chief executive, indicating potential for a customer-focused turnaround.

- Despite macro headwinds and weak China performance, Niccol’s expertise could drive a US strategy revival, supporting a buy rating on the stock.

- Shares are modestly undervalued in my view, with a bullish technical chart.

- Risks include ongoing challenges in China and heightened domestic competition, but solid US retail sales and the company’s free cash flow yield offer reasons for optimism.

Nadya So

Starbucks (NASDAQ:SBUX) had its best day ever when it was announced that Chipotle’s (CMG) CEO Brian Niccol would become its new chief executive. Shares soared 22%, but the rally merely brought SBUX back to where it traded in Q1 of this year. The Niccol-honeymoon period is ongoing, but macro headwinds remain in place. Weakness in China and concerns regarding the Seattle-based company’s domestic strategy are in play.

But recent retail sales figures are encouraging, and a legitimate Starbucks bull case involves Niccol’s experience and expertise lending itself to a customer-focused turnaround strategy in the US. I reiterate a buy rating on the stock.

I was bullish on SBUX stock back in April, but shares faltered after its July Q2 profit report. The Niccol news helped restore the stock close to the flat line for 2024, though that is a sharp underperformance to the S&P 500. Let’s see where the company now stands fundamentally and with respect to the technicals as the company’s FY 2025 is about to get underway.

SBUX: The Niccol Effect – Stock Surged 22%

Back in July, SBUX reported a mixed set of quarterly results. Q3 non-GAAP EPS of $0.93 was in line with estimates, but revenue of $9.1 billion, down 1% from the same period a year earlier, was a material $150 million miss. Global comp-store sales dipped by 3%, with comp-transaction declining by 5%, though the company was able to push through a 2% increase in average ticket prices.

Shares rose close to 3% in the session that followed – perhaps a lot of bad news was baked into the stock price after what had been a notably negative performance YTD in July.

Niccol has his work cut out for him to turn around SBUX –2% US comp-store sales as of the end of June. Its operating income dipped from $4.16 billion to just $4.1 billion in the third quarter. What concerned investors was the firm’s operating margin fall from 21.7% to 21.0% as higher labor costs continued to cast a negative cloud over profitability trends. China is still a sore spot – comp-store sales plunged by 14% there versus a –10.6% consensus expectation.

Risks with SBUX are apparent: Few signs of an imminent macro turn in China are likely to weigh on the company’s overall EPS, while there’s still uncertainty as to how Niccol can make the Starbucks brand name as attractive as it was just a few years ago. Competition from smaller coffee establishments and long wait times are hurdles to overcome.

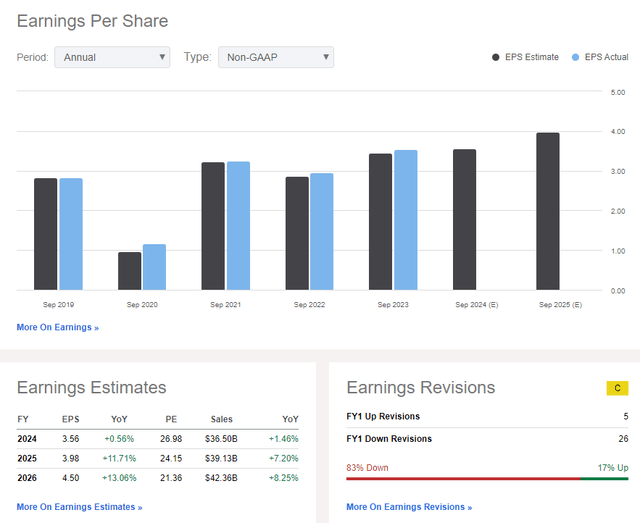

On the earnings outlook, there is some reason for hope. Operating EPS is projected to rise about 1% in 2024 with out-year per-share earnings growth in the low double digits. An even higher EPS boost is then expected in FY 2026. But following the soft Q2 and even after the new CEO announcement, there has been a slew of downward EPS revisions by Wall Street analysts. But Starbucks’ free cash flow per share is decent at $3.37, resulting in a 3.5% FCF yield.

Starbucks: Revenue, Earnings, EPS Revisions Estimates and Trends

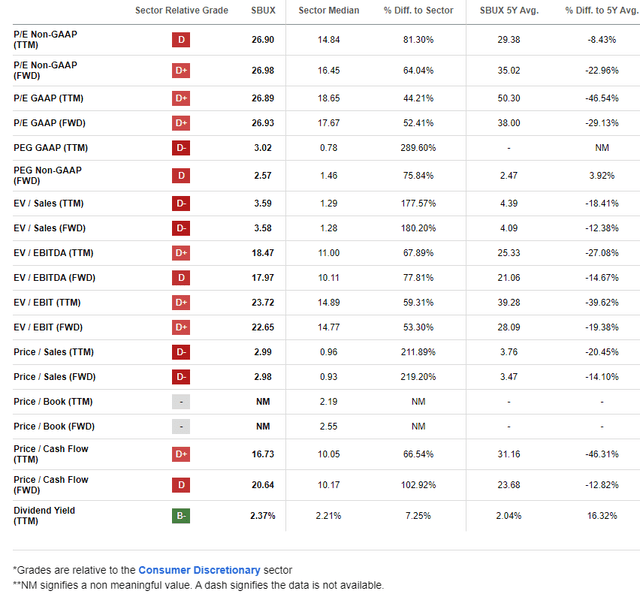

On valuation, I still feel confident in my general assumptions from April. If we assume non-GAAP EPS of $3.98 in the next 12 months and apply a P/E multiple of 27, which would be a PEG ratio of 2.1-2.2 given the low-double-digit EPS growth rate in the years ahead, then shares should trade near $106. I did slightly lower my PEG assumption given the reality that SBUX might not get the same halo as it once did.

Also bear in mind that the company trades modestly cheap on a price-to-sales basis relative to its history.

SBUX: Less of a Valuation Premium Today

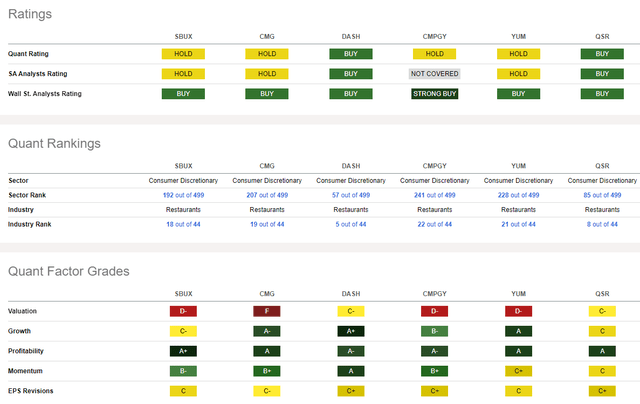

Compared to its peers, SBUX features a weak valuation rating, but I will again note that many of its valuation multiples are cheap on a relative basis. Moreover, growth is seen picking up in the quarters to come, and long-term profitability trends could turn more favorable if Niccol’s expertise is effectively monetized for shareholders.

And while EPS revisions have been soft lately, share-price momentum has turned a bit more sanguine in the past two months.

Competitor Analysis

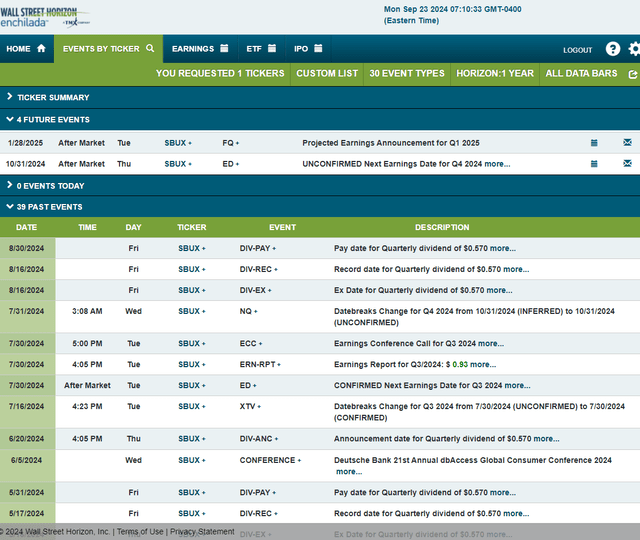

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2024 earnings date of Thursday, October 31 AMC. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

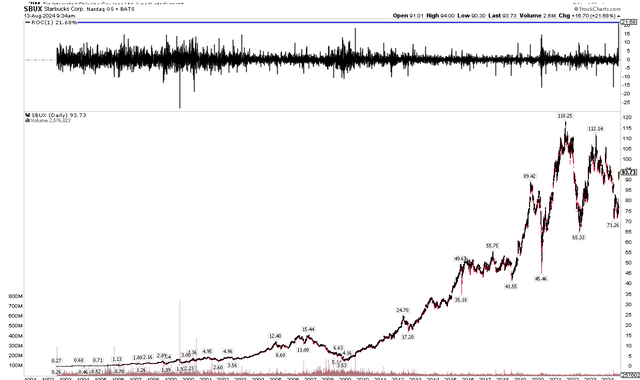

The Technical Take

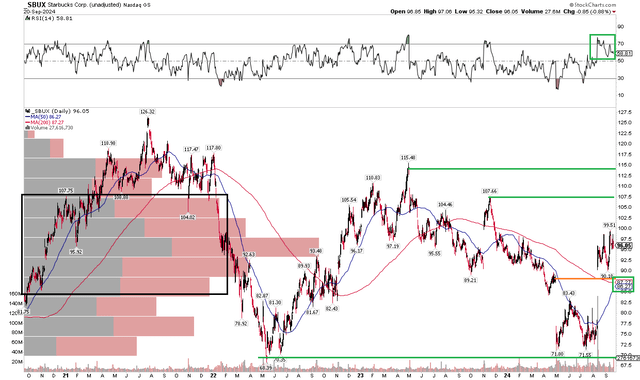

With shares slightly to the cheap side and a new leader at the helm, SBUX’s chart is somewhat encouraging. Notice in the chart below that shares notched a double-bottom low in the high $60s to low $70s. The major gap-higher followed news that Niccol was swapping sides from CMG to SBUX, and I am particularly encouraged to see that shares have held that surprise rally.

Also take a look at the RSI momentum oscillator at the top of the graph – like price, it too, is holding strong levels and not succumbing to much bearish pressure. Another indicator that aligns with the bulls is what’s likely to be a golden cross pattern in which the long-term 200-day moving average rises through the shorter-term 50dma. The 200dma is also flattening out in its slope after a protracted downtrend in which the bears controlled the primary trend. There is, however, a high amount of volume by price up to $107 that will make it tough on the bulls, so that’s a technical risk.

Overall, resistance is apparent at $108, near my intrinsic value target, while support is in the upper $80s.

SBUX: Shares Hold Key Support, Q3 Bounce Remains Healthy

The Bottom Line

I have a buy rating on SBUX. I see the stock as modestly undervalued, while the technical chart leans bullish heading into the company’s FY 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.