Summary:

- TSMC leads the global foundry market with advanced 3nm, 5nm, and 7nm technologies; 2nm and A16 processes will secure long-term market leadership.

- Capacity utilization is expected to rise in H2 FY24, boosting near-term growth; a one-year target price of US$200 per share is set.

- Potential UAE expansion and U.S. manufacturing facilities will drive long-term growth; TSMC is well-positioned to gain market share in advanced electronics and AI.

- Key risks include U.S. government pressure on Nvidia and Apple to use Intel foundries and rising CAPEX impacting free cash flow in FY25.

JHVEPhoto

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) owns almost 30% of global foundry market, leading in 3nm, 5nm and 7nm process technologies. The company anticipates the capacity utilization will increase in the second half of FY24, which will potentially improve the overall growth in the near-term. In addition, their latest 2nm and A16 will enable TSMC to maintain their market leader position for the long run. I am initiating with a ‘Buy’ rating with a one-year target price of US$200 per share.

2nm in 2025 and A16 in 2026

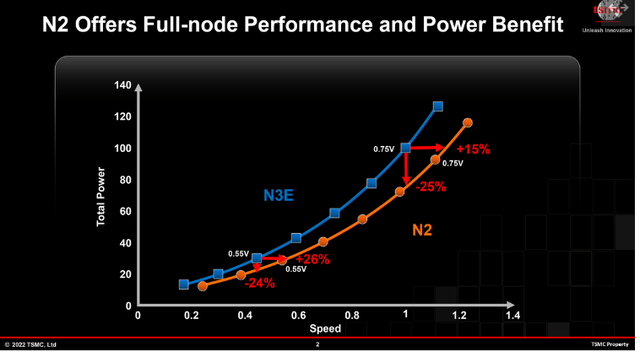

TSMC introduced their 2nm (N2) process technology in June 2022, offering a 10% to 15% speed improvement at the same power, or 25% to 30% power improvement at the same speed, and more than 15% chip density increase as compared with N3E, as disclosed in their earnings call. As indicated in the chart below, N2 delivers full-node performance and power benefit compared to N3E products. The management expects the sales in the first two years for N2 will surpass both 3nm and 5nm sales in their respective initial two-year periods. N2 is on track for volume production in 2025, according to their management.

In April 2024, TSMC announced their leading-edge 1.6nm-class process technology, a new A16 manufacturing process. As indicated in their Q2 FY24 earnings call, A16 is best suited to high-performance computing with complex signal route and dense power delivery network, and the mass production is scheduled for the second of 2026.

I am encouraged by their technology advancements in the 1.6nm and 2nm process technologies. The increased computing power and chip density increase will be highly suitable for AI and large machine learning tasks, in my view.

In contrast, Samsung Electronics (OTCPK:SSNLF) targets mass production of 2nm process by 2025 and 1.4nm by 2027. As such, Samsung has a similar roadmap to TSMC. During the latest earnings call, Intel (INTC) also indicated that their 20A (2nm) was ready for initial production in Q3 FY24. It is evident that all the major players are progressing towards 2nm process technology in the coming years.

Potential Expansion in UAE

As reported by The Wall Street Journal on September 22nd, TSMC and Samsung have been in discussions to build huge factory complexes in the United Arab Emirates in the coming years. I think the potential expansion makes sense for TSMC. G42, the most respectable AI company in UAE, has received $1.5 billion investment from Microsoft (MSFT) recently. G42 has strong connections with influential members of Abu Dhabi’s royal family. I think the UAE government is aiming to attract global foundry leaders to establish manufacturing facilities in the region to accelerate their technology advancement in AI. If the news turns out to be true, I’d consider it a positive catalyst for TSMC’s long-term growth.

Recent Result, Outlook & Valuation

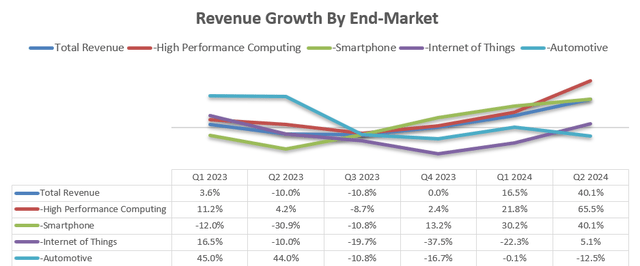

ASML released their Q2 FY24 result on July 18th, reporting 40.1% total revenue growth driven by strong growth in HPC and smartphones, as depicted in the chart below.

During the earnings call, the management anticipated the overall capacity utilization would improve in the second half of FY24, driven by growing demands for sub-7nm process technologies. I think the improvement in utilization will benefit the company’s near-term growth and expand their gross margins.

In addition, their August monthly report showed 33% year-over-year growth in revenue. Considering the strong growth in the first 8-month, I don’t anticipate any big surprise in their full-year result. I forecast their revenue will grow by 27% in FY24, reflecting strong growth in HPC and smartphones.

For their normalized revenue growth from FY25 onwards, I am considering the following factors:

- Imarc projects that the global foundry market will grow at a CAGR of 5.2% from 2023 to 2032, driven by the rising demand for advanced electronics and AI workloads. TSMC is a clear leader in the most advanced process technology below 7nm. I anticipate TSMC will gain market share gradually from regional small players.

- As discussed previously, TSMC is building three manufacturing facilities in the U.S. soil. Once these facilities ramp up production, I anticipate the company will secure more long-term orders from U.S. based fabs.

- Considering these factors, I anticipate TSMC will grow their revenue by 8% on a normalized basis, assuming 5% market growth and 3% manufacturing capacity expansions.

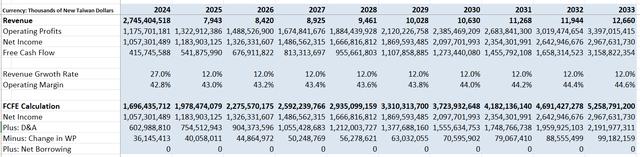

I project 20bps annual margin expansion driven by 10bps from gross margin expansion due to pricing, and 10bps from R&D operating leverage. With these assumptions, the DCF and free cash flow from equity (FCFE) can be summarized as follows:

The cost of equity is estimated to be 11% assuming: risk-free rate 3.6%; beta 1.16; equity risk premium 6.5%. Discounting all the future FCFE, the one-year target price of TMSC’s ADR stock is calculated to be US$200 per share.

Key Risks

- As reported by the media, the U.S. government is pressuring Nvidia (NVDA) and Apple (AAPL) to use Intel’s foundries. Both companies rely on TSMC to produce advanced chips and GPUs. I think it totally makes sense for the government to push enterprises to use local foundry platforms due to the increasing geopolitical risks. However, I don’t anticipate Nvidia and Apple will switch to Intel’s Foundry anytime soon; as major changes in global supply chain could pose substantial risks of supply disruptions for these high-tech customers.

- During the earnings call, TSMC’s management indicated that their capital expenditure as a percentage of revenue will increase in the coming years, as the company ramps up their latest 2nm manufacturing facilities. The rising CAPEX will present some growth challenges in their free cash flow in FY25.

- TSMC will construct a third factory in Phoenix, a 2nm fab scheduled to be operational before the end of the decade. The Biden government provides the company with $6.6 billion in grants and $5 billion in loans. For TSMC, it is a long-term commitment for a huge capital investment in the U.S.. While I think it is important for TSMC’s long-term growth, it would create some financial burdens for the company.

End Note

I like TSMC’s leading foundry business, particularly in their N2 and A16 process technologies, which paves the foundation for their future growth. The ongoing capacity expansion reflects the company’s confidence in their long-term growth potential. I am initiating with a ‘Buy’ rating with a one-year target price of US$200 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.