Summary:

- Visa’s stock rallied despite a potential DOJ antitrust lawsuit, but valuation risks and DOJ accusations could impact future performance.

- DOJ alleges Visa’s anti-competitive practices in the debit card market; past probes and abandoned acquisitions highlight ongoing scrutiny.

- Visa’s profitability and growth potential remain strong, with opportunities in global consumer payments and value-added services for businesses.

- Visa comparison to Affirm, Upstart, Mastercard, and more.

- Investors should consider Visa’s long-term potential and use recent underperformance as a buying opportunity despite short-term DOJ-related volatility.

FinkAvenue

In the month preceding a report that the U.S. Department of Justice would file an antitrust lawsuit against Visa Inc. (NYSE:V), shares enjoyed a strong rally. V stock had entered a downtrend from March 2024 through August. The stock bottomed at below $260 and closed on Monday at $288.

How accurate is Bloomberg’s report that the DOJ would accuse Visa of engaging in practices that prevented its competitors from entering the debit card market? More importantly, if it files the suit, how strong is its case? To answer that, start with a review of the history between the DOJ and Visa.

DOJ Visa Prior Probe

On May 2, 2023, Visa filed a civil investigative demand. Visa disclosed that the DOJ sought additional documents and information about the company’s U.S. debt business. Additionally, it wanted more details about Visa’s competition with other payments and networks.

On January 12, 2021, Visa abandoned its plans to acquire Plaid Inc. in a merger deal worth $5.3 billion. The DOJ had filed a lawsuit to block the acquisition of the fintech app on November 5, 2020. It said that Plaid allowed developers to plug into the consumer’s financial accounts. However, since it accessed data on behalf of 200 million customer bank accounts, it would disrupt Visa’s monopoly. The DOJ alleged that Visa’s CEO viewed the acquisition as an insurance policy that threatened the firm’s all-important U.S. debit business.

Upcoming Antitrust Lawsuit

On Tuesday, Bloomberg reported that the DOJ will initiate an antitrust lawsuit against Visa. According to the report, the DOJ will accuse the firm of taking steps to prevent its competitors from challenging its debit card market dominance. The government will say that Visa made exclusive agreements that prevented competing networks from expanding. As a result, technology firms in the debit market could not challenge Visa.

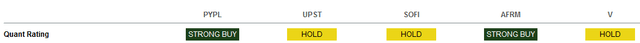

Before rumors of the DOJ action surfaced, shares of Upstart Holdings, Inc. (UPST), Affirm Holdings, Inc. (AFRM), SoFi Technologies, Inc. (SOFI), and PayPal Holdings, Inc. (PYPL) rallied. Readers may assess Visa along with those stocks. The SA Quant Ratings below ranked PYPL and AFRM stock as a strong buy.

From a sector ranking perspective, Affirm and PayPal fared best. Visa ranked lower, suggesting that investors should not have increased their position in V stock.

Furthermore, Visa scored unfavorably on valuation, offset by an A+ on profitability.

Although the DOJ case may prove only a rumor, Visa already had risks of a valuation correction. If the DOJ proceeds with the filing, long-term investors need not react. Visa is highly profitable and offers consistent growth. The weak momentum grade only measures the stock’s recent underperformance.

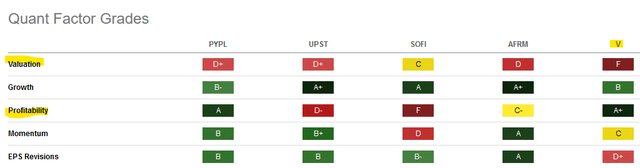

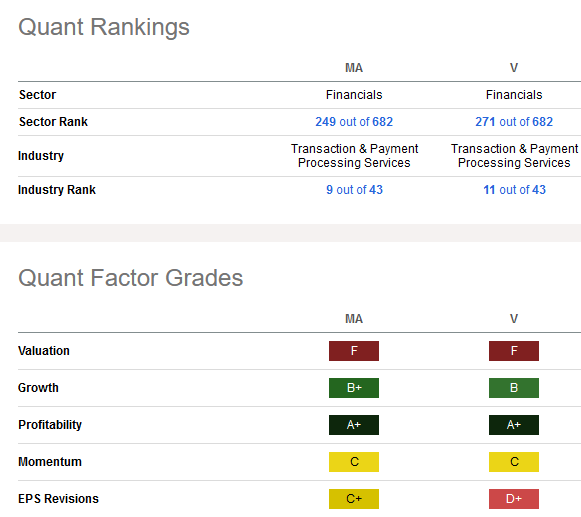

Investors may also downplay the lower EPS revision grade. This measured the analyst’s downward earnings forecast in the last 90 days. After the DOJ news broke out, a Citi analyst cited a preference for Mastercard Incorporated (MA) over Visa. This may prove reactionary since the stocks are close in their sector and industry rank. They have virtually identical grades, although MA stock has better growth, momentum, and EPS revision grades:

Seeking Alpha

Opportunities

At a recent conference hosted by Goldman Sachs, Visa cited multiple payment flow opportunities. That included paying for rent and loan repayments. That increased its penetrable addressable market.

Visa focuses on the consumer payments market but seeks growth in value-added services for businesses. There, it has new flows that are beyond the usual consumer-to-payments business. This area includes the consumer-to-merchant business.

Visa’s CFO said that the consumer payments opportunity is worth $20 trillion globally. Should the DOJ limit the company’s U.S. strength, Visa may refocus its efforts to strengthen engagement and acceptance in other countries.

Risks

At the time of writing, the Chinese stock market (KWEB) is rallying in response to the government cutting rates to stabilize its housing market. However, Chief Financial Officer Chris Suh said that weak domestic volumes in China are a headwind. Payment volumes in Asia Pacific did not change Y/Y. Even though it does not process transactions domestically in China, the country has an impact on the Asia Pacific market.

Your Takeaway

Visa shares could give back some of its recent gains. Its valuation is more likely to weigh on the stock, with the DOJ news as a negative catalyst. Still, the government is suing companies like Alphabet Inc. (GOOG) and Apple Inc. (AAPL) for anti-competitive practices. Yet, their shareholders are not panic-selling the stock.

Visa remains an attractive stock to buy. Take advantage of the under-performance to build on the core position.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself tips and tricks for free here:

- Subscribe to the Free DIY Tier to get a preview of the subscription. Read dozens of articles. This is completely separate from the alerts you get when following me.

- The Basic tier is the second level.

- The Full Service is for readers who want it all, want a helping hand in the markets, and want to chat in the forum with like-minded do-it-yourself investors.