Summary:

- The Coca-Cola Company is a Dividend King with a streak of 60 years of increases and is due for another increase with its next dividend.

- While debt has increased in recent years, the company sports impressive financials with plenty of cash on the balance sheet.

- Shares are expensive today at 25x earnings, which is above the average multiple and too rich for a mature business like Coca-Cola.

- The yield is 2.8% and should continue to grow in the mid-single digit range.

- Buybacks should continue, but I don’t think The Coca-Cola Company investors should be excited about repurchases at the current valuation.

Georgiy Datsenko

Over the last month, I have started working with some family friends on their investments trying to help them find good risk/reward prospects as well as evaluating some of their current holdings. One of the holdings I will be taking a closer look at today is the beverage giant The Coca-Cola Company (NYSE:KO). They have held the stock for a long time, but I think the forward returns will be lackluster due to the company’s large size, relatively expensive valuation, and slow growth.

Investment Thesis

Coca-Cola is a favorite of dividend investors due to its Dividend King status and 60-year streak of dividend hikes. Investors can expect a growing 2.8% dividend supplemented by share buybacks for years to come. The company has stable margins with plenty of cash on the balance sheet and a manageable debt load. However, as a mature business with a market cap of $272B, the company’s growth isn’t likely to overcome the stock’s rich valuation to provide attractive returns for investors. Shares trade at a lofty 25x earnings, which is above the average multiple, and far too expensive for a business like Coca-Cola. Investors might want to consider selling shares today, especially if you have other ideas with a better risk/reward profile.

The Financials

A quick peek at Coca-Cola’s 10-Q shows a lot to like with their financials. The balance sheet has $11.2B in cash and equivalents, which is plenty of dry powder for the company to work with. With the company’s consistent business and A+ credit rating, I don’t think there is much risk with the company’s long-term health. One thing I noticed looking at the balance sheet over the last couple years is the increase in debt. It’s up about $10B since the end of 2019, but has come down slightly in the last couple years.

Despite the increase in debt on the balance sheet over the last couple years, it’s not too much for a company the size of Coca-Cola. The other thing to consider is that the interest rates are very low, with most of their debt issues carrying interest rates below 2%. The income statement shows that the margins have stayed pretty stable in 2022 compared to 2021, something that will probably stay the same moving forward. While the company’s financials don’t pose a risk to a long thesis, the valuation is the biggest reason that I’m skeptical about the stock’s ability to provide attractive long-term returns for investors.

Valuation

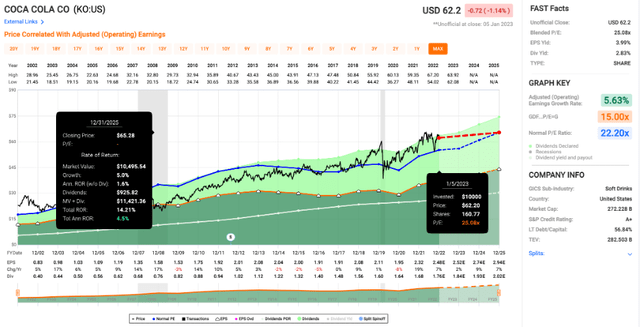

Many investors view Coca-Cola stock as a defensive play, but I think the valuation is too rich today to justify buying new shares. In my opinion, it might be a decent time to sell, especially if investors have better ideas. Shares today carry a 25x earnings multiple, which is too rich for my blood. It is a couple turns higher than the average multiple of 22.2x over the last two decades. Personally, I’m not that interested in buying shares because of the company’s product line, but I think it’s hard to justify adding shares anywhere above 20x earnings.

Price/Earnings (fastgraphs.com)

There just doesn’t appear to be a margin of safety today. The company is already a large and mature business with a market cap of $272B, and growth isn’t expected to be very impressive moving forward. If you have held shares for a long time, I don’t think it’s automatically time to sell, but I think the company’s (and the stock’s) best days are in the rear-view mirror. One of the things that the stock does have going for it is a long track record of dividend increases.

Dividends & Buybacks

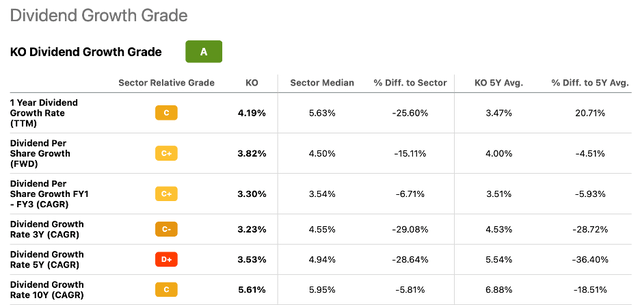

Coca-Cola has earned the coveted title of Dividend King with their 60-year streak of dividend hikes. The yield sits at 2.8%, and they are due for another increase with the next dividend. While the have a long record of dividend increases, the pace of the dividend hikes has been fairly slow in recent years. My guess is that the dividend hikes will continue in the mid-single digit range, but I don’t think there is much of a chance of that accelerating in coming years. Below is a chart showing Coca-Cola’s dividend growth rates over the last ten years.

Dividend Growth (seekingalpha.com)

Coca-Cola has supplemented the dividend with consistent buybacks. For the first nine months of 2022, the company repurchased $1.3B in stock (21.3M shares at an average price of $62.67). A good chunk of these buybacks went towards employee stock options, but investors can expect Coca-Cola to continue to buy back stock and reduce shares outstanding. I love buybacks as much as the next investor, but I’m not a huge fan in this case. The valuation is just too rich for me to get excited about buybacks.

Conclusion

The Coca-Cola Company has long provided solid returns for investors along with a growing stream of dividends. The financials are stable despite an increased debt load over the last couple years, and the company should continue to chug along for the foreseeable future. While the 2.8% dividend is likely to grow for the foreseeable future, I don’t think the returns will be all that attractive for investors. I just don’t see much in the way of a margin of safety paying 25x earnings for a mature business the size of Coca-Cola. The Coca-Cola Company investors might want to consider selling the stock and reinvesting the proceeds, especially if you have a better idea with a superior risk/return profile.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.