Summary:

- Applied Materials posted $6.78 billion in revenue in 3Q24, a 5% YoY increase driven by core business growth.

- AI, IoT, EVs, and clean energy are fueling long-term demand for Applied’s semiconductor systems and services.

- AMAT captured 41% of the wafer fab equipment market in 2023, up from 31% in 2018.

- Transition to gate-all-around transistors could grow AMAT’s addressable market by 16.7%, boosting revenue opportunities.

- DRAM equipment sales are expected to grow by 24.1% in 2024, while NAND sales may rise by 55.5% in 2025.

crstrbrt

Investment Thesis

Applied Materials, Inc. (NASDAQ:AMAT) is well-positioned for long-term growth, supported by its semiconductor systems and services leadership. With record Q3 2024 revenues of $6.78 billion, driven by core segments, the company is capitalizing on solid industry trends, including AI, IoT, EVs, and clean energy.

Applied’s advanced materials engineering expertise, particularly in gate-all-around transistors and high-bandwidth memory, provides a competitive edge in the fast-evolving semiconductor market. Its growing market share in wafer fab equipment (WFE) and strong DRAM positioning signal sustained growth potential.

Despite short-term challenges in China, Applied’s operational edge and strategic capture of key tech transitions, like energy-efficient computing, support a bullish outlook. With a solid position in high-demand areas, AMAT remains a buy for long-term investors.

Applied Materials Hits Record High Revenue Through Operational Edge

In Q3 2024, Applied Materials had record revenues of $6.78 billion with a 5% year-over-year (YoY) increase. This strong performance was backed by growth in its core business segments: Semiconductor Systems, Applied Global Services (AGS), and Displays.

As a result, the earnings hit the high end of the guided range, indicative of operational edge. Applied may deliver strong results based on its solid position within the semiconductor industry and the broader secular trends reshaping demand for advanced chips. These trends are AI, the IoT, robotics, EV, and clean energy. They collectively fuel multi-decade inflections and may considerably expand Applied’s target semiconductor market.

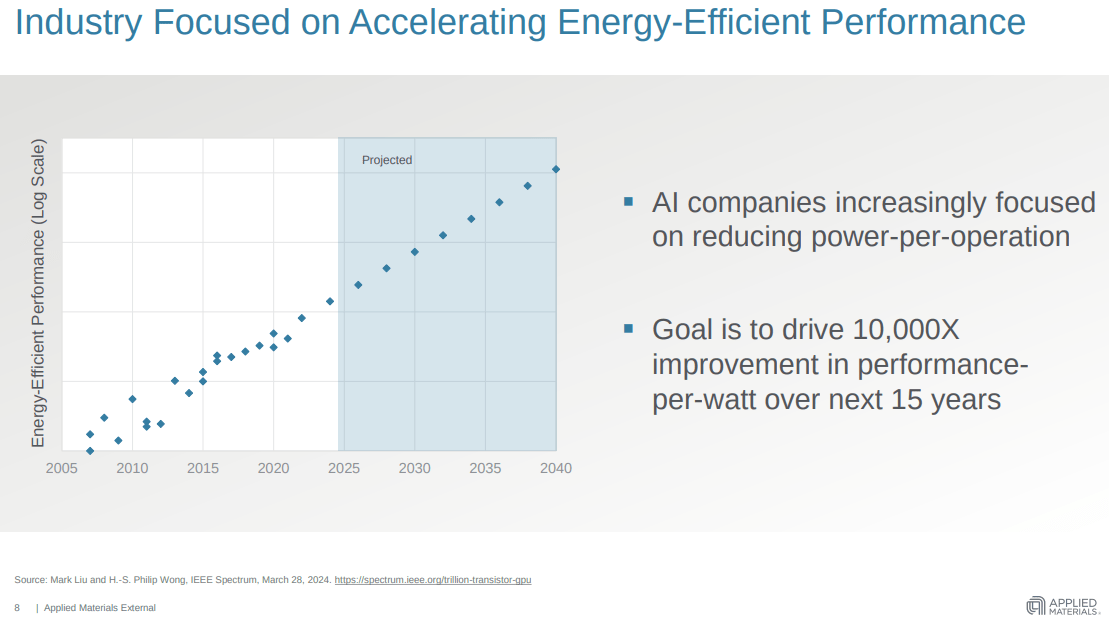

Moreover, the company’s strategy revolves around capitalizing on these trends by leveraging its “connected portfolio” of tech products and services. This integration allows Applied to lead the advancement of semiconductors. For instance, the push toward more energy-efficient computing targets AI’s scalability needs and increases demand for high-performance chips. With major AI companies, the focus has shifted from simply improving operations per second to reducing power-per-operation. This shift requires a 10K-fold improvement in performance-per-watt over the next 15 years. This is fueling an immediate demand for innovation in semiconductor materials engineering (where Applied Materials excels).

Q3 2024 Earnings Presentation

Further, Applied Materials holds expertise in materials science, making it a leader in leading-edge logic that involves significant advancements in transistor design. As the industry transitions from FinFET transistors to gate-all-around (GAA) transistors, Applied’s available market for the transistor module may grow from $6 billion to $7 billion for every 100K wafer starts per month. This marks a 16.7% increase in the total addressable market (TAM), and Applied expects to capture over 50% of the process equipment spending for these transistor fabrication steps. This moat is solidifying Applied’s market lead.

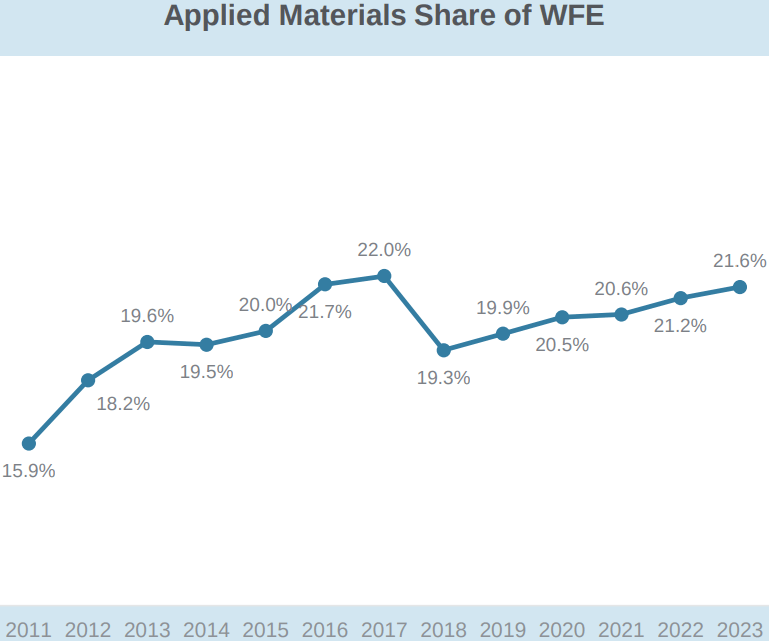

In 2018, Applied held a 31% share of the materials engineering market for WFE. This share has since expanded to 41% in 2023, demonstrating the company’s lead in the critical tools and processes required for next-generation device architectures, which include GAA transistors, 4F-squared DRAM, and advanced packaging solutions.

Another major category is DRAM. Applied has grown its market share by 10% over the past decade. DRAM is critical in energy-efficient computing, and its growth prospects remain strong as the industry undergoes major inflections.

One such inflection is the transition from 6F-squared to 4F-squared DRAM. This shift enabled by materials engineering may expand Applied’s market opportunity by 10% to ~$6.5 billion for every 100K wafer starts per month. Additionally, the subsequent move to 3D DRAM may grow the addressable market by 15% and further expand the company’s top-line potential.

Similarly, Applied has a strong lead in die-stacking technologies that enable high-bandwidth memory (HBM), which is essential for AI and advanced data processing tasks. In 2024, Applied is on track to generate over $600 million in HBM packaging revenue, 6X the figure recorded in 2023. Overall, revenue from its advanced packaging portfolio is expected to reach $1.7 billion in 2024 and has prospects of doubling over the next several years as heterogeneous integration becomes more widely adopted.

In 2011, the company had a market share of 15.9% in the WFE market. At the close of 2018, this share moved to 19.3% and consecutively increased to 21.6% in 2023. This sequential growth in the market share is due to the company’s strategic positioning in seeking emerging opportunities such as AI, data centers, and high-performance computing in the semiconductor industry. The WFE market may hit significant growth in leading-edge logic and memory applications.

AMAT Market Briefing

In 2024, the sales of WFE for foundry and logic applications may reach $57.2 billion, a modest 2.9% YoY decline due to softening demand for mature nodes. However, this may be followed by a solid 10.3% increase in 2025, based on rising demand for advanced nodes and new device architectures. This market outlook holds a growth opportunity for Applied, as it leads in producing equipment for advanced processes like GAA transistors and 3D DRAM.

Finally, memory-related CapEx in DRAM and NAND may be the fastest-growing segments within WFE. DRAM equipment sales may increase by 24.1% in 2024, with 12.3% growth in 2025. This trend is fueled by the demand for HBM in AI applications. Meanwhile, NAND equipment sales may grow by 1.5% in 2024 before experiencing a massive 55.5% increase in 2025 based on the recovery towards normalization of supply and demand.

Overall, Applied’s lead in DRAM and NAND equipment may capture growth and expand its market share in these segments. Technically, AMAT’s direct positive correlation with top-line growth may lead to a breakout in market valuation in upcoming quarters.

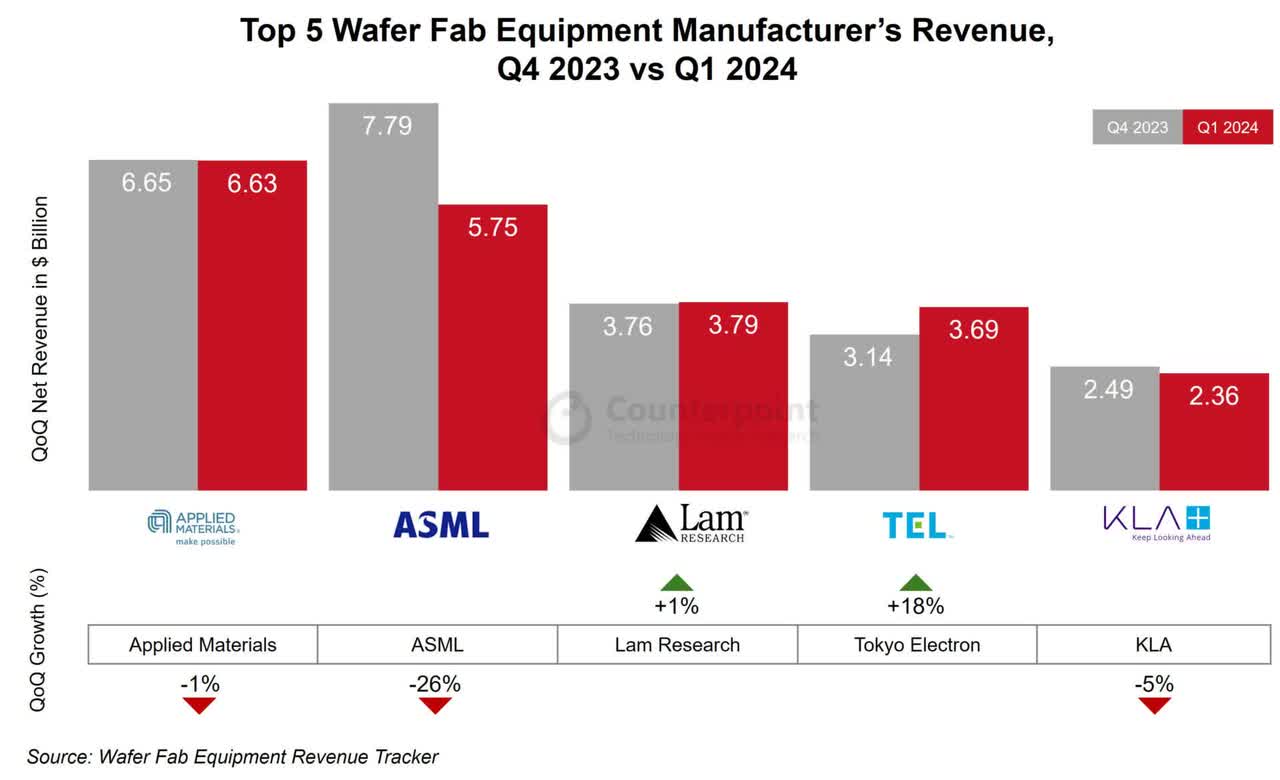

Counterpoint Research

Will Weakness in the World’s Largest Semiconductor Market Hit Its Stock?

On the downside, in Q3, Applied Materials’ China-based revenue fell by 11% sequentially. This led to a decline in its total revenue from China, dropping to 32% of its global revenue mix. Given China’s projected lead in equipment purchases that may exceed $35 billion in 2024, this decline signals a significant weakness in Applied’s strategic ability to capitalize on the largest market for semiconductor equipment.

In short, the declining trend in China is concerning because this region represents a significant portion of Applied’s addressable market and may hit its stock valuation hard. Further, the industry outlook for 2025 anticipates that China’s equipment spending may contract after significant investments over the past few years. This points to another potential downside: China’s collapse could limit its growth potential and disrupt its supply chain and revenue streams.

Moreover, Applied heavily depends on several major tech transitions within the semiconductor sector, such as energy-efficient computing and AI-related tech (as mentioned above). The downside of this reliance is that these transitions may not occur as quickly as expected. The shift to gate-all-around transistors expands Applied’s market opportunity by $1 billion per 100 K wafer starting monthly.

However, this growth is contingent on the semiconductor industry demand and CapEx trend to integrate these advancements. The company projects a 50% capture rate in transistor and interconnect process equipment spending for this. This aggressive assumption leaves little room for delays or missteps in tech adoption. The speed and magnitude of these inflections are highly uncertain, and any delays could slow Applied’s growth and may lead to massive room for the stock to fall by impacting the available market.

Takeaway

Applied Materials achieved record revenues in Q3 2024, driven by strength in semiconductor systems, services, and displays. Its leadership in AI, IoT, and energy-efficient computing positions it well for future growth, particularly in advanced chip manufacturing. However, challenges in the Chinese market, reliance on tech transitions, and the cyclical nature of semiconductor demand could pose risks to its growth and stock performance moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.