Summary:

- Comcast Corporation, with a $150 billion market cap, faces significant existential threats to its utility model, particularly from competitors like AT&T Fiber.

- The company’s financial results and segment performance are crucial in assessing its current market position and future prospects.

- Comcast’s free cash flow ((FCF)) is a key metric to watch, as it impacts the company’s ability to invest and grow.

- Despite risks, understanding Comcast’s strategic responses to these threats is essential for evaluating its long-term investment potential.

SweetBabeeJay

Comcast Corporation (NASDAQ:CMCSA) has long been a telecommunication and media conglomerate in the U.S. with a market capitalization of $150 billion. The company has continued to buy back shares, but earnings and revenue remain weak. Additionally, as we’ll see throughout this article, Comcast’s utility model faces existential threats.

Comcast Financial Results

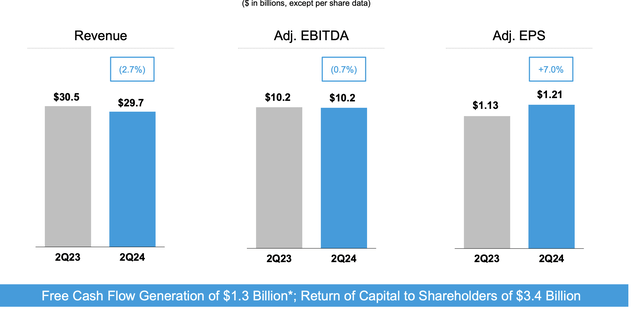

Comcast saw a modest decline in its revenue as its financials has also suffered.

The company saw $1.3 billion in FCF generation for the quarter, or more than $5 billion annualized. Versus a $150 billion market capitalization, that’s a FCF yield of just over 3%. Declining revenue and EBITDA with adjusted EPS growth being driven by share repurchases from prior earnings shows a weaker financial picture.

This shows the company’s continued threats that it’s facing to its core industries.

Comcast Segment Performance

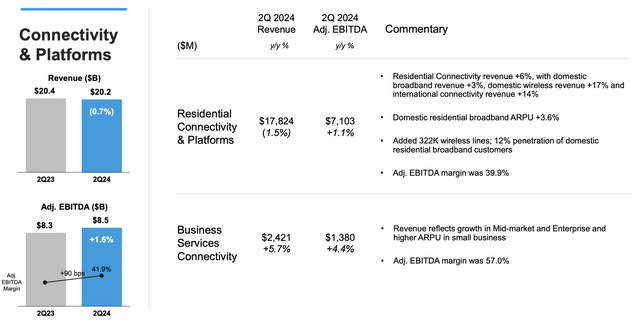

From a segment perspective the company’s two largest segments are connectivity and content.

The company’s connectivity business saw revenue decline modestly while adjusted EBITDA grew. This business is the vast majority of the company’s earnings, and it’s dependent on the company continuing to have strong offerings for its customers. However, as we’ll discuss more later, we see competition in this business increasing.

The company’s business services segment remains strong with higher margins, but remains a much smaller percentage of the company’s earnings.

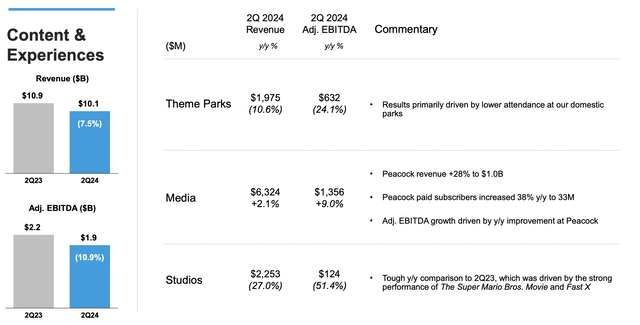

The company’s content and experiences segment continues to face numerous threats. The company saw revenue decline almost 8% and a double-digit decline in the company’s adjusted EBITDA. The company’s theme parks segment remains strong, but studios continue to face several threats as the move industry remains volatile.

The company has roughly 33 million subscribers to its streaming service Peacock, the weakest streaming service offering of any major media company. Companies in similar segments across the industry, such as Warner Bros. Discovery (WBD), have continued to struggle as well.

Comcast FCF

At the end of the day, what matters, especially for a company that’s seeing struggles in its business segments, are shareholder returns.

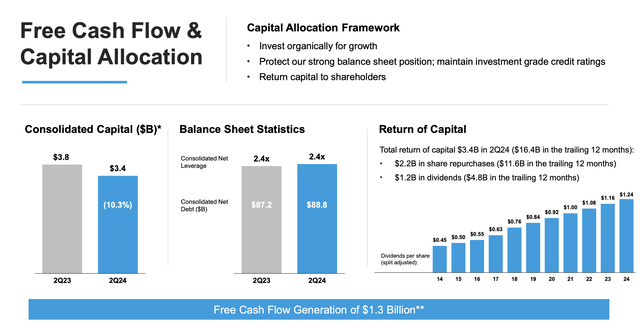

The company is continuing to invest heavily in its business to the tune of almost $14 billion annualized. The company has a massive amount of debt to the tune of almost $90 billion, which puts its enterprise value at almost $250 billion. The company hasn’t seen its debt declining at all, and while interest rates are starting to decline, it still has billions in annual interest expenses.

The company returned $3.4 billion in capital to the quarter, more than its entire FCF, primarily through share repurchases. The company continues to pay a 3% dividend, and share repurchases take the yield to almost 10%, but this is with the company increasing its debt YoY. Declining revenue and earnings for the company hurts the ability to continue returns.

Comcast is trading at a valuation where we’d want to see growth, or at least stagnation, but in our view, the company is also facing some existential threats.

Comcast Existential Threats

On top of all of this, Comcast has several existential threats, which will continue to hurt its margins and earnings over the long term.

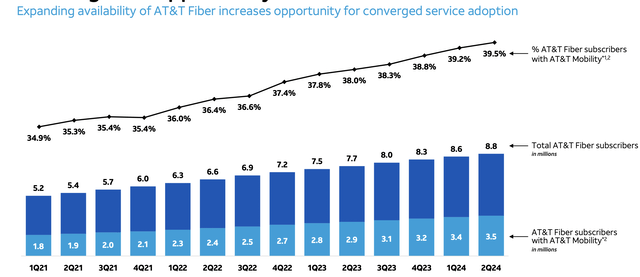

The above shows AT&T’s (T) growth of fiber, a business that it’s investing $10s of billions in. Building out such a network takes plenty of time, the company’s total potential subscribers that have access total ~23 million or ~18% of U.S. households. Building it out more will take plenty of time. Still, the company has almost 9 million subscribers and is targeting 45 million locations.

The company’s fiber offerings are stronger than Xfinity (symmetric gigabit instead of 1 gigabit down and 30 megabits up). In markets where both are present, that’s strong pressure on margins. There’s also competition like Google fiber expanding slowly, but a service that needs to be much less profitable given that Google benefits from its search and media assets.

This is a continued existential risk for Comcast and its margins over the long term.

Thesis Risk

The largest risk to our thesis is that Comcast has an impressive portfolio of assets that cost $10s of billions along with strong staying power in the markets. At the same time, the company has a reasonable valuation in an expensive market, which could make it a reasonable investment in the long term for those who hold on.

Conclusion

Comcast earns most of its money through its residential Internet business. That’s the business that drives the vast majority of the company’s shareholder returns. The company does that primarily through share buybacks, although it does have a respectable 3% dividend yield. However, this business also has several major threats.

AT&T is building up a major fiber network with better performance and taking away customers. Google fiber can be subsidized by the continued strength of Google’s main properties. This is an existential threat for Comcast. Additionally, the company’s movie and studio business has continued to suffer, which combined with the company’s debt will hurt the ability to drive future returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.