Summary:

- The Disney and Warner Bros. Discovery bundle shows promising early results.

- Linear Networks currently offer higher margins than streaming.

- The challenge is the amount of streaming business needed to replace the declining Linear profits long term.

- Warner Bros. Discovery’s strong growth figures from the bundle set high expectations for Disney’s upcoming quarterly report.

- It may well be possible to not increase bundle prices while increasing individual prices to drive consumers to low-churn bundles as a way of increasing profits.

JHVEPhoto

Recently, it was mentioned that the new Disney (NYSE:DIS) bundle with Warner Bros. Discovery (WBD) was off to a good start. The last article mentioned that the streaming profit results had improved tremendously compared to the previous years. What was missed in that discussion is the far better linear margins when compared to the streaming margins.

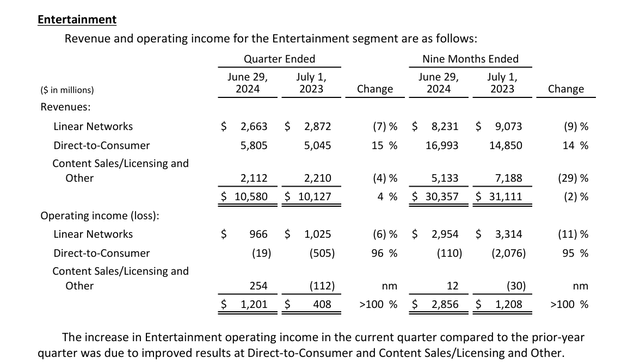

Disney Entertainment Operating Income Third Quarter 2024 (Disney Third Quarter 2024, Earnings Press Release)

Note that streaming revenue far exceeds the revenue from Linear Networks. That’s an accomplishment all by itself. But the streaming profit is not close to that “mouthwatering margin” for Linear shown above. The Linear margin is very roughly one third of the Linear revenue. That likely means there’s more cost-cutting for streaming ahead as well as a review of additional revenue through advertising (among other ideas).

Therefore, the news that the bundle with Warner Bros. Discovery is off to a good start is very important from a cost perspective. The good start not only represents a growth avenue, but it also represents the potential for less churn that can be very costly.

Obviously, content costs are higher for streaming than they are for linear. That will likely be addressed in the future as well. Long term, if Disney can achieve operating income margins that are anything close to the linear margins, this is going to be a very profitable company.

Interestingly, there’s also talk of Disney increasing prices. But the bundle price stays the same. The reason that this may work (and hence be a possibly viable strategy) is that churn is costly. It’s quite possible to trade a lower overall price for even lower costs if the lower churn works as planned. It’s probably too soon to tell for sure according to the opening article referenced. But the bundling appears to be attractive to many in the industry for this lower churn reason even if the price received is lower. Now let us see how the whole plan turns out. A successful bundle could mean that Disney uses pricing to head as many subscribers as possible towards a bundle to cut costs.

The Warner Bros. Discovery quarterly report comes first because the end of the current quarter for Disney is already the end of the fiscal year. Therefore, the Disney quarterly report will be very roughly a month later than usual and definitely after the Warner Bros. Discovery Report. However, Warner Bros Discovery CEO already reported some excellent growth figures at a recent conference. To the extent those growth numbers came from the bundle it sets some expectations for Disney growth as well. The report for the final fiscal quarter of the year could prove to be absolutely fascinating.

Succession

Ever since Bob Iger came back as CEO to Disney, his succession has been a hot topic because the first succession failed. The board announced that James Gorman, Executive Chairman of Morgan Stanley, will chair the succession committee.

There is a lot to be discussed internally to make sure there is not another failure as Bob Iger is not getting any younger. Investors need to realize that the pool of potential successors is probably not that large to start with. It’s also very hard to replace a high-performing CEO with yet another high-performing CEO as Bob Iger did when he replaced Michael Eisner.

Usually, there’s an unfortunate period of churn before a company like this finds a CEO that can adequately do the job that both investors and the board are used to seeing. Therefore, if and when a successor is announced there will likely be a period where the market waits for a track record of the successor.

Antitrust

Disney and Reliance announced a merger in India that would create a formidable competitor in the country. Recently, that merger receive the “OK” from the Indian government for the merger. This merger will likely complete in the next Disney fiscal year that begins in October.

Also headlined was Epic games (in which Disney has part ownership) lawsuit against Google (GOOG) (GOOGL) for the way in which Google Play (the store) stifles competition. Games are a relatively new venture for Disney. But it’s also another way to make money off hit movies and franchises.

Google has long been seen by many that need to use Google Play as an “issue.” So, there may well be some more legal fights down the road.

There’s also the delay in the sports bundle deal as well.

In summary, the whole streaming, and related industries are still really in the construction stage. These parts of the industry could materially differ as the court case decisions take effect over time. Building a new industry is a messy process. Expect more of these court cases down the road.

Betting

Now with the college football season underway, there’s an agreement that may become material as more fall and winter sports are on both linear and streaming.

Disney and PENN Entertainment (PENN) announced an agreement to add gambling which will be known as ESPN Bet. This is yet another way to make ESPN very profitable while the transition from linear to streaming continues.

Before really digging into the arrangement, it probably needs to first prove itself. Otherwise, the $1.5 billion initial payment (and $500 million of warrants to purchase shares of Penn Entertainment) may be the only thing to show for this deal.

Still, gambling in just about any form is a decent area for future growth if managed correctly. A successful venture here could potentially result in a merger in the future with a larger presence in gambling.

Summary

Disney made the headlines with two movies (Deadpool & Wolverine and Inside Out 2) to end its fiscal year with a bang. This helps to get the long-anticipated recovery going to the point where investors see the benefits. The rest of the “lineup” for the calendar year will show up in the next fiscal year.

But probably the larger long-term issue is replacing the generous linear gross margin with something equally lucrative. The company has several good ideas (as shown before) for future profits just in case streaming is not as profitable as intended.

Mr. Market loses patience really fast. But Netflix (NFLX) had years of negative cash flow before cash flow turned positive recently. Disney, on the other hand, emphasizes decent cash flow with profits and really has throughout its history.

Therefore, it will be interesting to see how the streaming and associated businesses develop. Disney is demonstrating that there’s a lot of potential money to be made from “hits” whether those hits are streaming franchises or movie franchises.

With Bob Iger at the helm, there are probably no worries that the company recovery continues with streaming about to become profitable. However, in a couple of years, there will be a new CEO. That CEO will have something to prove to the market after what happened with the last CEO.

Therefore, there could come a time when the stock “treads water.” It’s hard to replace one high-performing CEO with another. Disney was lucky enough to do that once. Many competitors and many in other industries have failed doing that. Time will tell if Disney beats the odds yet again to find a third (in a row) high performing CEO.

For the time being, Disney remains a strong buy. Much of what has happened means that the material parts of the recovery from fiscal year 2020 remain on track. Now, there’s likely to be some growth ahead.

Risks

The loss of the services of Bob Iger could have a material effect on the future of the company if a suitable replacement is not found. Actually, after someone like Bob Iger, there can be (and unfortunately usually is) a period of turnover in the CEO office until another high performing CEO is found. There are not many people that can be CEO in the first place. High performing CEOs are a subset of that “not many.”

As shown above, the Streaming part of the company has far more revenue than the Linear part of the company. Now this company, like Warner Bros. Discovery (and probably Netflix too) has to work on costs to get a similar profitability that Linear now has. There can be no assurance of success. Streaming could turn out to have totally different economies of scale and profitability parameters that Mr. Market may not like. It will likely be a while before any of us know for sure.

The gambling venture represents a new diversification move for the company. This may or may not succeed. It probably is riskier than other entertainment ventures because it’s not really like any existing parts of the company business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.